Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can acquire numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor within moments.

If you have a subscription, Log In and download the Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the file format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor. Each document you add to your account has no expiration date and is yours permanently. So, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

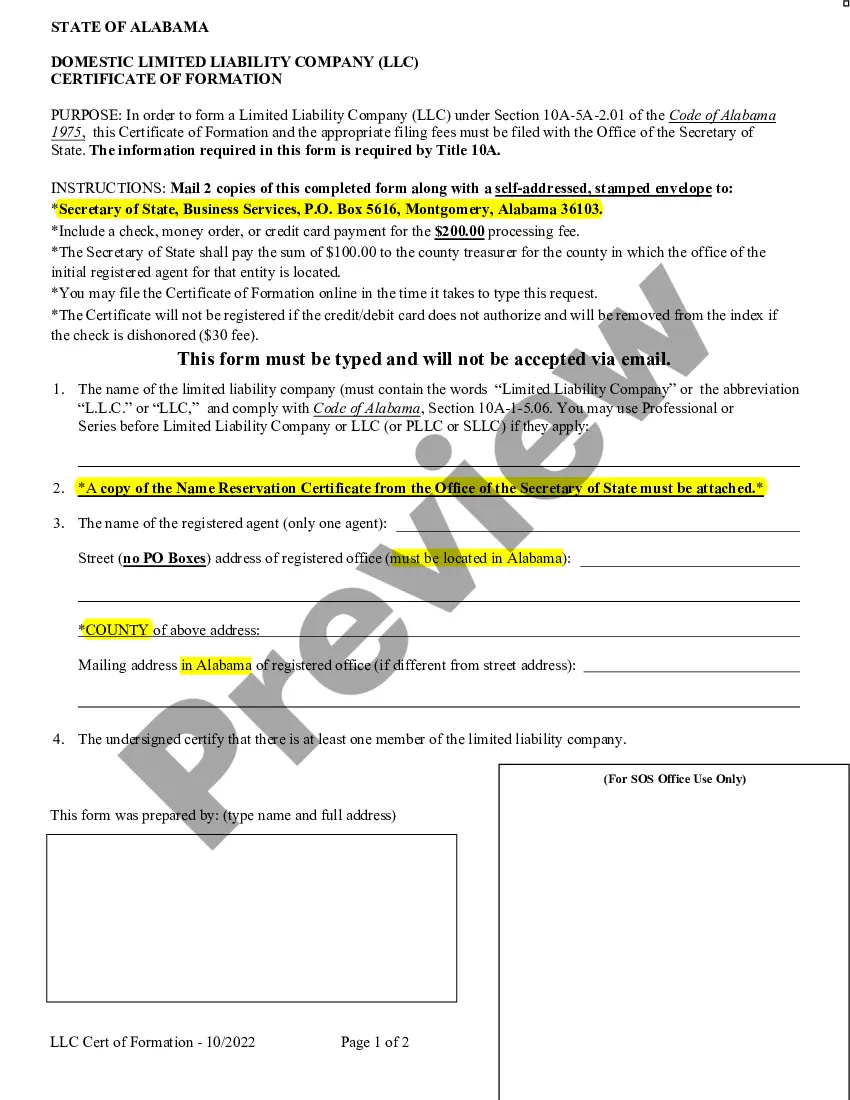

- Ensure you have selected the appropriate form for your locality/region.

- Click on the Review button to examine the form's information.

- Read the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

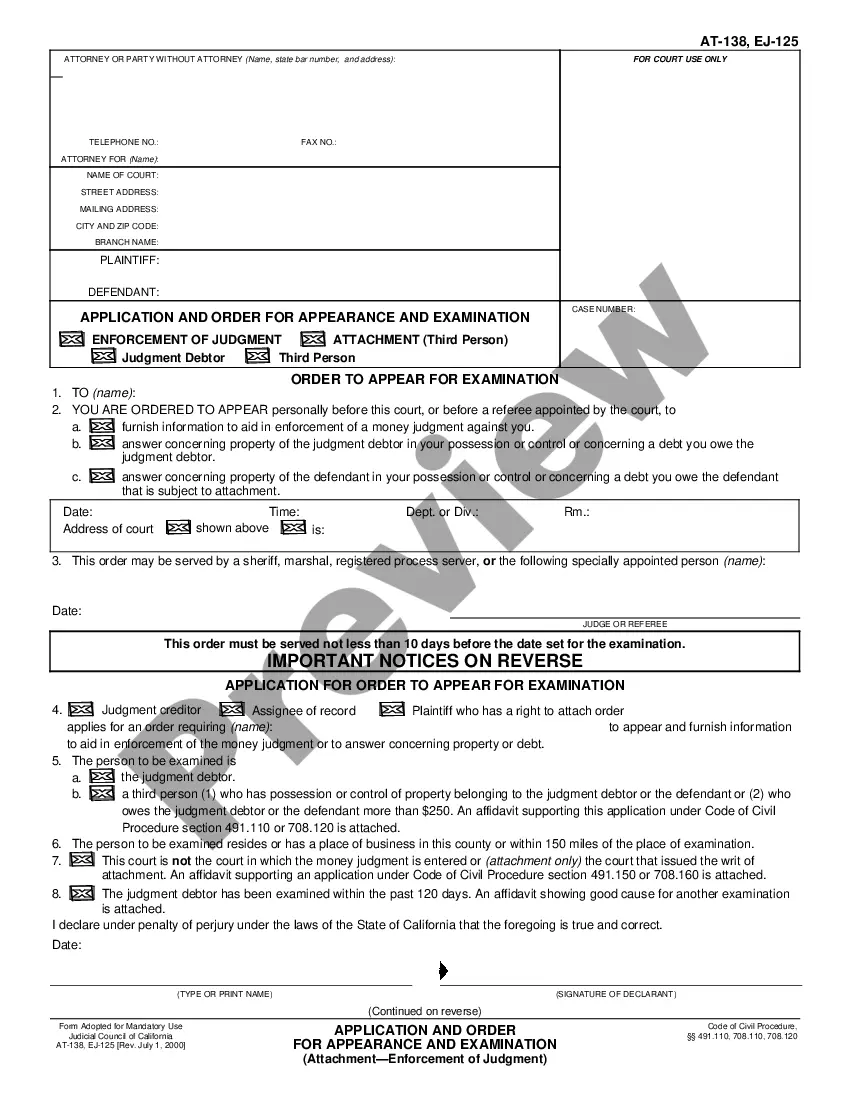

A legal agreement for an independent contractor outlines the terms of service between the contractor and the client. Specifically, a Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor details crucial aspects like payment terms, project scope, and confidentiality. Having a clear agreement ensures both parties understand their responsibilities and rights. Platforms like uslegalforms offer templates that can help you create a robust contract tailored to your needs.

In Massachusetts, independent contractors generally do not need to carry workers' compensation insurance. However, if you are operating under a Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor, you should consider the nature of your work and potential risks. Some businesses may require proof of insurance even for contractors. Always consult a legal expert to ensure you meet all necessary requirements.

Filling out a Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor is straightforward. First, gather all necessary information about both parties, including names, addresses, and contact details. Next, clearly outline the scope of work, payment terms, and deadlines. Finally, review the agreement carefully to ensure all details are accurate before both parties sign to establish a clear understanding of the working relationship.

In Massachusetts, an independent contractor agreement outlines the relationship between a business and the contractor. This agreement details the terms of engagement, including payment structure, responsibilities, and confidentiality issues. Understanding the specifics of this arrangement is crucial to avoid misclassification. For your Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor, USLegalForms offers templates that help you create a solid legal document.

Creating an independent contractor agreement is straightforward. First, define the scope of work and specify the terms, such as payment and deadlines. It’s essential to include clauses that outline confidentiality, ownership of work, and dispute resolution. You can utilize USLegalForms to simplify the process and ensure your Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor meets all legal requirements.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.