Louisiana Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

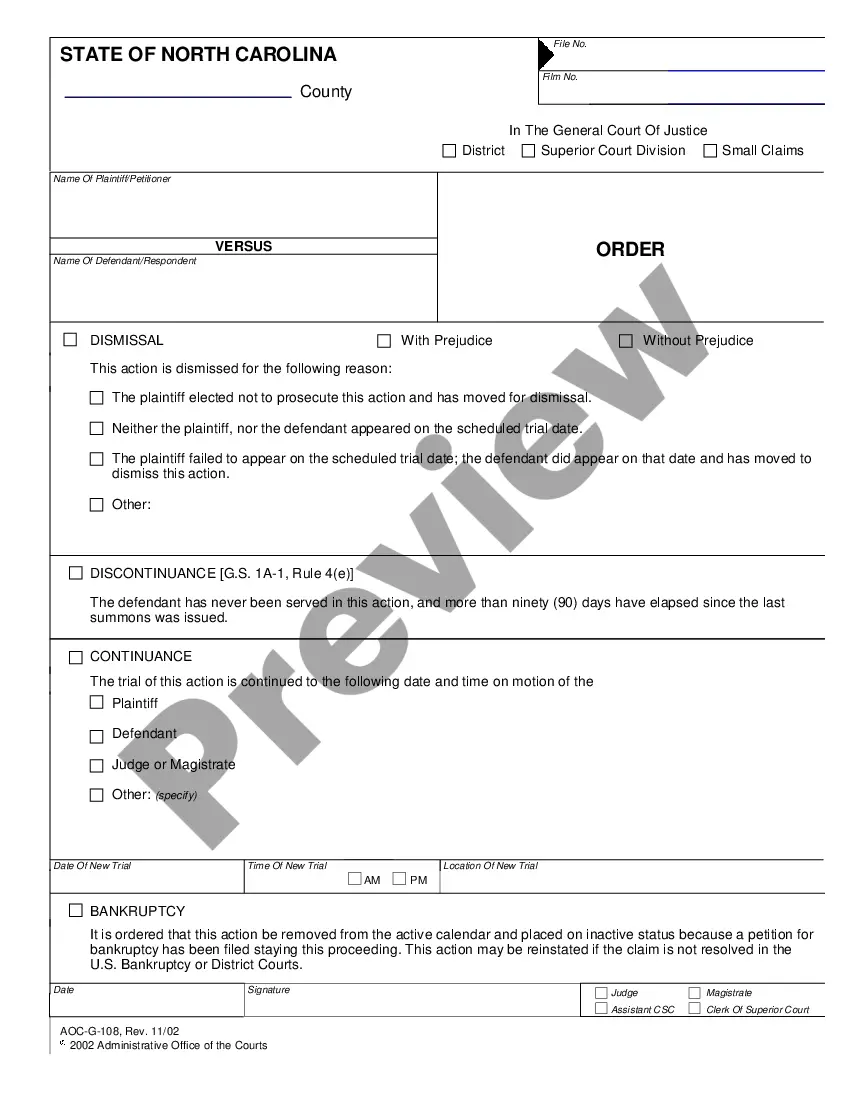

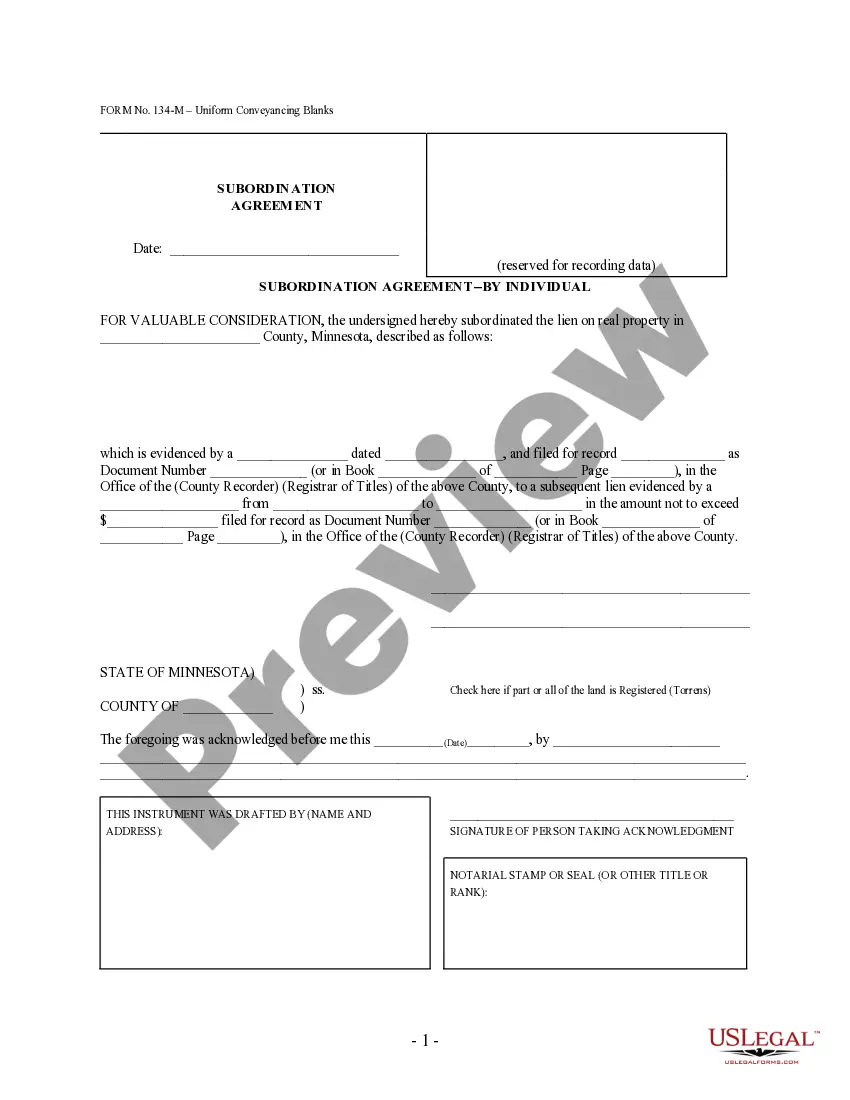

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

If you have to total, download, or printing legitimate document layouts, use US Legal Forms, the biggest selection of legitimate forms, which can be found on-line. Utilize the site`s easy and convenient lookup to obtain the documents you want. Different layouts for organization and personal reasons are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Louisiana Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts within a number of click throughs.

When you are already a US Legal Forms buyer, log in to your profile and then click the Obtain key to obtain the Louisiana Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. You may also gain access to forms you previously saved in the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the right city/land.

- Step 2. Make use of the Review solution to look through the form`s content material. Never forget about to see the explanation.

- Step 3. When you are not happy using the form, make use of the Search field near the top of the display to locate other versions from the legitimate form template.

- Step 4. Once you have located the shape you want, select the Get now key. Pick the pricing plan you like and add your credentials to sign up for an profile.

- Step 5. Method the financial transaction. You should use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Select the formatting from the legitimate form and download it on the system.

- Step 7. Full, revise and printing or signal the Louisiana Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

Every single legitimate document template you get is the one you have for a long time. You may have acces to every form you saved inside your acccount. Select the My Forms section and decide on a form to printing or download once more.

Contend and download, and printing the Louisiana Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts with US Legal Forms. There are thousands of specialist and state-distinct forms you may use for your personal organization or personal requires.

Form popularity

FAQ

If you've been the victim of identity theft, you can take steps to reclaim your good name and restore your credit. To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Under Louisiana law, you can report identity theft to your local police department. 1 Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).