Proposed Amendment to articles of incorporation regarding preemptive rights

Description

How to fill out Proposed Amendment To Articles Of Incorporation Regarding Preemptive Rights?

When it comes to drafting a legal form, it is easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself can not get a template to utilize, nevertheless. Download Proposed Amendment to articles of incorporation regarding preemptive rights from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Proposed Amendment to articles of incorporation regarding preemptive rights promptly:

- Be sure the form meets all the necessary state requirements.

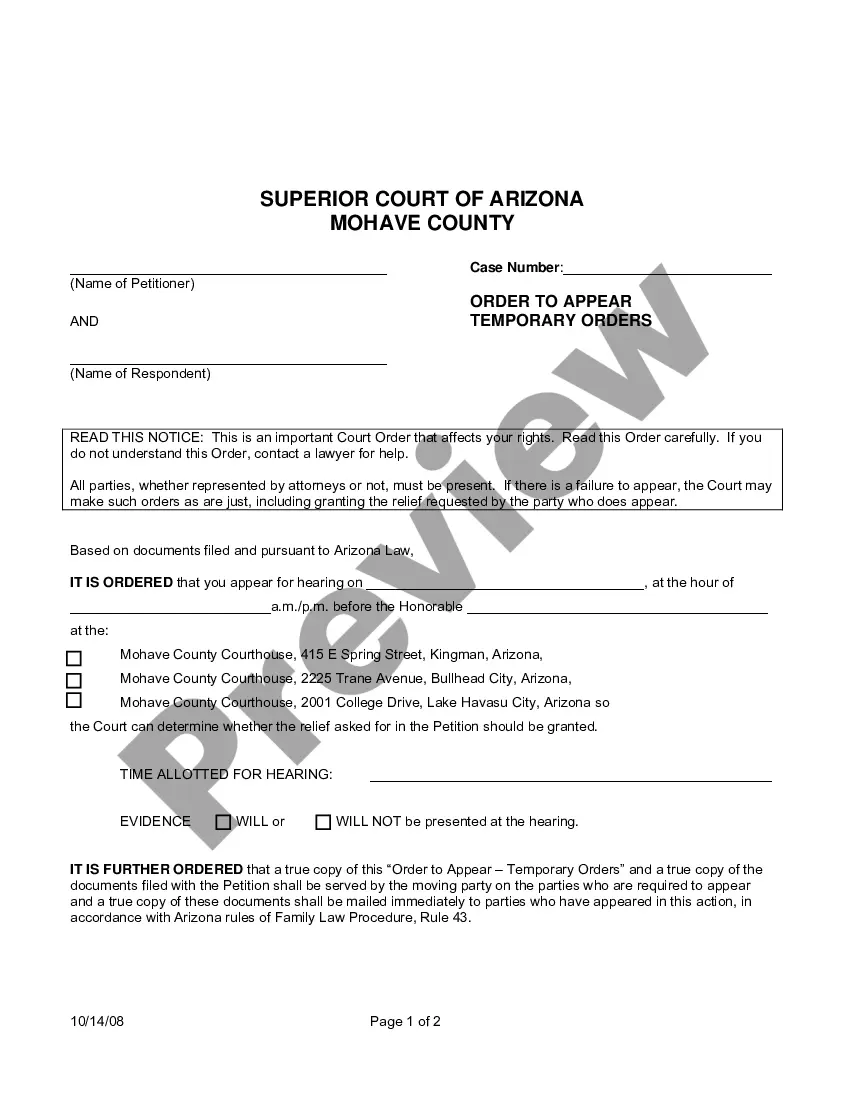

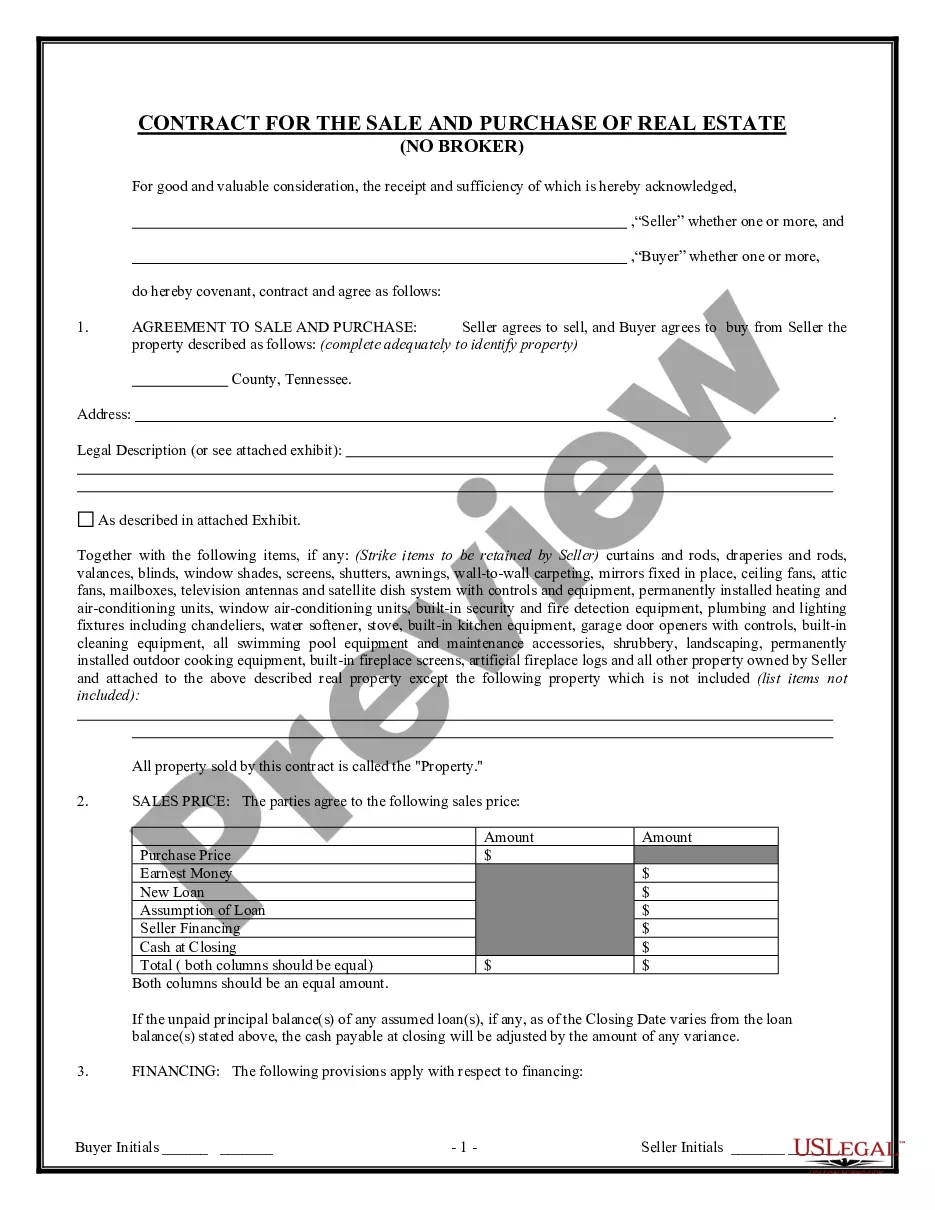

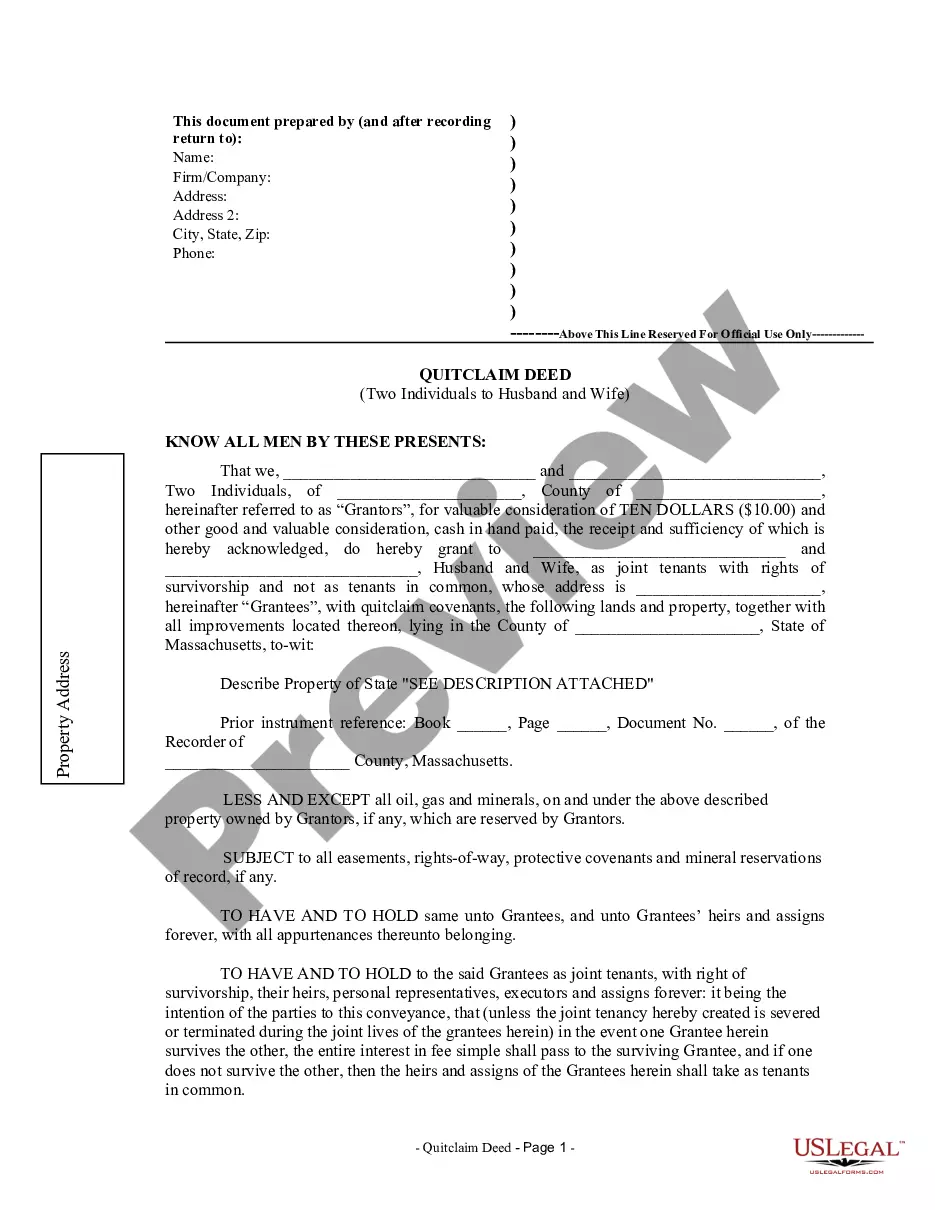

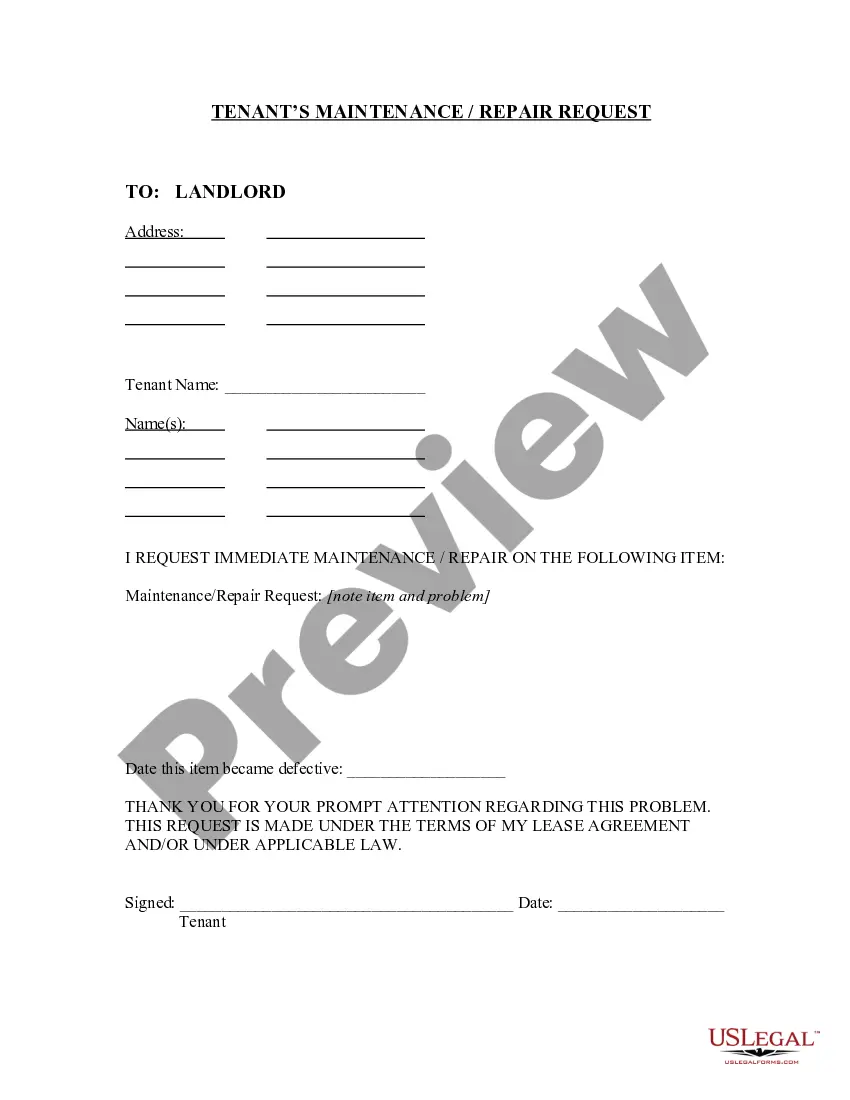

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Proposed Amendment to articles of incorporation regarding preemptive rights is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Preemptive rights give a shareholder the option to buy additional shares of the company before they are sold on a public exchange. They are often called "anti-dilution rights" because their purpose is to give the shareholder the ability to maintain the same level of voting rights as the company grows.

The two primary reasons for the existence of the preemptive right are: the first is that it protects the power of control of current Stockholders. The second is more important, a preemptive right protects stockholders against the dilution of value that would occur if new shares were sold at relatively low prices.

When an investor agrees to relinquish the right to acquire new stock when issued. They must wait until the stock is on the market.

1a : of or relating to preemption. b : having power to preempt. 2 of a bid in bridge : higher than necessary and intended to shut out bids by the opponents. 3 : giving a stockholder first option to purchase new stock in an amount proportionate to his existing holdings.

A Waiver of Pre-emption Rights can be used as an alternative to using the statutory procedures for disapplying pre-emption rights, such as passing a special resolution under s.The shareholders under this deed are waiving their pre-emption rights in respect of a proposed allotment of shares to be issued by the company.

Unless otherwise prescribed by this Code or by special law, and for legitimate purposes, any provision or matter stated in the articles of incorporation may be amended by a majority vote of the board of directors or trustees and the vote or written assent of the stockholders representing at least two-thirds (2/3) of

Definition. Right of existing shareholders in a corporation to purchase newly issued stock before it is offered to others. The right is meant to protect current shareholders from dilution in value or control. Preemptive rights, if recognized, are usually set forth in the corporate charter.

In short, the preemptive rights are necessary to shareholders because it allows existing shareholders of a company to avoid involuntary dilution of their ownership stake by giving them the chance to buy a proportional interest in any future issuance of common stock.

Right of existing shareholders in a corporation to purchase newly issued stock before it is offered to others. The right is meant to protect current shareholders from dilution in value or control. Preemptive rights, if recognized, are usually set forth in the corporate charter.