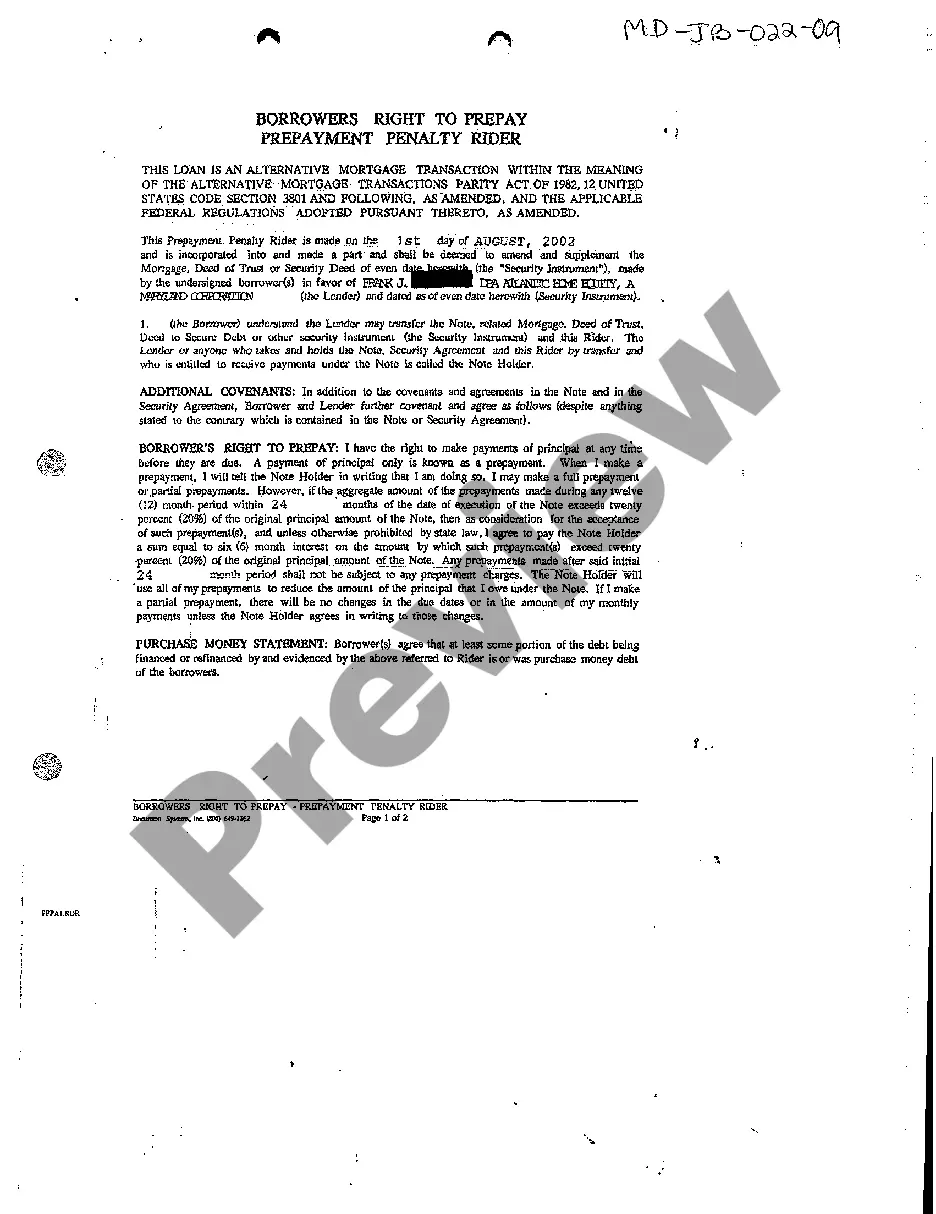

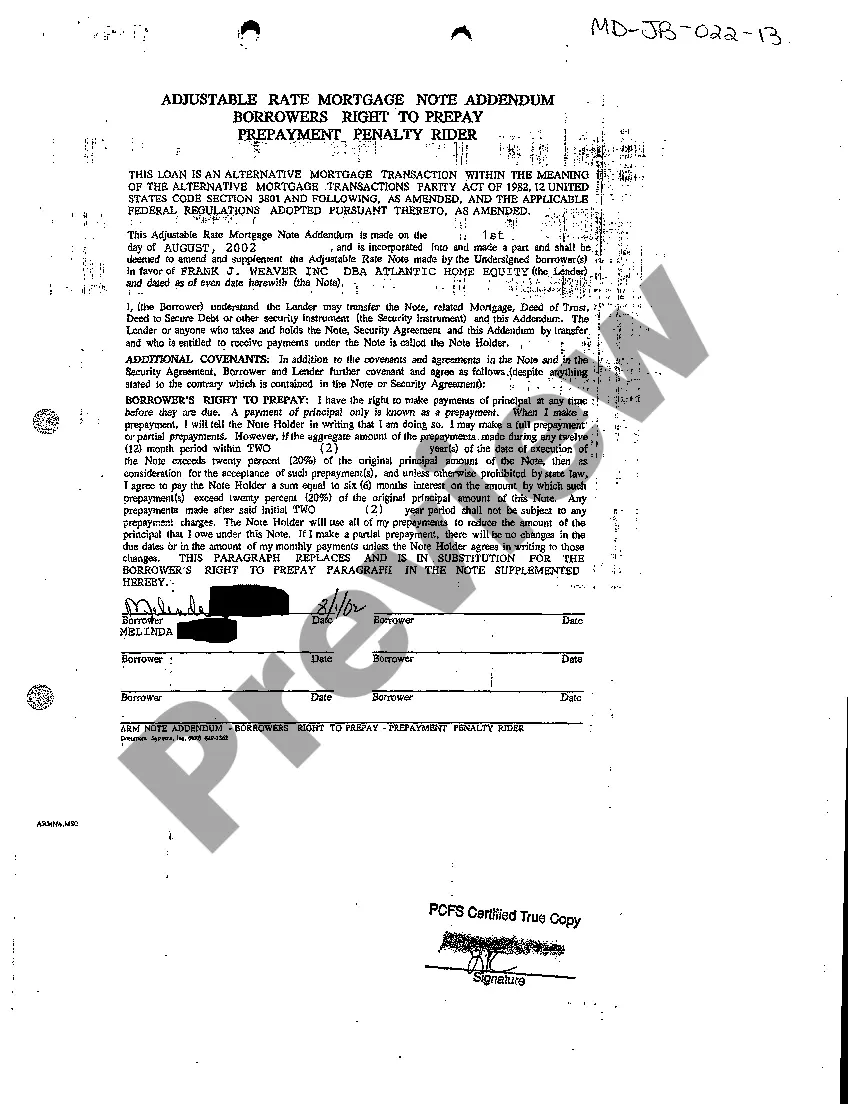

Maryland Borrowers Right to Prepay Prepayment Penalty Rider

Description

Key Concepts & Definitions

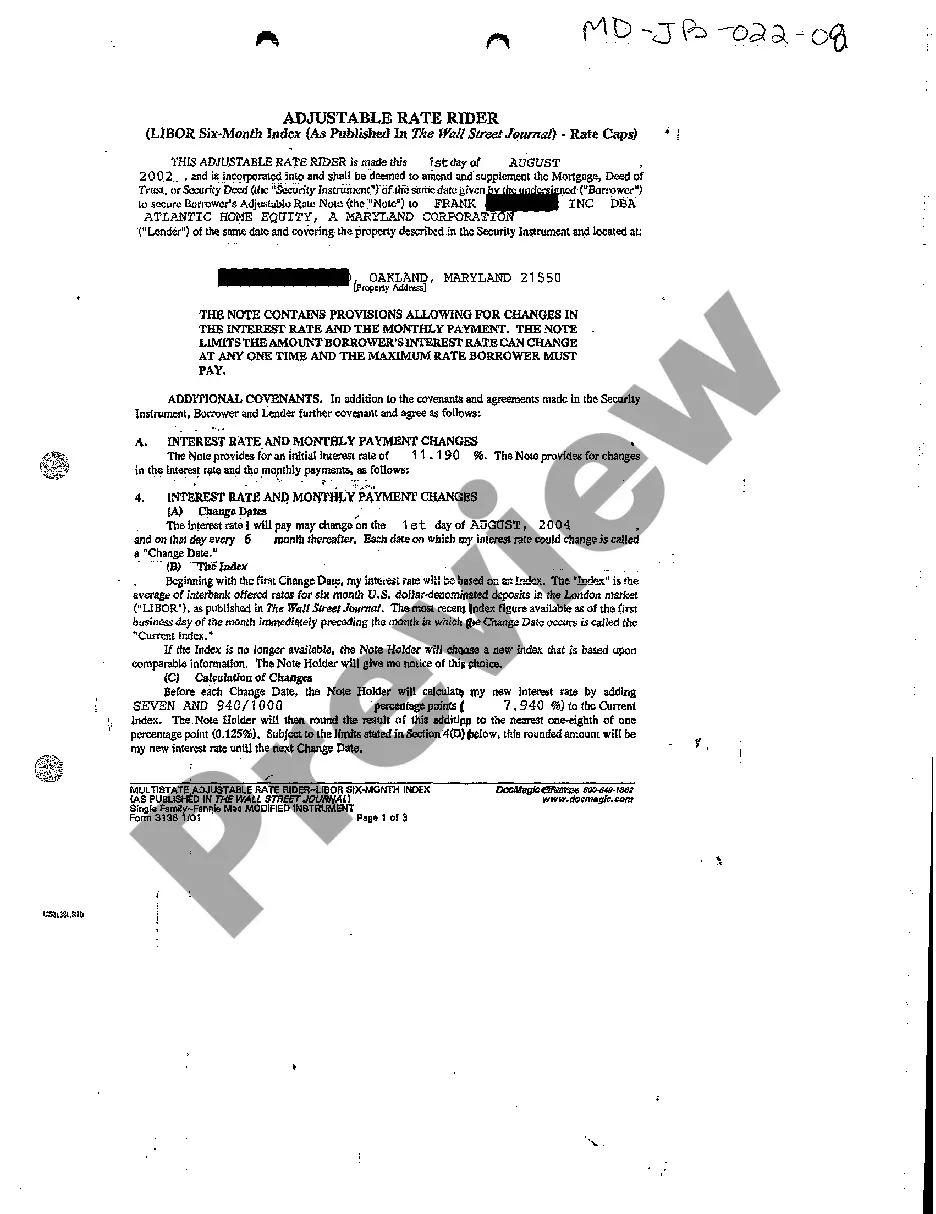

A10 Borrowers Right to Prepay Prepayment Penalty refers to the rights and provisions a borrower has in regard to repaying a portion or the full amount of their loan before the scheduled due date. Typically, prepayment can be enacted by a borrower to save on interest, but it might come with penalties to compensate the lender for the lost interest payments.

Step-by-Step Guide on How to Prepay Your Loan

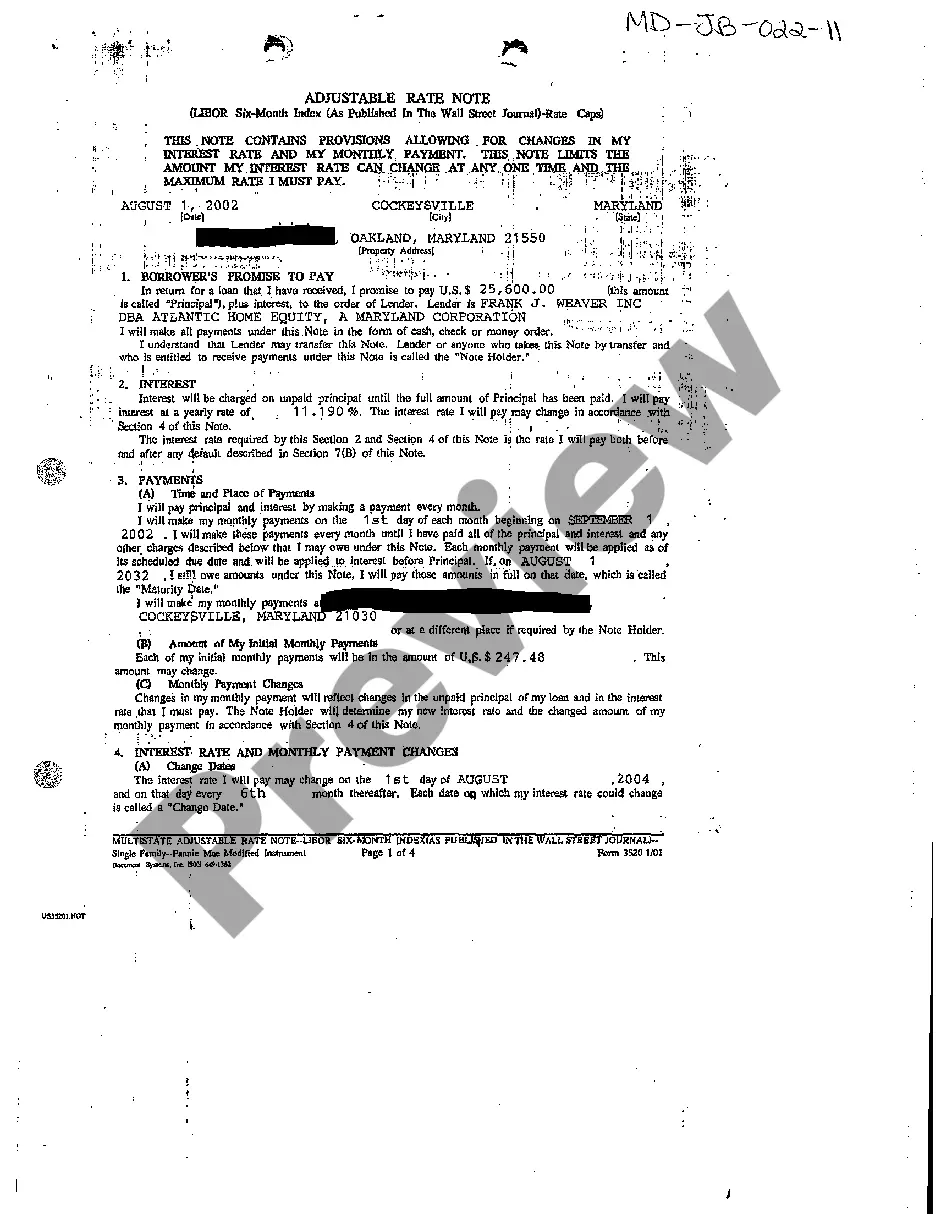

- Review Loan Agreement: Check your loan documents for terms related to prepayment. Look specifically for 'prepayment penalty' clauses.

- Contact Your Lender: Discuss with your lender or loan servicing company the options and potential costs associated with prepaying your loan.

- Calculate the Costs: Determine the financial benefits versus the penalties and see if prepayment is a beneficial move financially.

- Make the Prepayment: If it is beneficial, proceed to make the prepayment as specified by your lender to avoid any misunderstandings.

- Confirm Balance: After prepaying, confirm your new balance and terms with your lender.

Risk Analysis of Prepaying a Loan Early

Prepaying a loan can result in financial losses due to prepayment penalties. These penalties are imposed to recover potential lost interest by the lender. Risk factors include:

- Higher short-term financial burden.

- Losing out on better investment opportunities.

- Potential negative impact on credit score if not handled appropriately.

Key Takeaways

Understanding your rights and the potential costs associated with prepaying a loan is crucial. Always evaluate the financial impact, including the prepayment penalty, before deciding to prepay your loan.

Common Mistakes & How to Avoid Them

- Not reviewing the loan contract in depth.

- Failing to consult with financial advisors or the lender.

- Overlooking other financial opportunities and liquidity needs.

FAQ

Q: What is a prepayment penalty?

A: A fee imposed by the lender when a borrower pays off a loan before the term agreed upon.

Q: Can all loans be prepaid?

A: Not all loans have a prepayment option; it largely depends on the lender's terms and conditions.

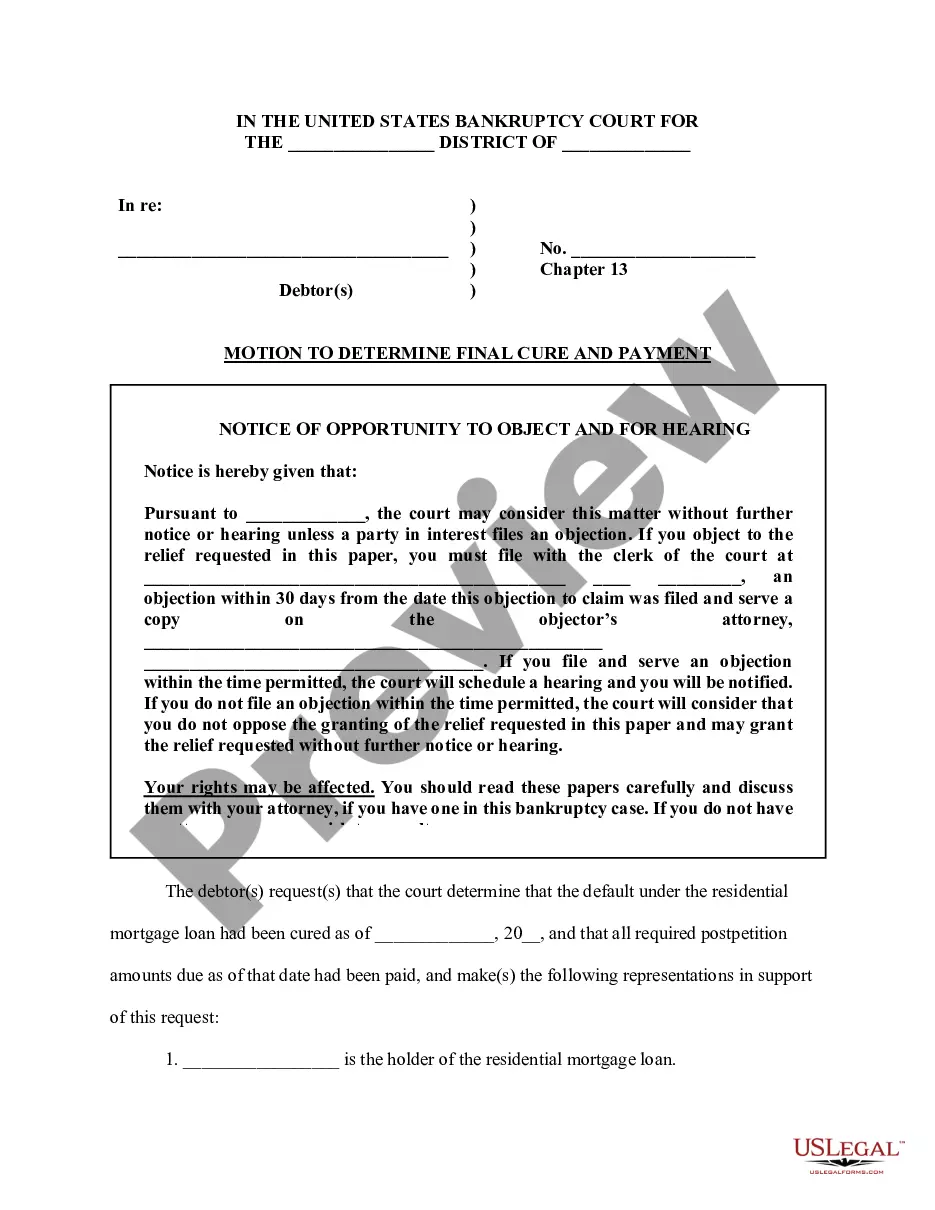

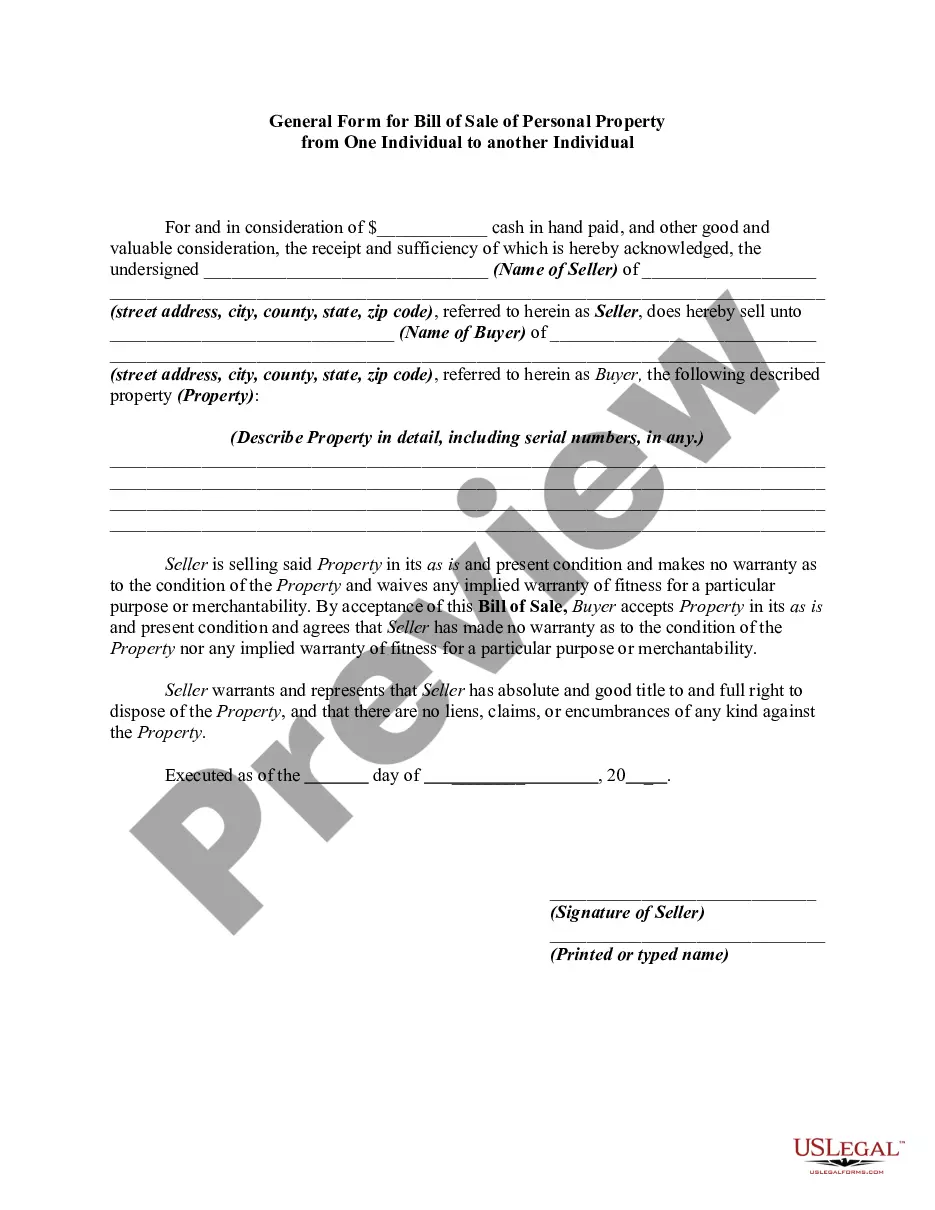

How to fill out Maryland Borrowers Right To Prepay Prepayment Penalty Rider?

Greetings to the largest repository of legal documents, US Legal Forms. Here, you can access any template, including Maryland Borrowers Right to Prepay Prepayment Penalty Rider forms, and retrieve them in abundance according to your needs.

Create official documents within hours instead of days or weeks, all without incurring substantial costs associated with hiring a lawyer. Obtain your state-specific template quickly and rest easy knowing it was created by our state-accredited attorneys.

If you are already a registered user, simply Log In to your profile and click Download next to the Maryland Borrowers Right to Prepay Prepayment Penalty Rider you require. As US Legal Forms operates online, you will always retain access to your stored documents, regardless of the device in use. Find them in the My documents section.

Once you have finalized the Maryland Borrowers Right to Prepay Prepayment Penalty Rider, submit it to your attorney for confirmation. This extra step is crucial to ensure you are fully protected. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If you haven’t set up an account yet, what are you waiting for? Follow our guidelines below to get started.

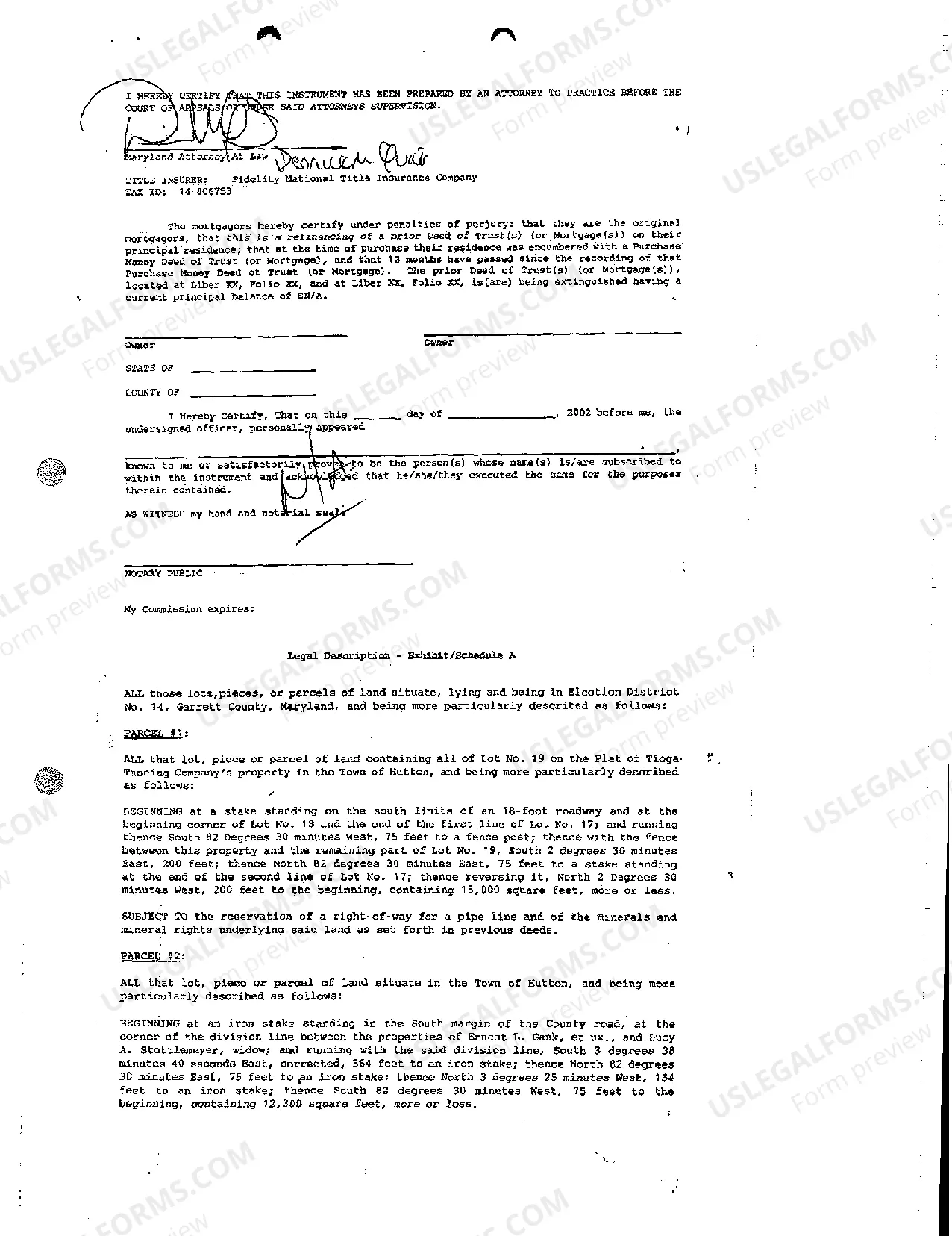

- Verify the validity of this state-specific form in your residing state.

- Review the description (if available) to determine whether it is the appropriate template.

- Explore additional content using the Preview feature.

- If the template fulfills all your requirements, just click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to sign up.

- Download the document in your desired format (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

Loan prepayment penalties are fees lenders might include in their terms to ensure you pay a certain amount of interest on your loan before paying it off. It might sound crazy, but making extra payments or paying your loan off early can actually cost you more because of loan prepayment penalties.

Federal law prohibits prepayment penalties for many types of home loans, including FHA and USDA loans, as well as student loans. In other cases, the early payoff penalties that lenders can charge are permitted but include both time and financial restrictions under federal law.

Yes, you can try negotiating it down, but the best way to avoid the fee altogether is to switch to a different loan or a different lender. Since not all lenders charge the same prepayment penalty, make sure to get quotes from different lenders to find the best loan for you.

Function: noun. The Prepayment Rider discusses the borrower's right to prepay their loan. Sometimes there are penalties for prepaying a loan during the life of the loan, or during the first several years of the loan. Some borrowers like to pay a little bit more than the monthly payments to pay off their loan sooner.

(ii) May not exceed an amount equal to 2 months' advance interest on the aggregate amount of all prepayments made in any 12-month period in excess of one-third of the amount of the original loan. (d) Prepayment penalty prohibited.

Federal law prohibits some mortgages from having prepayment penalties, which are charges for paying off the loan early.If your lender can charge a prepayment penalty, it can only do so for the first three years of your loan and the amount of the penalty is capped. These protections come thanks to federal law.

Are prepayment penalties illegal in Maryland? Not exactly. Prepayment penalties may be permissible under certain Maryland law and are subject to certain limitations. However, many Maryland laws do not permit prepayment penalties.