Louisiana Structure Erection Contractor Agreement - Self-Employed

Description

How to fill out Structure Erection Contractor Agreement - Self-Employed?

If you want to completely, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, which is available online.

Take advantage of the site’s simple and convenient search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to retrieve the Louisiana Structure Erection Contractor Agreement - Self-Employed with a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Louisiana Structure Erection Contractor Agreement - Self-Employed.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

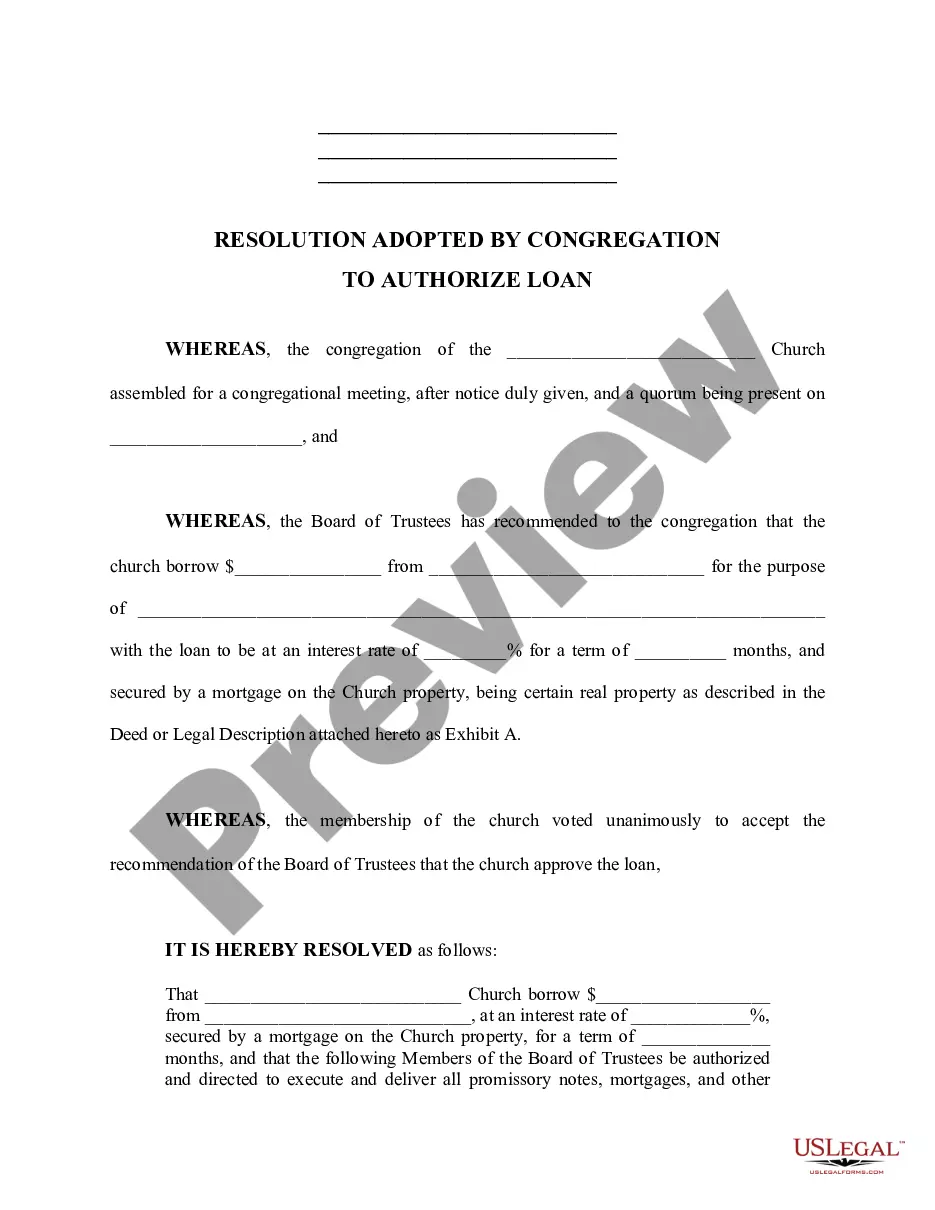

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are unhappy with the form, use the Search section at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Structuring an independent contractor agreement involves several steps. Start with an introduction that lists the parties involved, followed by a clear description of the services to be provided. Outline payment options, delivery timelines, and other terms to keep both sides on the same page. Ensure your Louisiana Structure Erection Contractor Agreement - Self-Employed is thorough to protect both parties.

A contractor agreement should include key components like the project scope, payment terms, deadlines, and confidentiality agreements. Clearly defining roles and responsibilities helps to prevent potential disputes. Ensure that the Louisiana Structure Erection Contractor Agreement - Self-Employed covers all these areas for clarity and legal protection.

To write an independent contractor agreement, start by including the parties' names and business details. Clearly define the project scope, payment terms, deadlines, and confidentiality clauses, if necessary. It’s crucial to draft the Louisiana Structure Erection Contractor Agreement - Self-Employed with precise language, allowing both parties to understand their obligations.

The best business structure for an independent contractor often depends on personal needs and preferences. Many choose to operate as a sole proprietor for simplicity, while others may form an LLC for liability protection. Consider your business goals and consult with a legal professional to determine which structure aligns best with your Louisiana Structure Erection Contractor Agreement - Self-Employed.

The compensation structure for an independent contractor typically depends on the agreement made with the client. This can include hourly rates, fixed project payments, or commissions based on performance. It's important to specify these terms clearly in the Louisiana Structure Erection Contractor Agreement - Self-Employed to avoid any misunderstandings.

Yes, you can write your own legally binding contract, including a Louisiana Structure Erection Contractor Agreement - Self-Employed. However, it's vital to include all the necessary elements such as parties' information, project details, and payment terms. You may want to consult existing templates for guidance. Platforms like uslegalforms can provide you with templates to simplify this process.

Filling out a contractor agreement requires clear communication of all the essential details. Start by entering the names and addresses of both parties involved. Next, outline the project scope, payment terms, and deadlines. Always ensure both parties sign the Louisiana Structure Erection Contractor Agreement - Self-Employed to make it legally binding.