Massachusetts Checklist - Partnership Agreement

Description

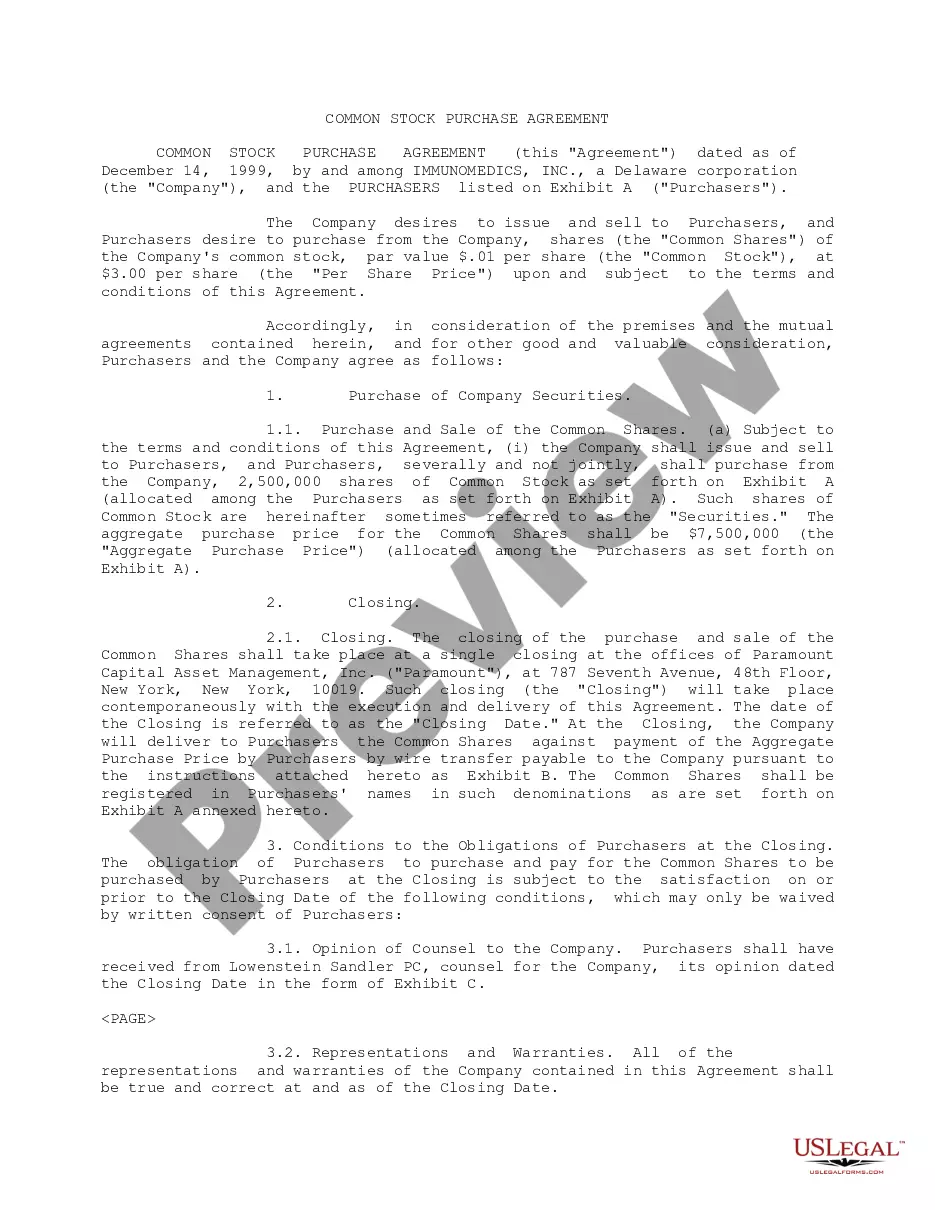

The partnership agreement is the heart of the partnership, and it must be enforced as written, with very few exceptions. Partners' rights are determined by the partnership agreement. If the agreement is silent regarding a matter, the parties' rights are typically determined by the UPA.

How to fill out Checklist - Partnership Agreement?

If you require thorough, retrieve, or generate legal document templates, utilize US Legal Forms, the predominant selection of legal forms available online.

Utilize the website's straightforward and user-friendly search to locate the documents you seek.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Each legal document template you procure is yours indefinitely.

You have access to every form you have purchased in your account. Click the My documents section and select a form to print or download again.

- Employ US Legal Forms to quickly find the Massachusetts Checklist - Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download button to obtain the Massachusetts Checklist - Partnership Agreement.

- You can also access forms you have previously purchased from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate state/country.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are unhappy with the form, use the Search bar at the top of the screen to find other versions of the legal document template.

- Step 4. After finding the form you need, click the Buy now button. Choose your desired pricing plan and enter your information to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Massachusetts Checklist - Partnership Agreement.

Form popularity

FAQ

A partnership agreement should include details like the business name, partners’ contributions, profit distribution, management structure, and terms for resolving disputes. These details promote clarity and prevent misunderstandings among partners. By referencing the Massachusetts Checklist - Partnership Agreement, all crucial elements can be incorporated seamlessly.

Yes, partnerships are required to file K-2 and K-3 forms if they have international activities. These forms provide necessary information for Massachusetts tax purposes and help ensure accurate reporting of income sourced from outside the U.S. Following the Massachusetts Checklist - Partnership Agreement can guide partners through these additional requirements.

To form a partnership, you need to have at least two partners and a mutual agreement to operate a business for profit. Additionally, creating a partnership agreement is highly recommended to outline each partner's roles and responsibilities. Consulting the Massachusetts Checklist - Partnership Agreement can help streamline this process effectively.

The components of a partnership agreement typically encompass the partnership name, business purpose, duration, partner contributions, profit-sharing, and management roles. These elements help establish a solid legal foundation for the business. Utilizing the Massachusetts Checklist - Partnership Agreement ensures that you cover all crucial components.

Yes, partnerships have specific filing requirements in Massachusetts, which commonly involve submitting Form 1065. This form allows the partnership to report its income and losses while providing partners with necessary tax information. By following the Massachusetts Checklist - Partnership Agreement, partners can ensure they meet all requirements efficiently.

A robust partnership agreement generally includes roles and responsibilities of each partner, capital contributions, profit-sharing ratios, decision-making guidelines, and dispute resolution processes. Including these items is essential for establishing a clear framework for collaboration. Adhering to the Massachusetts Checklist - Partnership Agreement ensures your partnership runs smoothly.

The six essential contents of a partnership typically include the partnership name, purpose, partner contributions, profit distribution, decision-making processes, and procedures for dissolving the partnership. Having clarity on these components addresses vital operational aspects. This structure supports the fundamentals outlined in the Massachusetts Checklist - Partnership Agreement.

Yes, Massachusetts does allow partnerships to apply for an extension if they need more time to file their partnership returns. This extension provides partners with extra time to gather necessary documents and ensure accurate reporting. Knowing the requirements for an extension is crucial for adhering to the Massachusetts Checklist - Partnership Agreement.

For the Massachusetts Checklist - Partnership Agreement, question 4 on the partnership return typically asks for specific financial data. This may include details on income, deductions, and credits attributed to the partnership. Accurate completion of this section ensures compliance with Massachusetts tax laws and promotes transparency among partners.

The proof of partnership existence primarily lies in the partnership agreement. A Massachusetts Checklist - Partnership Agreement details the partnership's structure and roles, serving as legal documentation. Additionally, records like tax filings and shared business assets also provide evidence of the partnership's existence.