This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Massachusetts Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

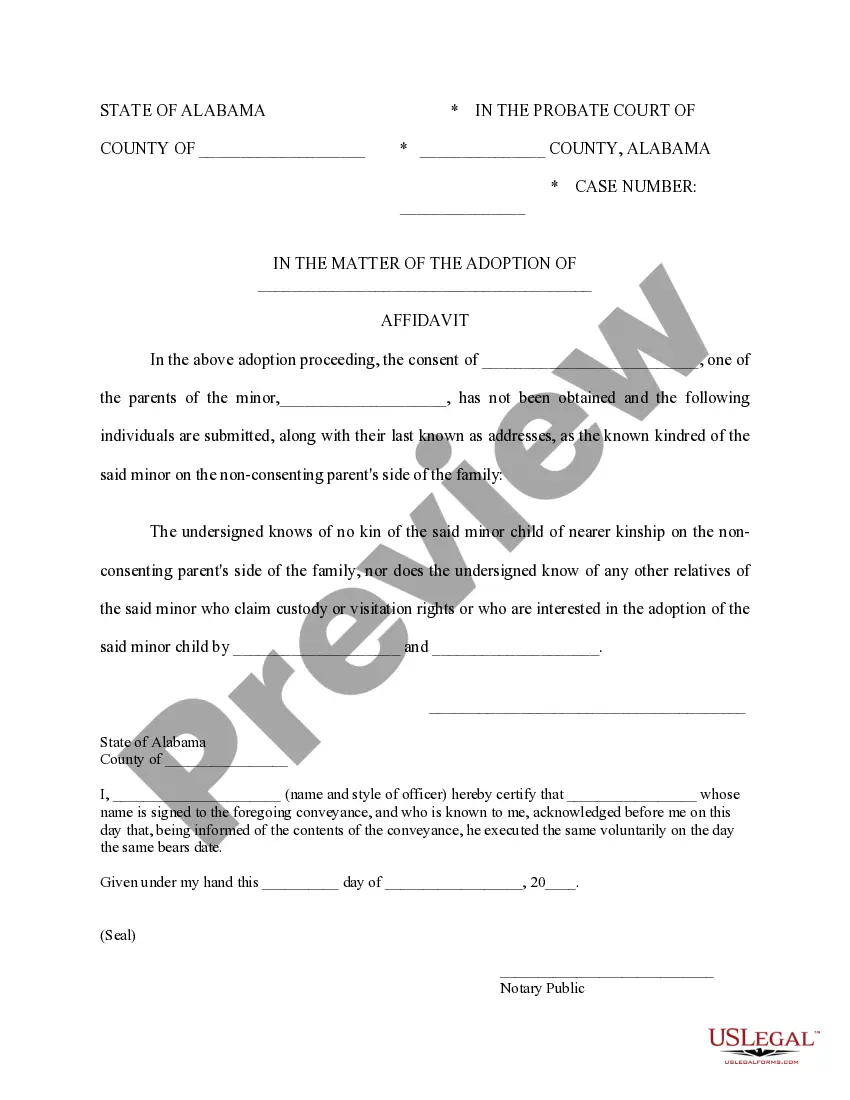

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

If you have to full, download, or printing lawful record templates, use US Legal Forms, the largest collection of lawful forms, that can be found on-line. Utilize the site`s basic and practical look for to find the papers you need. Numerous templates for company and specific purposes are sorted by types and claims, or search phrases. Use US Legal Forms to find the Massachusetts Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries within a few clicks.

In case you are already a US Legal Forms customer, log in to the account and click the Obtain switch to obtain the Massachusetts Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. You can even entry forms you formerly downloaded from the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for the correct metropolis/region.

- Step 2. Make use of the Preview solution to look over the form`s content material. Never neglect to learn the explanation.

- Step 3. In case you are not happy with the develop, make use of the Research area towards the top of the display screen to find other models from the lawful develop template.

- Step 4. Upon having found the form you need, go through the Get now switch. Pick the rates program you prefer and add your accreditations to register on an account.

- Step 5. Process the deal. You may use your charge card or PayPal account to finish the deal.

- Step 6. Find the file format from the lawful develop and download it on your own product.

- Step 7. Full, edit and printing or indicator the Massachusetts Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Every single lawful record template you purchase is your own eternally. You possess acces to every single develop you downloaded inside your acccount. Select the My Forms segment and pick a develop to printing or download again.

Compete and download, and printing the Massachusetts Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with US Legal Forms. There are many skilled and condition-distinct forms you can use for your personal company or specific requirements.

Form popularity

FAQ

Your Rights as the Beneficiary of a Trust As a beneficiary, you have a right to be informed about the trust's existence, its terms, and its administration. You're entitled to regular reports or accountings from the trustee, detailing the trust assets, liabilities, income, and expenses.

Yes, a trustee can refuse to pay a beneficiary if the trust allows them to do so. Whether a trustee can refuse to pay a beneficiary depends on how the trust document is written. Trustees are legally obligated to comply with the terms of the trust when distributing assets.

The assets are held in the trust with income or assets distributed to the individual later. The trust can be fixed or as flexible as you like with discretion given to the nominated trustee over what and when is distributed.

Disadvantages of a Testamentary Trust Lack of Privacy: Testamentary trusts are part of a person's will, which becomes public record upon their death. This means that the details of the trust and its beneficiaries are accessible to the public.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

Anyone listed as a trust beneficiary will be entitled to receive a copy of the Trust. Additionally, an heir of the settlor is entitled to a copy of the Trust. When an heir's told, they are disinherited, receiving a copy of the Trust is particularly important.

It is a trust structure that is often used to protect family assets by having greater control over management and distributions of the deceased estate to beneficiaries. It is crucial that the planning and appointing process of the trustee is well governed.

When the settlor dies, all or part of his or her assets are distributed to beneficiaries through testamentary trusts. While the trusts will be taxed as a whole, the beneficiaries of the individual trusts will not be taxed for the devise.