Louisiana Memorandum Of Trust - Short

Description

How to fill out Louisiana Memorandum Of Trust - Short?

You are invited to the most extensive legal document repository, US Legal Forms. Here, you can locate any template, including Louisiana Memorandum Of Trust - Short forms, and download them (as many as you want or require). Prepare formal documents within a few hours, rather than days or weeks, without spending a fortune on an attorney.

Obtain the state-specific template in just a few clicks and feel assured with the understanding that it was created by our qualified attorneys.

If you are already a registered user, simply Log In to your account and then click Download next to the Louisiana Memorandum Of Trust - Short you need. Since US Legal Forms operates online, you will always have access to your saved documents, regardless of the device you’re using. Find them in the My documents section.

Print the document and fill it out with your or your business’s information. Once you’ve completed the Louisiana Memorandum Of Trust - Short, send it to your attorney for verification. It’s an additional step, but a crucial one to ensure you’re fully protected. Join US Legal Forms now and gain access to a vast array of reusable templates.

- If you do not have an account yet, what are you waiting for? Refer to our instructions below to get started.

- If this is a state-specific document, verify its validity in your state.

- Review the description (if available) to determine if it’s the correct template.

- Explore more content using the Preview option.

- If the sample meets all your criteria, click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account for registration.

- Download the document in your desired format (Word or PDF).

Form popularity

FAQ

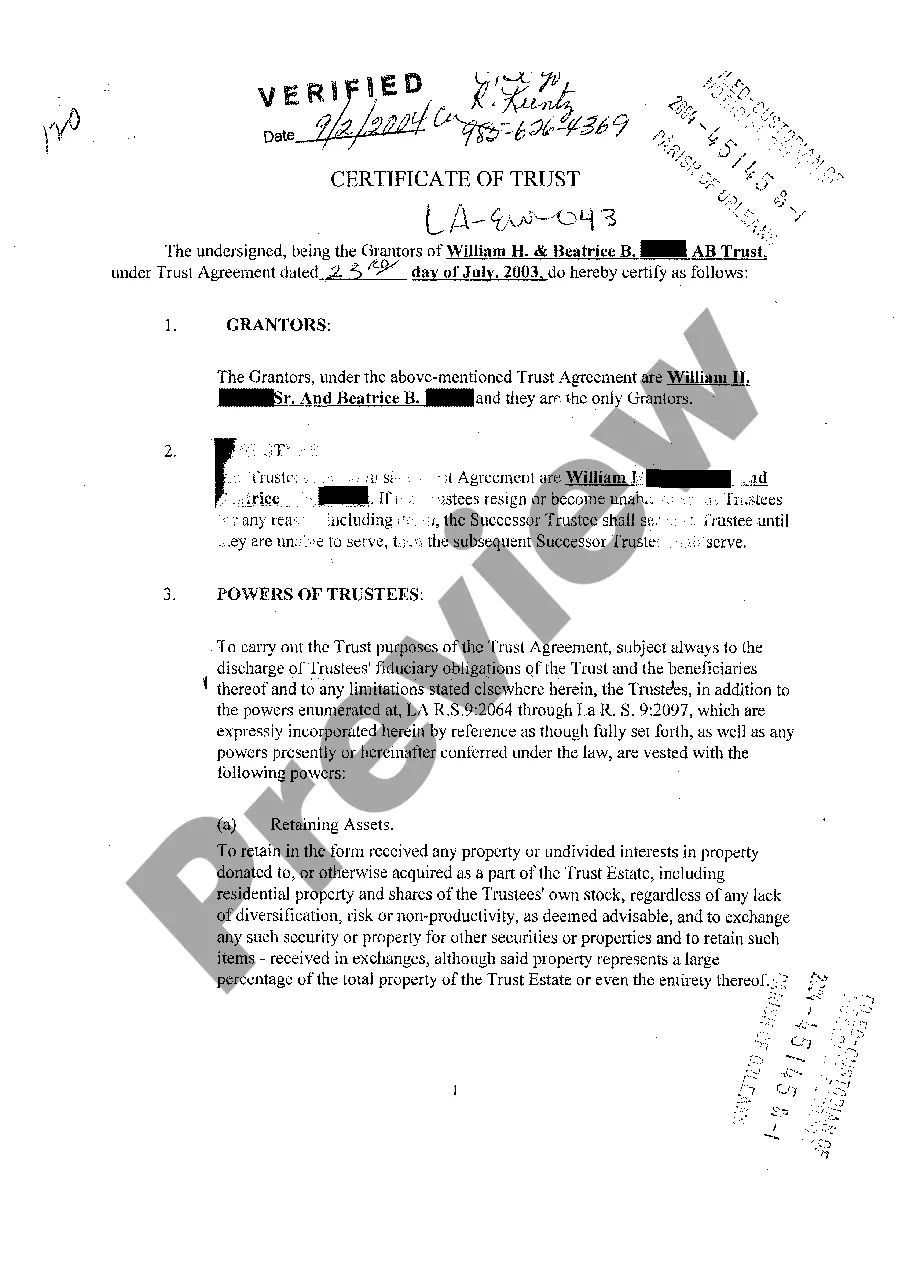

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

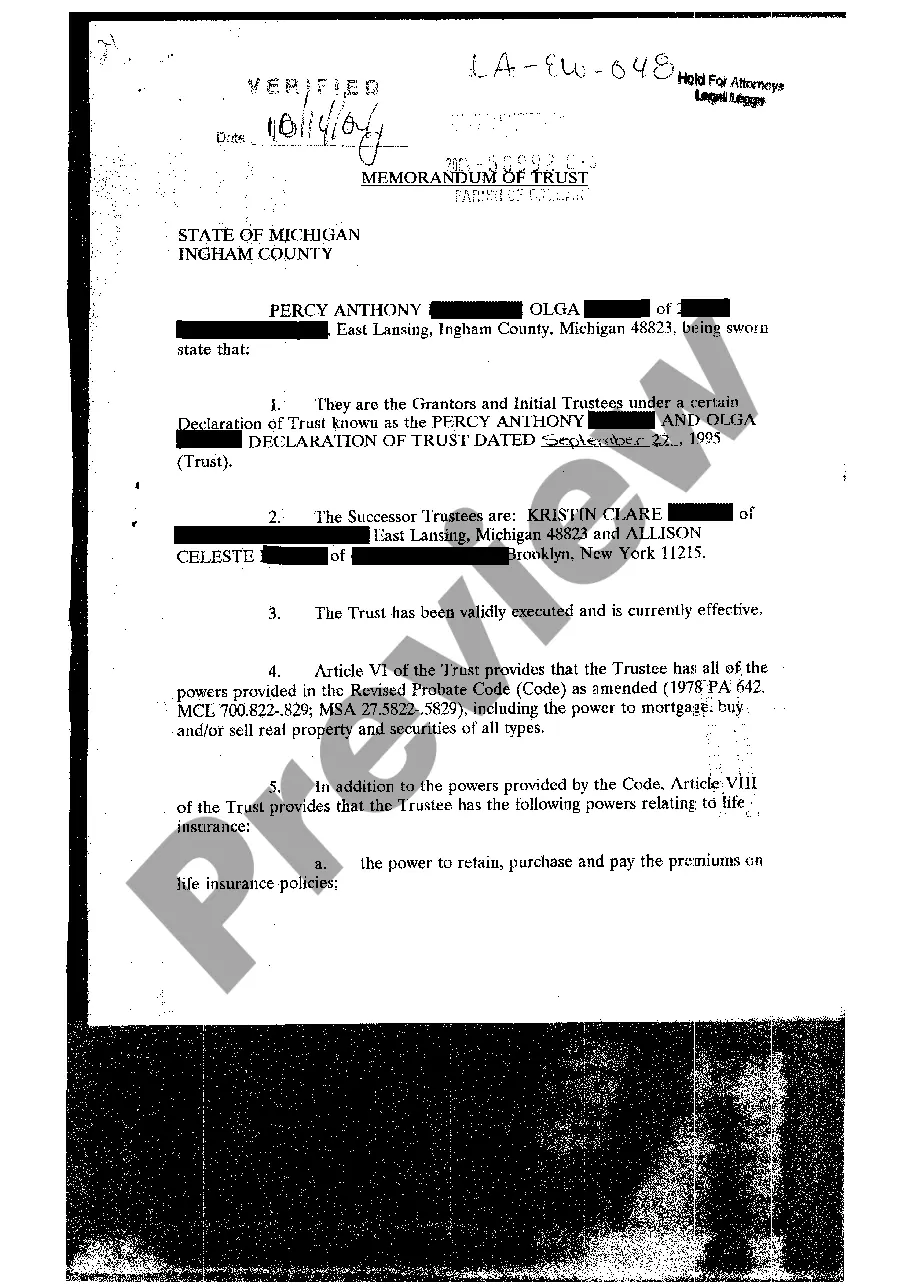

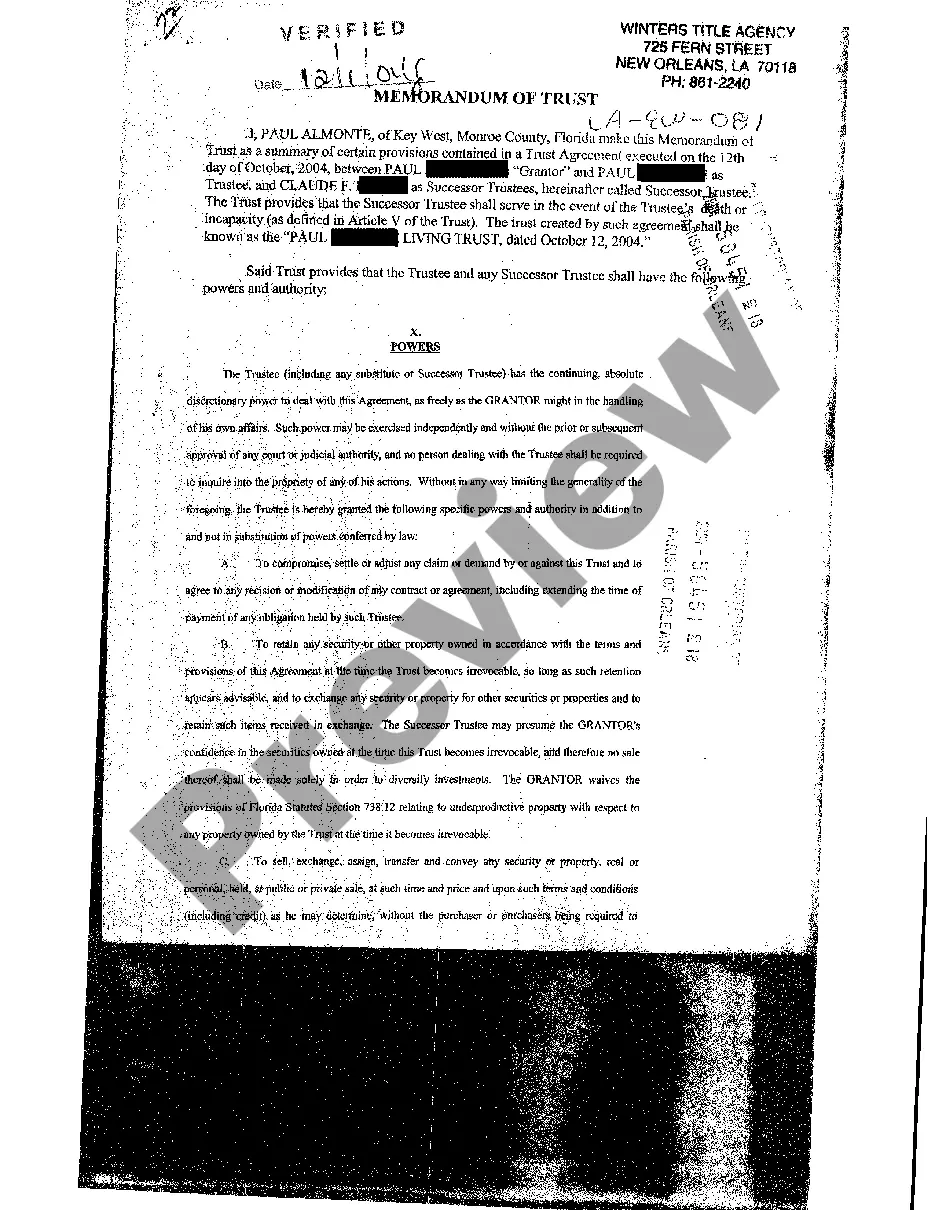

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust. It's then recorded in county in which the property is owned. The Memorandum of Trust is used in place of the actual trust to identify the grantor and trustees as well as the basic details of the trust.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral.The Short Form Deed of Trust is almost identical to a mortgage. With a Short Form Deed of Trust, a lender can foreclose on the property if the borrower defaults on making the loan payments.

Under Declaration of Trust Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

UDT is an abbreviation for under declaration of trust, which is the legal language used in some trust instruments to indicate that the grantor is both creating the trust and controlling its assets.Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

DTD is just an abbreviation for "dated," meaning the date the trust was signed. When referring to a trust, one should always use the date of the trust.