Louisiana Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

Are you currently in a situation where you require documentation for both business or personal purposes almost daily.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms provides a vast selection of form templates, including the Louisiana Foundation Contractor Agreement - Self-Employed, designed to meet state and federal requirements.

Once you find the correct form, simply click Purchase now.

Choose the pricing plan you require, fill in the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Foundation Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

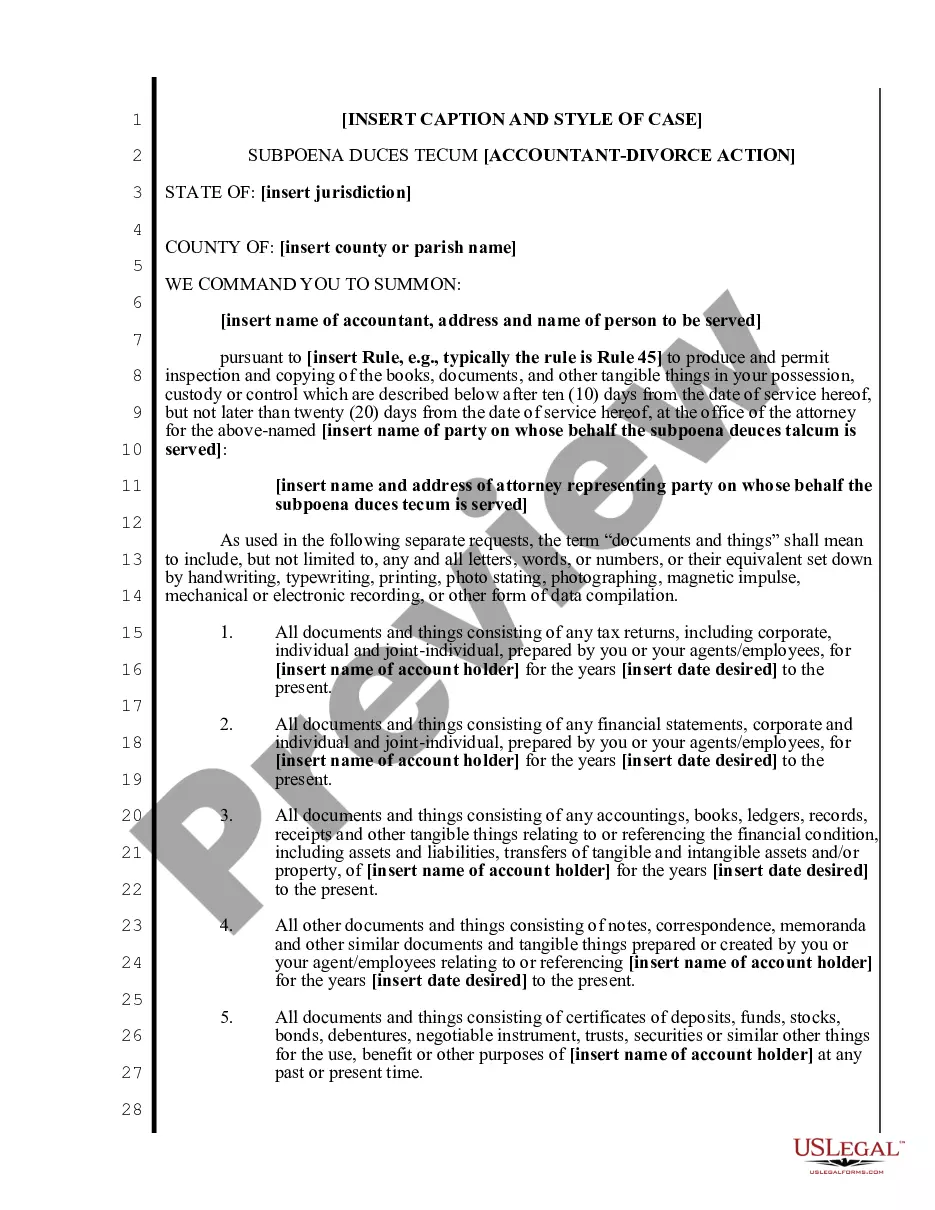

- Use the Review button to examine the form.

- Read the details to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

An independent contractor is indeed considered self-employed. This status indicates you provide services independently to clients without being a permanent employee. Your Louisiana Foundation Contractor Agreement - Self-Employed outlines this relationship, detailing your work, payment terms, and rights, which reinforces your status as an independent contractor.

Yes, independent contractors file as self-employed for tax purposes. This means you report your earnings and expenses using Schedule C on your tax return. It is important to keep accurate records throughout the year. Using a Louisiana Foundation Contractor Agreement - Self-Employed can help ensure that you properly categorize your income and expenses.

To prove you are an independent contractor, maintain clear records of your work, including invoices and tax payments. Having a signed Louisiana Foundation Contractor Agreement - Self-Employed is vital, as it outlines your agreements with clients. Additionally, you can provide proof of your business operations, like marketing materials or a business website, to strengthen your case.

Whether to use 'self-employed' or 'independent contractor' often depends on the context. 'Self-employed' provides a broader view of your status as a business owner, while 'independent contractor' specifies your relationship to clients. Both terms can be used interchangeably, but using 'independent contractor' in your Louisiana Foundation Contractor Agreement - Self-Employed can enhance clarity about your work arrangement.

Being self-employed means you run your own business or offer services independently without an employer. Typically, you receive payment directly from clients, and you assume responsibility for paying taxes on your earnings. Your Louisiana Foundation Contractor Agreement - Self-Employed will clearly define your role and responsibilities, ensuring you comply with legal standards.

Setting up as a self-employed contractor involves several steps. First, choose a business structure that suits your needs, such as a sole proprietorship or LLC. Next, obtain any necessary licenses and permits for your work. Finally, outline your services in a Louisiana Foundation Contractor Agreement - Self-Employed to establish professional and legal boundaries.

To fill out an independent contractor agreement, begin by entering your name, the client’s name, and the project details. Next, specify the scope of work, payment terms, deadlines, and any other important provisions. Make sure to include a termination clause and space for signatures. This process ensures clarity in your Louisiana Foundation Contractor Agreement - Self-Employed and protects both parties.

To create a Louisiana Foundation Contractor Agreement - Self-Employed, begin by clearly outlining the scope of work. Include details such as the payment terms, project timelines, and any specific responsibilities. It is essential to define the relationship between you and the contractor to avoid any legal misunderstandings. Consider using a reliable platform like US Legal Forms, which provides customizable templates tailored for your needs.

Writing an independent contractor agreement requires clarity and structure. Start by defining the scope of work, payment terms, and duration of the contract. Include provisions relating to termination and confidentiality to protect both parties. Using platforms like uslegalforms can simplify this process, ensuring that your Louisiana Foundation Contractor Agreement - Self-Employed includes all necessary details for effective operation.

Indeed, a contractor falls under the self-employed category. This classification allows contractors to choose their clients, set their hours, and determine their methods of operation. As a self-employed professional, you also assume responsibility for your taxes and business liabilities. If you are seeking to solidify this status, a Louisiana Foundation Contractor Agreement - Self-Employed is crucial.