Massachusetts Requisition Slip

Description

How to fill out Requisition Slip?

Are you presently in a location where you require documents for either commercial or specific purposes almost every day.

There is a multitude of legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers an extensive array of form templates, including the Massachusetts Requisition Slip, designed to comply with state and federal requirements.

Choose the pricing plan you prefer, provide the necessary information to set up your account, and pay for your order using PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Massachusetts Requisition Slip template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/county.

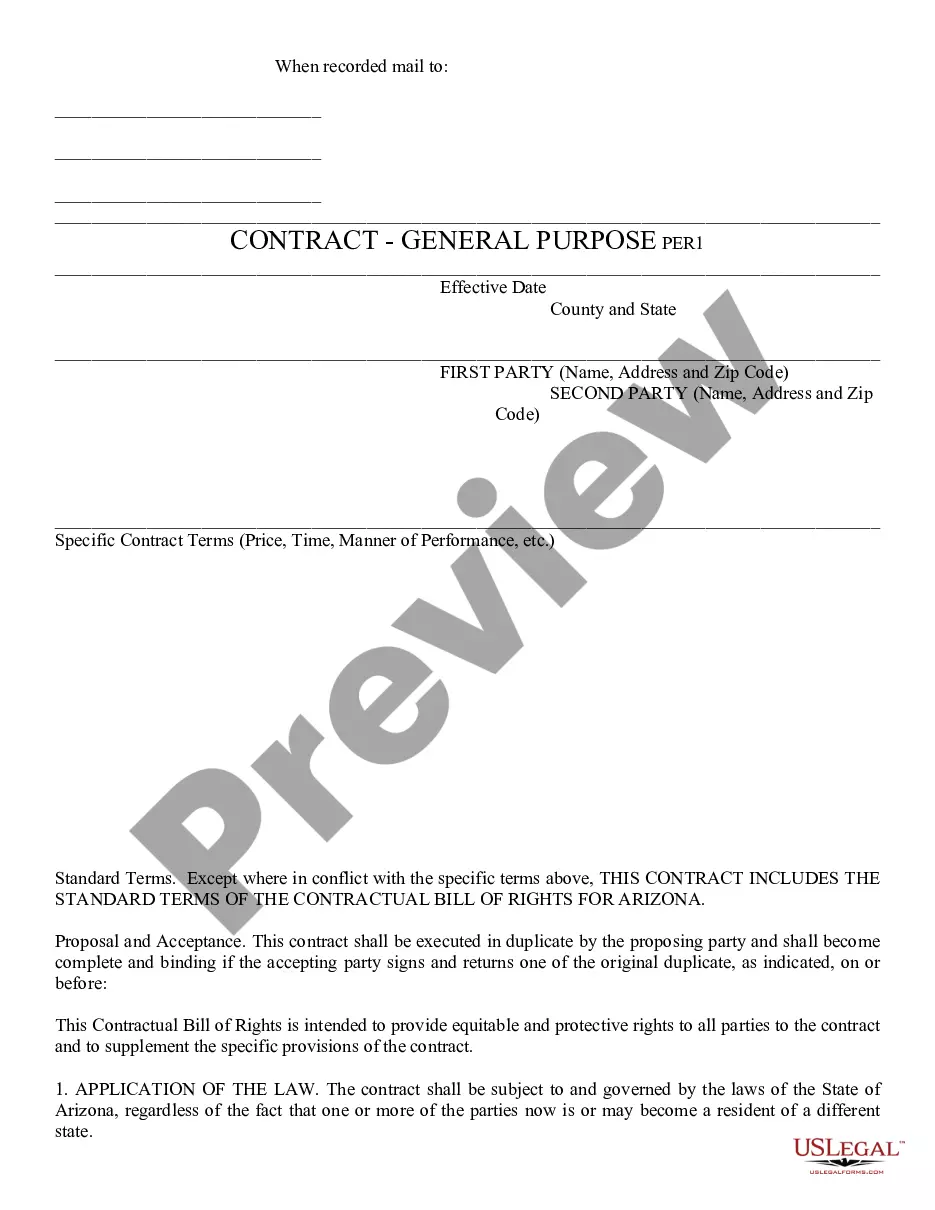

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to identify the form that suits your needs.

- After locating the correct form, click Acquire now.

Form popularity

FAQ

You typically mail your Massachusetts federal tax return to the appropriate address depending on the type of return you are filing. Always ensure you verify the current mailing address as it can change each tax year. To organize your documents effectively, the Massachusetts Requisition Slip can be a valuable asset before submission.

Filing Form 1 in Massachusetts can be done either online or by sending it through the mail to the Department of Revenue. Ensure you provide accurate and complete information to avoid unnecessary complications. The Massachusetts Requisition Slip can serve as a checklist to help you prepare your documents correctly.

You should file MA Form 355S, which pertains to S corporations, with the Massachusetts Department of Revenue. You can submit it by mail or utilize their online filing option. If you're looking for guidance, the Massachusetts Requisition Slip can simplify the data collection process before you initiate your filing.

You file Form 2 with the Massachusetts Department of Revenue, either online or by mailing a physical copy. Make sure to follow the instructions carefully to ensure your submission is complete and accurate. If you're using the Massachusetts Requisition Slip, it can help you avoid mistakes during the filing process.

You should mail Massachusetts 1099 forms to the Massachusetts Department of Revenue, specifically to their P.O. Box. Always remember to use the correct address, as incorrect submissions may lead to processing issues. The Massachusetts Requisition Slip can assist in ensuring you send all required documents promptly.

MA Form 355 is required for corporations doing business in Massachusetts that have a corporate excise tax liability. If your corporation has income or engages in transactions in the state, you need to file this form. Utilizing the Massachusetts Requisition Slip can help you gather necessary information efficiently.

You can file your MA Form 1 online or by mailing it directly to the Massachusetts Department of Revenue. Make sure to double-check your information to avoid delays. Using the Massachusetts Requisition Slip may streamline your filing process. Consider exploring online services for ease.

A new employee must complete important paperwork such as the W-4 for tax withholding, the Massachusetts Employee's Withholding Exemption Certificate, and the I-9 for employment eligibility verification. Additional paperwork may include company-specific documents regarding employee policies and benefits. To ensure that you’re on the right track, using the Massachusetts Requisition Slip can help organize and clarify the necessary documents for a smooth start.

New employees in Massachusetts typically need to fill out several key forms, including the W-4 form for federal tax withholding, the Massachusetts Employee's Withholding Exemption Certificate, and the I-9 form for employment eligibility verification. Additionally, there may be company-specific forms regarding policies and health benefits. Using the Massachusetts Requisition Slip can provide clear guidance on these requirements and streamline the onboarding process.

Massachusetts form 355S is the Short Form for the Massachusetts corporate excise tax return. This form is specifically designated for certain types of corporations who meet criteria laid out by the state. It simplifies the tax reporting process for eligible organizations. Utilizing resources like the Massachusetts Requisition Slip can help you navigate tax filing requirements and ensure you submit the correct forms.