Massachusetts Deed and Assignment from individual to A Trust

Description

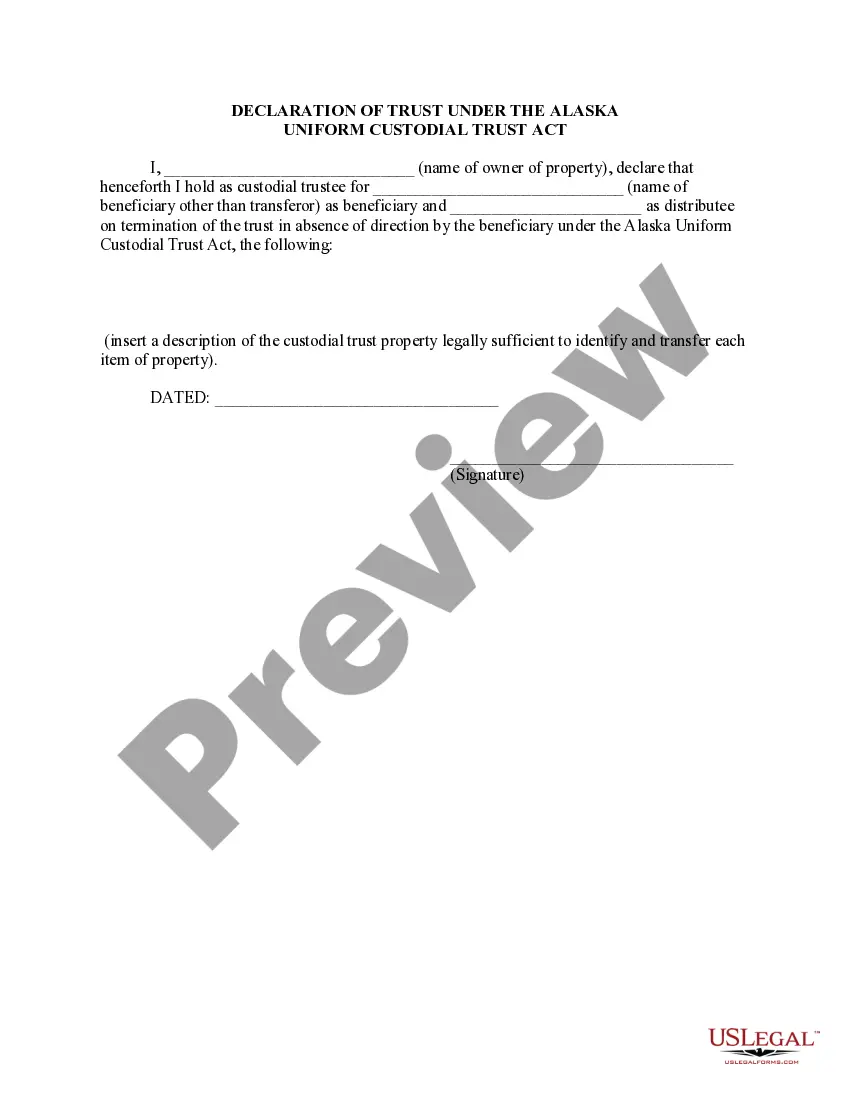

How to fill out Deed And Assignment From Individual To A Trust?

It is possible to commit hrs online attempting to find the legitimate papers format that fits the federal and state needs you will need. US Legal Forms supplies 1000s of legitimate kinds which can be evaluated by professionals. It is simple to acquire or produce the Massachusetts Deed and Assignment from individual to A Trust from your assistance.

If you already have a US Legal Forms profile, you can log in and then click the Down load button. Following that, you can full, revise, produce, or indicator the Massachusetts Deed and Assignment from individual to A Trust. Every single legitimate papers format you buy is your own eternally. To obtain one more copy of the obtained type, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms website initially, keep to the easy directions listed below:

- Initially, make sure that you have chosen the proper papers format for the county/city of your choice. Look at the type explanation to ensure you have picked the correct type. If readily available, use the Preview button to check through the papers format too.

- If you want to locate one more variation of the type, use the Research field to discover the format that meets your requirements and needs.

- After you have located the format you desire, simply click Acquire now to carry on.

- Find the pricing strategy you desire, type in your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your charge card or PayPal profile to cover the legitimate type.

- Find the structure of the papers and acquire it to your product.

- Make alterations to your papers if needed. It is possible to full, revise and indicator and produce Massachusetts Deed and Assignment from individual to A Trust.

Down load and produce 1000s of papers web templates utilizing the US Legal Forms site, that provides the biggest variety of legitimate kinds. Use expert and condition-distinct web templates to handle your small business or personal requires.

Form popularity

FAQ

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

To make a living trust in Massachusetts, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

You might choose to put just a few vital assets, such as your house, in a trust and have everything else be decided by your will. This can help ensure a speedy transfer for your most important assets while the rest of your estate goes through the normal probate process.

In Massachusetts, the cost for comprehensive estate plan drafting can range from $900 to $4,950 or more, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Massachusetts can range from roughly $250 to $1,000. A trust typically costs anywhere between $900 and $3,450.

Transferring personal property to a trust To place them in your living trust fund, you can name them in your trust document on a property schedule (basically a list you attach to the trust document that is referred to in the document) and indicate that their ownership is being transferred to the trust.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed.