Maryland Gift Deed - One Individual to Two Individuals as Joint Tenants

Description

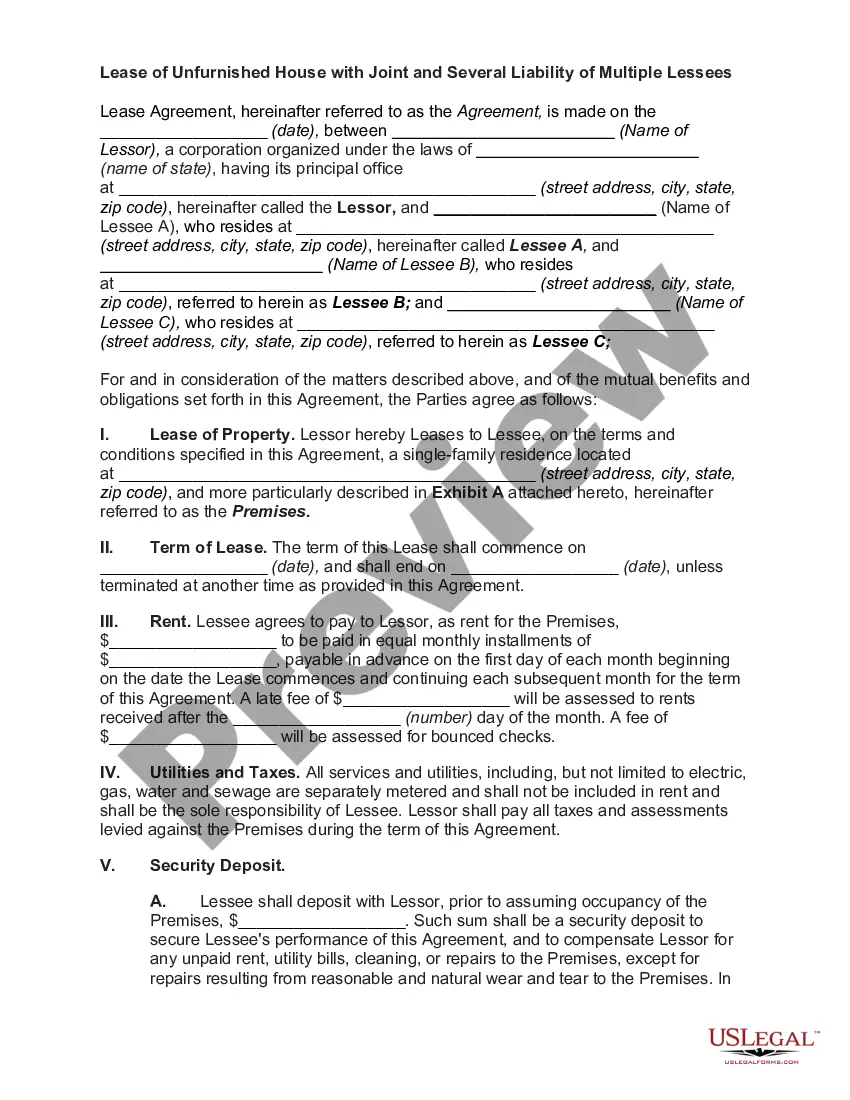

How to fill out Maryland Gift Deed - One Individual To Two Individuals As Joint Tenants?

Among numerous complimentary and fee-based examples that you can obtain online, you cannot guarantee their trustworthiness.

For instance, who fashioned them or if they’re sufficiently qualified to manage the task you need them for.

Stay composed and make use of US Legal Forms! Uncover Maryland Gift Deed - One Individual to Two Individuals as Joint Tenants templates crafted by skilled attorneys and escape the costly and time-consuming task of searching for a lawyer and subsequently compensating them to draft a document for you that you can effortlessly find on your own.

Opt for a pricing plan and establish an account. Payment for the subscription can be made using your credit/debit card or Paypal. Download the document in the desired format. Once you’ve completed registration and payment for your subscription, you may utilize your Maryland Gift Deed - One Individual to Two Individuals as Joint Tenants as frequently as required or for as long as it remains active in your state. Modify it in your chosen editor, complete it, sign it, and print it. Accomplish more for less with US Legal Forms!

- If you hold a membership, Log In to your profile and locate the Download button alongside the file you wish to retrieve.

- You will also have the capability to access all of your previously obtained files in the My documents section.

- If you’re utilizing our platform for the first occasion, adhere to the guidelines outlined below to acquire your Maryland Gift Deed - One Individual to Two Individuals as Joint Tenants with ease.

- Verify that the document you discover is applicable in the region where you reside.

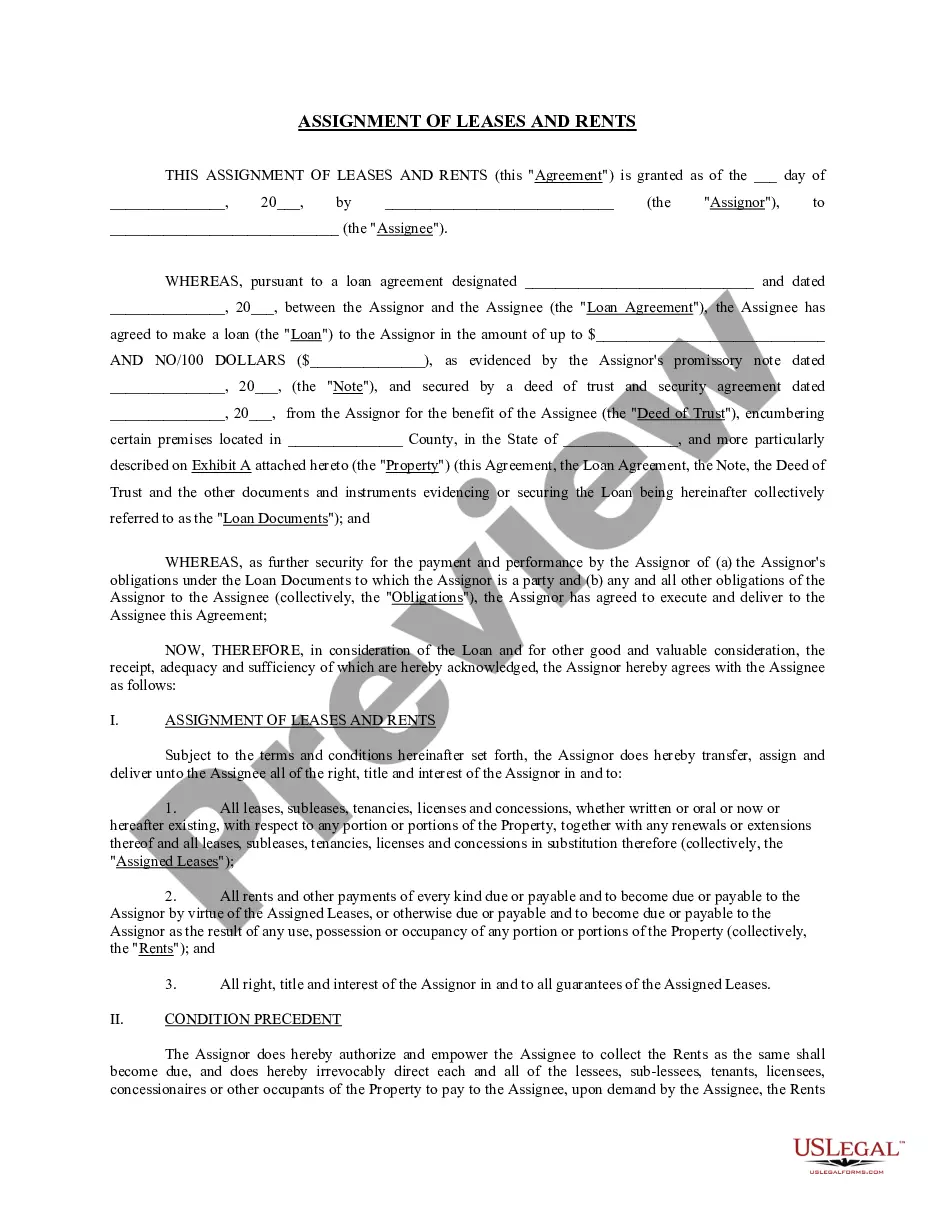

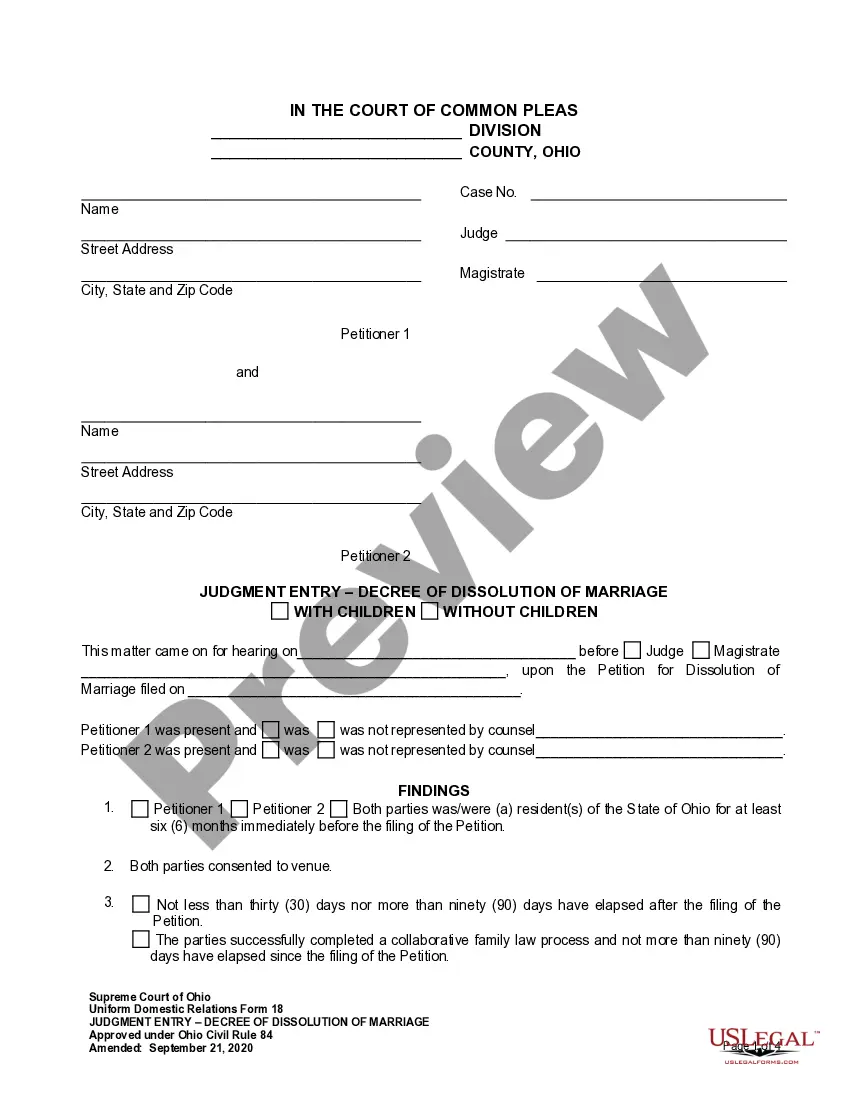

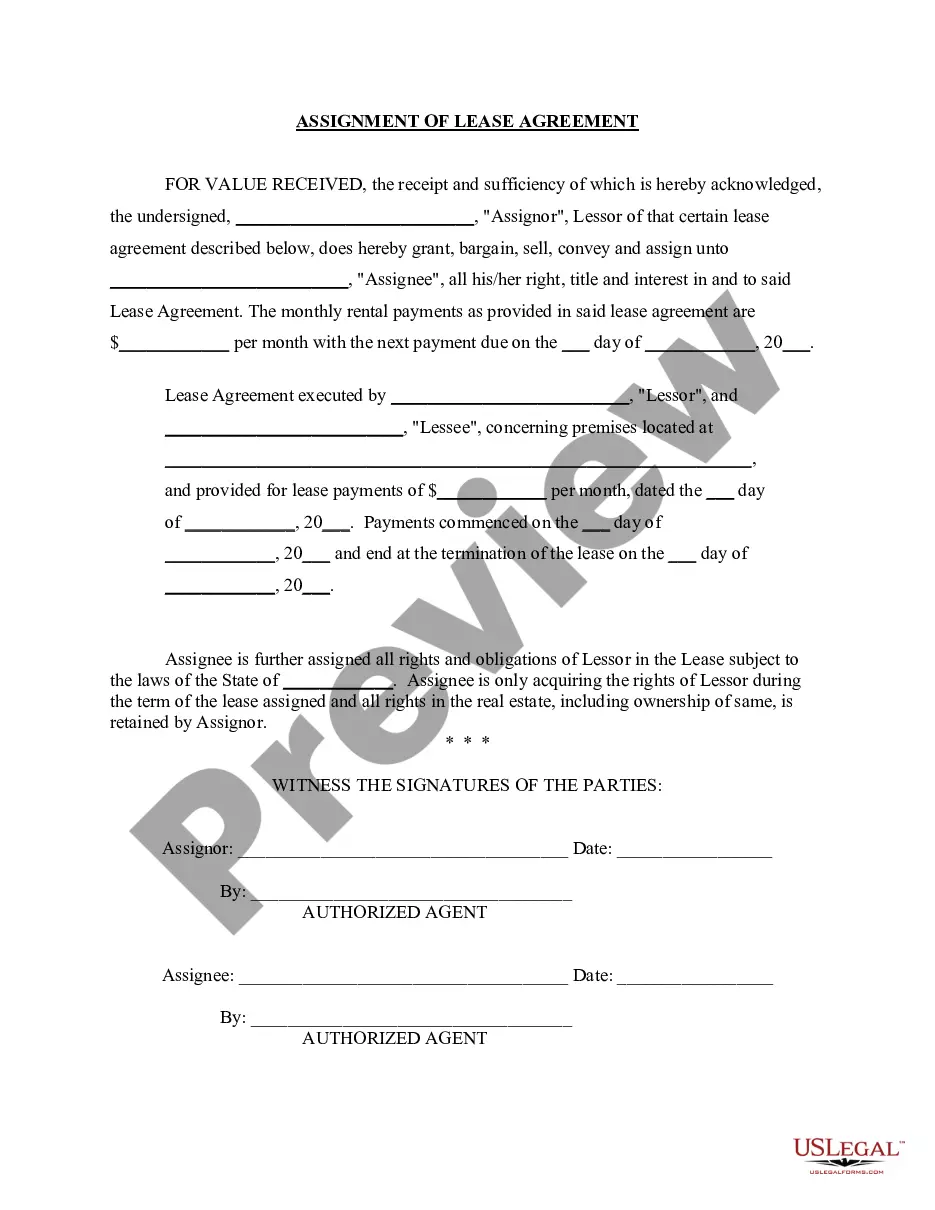

- Examine the template by reading the description utilizing the Preview feature.

- Select Buy Now to initiate the purchasing process or search for another sample using the Search bar situated in the header.

Form popularity

FAQ

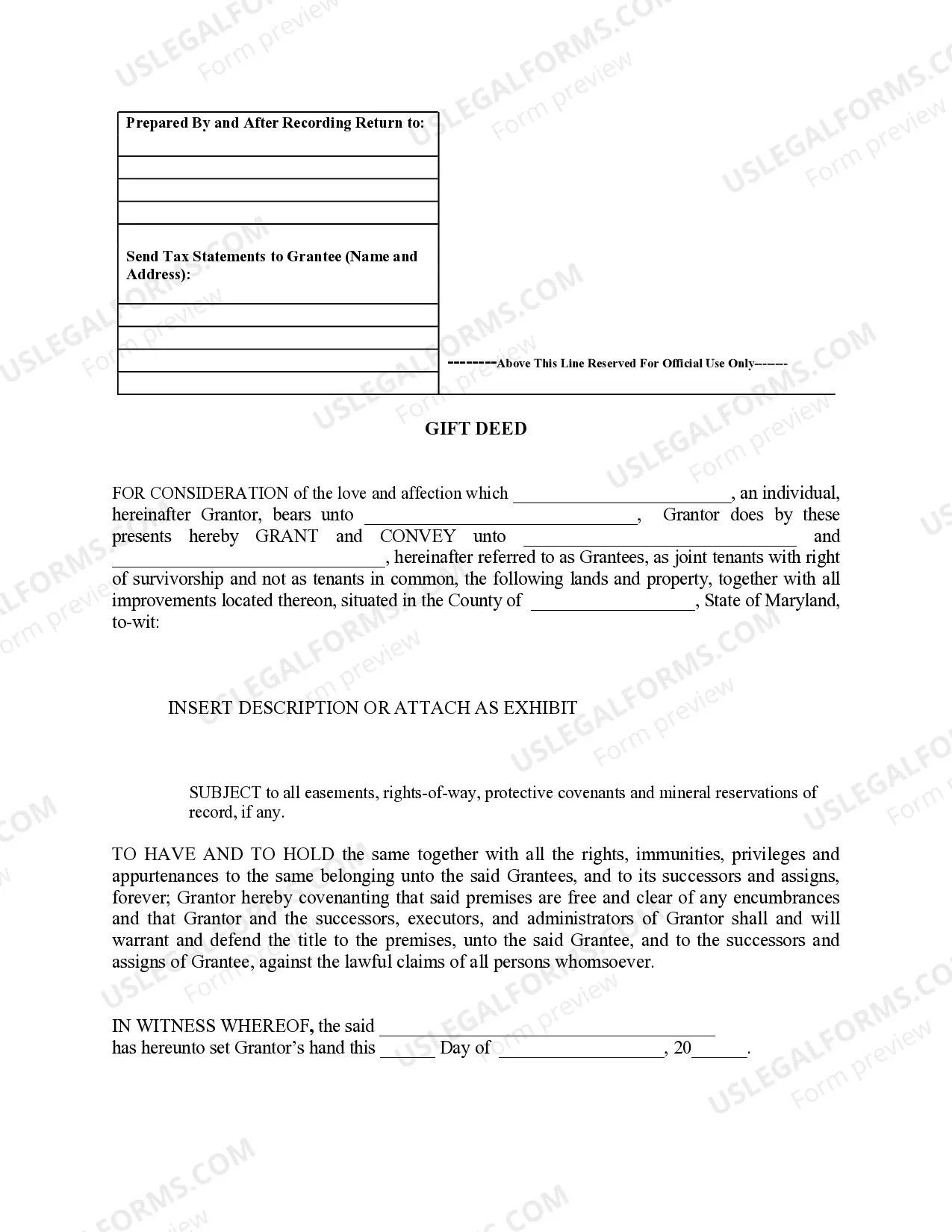

Tenancy by the entirety is the third option for joint ownership of real property in Maryland. Unlike joint tenancy and tenancy in common, tenancy by the entirety is only available to a married couple.Maryland has a presumption that property held by a married couple is held as tenants by the entireties.

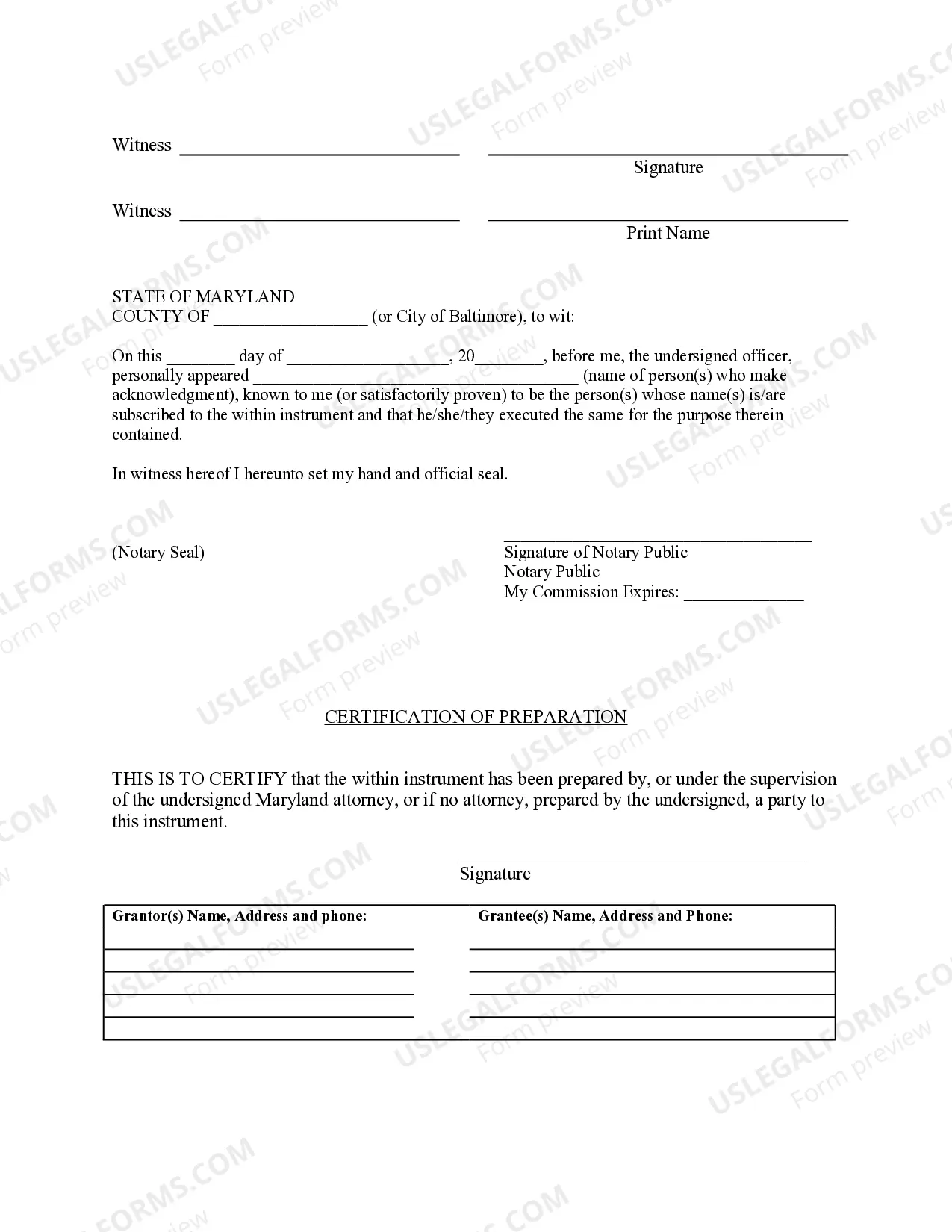

A consenting individual may be removed from a deed by filing a quitclaim deed. Under Maryland law each county has a separate procedure and requirements for filing a quitclaim deed.

In Maryland, each owner, called a joint tenant, must own an equal share. Tenancy by the entirety. This form of joint ownership is like joint tenancy, but it is allowed only for married couples in Maryland.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

It will depend what state the property is in. For example, the minimum fee payable when changing the title to have someone removed from a property title in NSW is $133.48. This fee must be paid to the NSW Government Land & Property Information Department.

A quitclaim deed will remove the out-spouse (or departing spouse) from the title to the property, effectively relinquishing their equity or ownership in the home. The execution of a quitclaim deed is typically a requirement of a divorce settlement in order to complete the division of assets.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.