Maryland Adjustable Rate Rider

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Adjustable Rate Rider?

Greetings to the largest collection of legal documents, US Legal Forms. Here, you can discover any sample including Maryland Adjustable Rate Rider templates and download as many as you require.

Create official documents in only a few hours, instead of days or even weeks, without spending a fortune on a lawyer or attorney. Obtain the state-specific form in just a few clicks and be assured that it was created by our licensed attorneys.

If you’re an existing subscribed customer, simply Log In to your account and click Download next to the Maryland Adjustable Rate Rider you require. As US Legal Forms is an online solution, you will typically have access to your downloaded templates, no matter what device you are using. Find them in the My documents section.

Print the document and fill it in with your or your business’s information. After completing the Maryland Adjustable Rate Rider, send it to your attorney for validation. This extra step is essential for ensuring that you’re completely protected. Sign up for US Legal Forms today and gain access to a vast collection of reusable samples.

- If you do not have an account yet, what are you waiting for.

- Review our guidelines below to get started.

- If this is a state-specific template, verify its applicability in your state.

- Examine the description (if available) to determine if it’s the correct sample.

- Explore more details using the Preview feature.

- If the sample fulfills all your criteria, simply click Buy Now.

- To set up your account, choose a pricing plan.

- Use a card or PayPal account to register.

- Download the template in your desired format (Word or PDF).

Form popularity

FAQ

The minimum credit score for the Maryland Mortgage Program (MMP) is typically around 640. However, requirements can vary based on the specific type of financing and terms associated with the Maryland Adjustable Rate Rider. A higher credit score often increases your chances of securing a better interest rate, making monthly payments more manageable. For tailored solutions and advice, consider exploring the resources available on uslegalforms.

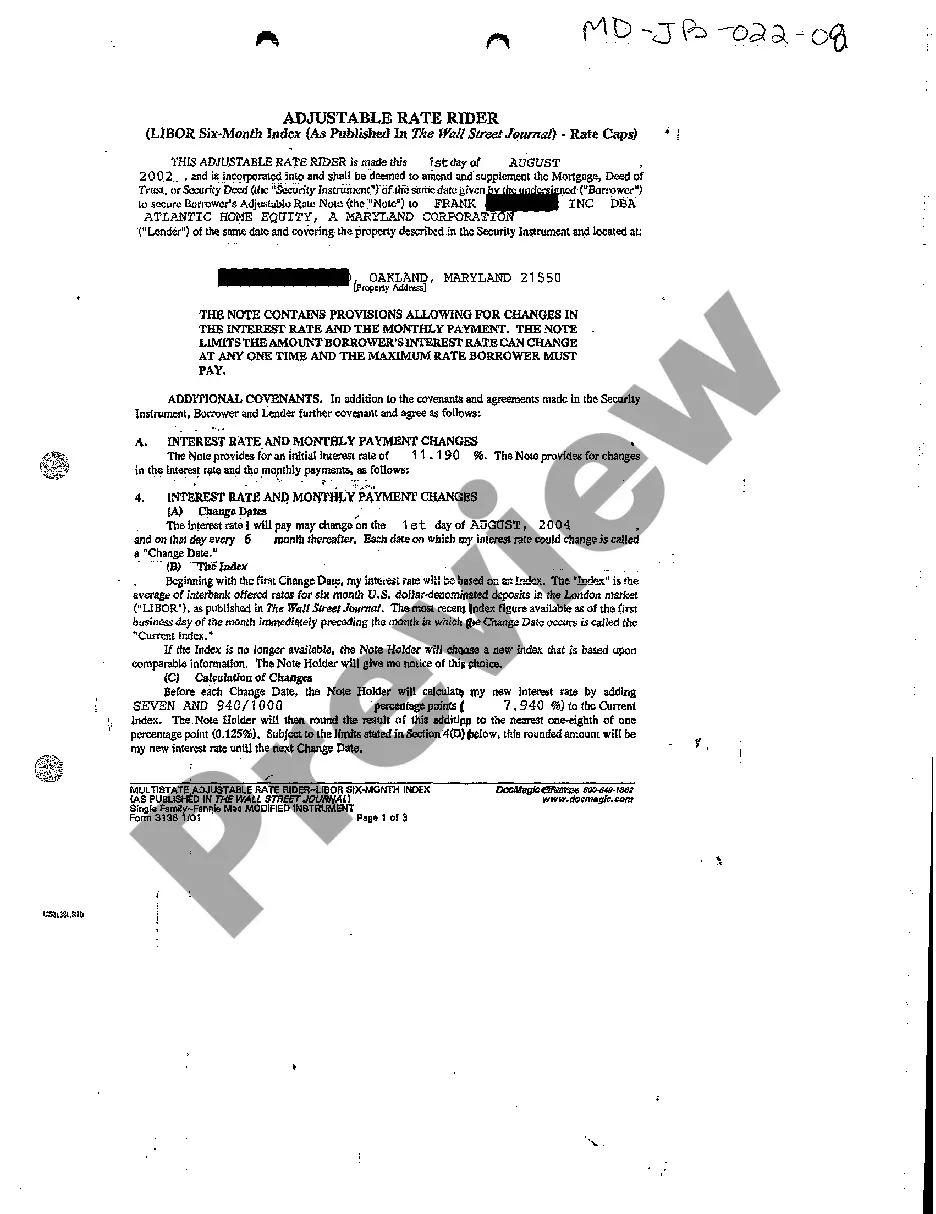

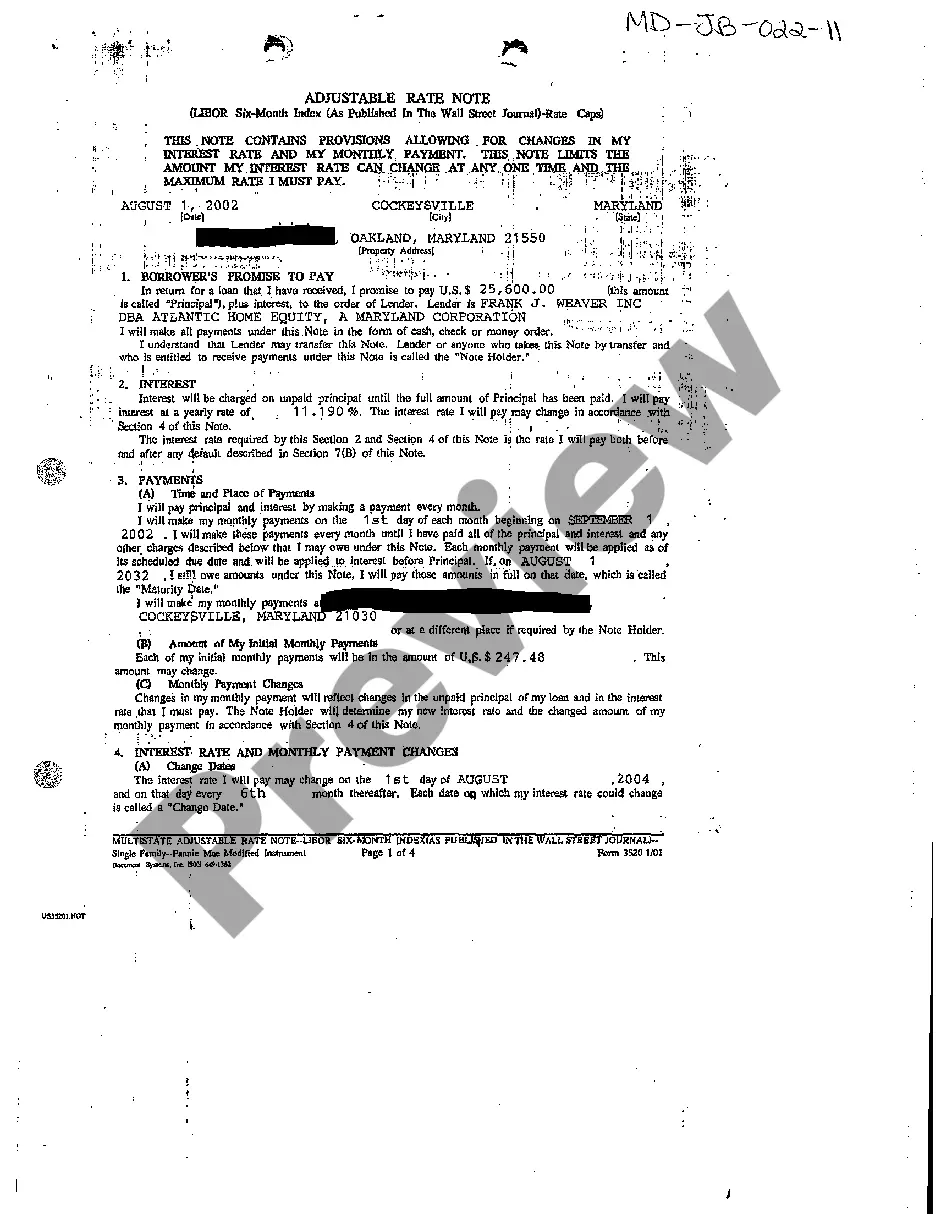

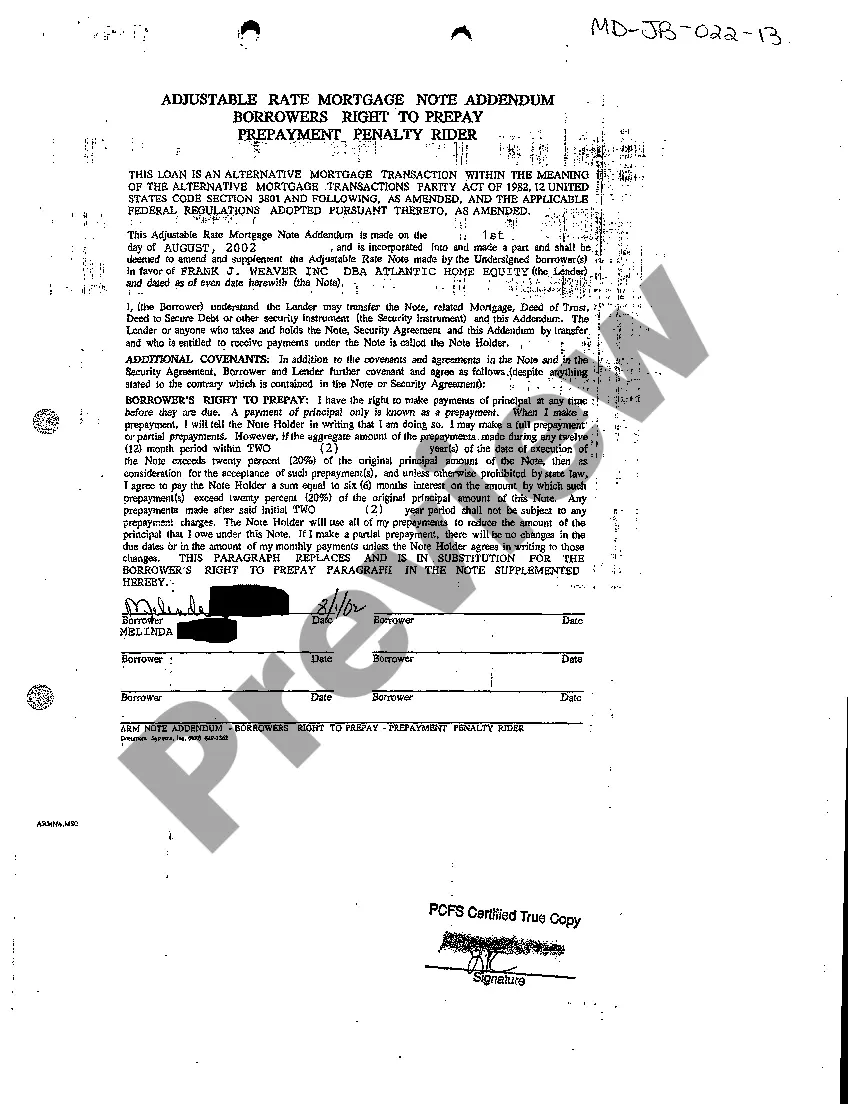

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

Uniform Instruments are the Fannie Mae/Freddie Mac and Freddie Mac Notes, Riders, and Security Instruments (Deeds of Trust and Mortgages) used when originating Single-Family residential mortgage loans, in all States and U. S. Territories, as identified in the List of Single-Family Uniform Instruments provided on this

For more than 25 years, SCHFA has helped thousands of individuals and families fulfill their dreams of owning a home. This program makes buying a home more affordable for qualifying homebuyers by offering a competitive 30-year fixed rate loan and a grant for downpayment and closing costs assistance.

Conventional loans require a 20% down payment, but FHA loans only require you provide 3.5% of your new home's value at the time of purchase. However, to receive the full potential of this perk, you must have a FICO® credit score of 580 or better.

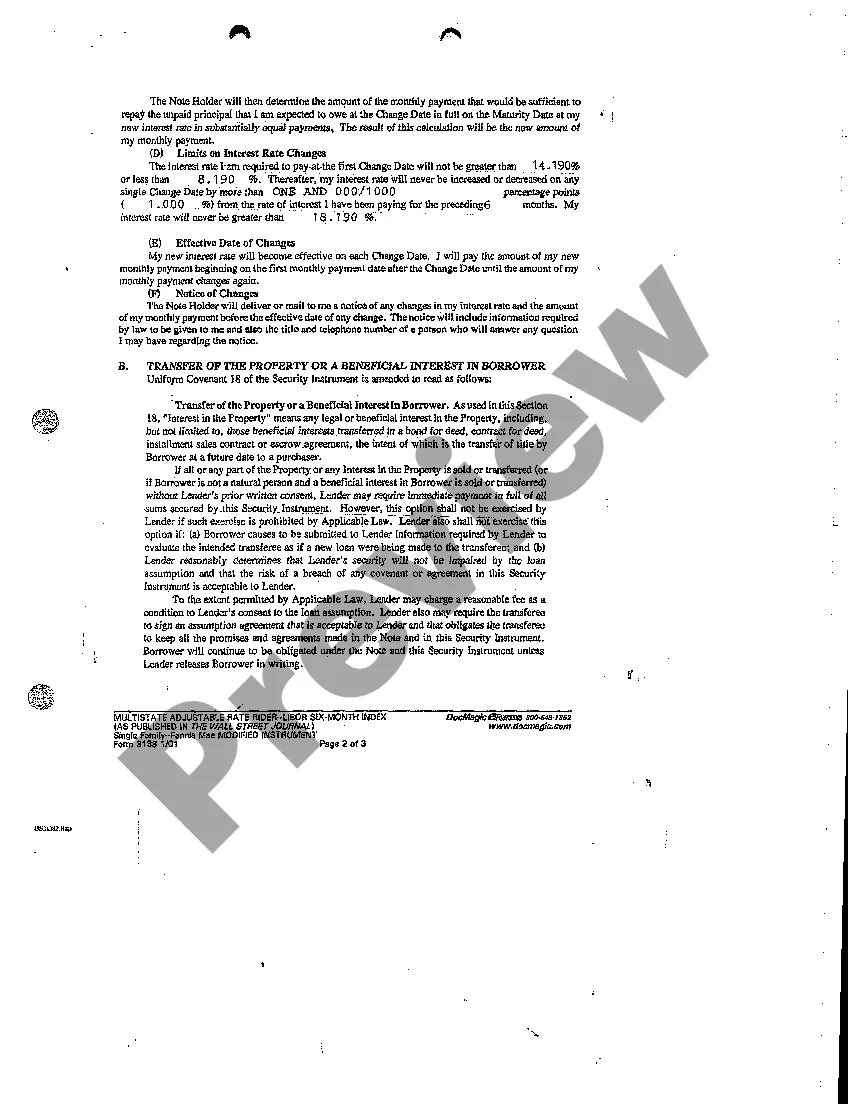

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

The Maryland Mortgage Program (MMP) helps homebuyers in Maryland achieve their dream of homeownership through a range of programs that make purchasing and owning a home more affordable. MMP home loans are 30-year fixed-rate loans available as either Government or Conventional insured loans.

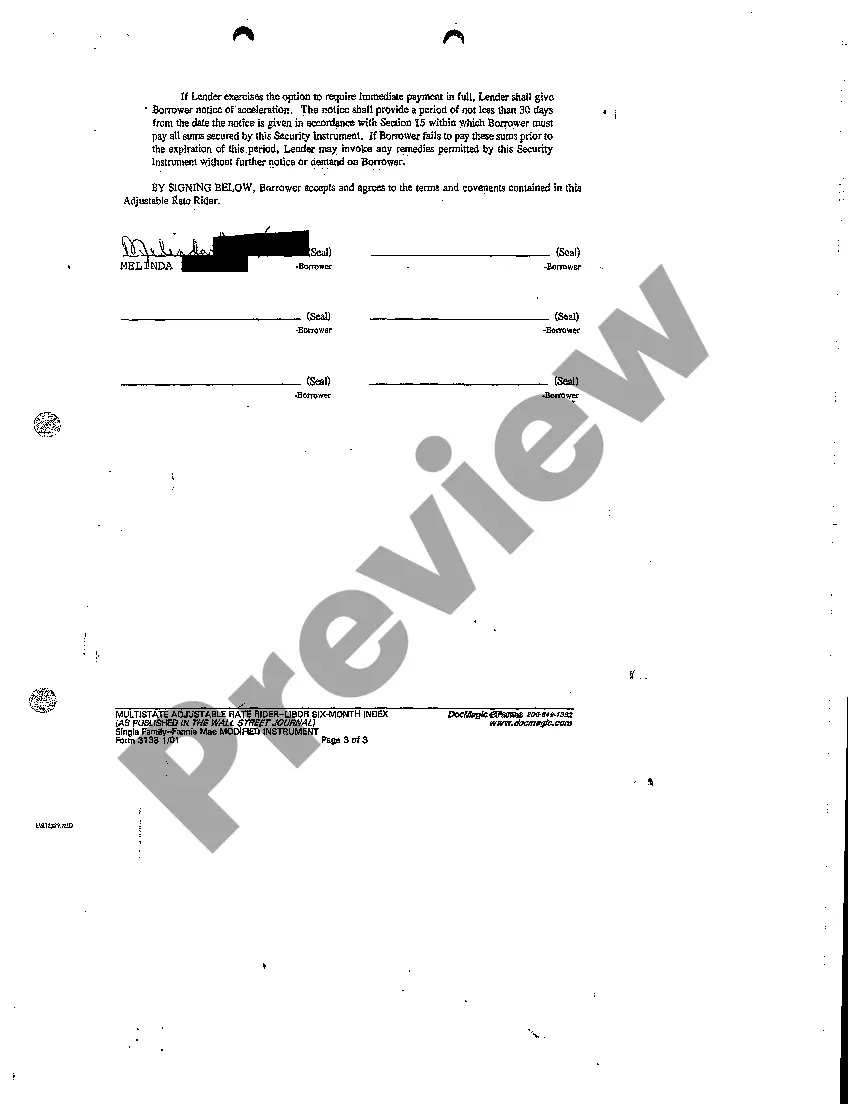

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date.The terms of this rider allow a lender to collect the property rent if you default on the loan. The rent the lender collects goes toward the outstanding loan balance.

The Maryland Mortgage Program (MMP) provides 30-year fixed-rate home loans to eligible homebuyers purchasing in Maryland.

A Maryland HomeCredit, generically referred to as a mortgage credit certificate, allows eligible homebuyers to claim a federal tax credit of up to $2,000 every year, for the life of the loan.This amount can be claimed as a tax credit each year until the loan is paid off, refinanced, transferred, or the home is sold.