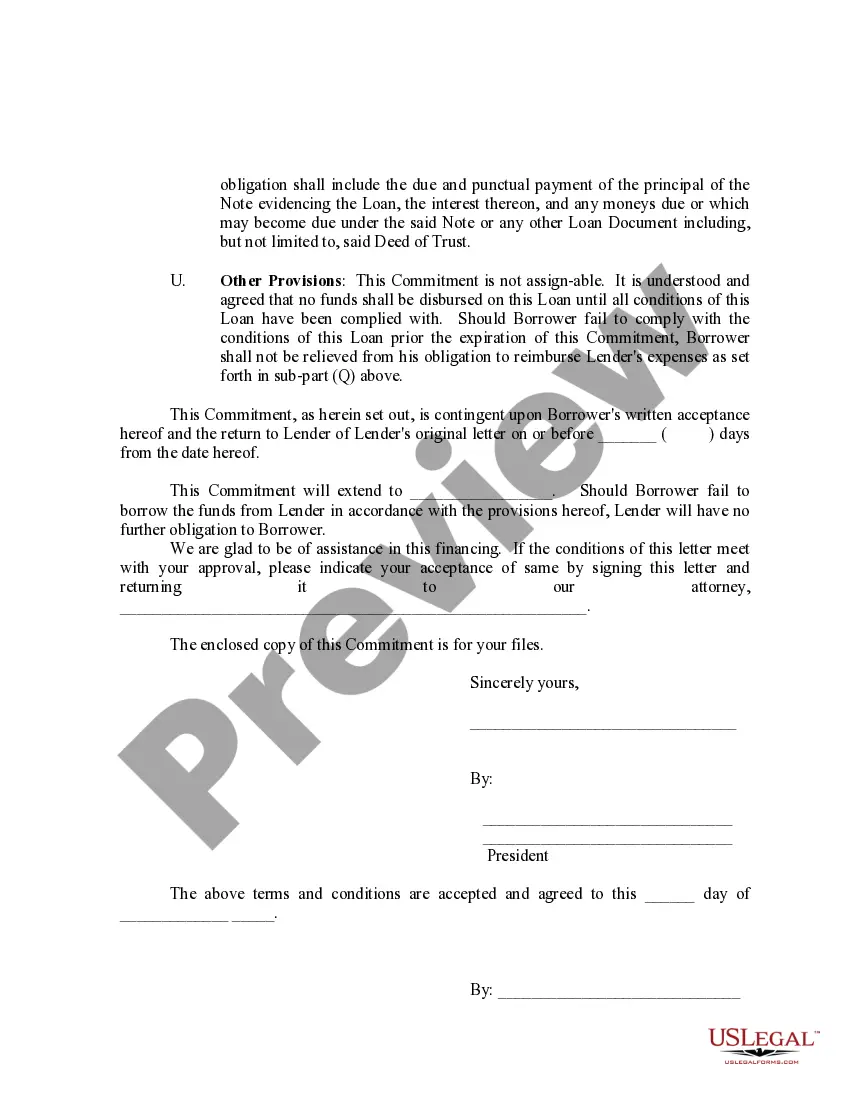

Louisiana Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

You can spend hrs on-line searching for the authorized document design which fits the federal and state specifications you require. US Legal Forms gives 1000s of authorized kinds that are reviewed by experts. You can easily obtain or print the Louisiana Loan Commitment Agreement Letter from my assistance.

If you have a US Legal Forms accounts, it is possible to log in and click the Download option. After that, it is possible to complete, change, print, or signal the Louisiana Loan Commitment Agreement Letter. Every single authorized document design you buy is your own property permanently. To acquire another duplicate of the acquired develop, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms site for the first time, adhere to the easy directions below:

- Initially, make sure that you have chosen the right document design for that county/city of your choosing. Look at the develop explanation to make sure you have selected the correct develop. If available, utilize the Preview option to check from the document design too.

- If you wish to get another model in the develop, utilize the Research field to get the design that meets your needs and specifications.

- Upon having identified the design you need, simply click Acquire now to carry on.

- Pick the prices plan you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You may use your credit card or PayPal accounts to pay for the authorized develop.

- Pick the file format in the document and obtain it to the gadget.

- Make modifications to the document if possible. You can complete, change and signal and print Louisiana Loan Commitment Agreement Letter.

Download and print 1000s of document themes utilizing the US Legal Forms Internet site, which provides the largest collection of authorized kinds. Use specialist and state-distinct themes to deal with your company or individual demands.

Form popularity

FAQ

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

Two examples of open-end secured loan commitments for consumers are a secured credit card?where money in a bank account serves as collateral?and a home equity line of credit (HELOC)?in which the equity in a home is used as collateral.

A loan commitment is a letter from a lender indicating your eligibility for a home loan. In essence, it is the lender's promise to fund the loan as stated by the terms in the letter. You receive a loan commitment letter once your application has been reviewed and the underwriting process is complete.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

Write clearly. Ensure that the letter is straightforward and the parties cannot interpret it differently. To achieve clarity, include as many details as possible to avoid any misunderstandings. Only include the terms that both parties have agreed on.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.