Louisiana Reservation of Income from Separate Property

Description

How to fill out Louisiana Reservation Of Income From Separate Property?

Greetings to the most essential legal document repository, US Legal Forms. Here, you will discover any specimen including Louisiana Reservation of Income from Separate Property forms and save them (as many as you wish/require). Create official paperwork within several hours, instead of days or weeks, without spending a fortune on a lawyer or attorney. Obtain the state-specific template with just a few clicks and feel assured with the knowledge that it was crafted by our state-licensed attorneys.

If you’re already a subscribed member, simply Log In to your account and then click Download next to the Louisiana Reservation of Income from Separate Property you desire. Because US Legal Forms is web-based, you’ll continually have access to your downloaded documents, regardless of the device you’re using. Find them in the My documents section.

If you don't possess an account yet, what are you waiting for? Review our instructions below to get started.

Once you’ve completed the Louisiana Reservation of Income from Separate Property, present it to your attorney for validation. It’s an additional step but a crucial one to ensure that you’re fully covered. Join US Legal Forms today and access a wide array of reusable samples.

- If this is a state-specific template, verify its applicability in your state.

- Examine the description (if available) to determine if it’s the correct form.

- View additional content with the Preview feature.

- If the example fits your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print the document and fill it with your/your business’s information.

Form popularity

FAQ

A Judgment of separation of property is a legal decree in Louisiana that formally separates the property rights of spouses. This judgment allows each spouse to retain ownership of their individual separate property while delineating any community property rights. By implementing a Louisiana Reservation of Income from Separate Property, it becomes clearer how income derived from these separated assets is allocated in future transactions.

Generally, community income is income from: Community property; Salaries, wages, and other pay received for the services performed by you, your spouse (or your registered domestic partner), or both during your marriage (or registered domestic partnership) while domiciled in a community property state; and.

The California legislature defines community property as all property, real or personal, wherever situated, acquired by a married person during the marriage while domiciled in this state. Your spouse also owns a one-half interest in your regular income, provided it doesn't come from your separate property.

The key to proving separate property is documentation and showing a paper trail to trace your separate property. Tracing is the method used when your original separate property has changed form, been exchanged, or sold during your marriage, resulting in you owning different property at the time of divorce.

In Idaho, Louisiana, Texas, and Wisconsin, income from most separate property is community income. In Arizona, California, Louisiana, Nevada, New Mexico and Washington, income from separate property will also be separate income (and will continue to be separate property after its earned).

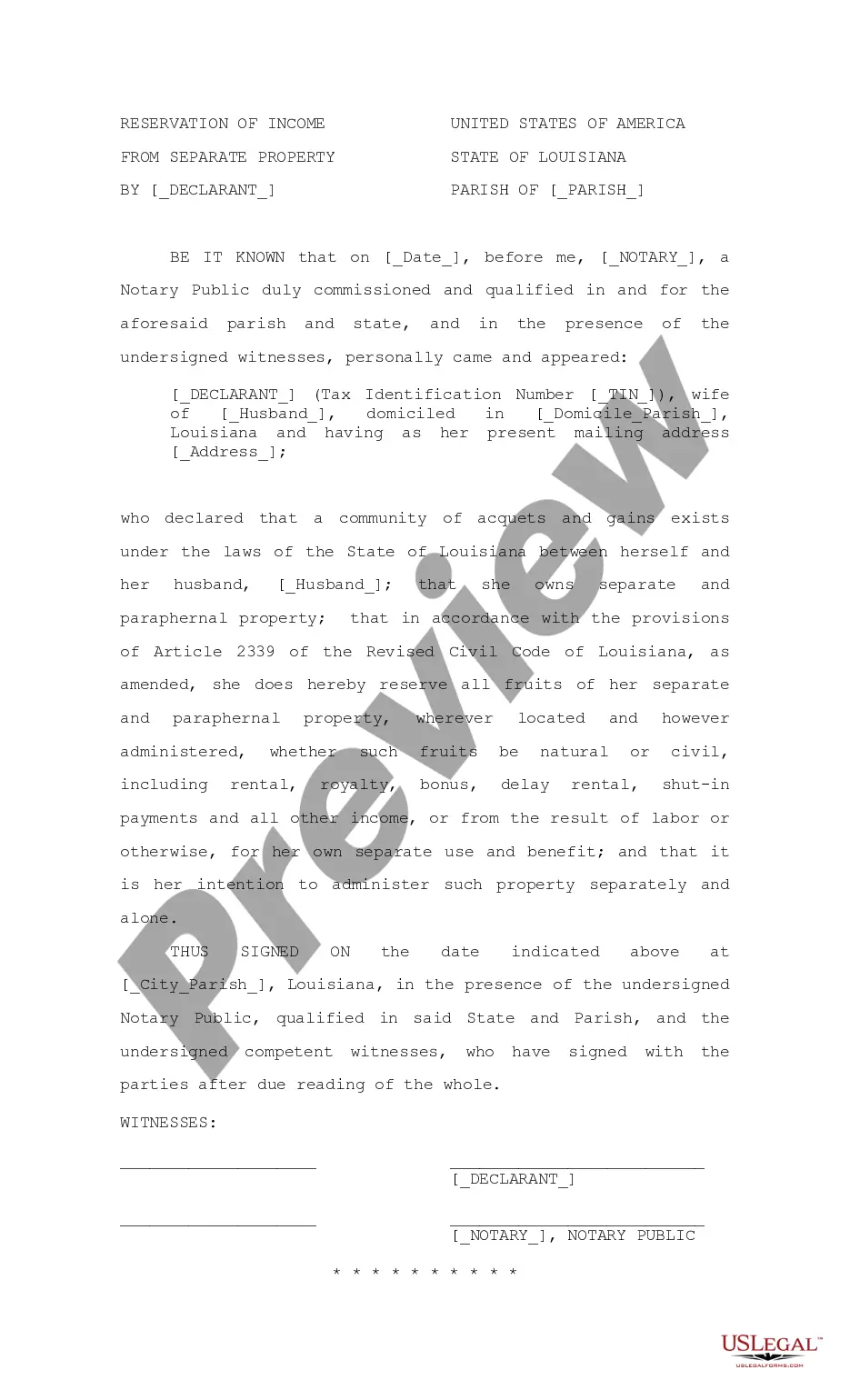

Income from separate property is usually community property under Louisiana law. If either the husband or the wife does not want to share the ownership of the income from separate property, however, that spouse can make a declaration before a Notary Public.

What Is Community Property? Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage.

Income that spouses earn after their date of separation is their own separate property. Note that money a spouse earns prior to the date of separation that isn't paid until after the date of separation is still marital property. What's important is when the income was earned, not when the income was paid.