Massachusetts Government Contractor Agreement - Self-Employed

Description

How to fill out Government Contractor Agreement - Self-Employed?

Selecting the correct official document template can be a challenge. Clearly, there are numerous formats available online, but how will you locate the official form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Massachusetts Government Contractor Agreement - Self-Employed, which you can utilize for both business and personal purposes. All of the forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Massachusetts Government Contractor Agreement - Self-Employed. Use your account to browse the official forms you may have previously purchased. Navigate to the My documents section of your account and get another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure you have selected the correct form for your area/region. You can review the document using the Preview button and read the document description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the document is correct, click on the Get now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the official document template to your system. Finally, complete, review, and print and sign the acquired Massachusetts Government Contractor Agreement - Self-Employed.

- US Legal Forms is the largest repository of official documents where you can find a multitude of file templates.

- Utilize the service to obtain properly crafted paperwork that comply with state regulations.

- Selecting the right document can be challenging.

- Ensure the form meets your needs before purchasing.

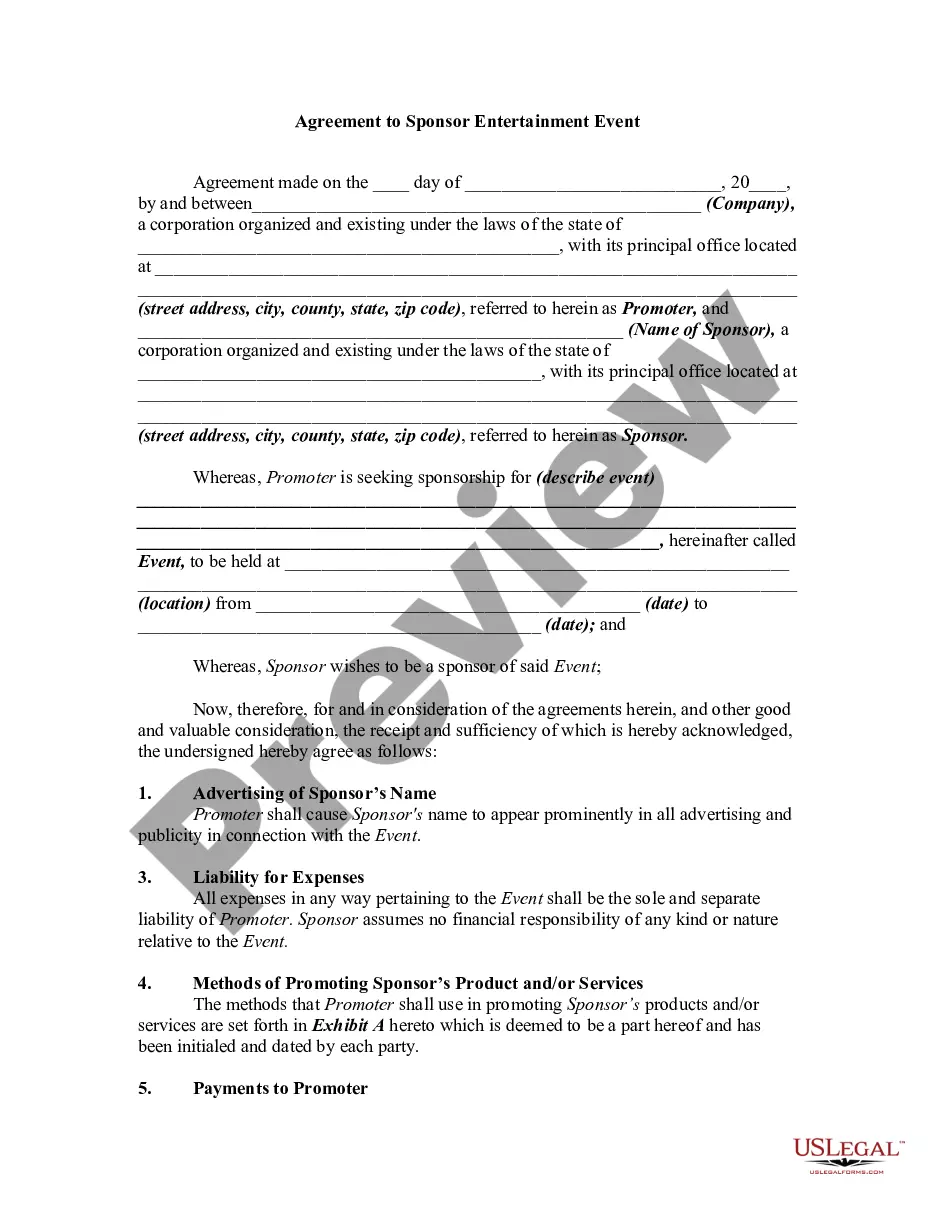

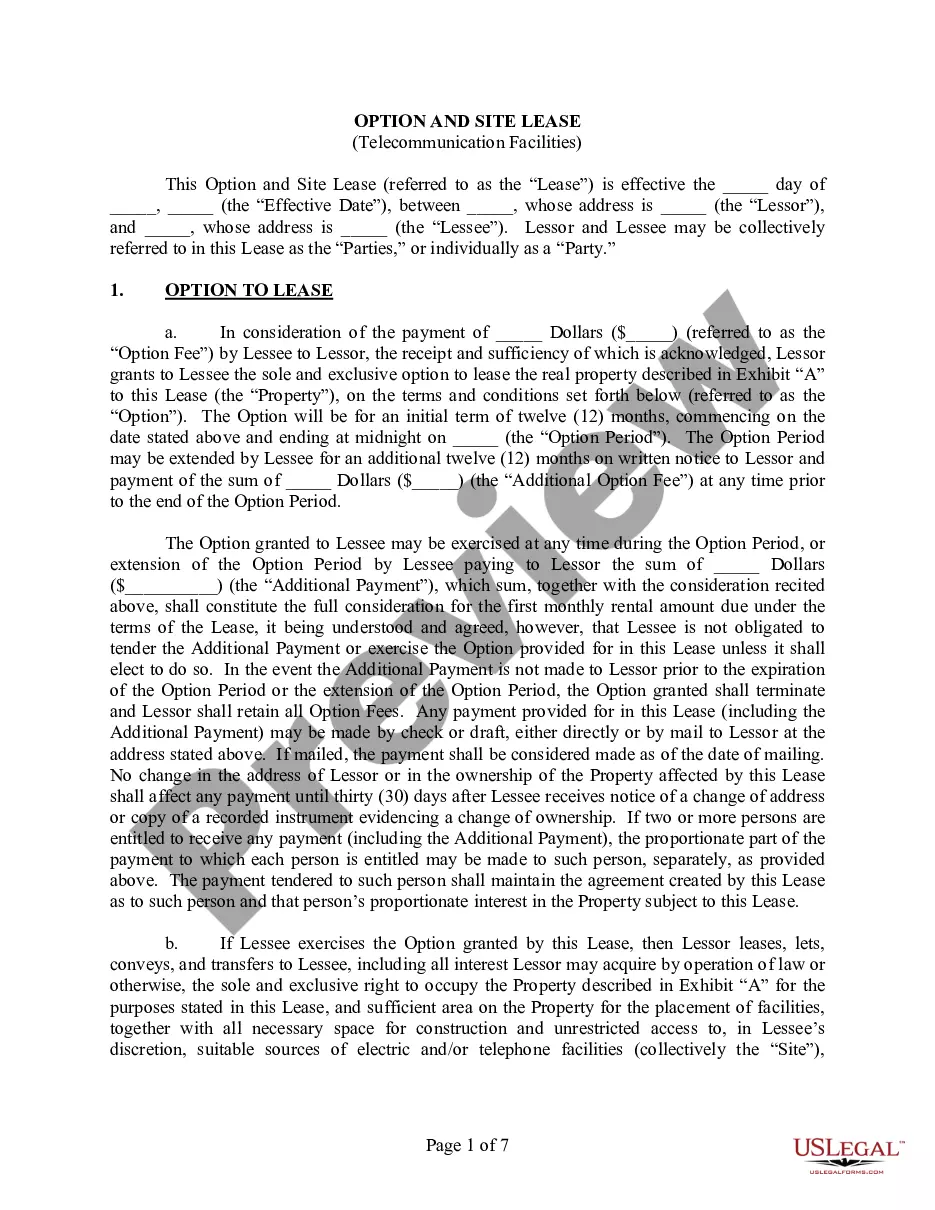

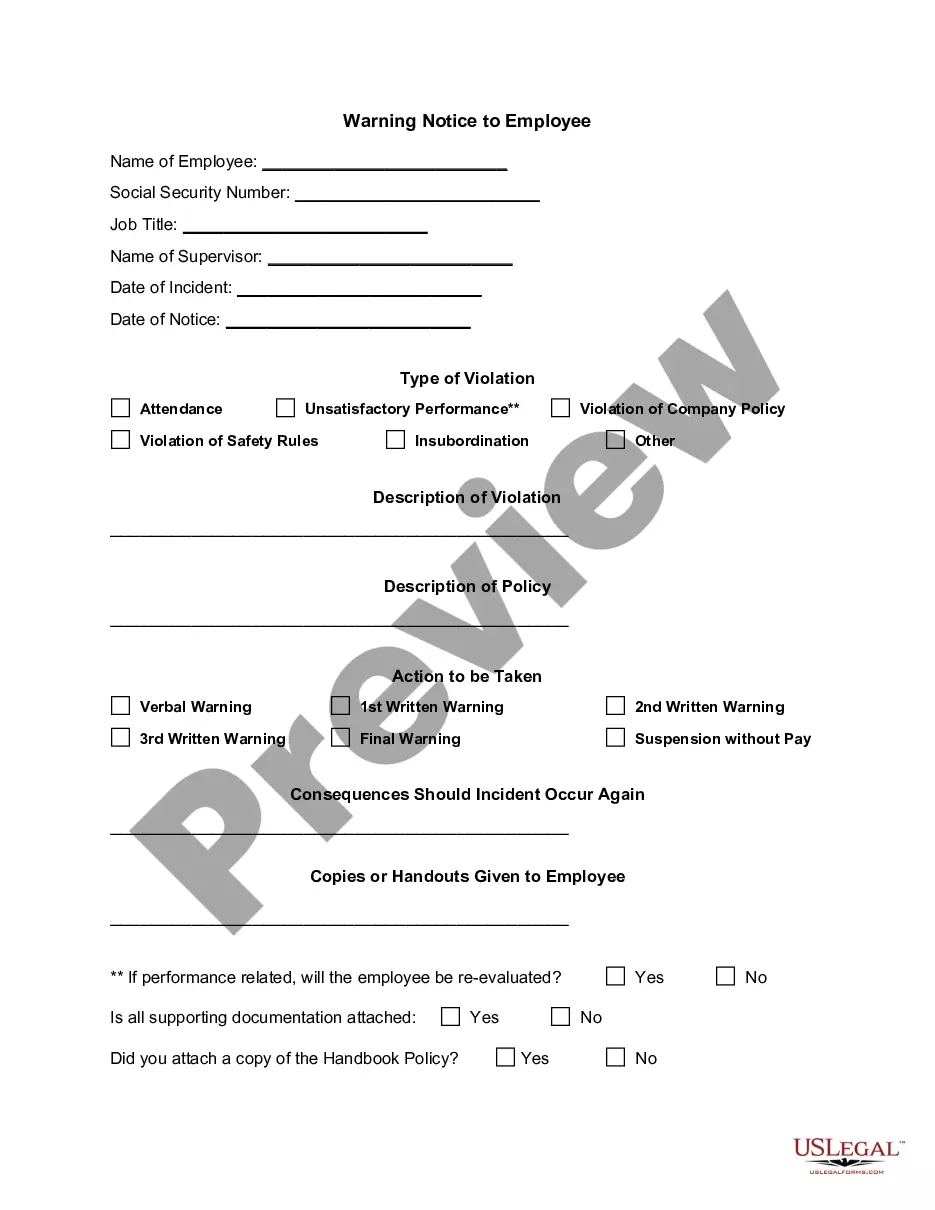

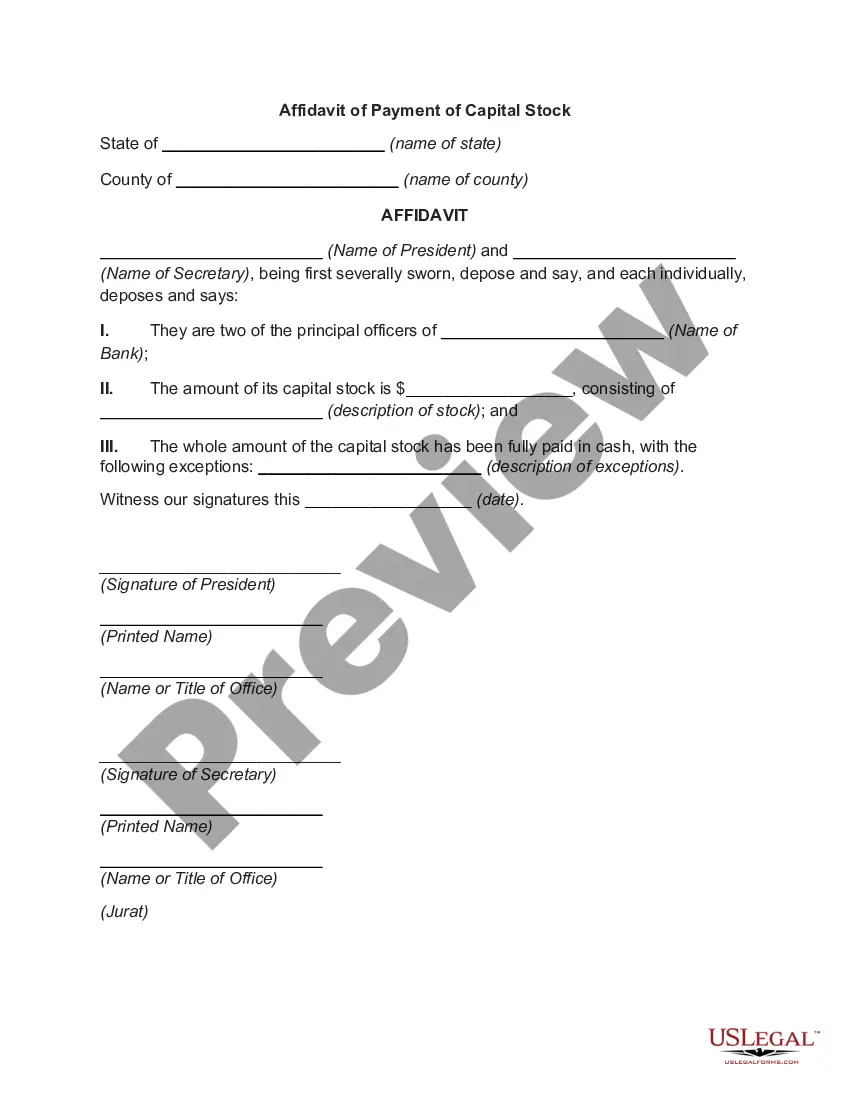

- Use the Preview feature to verify the document.

- Easily manage your forms through your account.

Form popularity

FAQ

Writing an independent contractor agreement begins with outlining the parties involved, which includes your name and the hiring entity's name. Specify the work to be performed, payment arrangements, and timelines for completion. Make sure to include clauses that address confidentiality and dispute resolution. Using the Massachusetts Government Contractor Agreement - Self-Employed template from uslegalforms can make drafting this agreement easier and more comprehensive, ensuring you cover all essential aspects.

Filling out an independent contractor form is straightforward. Start by entering your personal information, including your name, address, and contact details. Next, provide the scope of work you will be completing, along with the payment terms and any other relevant details. To streamline this process, consider using the Massachusetts Government Contractor Agreement - Self-Employed from uslegalforms, which offers a clear structure and ensures you include all necessary elements.

Yes, in many cases, a contractor is considered self-employed. Contractors operate under their own business structures and provide services to clients without being classified as employees. This classification allows them to use a Massachusetts Government Contractor Agreement - Self-Employed, which outlines their responsibilities and ensures clarity. Being self-employed offers flexibility and control over their work, but it also requires an understanding of the legal implications.

An independent contractor agreement in Massachusetts outlines the working relationship between a contractor and a client. This legal document specifies the scope of work, deadlines, payment terms, and responsibilities. Using a Massachusetts Government Contractor Agreement - Self-Employed allows you to customize these terms to fit your unique situation, protecting both parties involved. It serves as a reliable reference to resolve any potential disputes.

The 3 hour rule in Massachusetts governs how employers must handle payments for employees and independent contractors. It stipulates that if a contractor works for more than three hours, they are entitled to payment for that minimum time period, even if the work is cut short. Understanding this rule is crucial for self-employed individuals, especially when drafting a Massachusetts Government Contractor Agreement - Self-Employed. This agreement should include payment terms that cater to these regulations.

Yes, creating a contract is essential if you're self-employed. A Massachusetts Government Contractor Agreement - Self-Employed helps define the terms of your work with clients clearly. It protects both your rights and the client's interests, ensuring that expectations are aligned from the start. Without a contract, misunderstandings regarding deliverables, payment, and timelines may arise.

Filling out an independent contractor agreement requires attention to detail. Start by gathering all necessary information about the parties involved, the services to be provided, and the monetary compensation. Using a template for a Massachusetts Government Contractor Agreement - Self-Employed can streamline this process and help ensure you don’t miss any key elements.

New rules for the self-employed often focus on tax regulations, benefits, and rights. Staying informed about the latest developments can help you navigate the landscape more effectively. Utilizing resources such as a Massachusetts Government Contractor Agreement - Self-Employed can assist you in complying with these new requirements and ensuring your agreements are up to date.

Absolutely, having a contract is crucial when you are self-employed. A Massachusetts Government Contractor Agreement - Self-Employed helps define your relationship with clients and protects your rights. It details your scope of work, payment terms, and other vital elements that clarify expectations.

Yes, being a contractor does count as self-employed. When you work under a Massachusetts Government Contractor Agreement - Self-Employed, you manage your own business and receive payment directly for your services. This arrangement allows for greater flexibility and independence compared to traditional employment.