Massachusetts Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

If you require to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

A variety of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have found the form you need, select the Buy now option. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Massachusetts Authorization of Consumer Report with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Massachusetts Authorization of Consumer Report.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/state.

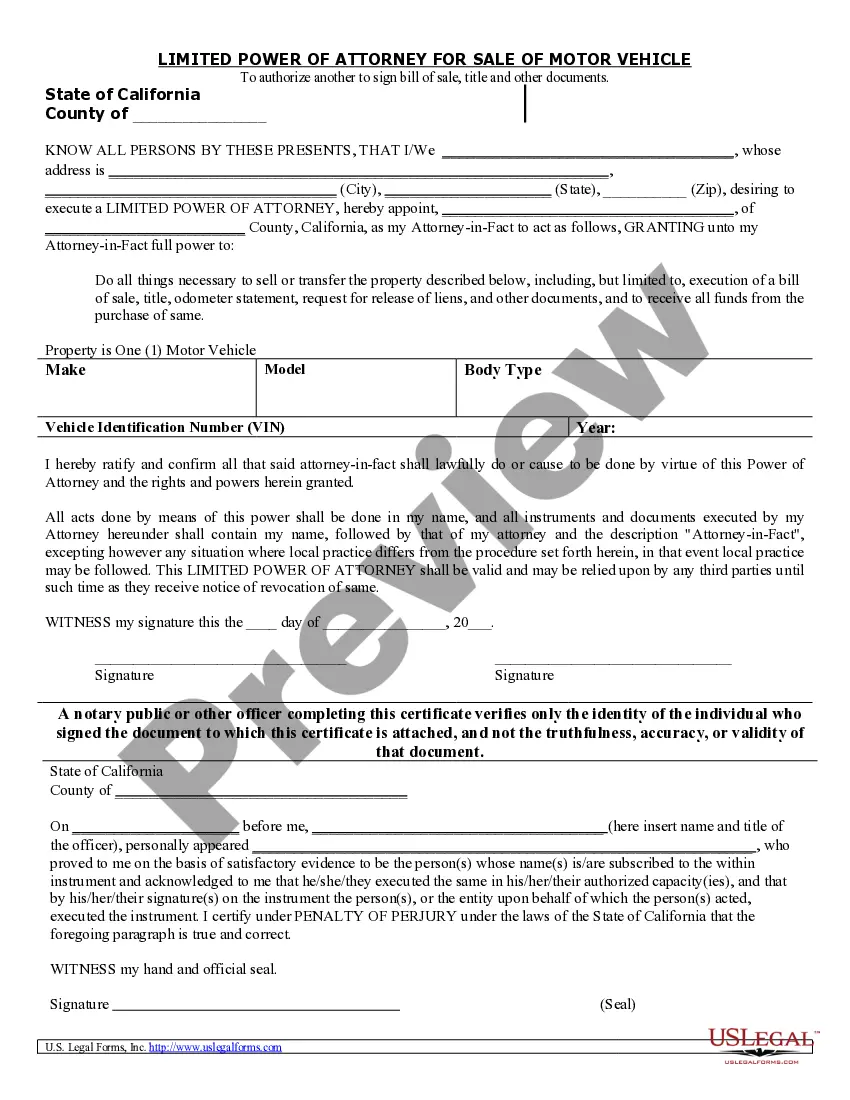

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A demand letter, as required by the Massachusetts Consumer Protection Act, is a formal notice sent to the party you believe has engaged in unfair practices. It outlines your grievances and specifies the resolution you seek. Sending this letter is a critical step before filing a 93A claim, and referencing the Massachusetts Authorization of Consumer Report can strengthen your position.

Employers routinely obtain consumer reports that include the verification of the applicant/employee's Social Security number; current and previous residences; employment history, including all personnel files; education; references; credit history and reports; criminal history, including records from any criminal

A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments. Increasingly, these records also include your activity on social media, such as Twitter and Facebook.

To dispute inaccurate information on your checking account consumer report, you should file a dispute with the checking account reporting company that compiled the report. You should also file a dispute with the bank, credit union, or company that provided the information to the checking account reporting company.

You can request and review your free report through one of the following ways:Online: Visit AnnualCreditReport.com.Phone: Call (877) 322-8228.Mail: Download and complete the Annual Credit Report Request form . Mail the completed form to:

An investigative consumer report is more like a detailed background check. Facts that create a picture of who you are as a person are included in this kind of report, and the gathering of that information might even include interviews with your neighbors, friends and associates.

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

You can order reports including your annual free reports from Experian, Equifax, and TransUnion at annualcreditreport.com and we recommend that you check your report with each company at least once per year . But you will have to order the specialty consumer reports individually from each reporting company.

Unlike federal law, California law also requires new consent each time an investigative report is sought during employment if the report is for purposes other than suspicion of wrongdoing or misconduct. Employers must provide the applicant or employee with the opportunity to request a copy of the report.

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.