The Massachusetts Summary of Loan Modification is a program designed to help those with mortgages in Massachusetts who are struggling to make their payments. It is a free service that helps borrowers understand their loan and the loan modification process. This program offers several types of loan modifications depending on a borrower’s individual situation. These include: Principal Reduction Modifications, Interest Rate Reduction Modifications, Loan Term Extensions, and Forbearance or Repayment Plans. The program also provides guidance on how to apply for a loan modification, and also provides assistance in negotiating a new loan agreement with the lender.

Massachusetts Summary of Loan Modification

Description

How to fill out Massachusetts Summary Of Loan Modification?

Handling legal documents demands focus, precision, and utilizing properly prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Massachusetts Summary of Loan Modification template from our platform, you can trust it complies with federal and state laws.

Utilizing our service is straightforward and efficient. To obtain the necessary document, all you need is an account with an active subscription. Here’s a short guide for you to locate your Massachusetts Summary of Loan Modification in just a few minutes.

All documents are created for multiple uses, like the Massachusetts Summary of Loan Modification displayed on this page. If you need them again, you can fill them out without additional payment - simply go to the My documents tab in your profile and complete your document whenever you require it. Try US Legal Forms and complete your business and personal paperwork swiftly and in full legal adherence!

- Make sure to thoroughly review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Look for an alternative official template if the one you opened does not align with your circumstances or state regulations (the tab for this is located in the upper page corner).

- Log in to your account and save the Massachusetts Summary of Loan Modification in your preferred format. If it’s your first time using our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you wish to receive your form and click Download. Print the form or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Yes, a loan modification is generally considered HMDA reportable if it meets specific criteria. If the modification changes the original terms of the loan in a significant way, such as extending the loan term or adjusting the interest rate, it must be reported. Being aware of these reporting requirements helps ensure compliance, particularly during the process of a Massachusetts Summary of Loan Modification. Utilizing the uslegalforms platform can simplify this understanding for you.

Under the Home Mortgage Disclosure Act (HMDA), certain categories of loans are not reportable. For instance, temporary financing and loans secured by vacant land are typically excluded. This also includes loans made to businesses rather than individuals. Understanding these exclusions can clarify your options when considering a Massachusetts Summary of Loan Modification.

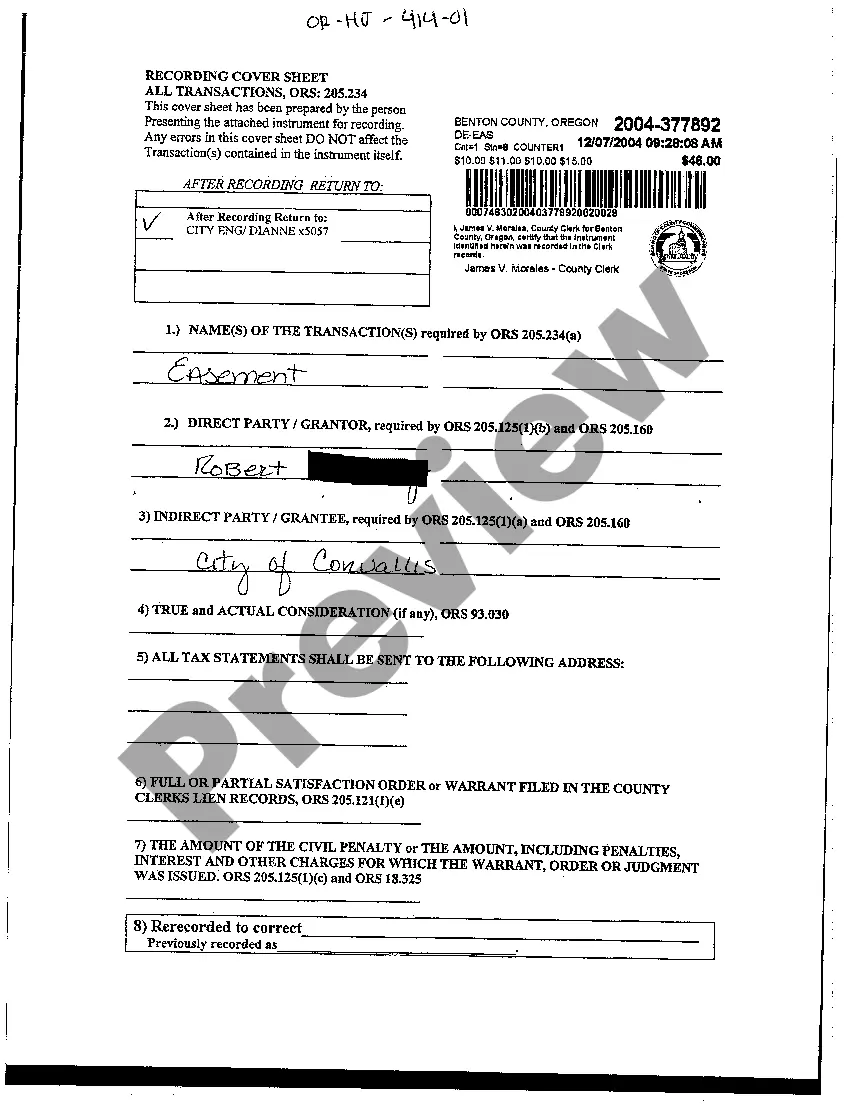

While it is not mandatory to record a loan modification in Massachusetts, doing so provides significant benefits. Recording serves as public notice of the new loan terms and can protect both the borrower and the lender. The Massachusetts Summary of Loan Modification emphasizes the value of proper documentation for future reference and legal clarity.

In Massachusetts, a mortgage modification does not necessarily need to be recorded, but doing so is highly advisable. Recording the modification protects your rights and clarifies the terms for all parties involved. The Massachusetts Summary of Loan Modification recommends consulting with a legal professional for guidance on the recording process.

To apply for a loan modification in Massachusetts, you will typically need documents such as your income verification, current mortgage statement, and hardship letter. The Massachusetts Summary of Loan Modification can guide you through the necessary documentation process. Having these documents organized can significantly streamline your application.

Loan modifications in Massachusetts are documented through a formal agreement that outlines the new loan terms. This process is crucial for keeping a clear record of all modifications, ensuring compliance with state regulations. The Massachusetts Summary of Loan Modification highlights the importance of having both parties agree on and sign the new terms.

If you face issues with your loan modification in Massachusetts, you can file a complaint through the Massachusetts Attorney General’s Office. The Massachusetts Summary of Loan Modification provides essential guidelines for this process, ensuring your concerns are documented. Providing clear evidence and details of your situation will help facilitate the review of your complaint.

The Massachusetts Summary of Loan Modification outlines how the loan modification is formally documented. Typically, this involves creating a new agreement that details the revised loan terms, which both parties must sign. Documentation serves not only as a record of the agreed changes but also protects the rights of both the borrower and lender.