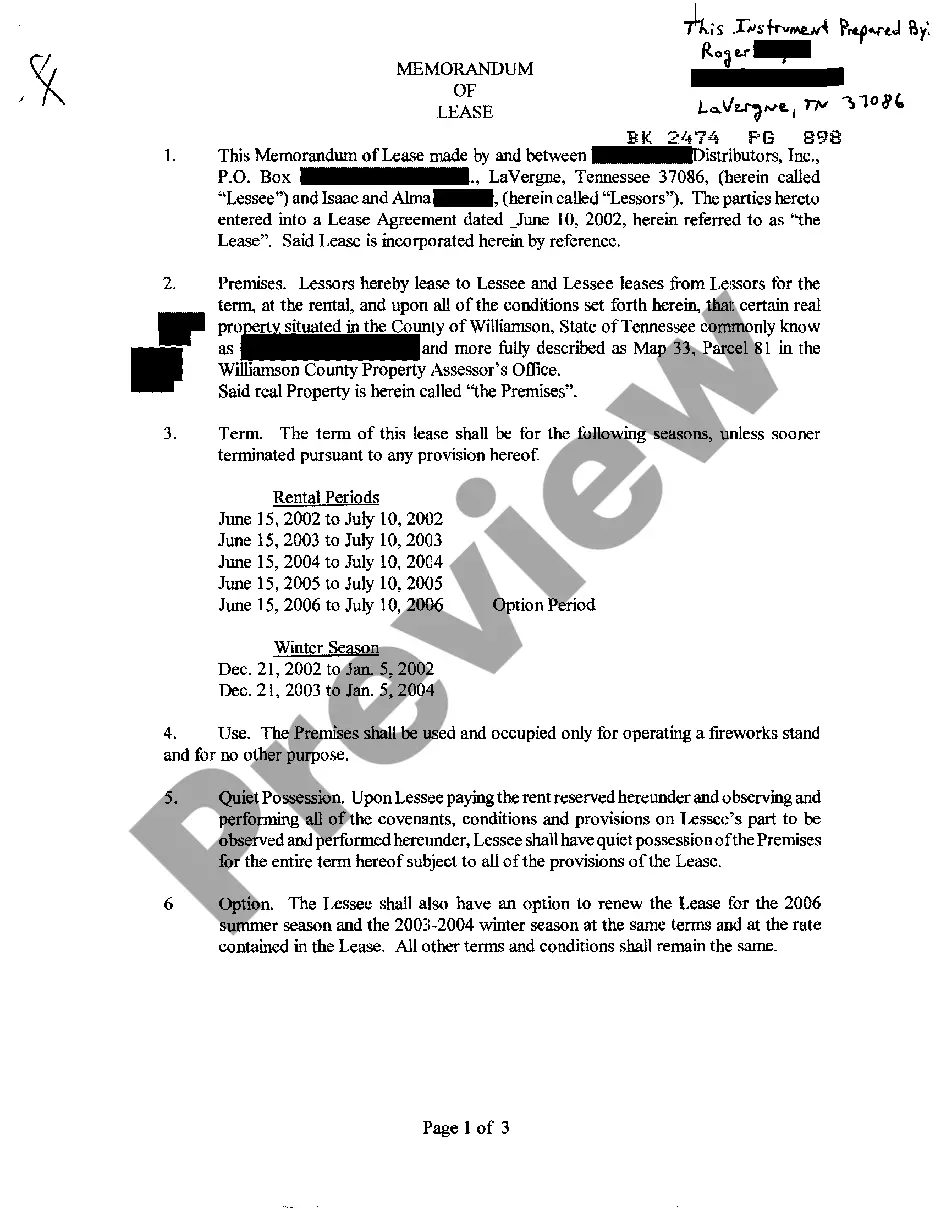

Massachusetts Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

Finding the right authorized document template could be a battle. Of course, there are a lot of templates available on the Internet, but how do you discover the authorized develop you need? Take advantage of the US Legal Forms internet site. The support gives a huge number of templates, for example the Massachusetts Deed and Assignment from Trustee to Trust Beneficiaries, that can be used for enterprise and private needs. Each of the varieties are examined by professionals and fulfill federal and state requirements.

When you are presently signed up, log in in your accounts and click the Download key to get the Massachusetts Deed and Assignment from Trustee to Trust Beneficiaries. Make use of accounts to search throughout the authorized varieties you might have ordered in the past. Proceed to the My Forms tab of your own accounts and get one more copy of the document you need.

When you are a brand new user of US Legal Forms, listed here are basic guidelines for you to stick to:

- Initially, make sure you have selected the appropriate develop to your metropolis/region. You may check out the shape using the Preview key and browse the shape description to ensure it will be the right one for you.

- In case the develop is not going to fulfill your expectations, use the Seach field to get the correct develop.

- When you are certain the shape would work, select the Purchase now key to get the develop.

- Pick the rates strategy you desire and enter the needed details. Design your accounts and pay for an order making use of your PayPal accounts or Visa or Mastercard.

- Select the document structure and obtain the authorized document template in your product.

- Comprehensive, edit and printing and indicator the attained Massachusetts Deed and Assignment from Trustee to Trust Beneficiaries.

US Legal Forms will be the largest collection of authorized varieties that you can discover a variety of document templates. Take advantage of the company to obtain expertly-manufactured papers that stick to express requirements.

Form popularity

FAQ

Transferring personal property to a trust To place them in your living trust fund, you can name them in your trust document on a property schedule (basically a list you attach to the trust document that is referred to in the document) and indicate that their ownership is being transferred to the trust.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds. How to distribute trust assets to beneficiaries - Policygenius Policygenius ? ... ? What is a trust? Policygenius ? ... ? What is a trust?

The transferee must have been a beneficiary of the trust when the property was acquired and became an asset of the trust (i.e. the relevant time). There must be no consideration for the transfer and the transfer of property from trustee to beneficiary must not be part of a sale or other arrangement.

To make a living trust in Massachusetts, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets. Probate Trusts - The Superior Court of California, County of Santa Clara scscourt.org ? self_help ? probate ? property scscourt.org ? self_help ? probate ? property

When property is ?held in trust,? there is a divided ownership of the property, ?generally with the trustee holding legal title and the beneficiary holding equitable title.? The trust itself owns nothing because it is not an entity capable of owning property.

Key Takeaways. Irrevocable trusts cannot be modified, amended, or terminated without permission from the grantor's beneficiaries or by court order. The grantor transfers all ownership of assets into the trust and legally removes all of their ownership rights to the assets and the trust. Irrevocable Trusts Explained: How They Work, Types, and Uses investopedia.com ? terms ? irrevocabletrust investopedia.com ? terms ? irrevocabletrust

Yes, as a trustee, you can transfer stock from a trust to a beneficiary without selling it if the terms of the trust allow you to do so. If the trust instrument allows for the transfer of stock to a beneficiary, the trustee can transfer the stock as directed by the trust agreement. Can You Sell Stock In a Trust After Death? - RMO LLP rmolawyers.com ? can-you-sell-stock-in-a-trust-af... rmolawyers.com ? can-you-sell-stock-in-a-trust-af...