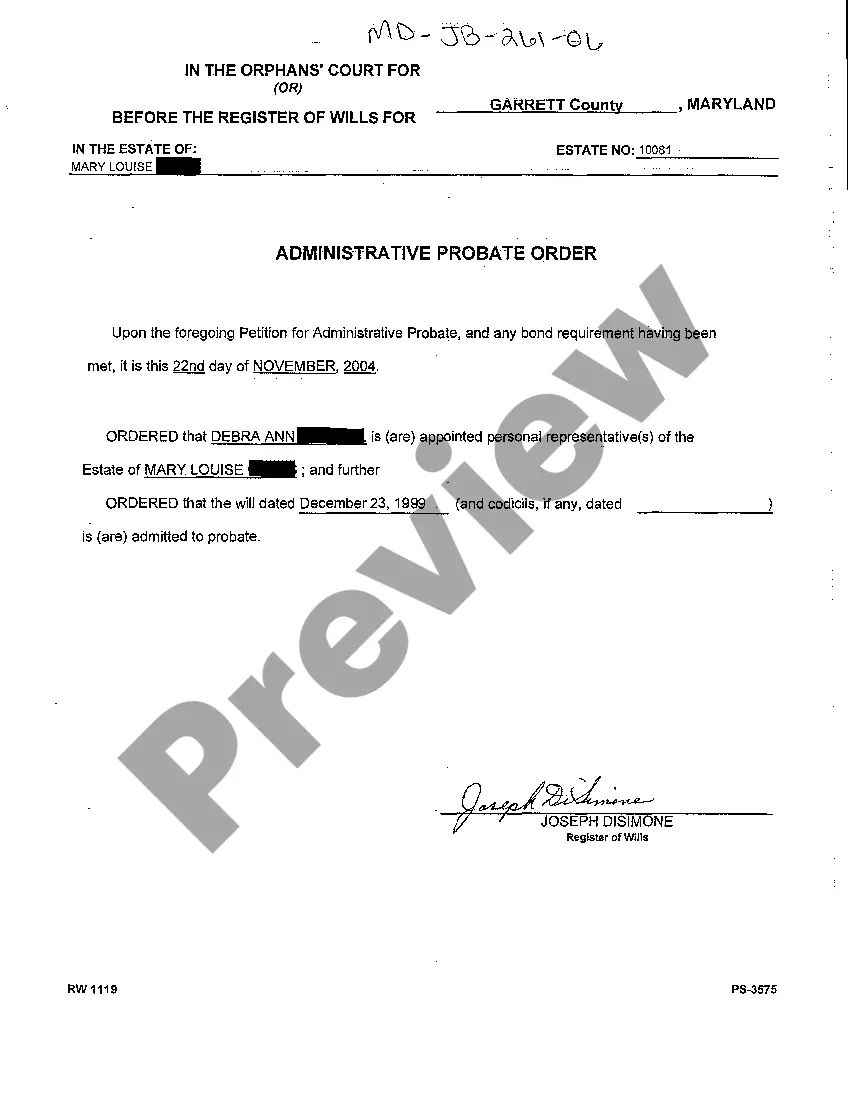

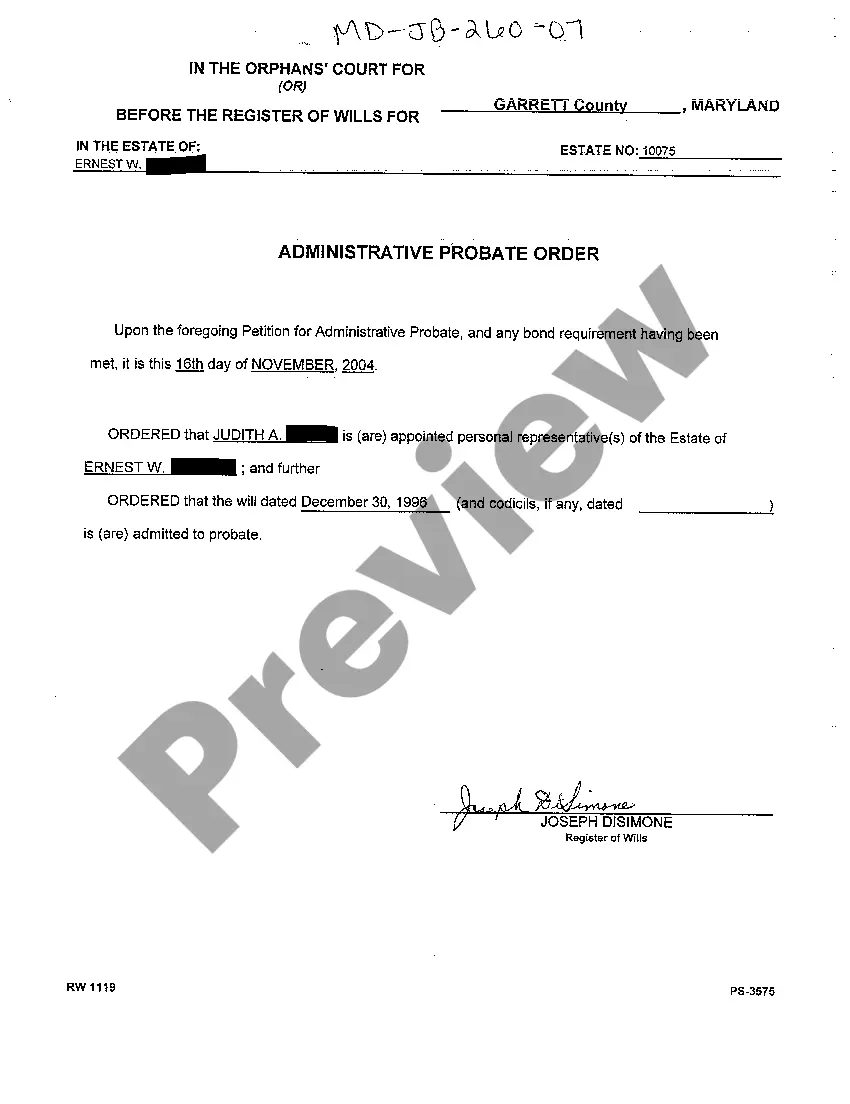

Maryland Administrative Probate Order Admitting Will to Probate and Appointing Personal Representative

Description

How to fill out Maryland Administrative Probate Order Admitting Will To Probate And Appointing Personal Representative?

You are invited to the most extensive collection of legal documents, US Legal Forms. Here, you can discover any template, including the Maryland Administrative Probate Order Admitting Will to Probate and Appointing Personal Representative, and save as many as you wish/need.

Create official documents in a few hours rather than days or even weeks, without incurring significant costs with an attorney. Obtain the state-specific example with just a few clicks and rest assured knowing it was prepared by our certified lawyers.

If you’re already a subscribed client, simply Log In to your account and click Download next to the Maryland Administrative Probate Order Admitting Will to Probate and Appointing Personal Representative you need. Because US Legal Forms is an online platform, you’ll always have access to your saved forms, regardless of the device you’re using. Find them under the My documents section.

Print the document and fill it with your/your company’s details. Once you’ve completed the Maryland Administrative Probate Order Admitting Will to Probate and Appointing Personal Representative, send it to your attorney for approval. It’s an additional step, but a crucial one to ensure you’re completely protected. Sign up for US Legal Forms now and access thousands of reusable templates.

- If you don’t possess an account yet, what are you waiting for.

- Review our instructions below to get going.

- If this is a state-specific document, verify its validity in your state.

- Examine the description (if available) to determine if it’s the correct template.

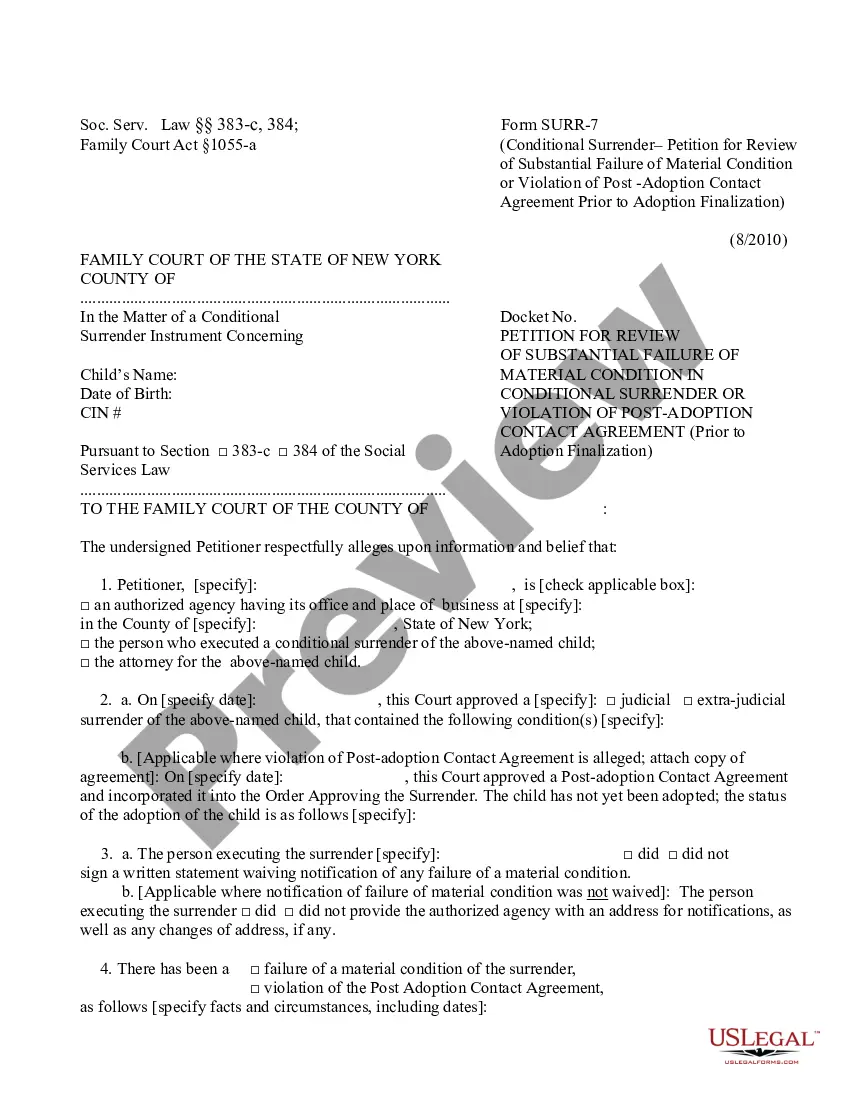

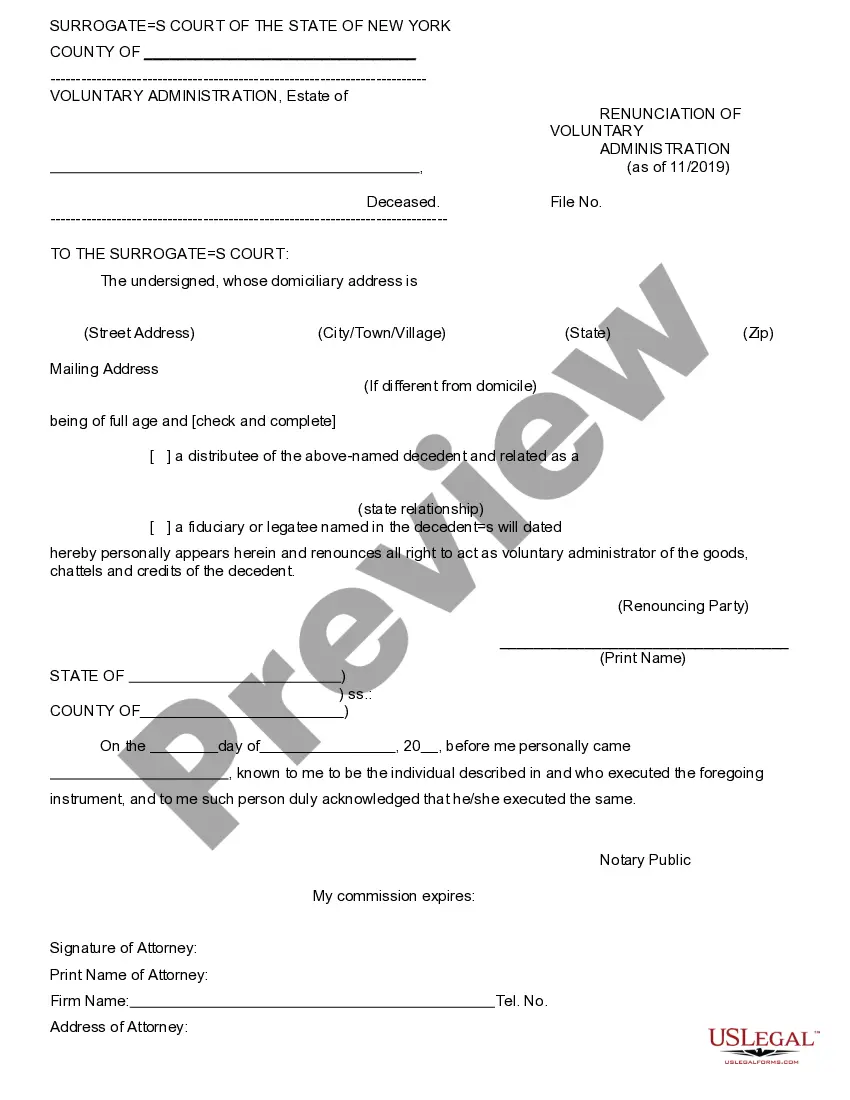

- Explore additional content with the Preview feature.

- If the document fulfills all your requirements, click Buy Now.

- To create an account, select a pricing scheme.

- Utilize a credit card or PayPal account to register.

- Download the file in your preferred format (Word or PDF).

Form popularity

FAQ

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A Personal Representative must be appointed by the Register of Wills or the Orphans' Court before disposing of any assets. When appointed, Letters of Administration will be issued to the Personal Representative. Forms and procedures herein are mandated by Maryland Code and Maryland Rules.

According to California statutes, a personal representative must use ordinary care and diligence and act reasonably and in good faith in administering the estate. The personal representative has a fiduciary duty toward the estate and interested parties like heirs, will beneficiaries and estate creditors.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.