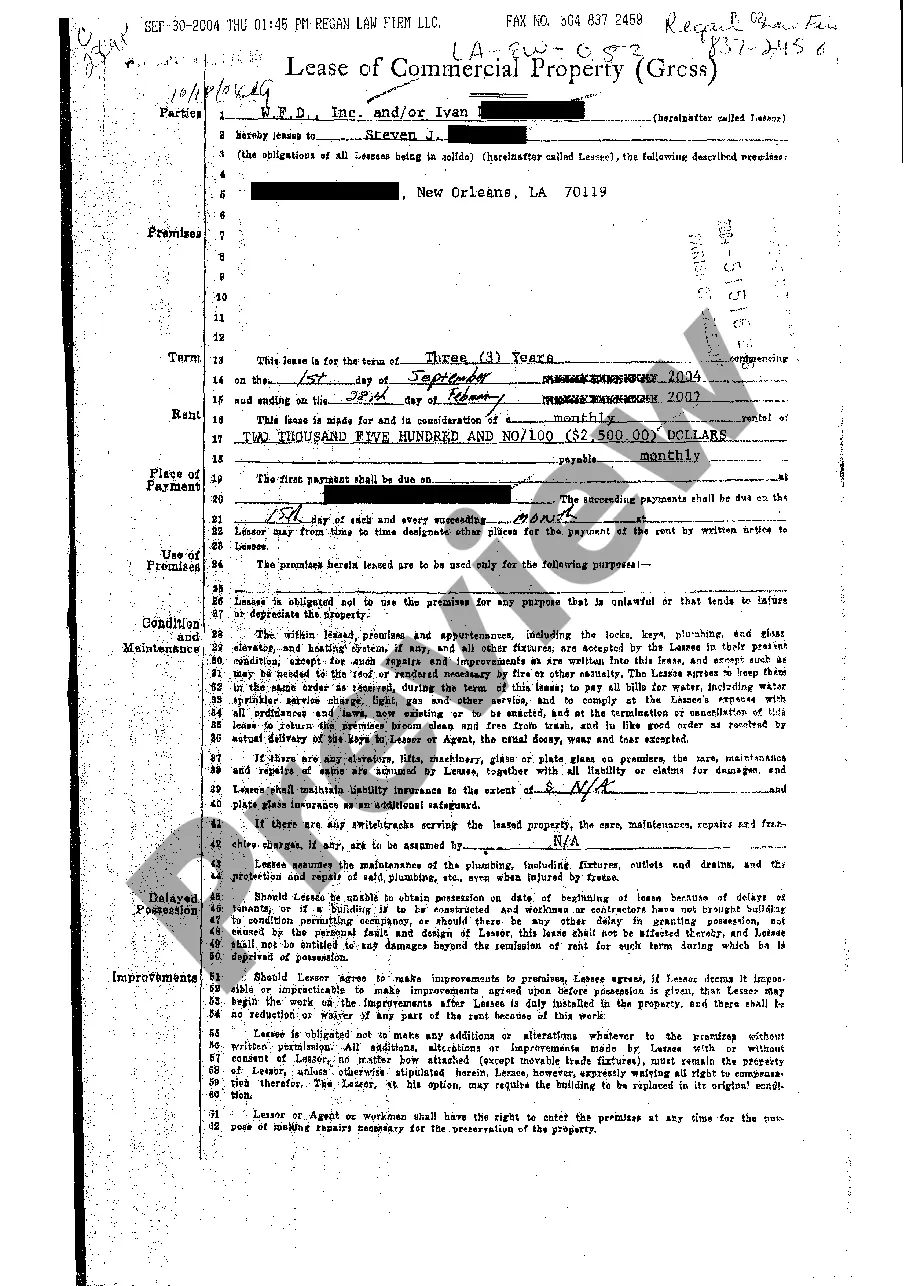

Louisiana Sample Lease Of Commercial Property (Gross)

Description

How to fill out Louisiana Sample Lease Of Commercial Property (Gross)?

You are invited to the most extensive legal documents repository, US Legal Forms. Here, you can procure any template such as Louisiana Sample Lease Of Commercial Property (Gross) forms and retrieve them (as many as you desire/need). Create formal documents within hours, rather than days or weeks, without spending a fortune on an attorney. Acquire your state-specific form in just a few clicks and feel confident knowing it was created by our licensed legal experts.

If you’re already a registered user, simply Log Into your account and then press Download next to the Louisiana Sample Lease Of Commercial Property (Gross) you require. Since US Legal Forms operates online, you’ll consistently have access to your downloaded documents, regardless of the device you’re using. Locate them in the My documents section.

If you haven’t set up an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve completed the Louisiana Sample Lease Of Commercial Property (Gross), provide it to your lawyer for confirmation. It’s an extra step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific template, verify its validity in your state.

- Review the description (if available) to ascertain whether it’s the correct template.

- Explore additional information using the Preview feature.

- If the document meets all your needs, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

- Print the document and fill it in with your or your business’s information.

Form popularity

FAQ

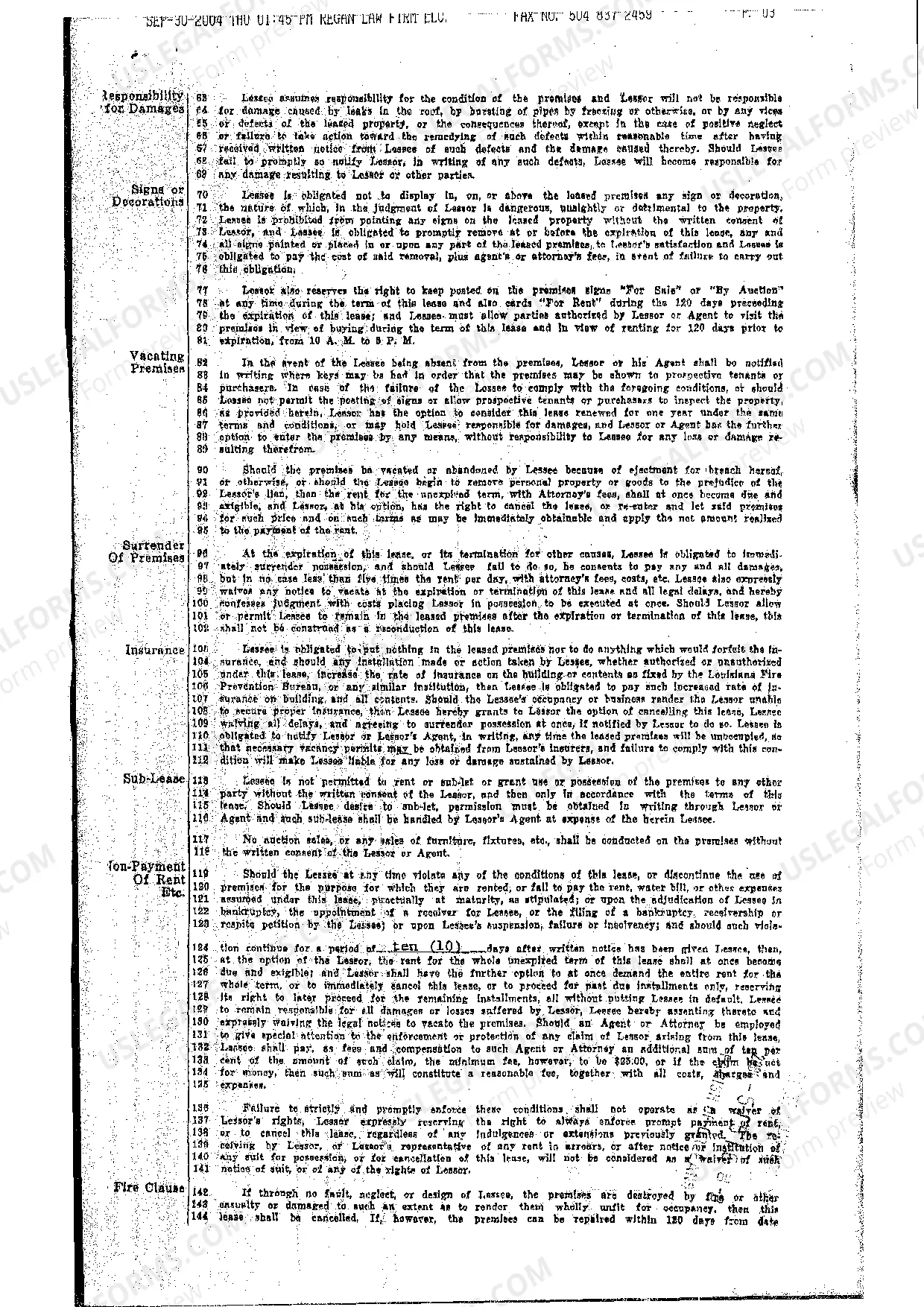

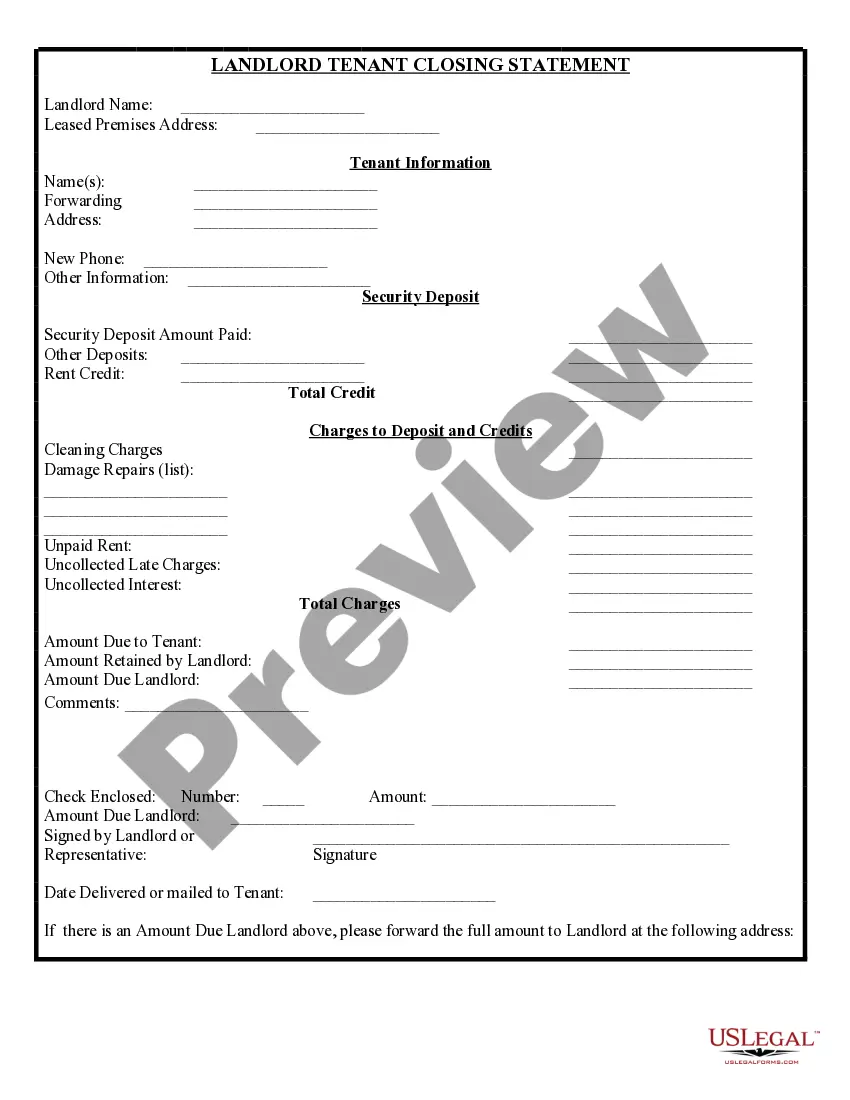

Just like a residential rental or lease, your commercial landlord is going to insist on a security deposit. The security deposit can be used by the landlord for a number of reasons, but most commonly it will be used to cover any damage at the end of your lease if you do not renew your agreement.

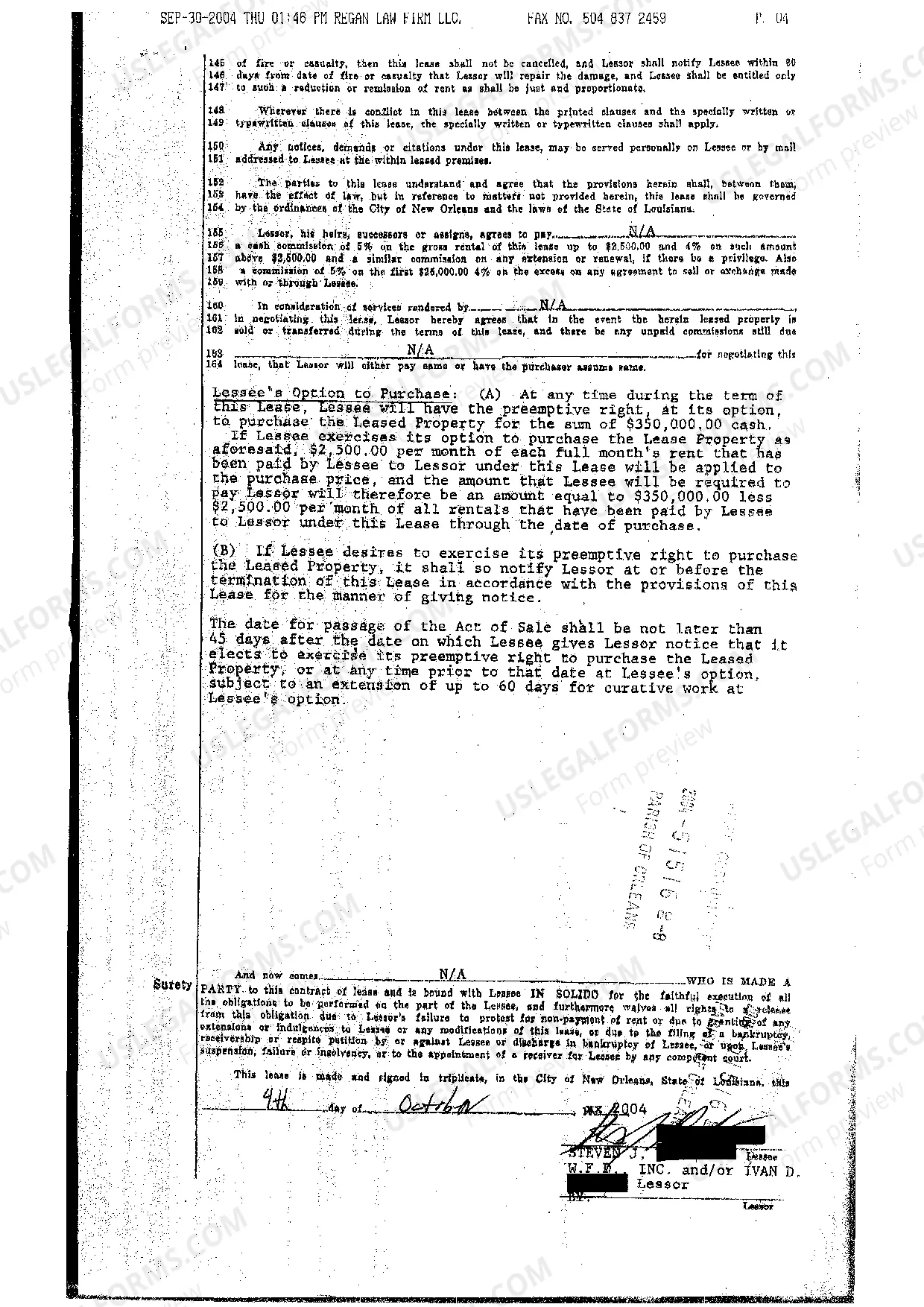

The most basic equation for calculating a lease payment takes the number of square feet times the cost per square foot, then amortizes that over a 12-month span. For example, if you have 1,000 square feet and the cost per square foot is $12, the annual lease amount would be $12,000.

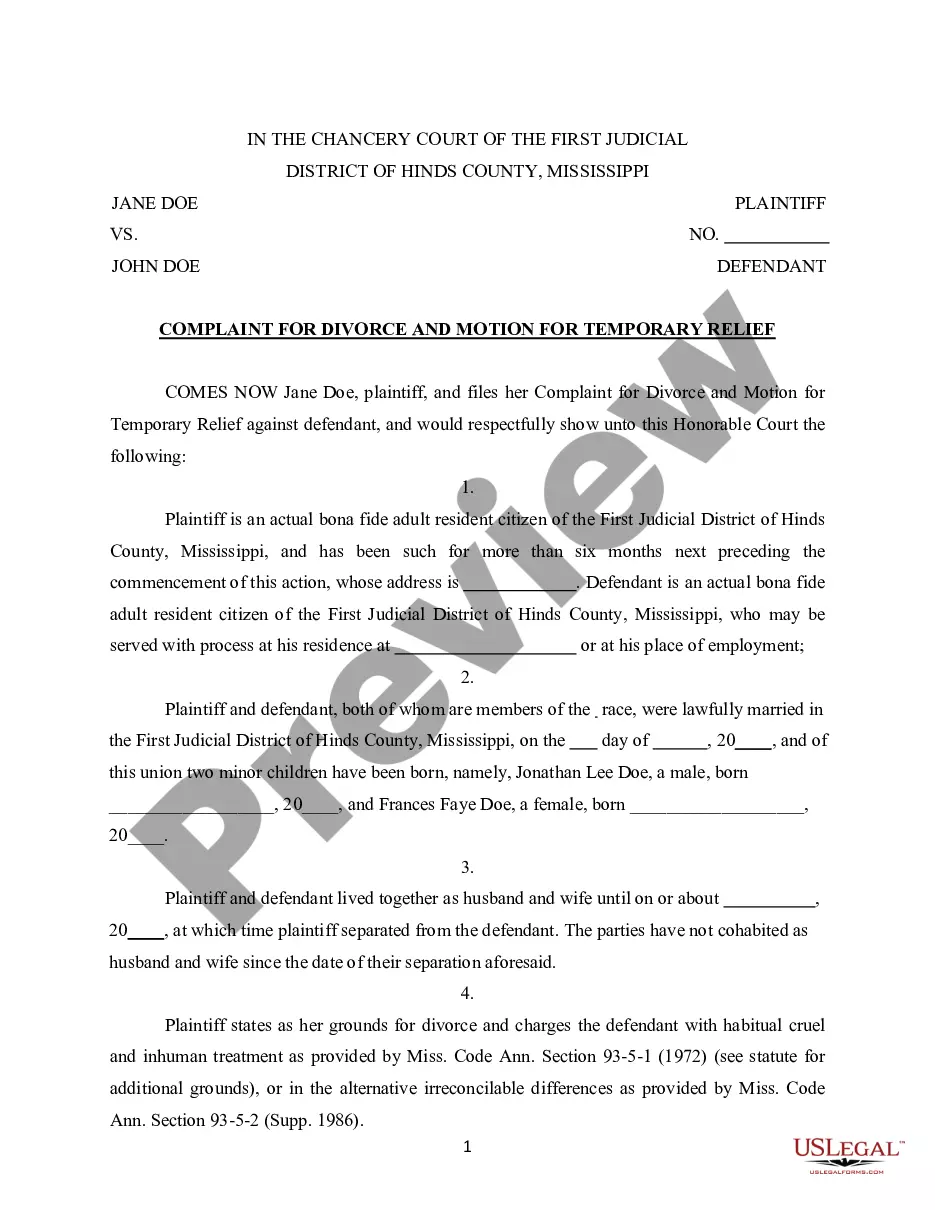

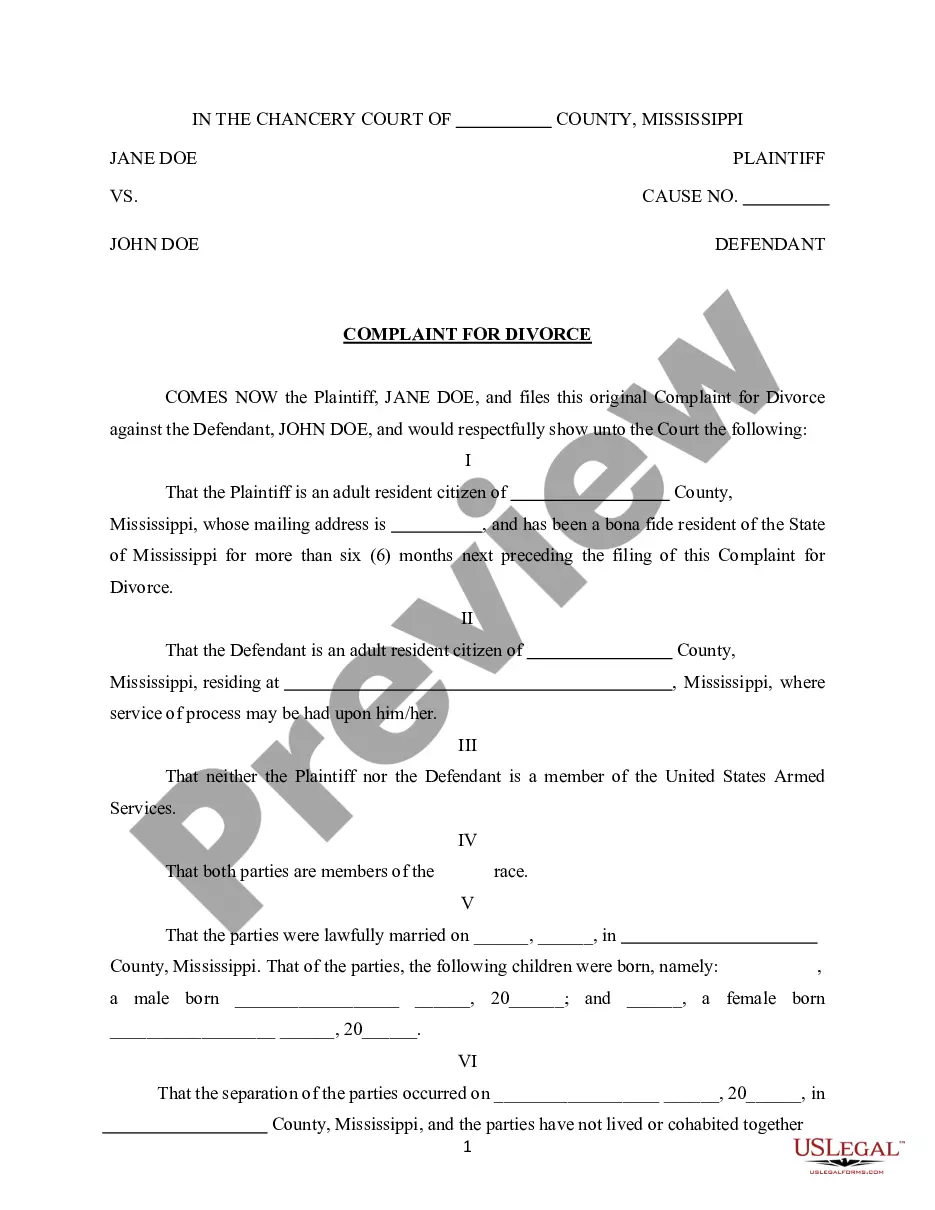

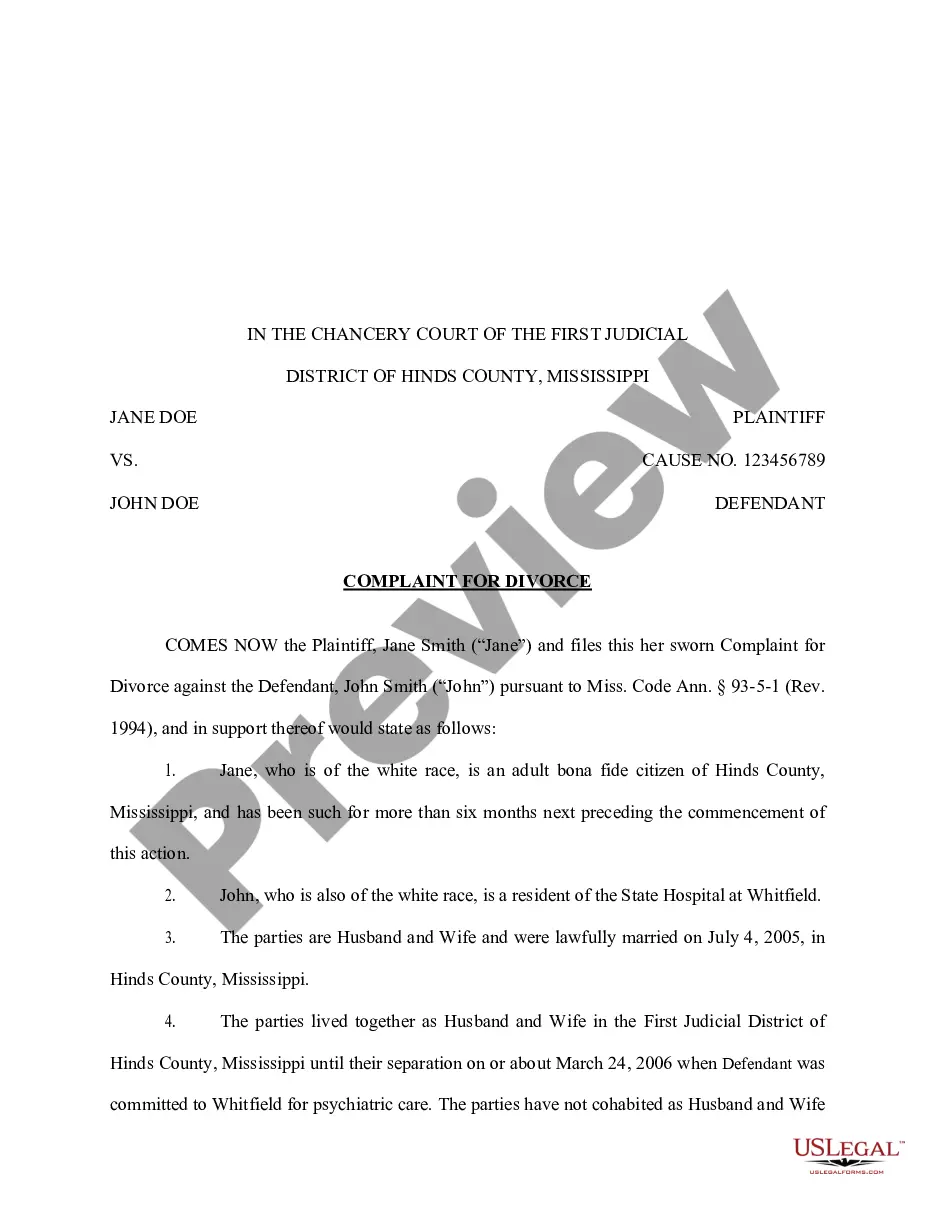

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

A gross lease is a lease that includes any incidental charges a tenant might incur. These charges could include taxes, insurance, utilities, and any other charges that might be added to the final lease cost.

Bank references. Current credit reports/scores from all three reporting bureaus. Previous/current landlord references (for an existing business moving to a new location) Personal and corporate financial statement(s) A copy of your business plan. Business bank statement(s) Prior tax returns.

The Parties & Personal Guarantees. Lease Term & Renewals. Rent Payments and Expenses. Business Protection Clauses.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

Outgoings are expenses that a landlord incurs directly from owning a property. Commercial property outgoings can include things like council rates and body corporate fees, but not capital improvements to a property, such as renovations.

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.