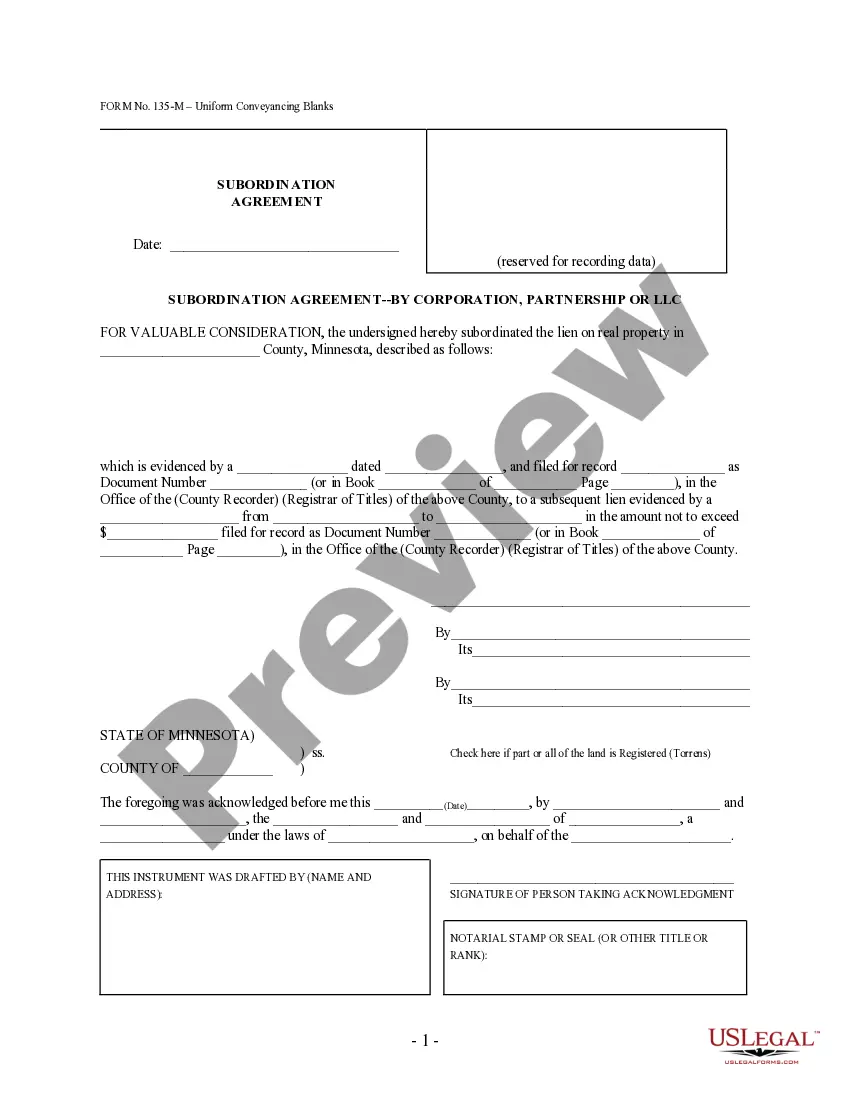

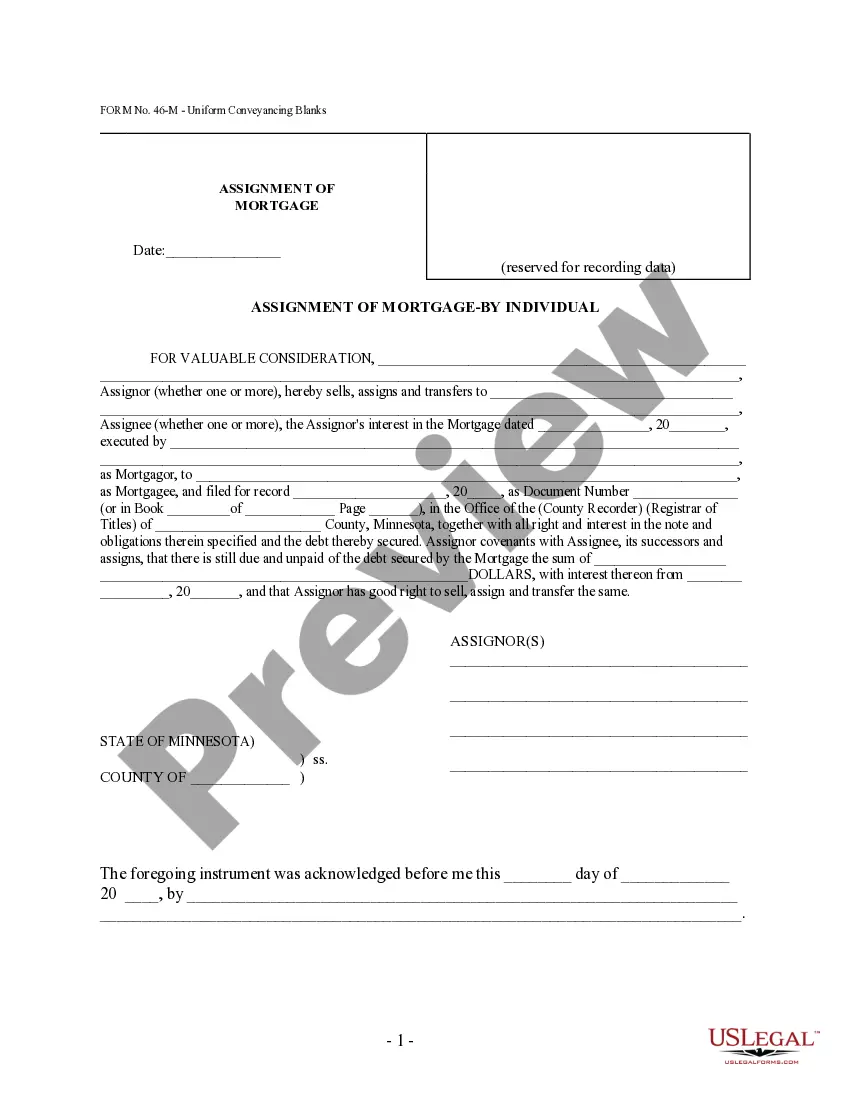

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Subordination Agreement by Individuals - UCBC Form 20.8.1

Description

How to fill out Minnesota Subordination Agreement By Individuals - UCBC Form 20.8.1?

Obtain any template from 85,000 legal documents including Minnesota Subordination Agreement by Individuals - UCBC Form 20.8.1 online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you possess a subscription, sign in. Once you are on the form’s page, click the Download button and navigate to My documents to gain access to it.

If you have not subscribed yet, follow the guidelines below.

With US Legal Forms, you will consistently have rapid access to the appropriate downloadable template. The platform provides you with access to documents and categorizes them to enhance your search. Utilize US Legal Forms to acquire your Minnesota Subordination Agreement by Individuals - UCBC Form 20.8.1 swiftly and effortlessly.

- Verify the state-specific criteria for the Minnesota Subordination Agreement by Individuals - UCBC Form 20.8.1 you intend to utilize.

- Review the description and examine the sample.

- When you are convinced the template meets your needs, simply click Buy Now.

- Select a subscription plan that aligns with your financial plan.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is ready, print it out or save it to your device.

Form popularity

FAQ

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Step 1: Download the Minnesota quitclaim deed. Step 2: Enter the name and address of the preparer on the top left-hand corner of the form. Step 3: Enter the return address information under the preparer's information.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.However, it's also possible to have other liens. You might have some placed by contractors until work is paid off.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

A written contract in which a lender who has secured a loan by a mortgage or deed of trust agrees with the property owner to subordinate its loan (accept a lower priority for the collection of its debt), thus giving the new loan priority in any foreclosure or payoff.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.