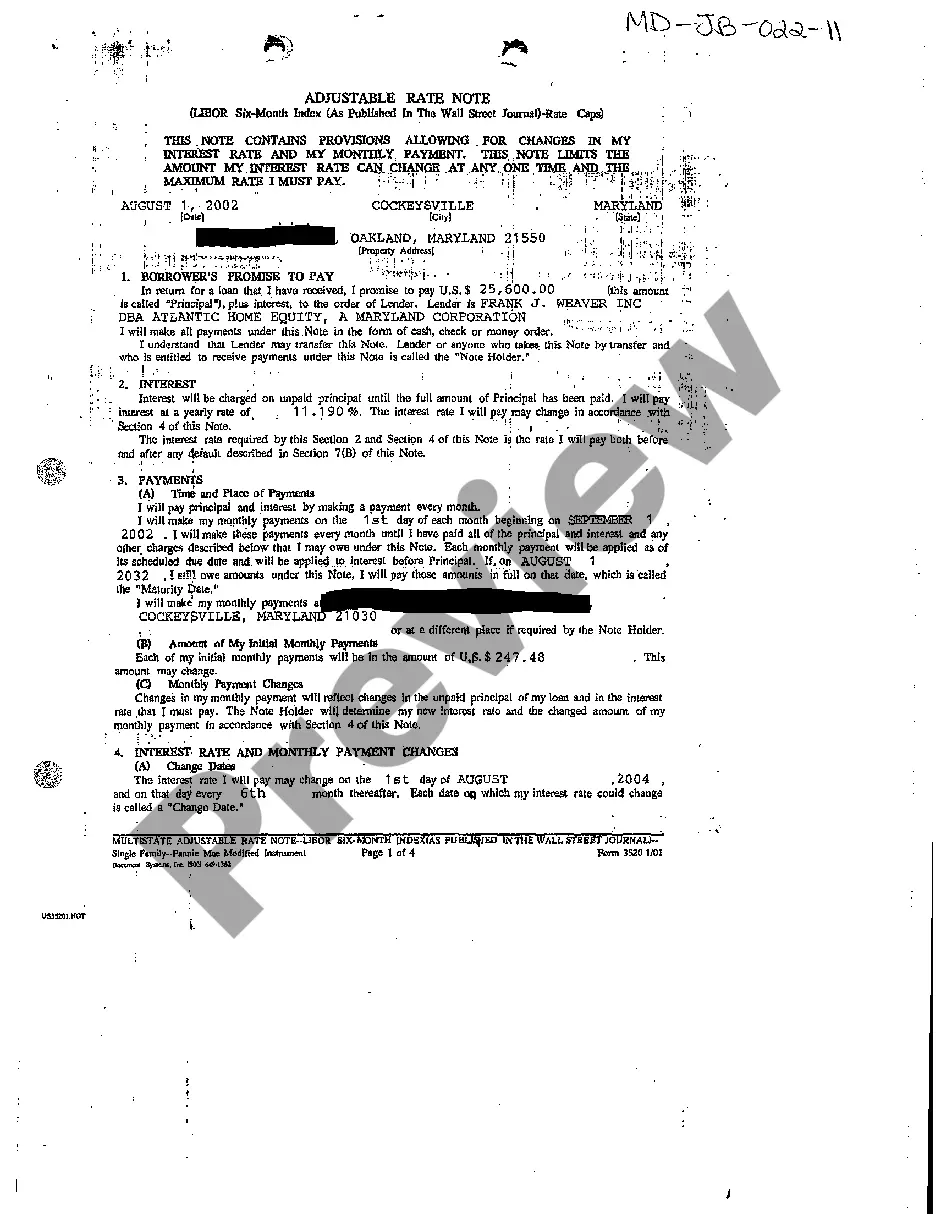

Maryland Adjustable Rate Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Adjustable Rate Note?

You are invited to the most expansive legal documents repository, US Legal Forms. Here you can obtain any template such as Maryland Adjustable Rate Note templates and preserve them (as many as you desire/need). Prepare official documentation in just a few hours, rather than days or even weeks, without incurring significant costs with an attorney.

Acquire your state-specific sample with a few clicks and rest assured knowing that it was created by our state-qualified lawyers.

If you’re already a subscribed user, simply Log In to your account and click Download next to the Maryland Adjustable Rate Note you require. Since US Legal Forms is web-based, you will typically get access to your stored templates regardless of which device you’re using. Find them under the My documents tab.

Print the document and complete it with your/your business’s information. Once you’ve finalized the Maryland Adjustable Rate Note, forward it to your attorney for validation. It’s an additional step, but a crucial one to ensure you’re fully protected. Register for US Legal Forms today and gain access to thousands of reusable samples.

- If you don’t have an account yet, what are you waiting for.

- Review our instructions below to begin.

- If this is a state-specific example, verify its validity in your state.

- Consult the description (if provided) to ensure it’s the correct template.

- Explore more content with the Preview feature.

- If the example satisfies all your needs, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Save the file in your preferred format (Word or PDF).

Form popularity

FAQ

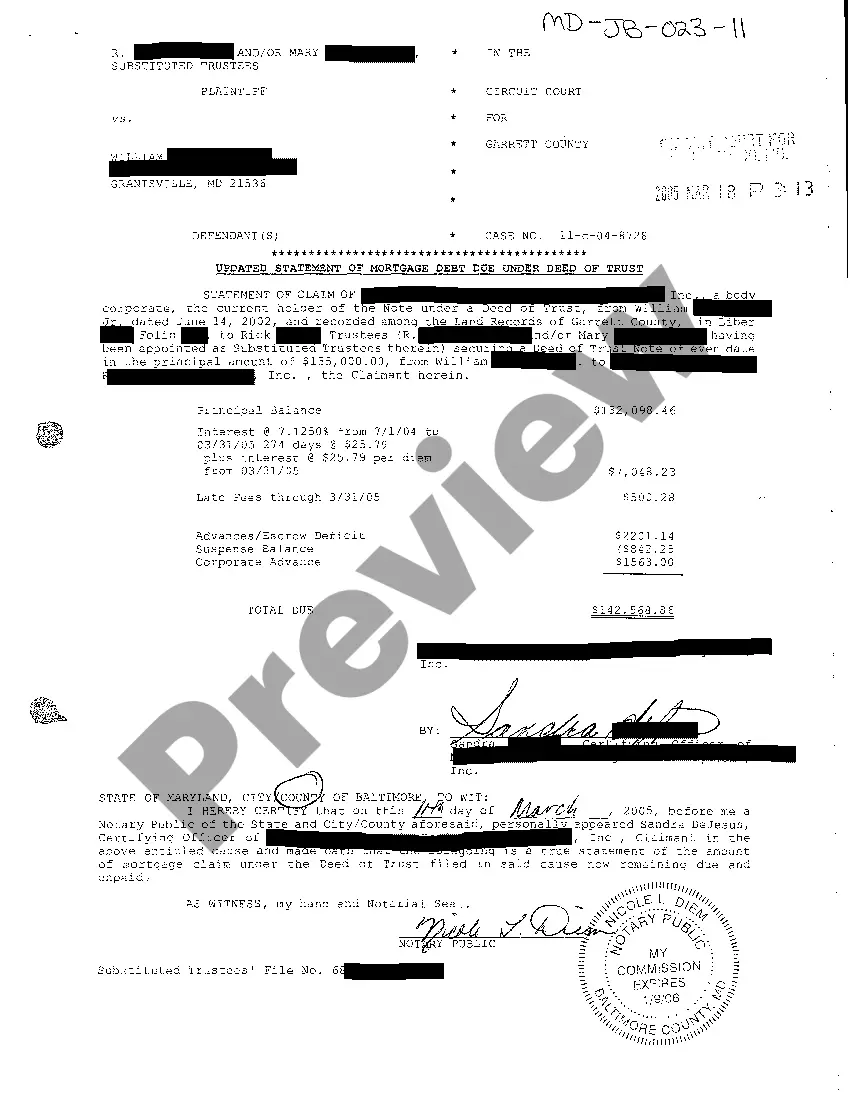

Uniform Instruments are the Fannie Mae/Freddie Mac and Freddie Mac Notes, Riders, and Security Instruments (Deeds of Trust and Mortgages) used when originating Single-Family residential mortgage loans, in all States and U. S. Territories, as identified in the List of Single-Family Uniform Instruments provided on this

But if interest rates stay low or even fall, adjustable-rate mortgages can potentially save you a lot of money. Fixed-rate mortgages may be a better choice for those who plan to stay put or need reliable mortgage payments that never change.

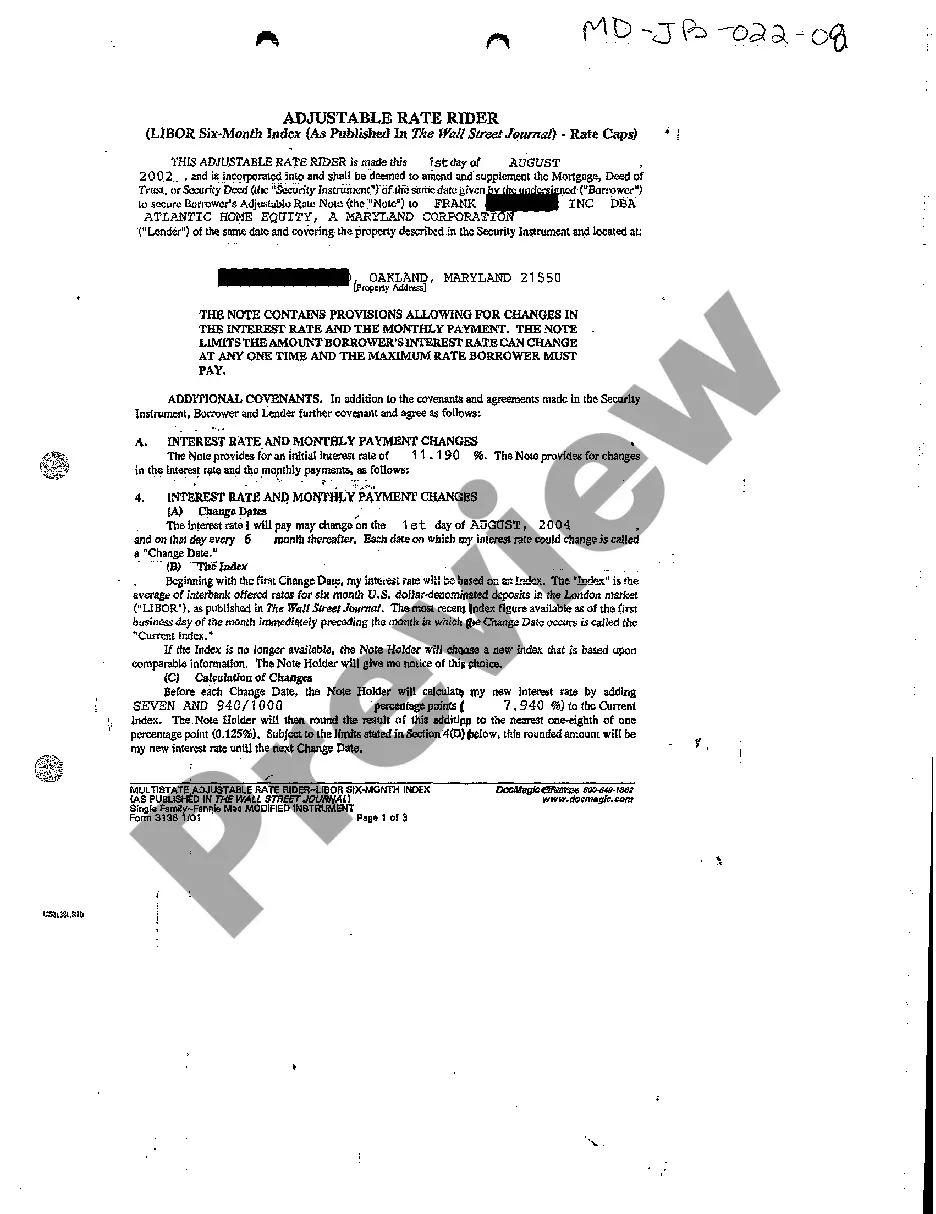

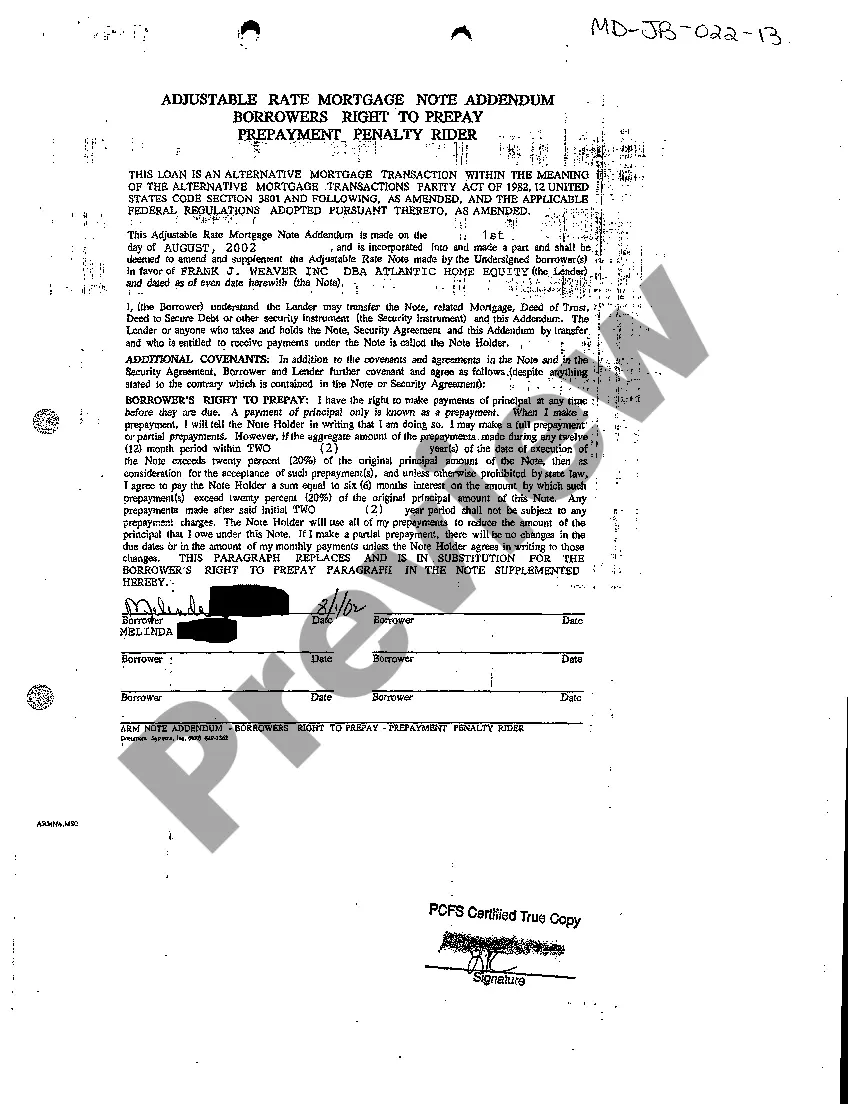

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

THIS NOTE PROVIDES FOR A CHANGE IN MY FIXED INTEREST RATE TO AN ADJUSTABLE INTEREST RATE. THIS NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES I MUST PAY. THIS NOTE ALSO CONTAINS THE OPTION TO CONVERT MY ADJUSTABLE INTEREST RATE TO A NEW FIXED RATE.

THIS NOTE PROVIDES FOR A CHANGE IN MY FIXED INTEREST RATE TO AN ADJUSTABLE INTEREST RATE. THIS NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES I MUST PAY. THIS NOTE ALSO CONTAINS THE OPTION TO CONVERT MY ADJUSTABLE INTEREST RATE TO A NEW FIXED RATE.

The difference between a fixed rate and an adjustable rate mortgage is that, for fixed rates the interest rate is set when you take out the loan and will not change. With an adjustable rate mortgage, the interest rate may go up or down. Many ARMs will start at a lower interest rate than fixed rate mortgages.

The Maryland Mortgage Program (MMP) provides 30-year fixed-rate home loans to eligible homebuyers purchasing in Maryland.

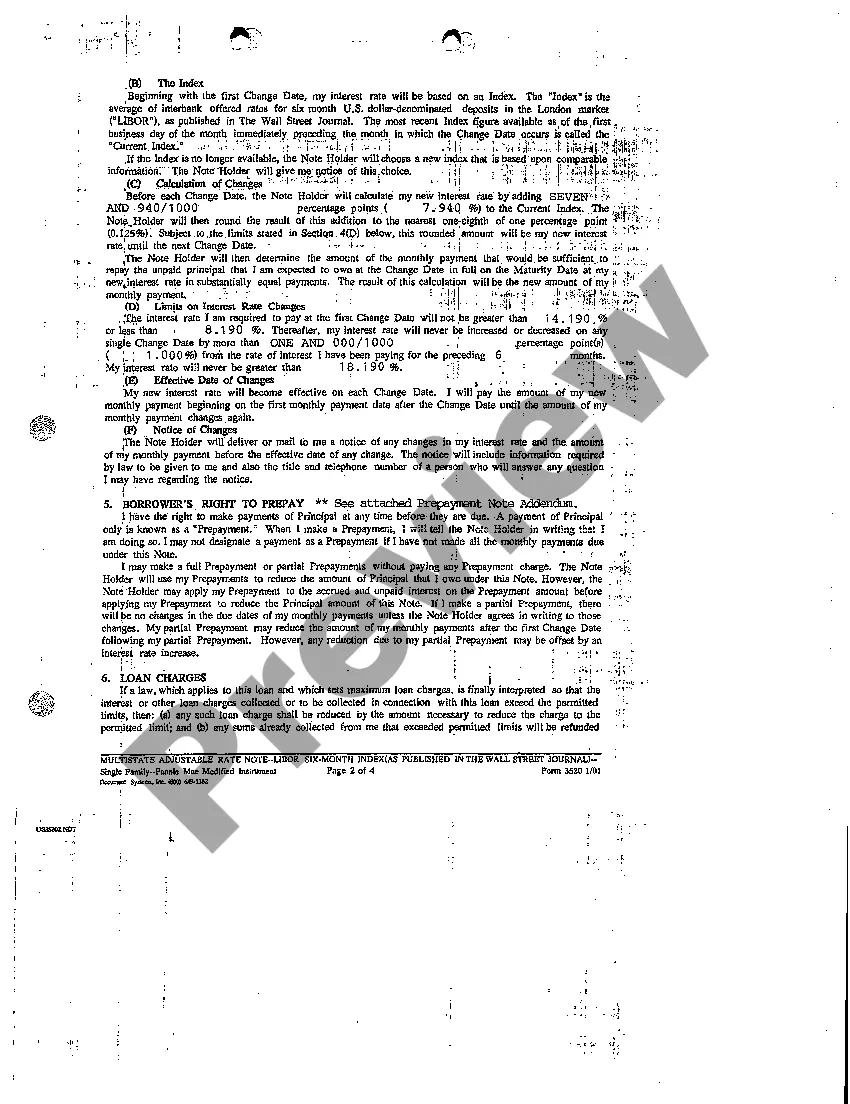

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

The difference between a fixed rate and an adjustable rate mortgage is that, for fixed rates the interest rate is set when you take out the loan and will not change. With an adjustable rate mortgage, the interest rate may go up or down.Your payment goes up when this index of interest rates increases.