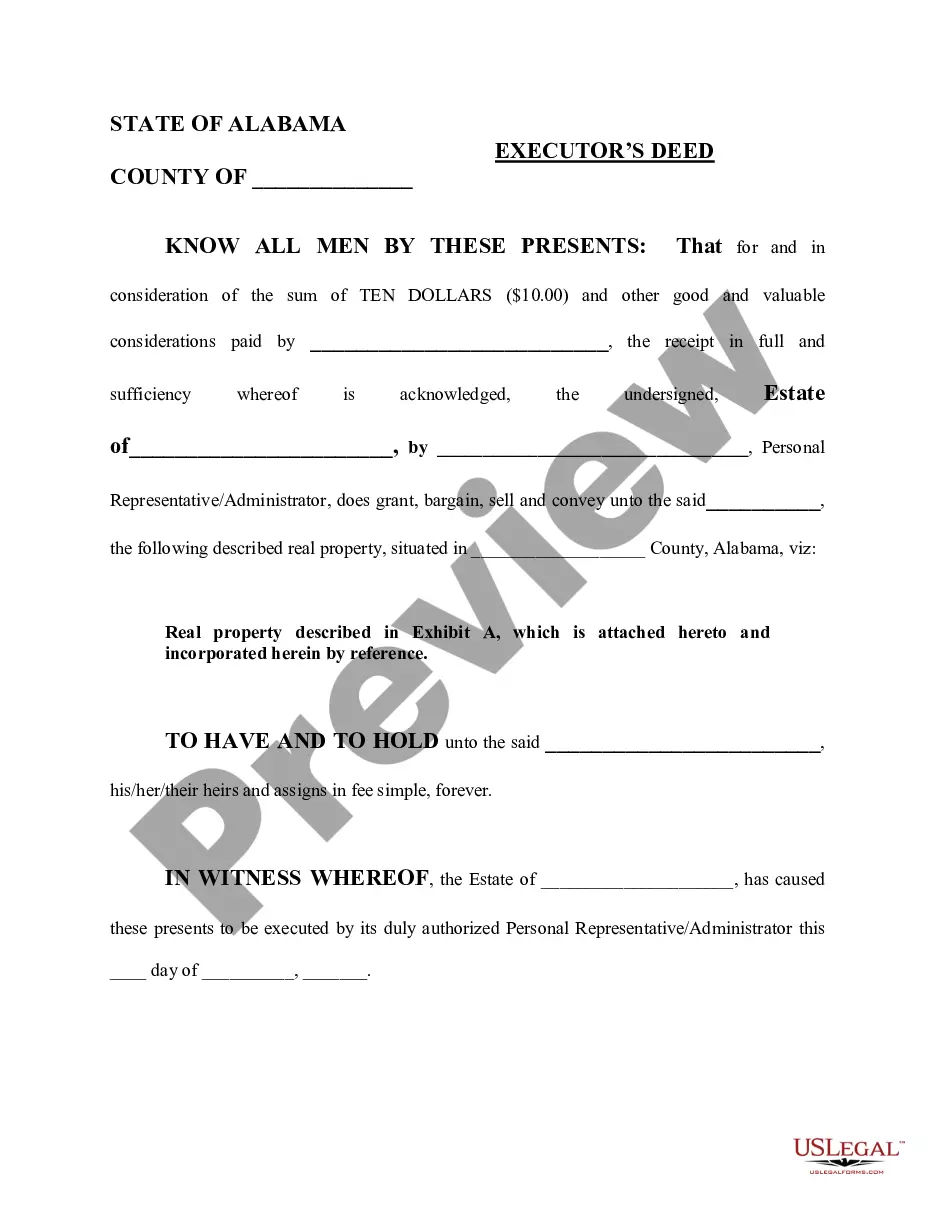

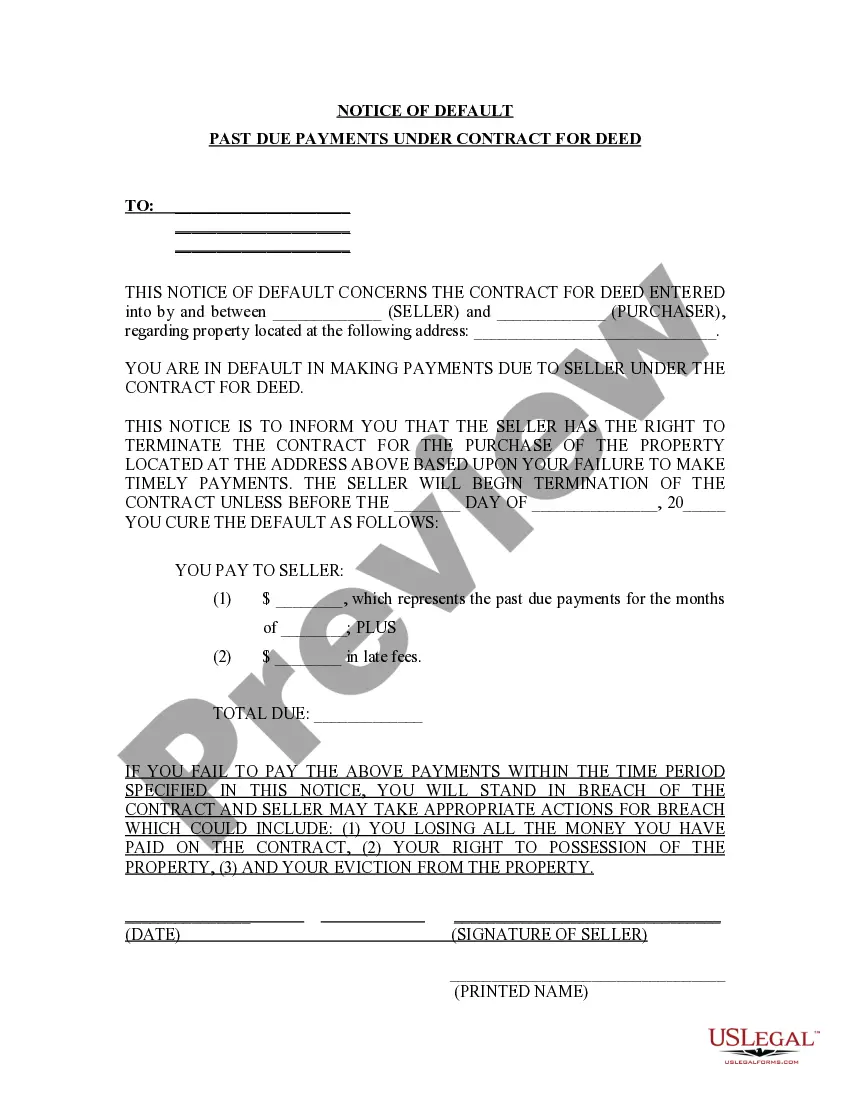

Massachusetts Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Massachusetts Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to secure a printable Massachusetts Notice of Default for Outstanding Payments related to Contract for Deed. Our legally acceptable forms are created and frequently revised by qualified attorneys.

Ours is the most extensive Forms library online and provides economical and precise templates for individuals, legal professionals, and small to medium-sized businesses.

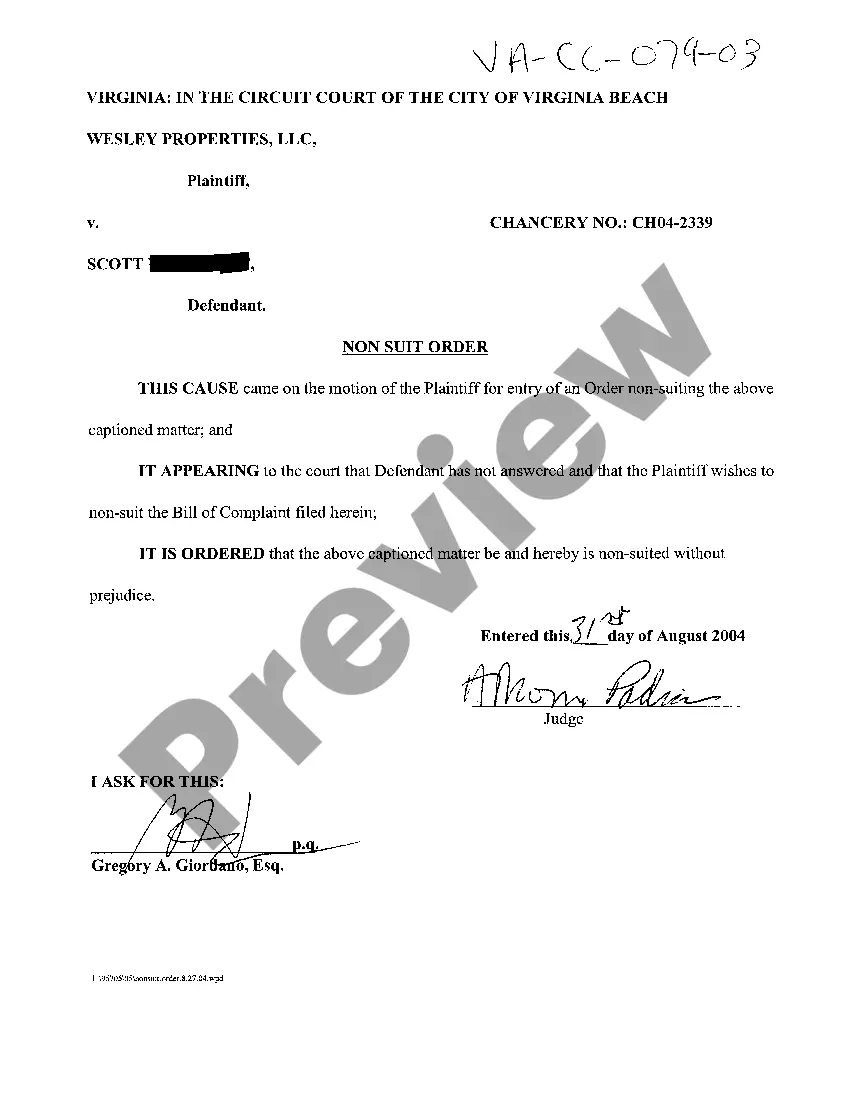

The documents are organized into state-specific categories, and some can be viewed before downloading.

US Legal Forms provides a vast array of legal and tax templates and bundles for both business and personal necessities, including Massachusetts Notice of Default for Outstanding Payments in relation to Contract for Deed. Over three million users have successfully utilized our platform. Choose your subscription plan and gain access to high-quality documents in just a few clicks.

- Ensure you have the appropriate template for the relevant state.

- Examine the document by perusing the description and using the Preview option.

- Select Buy Now if it is the form you need.

- Create your account and make payment via PayPal or credit card.

- Download the document to your device and feel free to use it multiple times.

- Utilize the Search function if you wish to find another document template.

Form popularity

FAQ

1. The seller's agent or attorney will draft the Purchase and Sale Agreement (P&S). This is the more binding legal document that is the official contract to purchase the home.

There is a federal law (and similar laws in every state) allowing consumers to cancel contracts made with a door-to-door salesperson within three days of signing. The three-day period is called a "cooling off" period.

The short answer is yes. A home seller can back out of an accepted offer on a house for several reasons, but fortunately, it's very uncommon.

If you entered into the contract over the phone, online or on your doorstep, you have 14 calendar days to cancel the contract under the Consumer Contracts Regulations.If you want to cancel a credit agreement, the Consumer Credit Act gives you a 14-day cooling-off period to cancel the agreement.

For lawsuits dealing with contracts in Massachusetts, the statute of limitations is typically six years after the contract was broken.

The Massachusetts statute of limitations is six years for any debt, regardless of whether it is a credit card debt, written contract or oral agreement.

No, but statutes of limitations generally allow at least one year. Except for when you sue a government agency, you almost always have at least one year from the date of harm to file a lawsuit, no matter what type of claim you have or which state you live in.

Massachusetts law only provides for cooling-off periods in extremely limited situations. merchant's usual place of business, you have three days to cancel the contract.