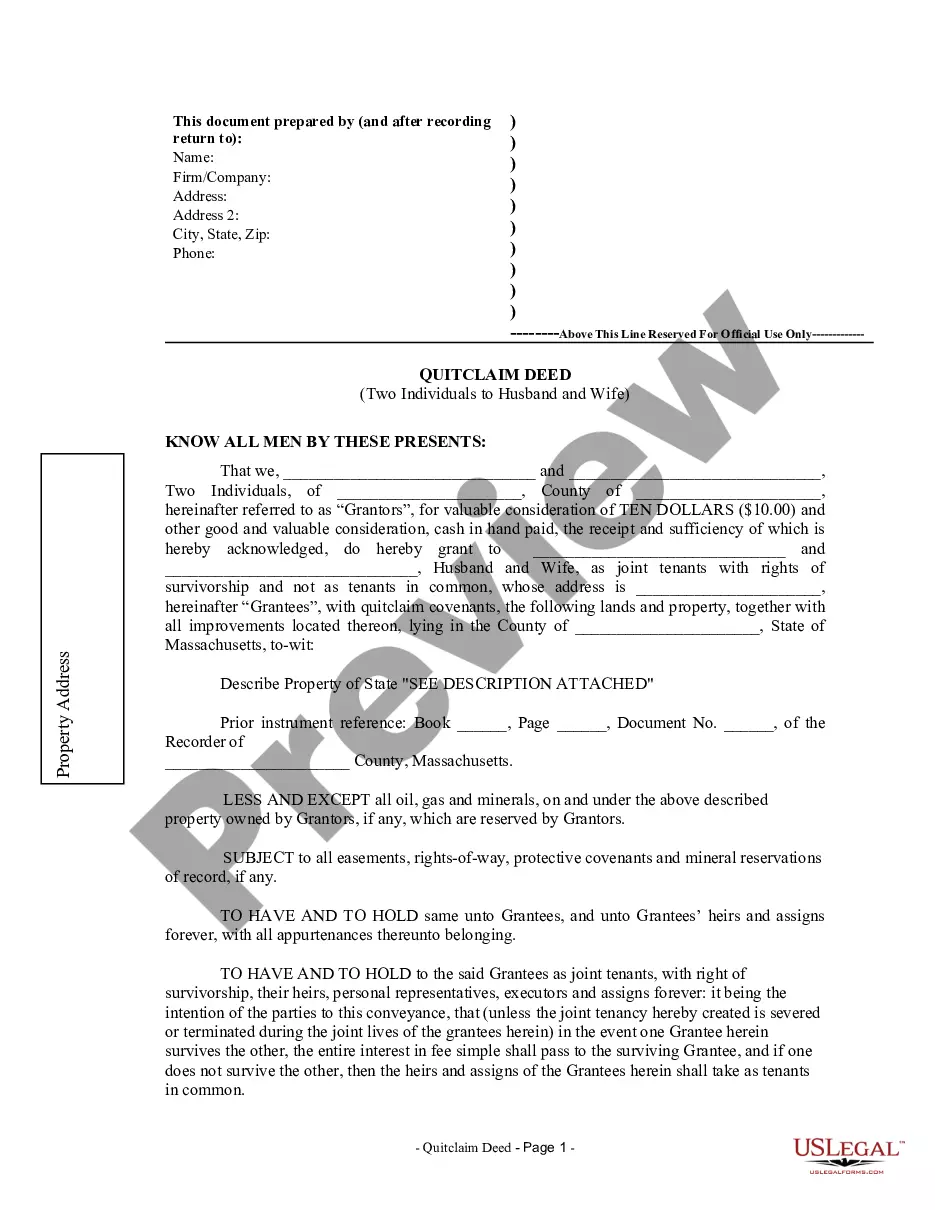

Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out Massachusetts Quitclaim Deed By Two Individuals To Husband And Wife?

Greetings to the most extensive legal document repository, US Legal Forms. Right here you will discover any template such as Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife forms and retrieve them (as numerous as you wish/need). Prepare formal documents in a few hours, rather than days or even weeks, without incurring hefty costs associated with hiring a lawyer. Obtain the state-specific template in just a couple of clicks and rest assured knowing it was crafted by our experienced attorneys.

If you’re already a registered client, just Log In to your account and click Download next to the Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife you need. Since US Legal Forms is an online platform, you’ll consistently have access to your saved templates, regardless of the device you’re using. Find them in the My documents section.

If you don't possess an account yet, what are you waiting for? Follow our instructions below to get started.

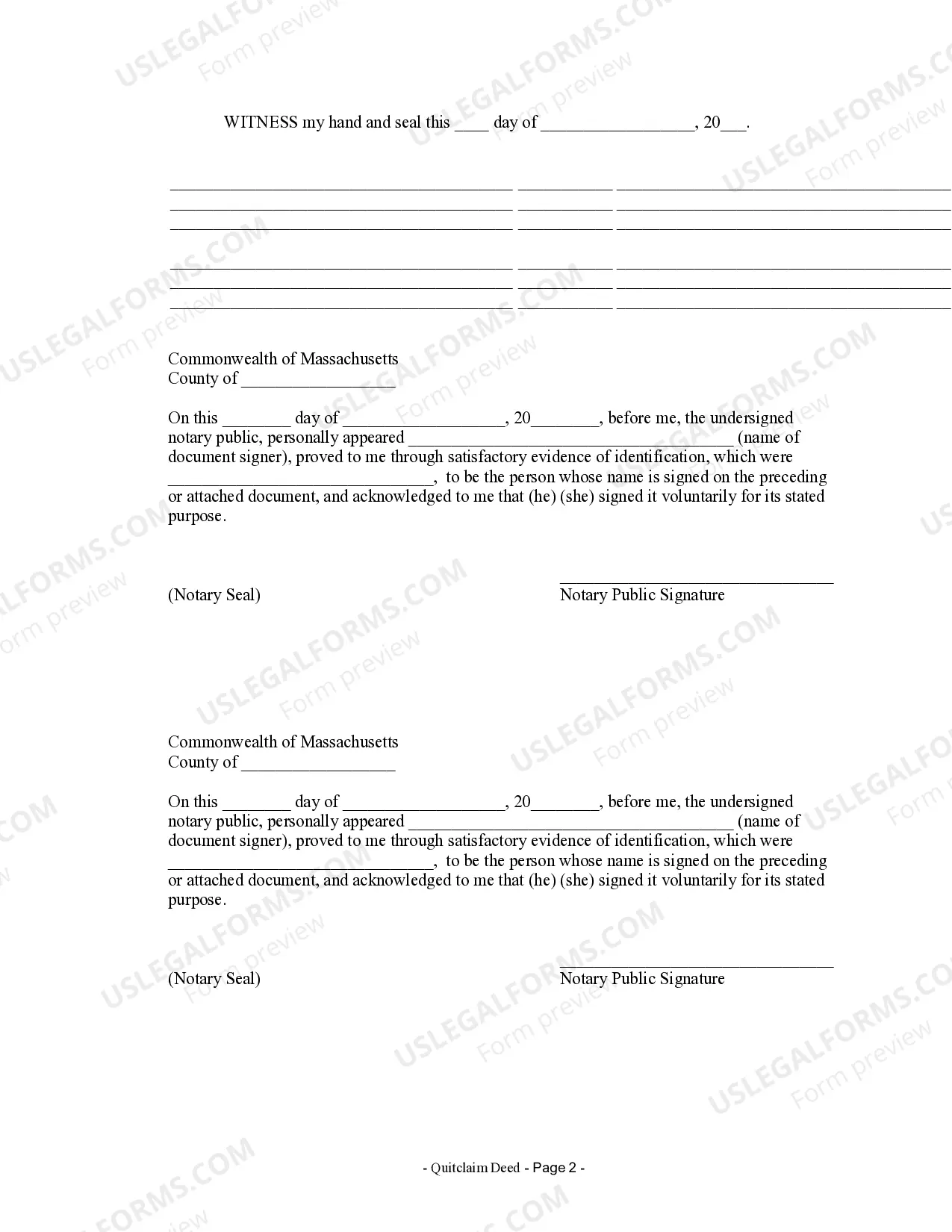

Once you’ve filled out the Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife, forward it to your lawyer for validation. It’s an extra step but a crucial one for ensuring you’re completely protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific template, verify its validity in your state.

- Review the description (if provided) to discern if it’s the correct template.

- View additional information with the Preview feature.

- If the document satisfies all of your requirements, click Buy Now.

- To create an account, select a pricing option.

- Use a credit card or PayPal account to subscribe.

- Download the document in the format you require (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

Misconceptions and Realities. It is a misconception that someone can be removed from the deed. Nor can a co-owner simply take away another party's interest in a property by executing a new deed without that other party. In short, no one can be passively removed from a title.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.