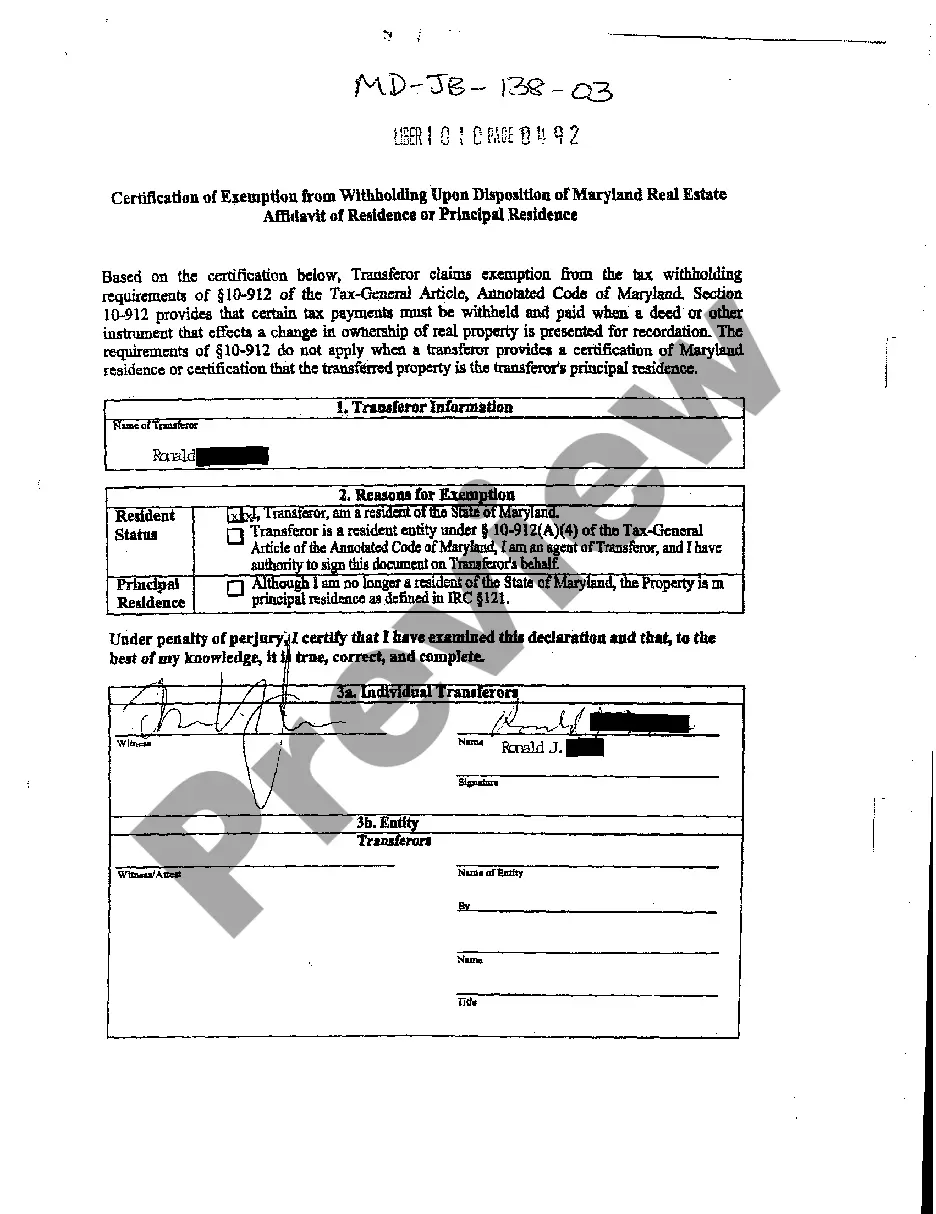

Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence

Description

Key Concepts & Definitions

A03 Certification of Exemption from Withholding refers to a specific documentation process that allows an individual or entity, under certain conditions, to be exempt from the mandatory withholding of taxes on income in the United States. This exemption is typically relevant for situations involving particular types of earnings or demographic statuses that do not require standard pre-withheld tax contributions.

Step-by-Step Guide

- Determine Eligibility: Review the criteria set by the IRS to understand if you qualify for the A03 exemption.

- Obtain the Necessary Form: Typically, a W-4 or similar form is used to declare exemption. Check the IRS website for the specific form applicable to A03 exemptions.

- Complete the Form: Fill in all required details accurately. Incorrect information can lead to penalties or denial of the exemption.

- Submit the Form: Provide the completed form to your employer or the relevant financial institution responsible for your income withholding.

- Keep Records: Always keep a copy of the submitted forms and any related correspondence for future reference or in case of disputes.

Risk Analysis

- Compliance Risk: Incorrectly claiming an exemption can lead to legal penalties, including fines and back taxes.

- Financial Risk: Errors in withholding status might result in underpayment or overpayment of taxes.

- Operational Risk: Employers must regularly revisit and validate the exemption statuses to ensure ongoing compliance with changing tax laws.

Key Takeaways

The A03 Certification: Is crucial for those qualified to leverage tax exemptions on specific income types. Ensuring accuracy during the application process is critical due to the legal implications of tax documents.

Best Practices

- Regularly Consult Tax Advisors: To stay updated on statutes and ensure compliance.

- Periodic Review: Regular assessment of eligibility as personal or legislative changes occur.

- Meticulous Record Keeping: Essential for defending your exemption status if audited by the IRS.

Common Mistakes & How to Avoid Them

- Failing to Update Information: Keep all personal and financial information updated to reflect current circumstances.

- Lack of Documentation: Always obtain and preserve records of submitted tax exemption forms and relevant correspondence.

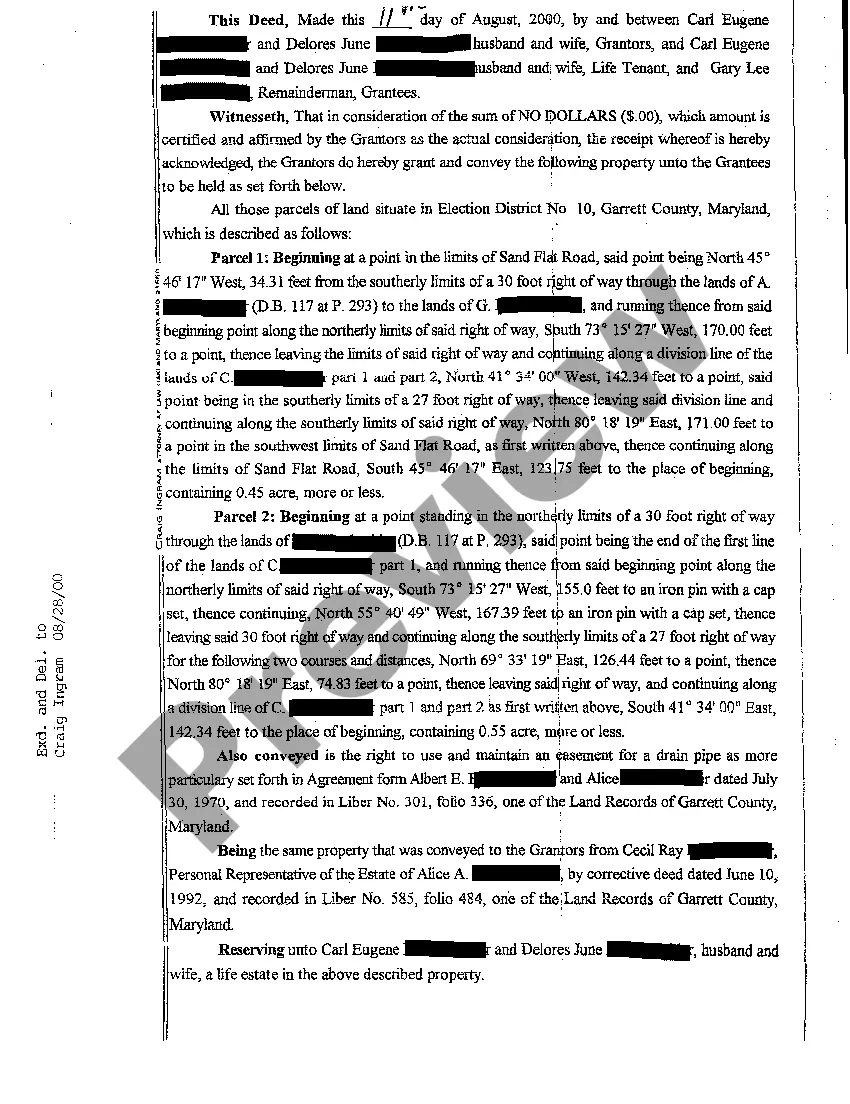

How to fill out Certification Of Exemption From Withholding Upon Disposition Of Maryland Real Estate Affidavit Of Residence Or Principal Residence?

You are invited to the most important legal documents collection, US Legal Forms.

Here you can discover any template including Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence templates and download them (as many as you wish/need).

Create official documents in just a few hours, instead of days or weeks, without having to spend a fortune on a lawyer or attorney.

Once the template satisfies all your requirements, click Buy Now. To establish your account, select a subscription plan. Use a credit card or PayPal to register. Save the document in your preferred format (Word or PDF). Print the document and enter your/your business’s information. After completing the Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, send it to your attorney for validation. This is an additional step, but a crucial one to ensure you’re fully protected. Join US Legal Forms now to gain access to a sizable number of reusable templates.

- Obtain the state-specific template with just a few clicks and rest assured knowing that it was prepared by our skilled legal experts.

- If you’re already a registered user, just Log In to your account and click Download next to the Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence you desire.

- Since US Legal Forms operates online, you’ll usually have access to your saved documents, regardless of the device you’re using.

- Locate them inside the My documents section.

- If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific form, verify its acceptability in your state.

- Review the description (if available) to determine if it’s the right template.

- Explore more details with the Preview functionality.

Form popularity

FAQ

The Maryland non-resident withholding tax exemption form is designed for non-residents who wish to avoid unnecessary tax withholdings on real estate transactions. By completing this form, non-residents can claim exemptions, which simplifies their tax obligations. For further clarity, this process is intricately linked with the Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

MW507. Employee's Maryland Withholding Exemption Certificate. Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.The above information comes from the University Tax Office.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Your current certificate remains in effect until you change it. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 5; enter EXEMPT in the box to the right on Line 5; and attach a copy of your spousal military identification card to Form MW507. Social Security numbers must be included.

Payors of distributions that are Eligible Rollover Distributions (ERDs) under IRC Section 3405(c), subject to mandatory federal income tax withholding, are required to withhold Maryland income tax from these distributions paid to Maryland residents at the rate of 7.75%.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.