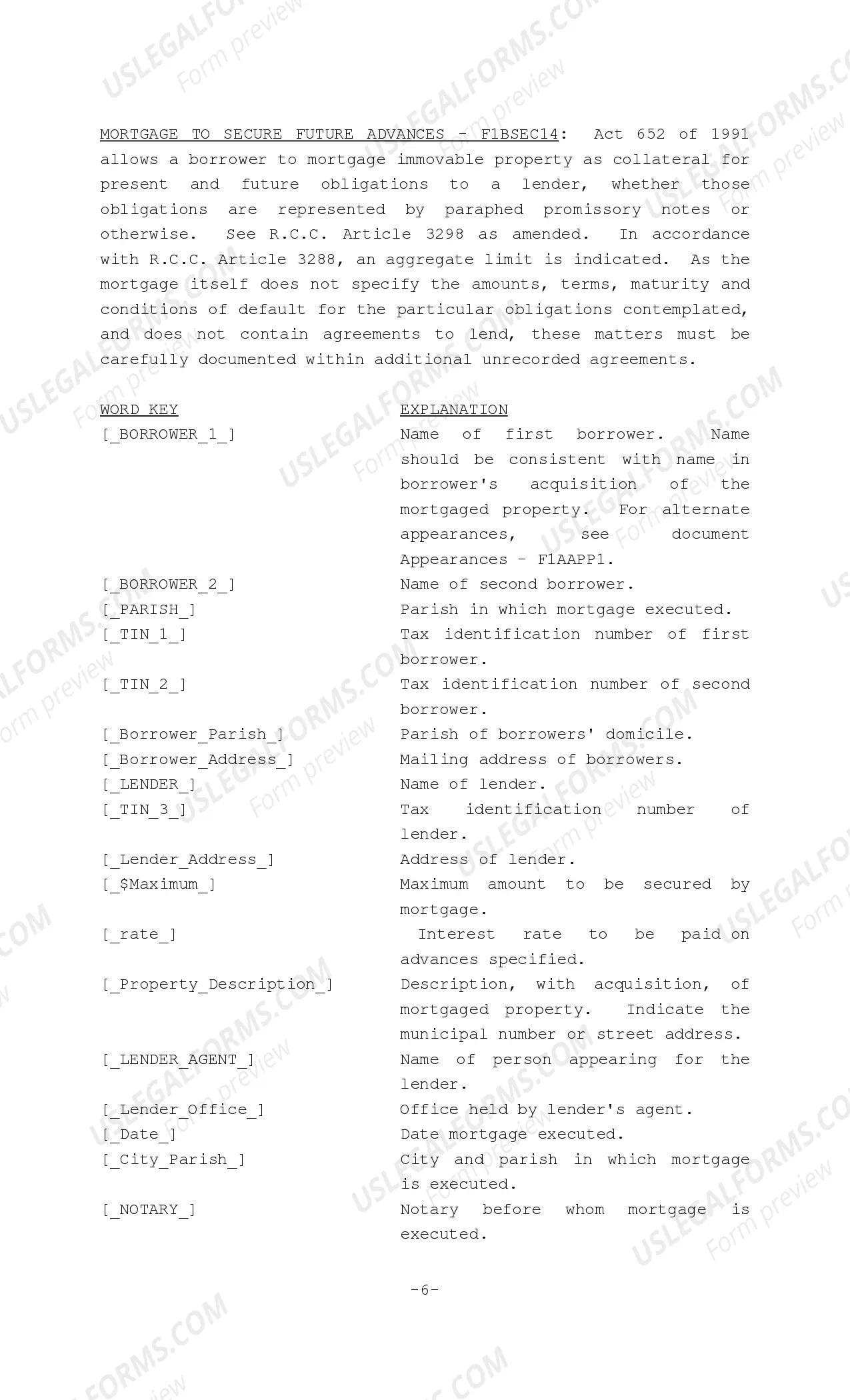

Louisiana Mortgage to Secure Future Advances

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Mortgage To Secure Future Advances?

You are invited to the most extensive legal documents collection, US Legal Forms. Here you can obtain any sample including Louisiana Mortgage to Secure Future Advances forms and download them (as many of them as you desire). Create official documents in just a few hours, instead of days or even weeks, without having to spend a fortune with an attorney. Acquire your state-specific sample in a few clicks and feel confident knowing that it was crafted by our skilled legal experts.

If you are already a subscribed user, just Log In to your account and then click Download next to the Louisiana Mortgage to Secure Future Advances you require. Because US Legal Forms is an online solution, you’ll typically have access to your downloaded documents, no matter the device you’re utilizing. View them in the My documents section.

If you don't have an account yet, what are you waiting for? Review our instructions below to get started.

Once you’ve completed the Louisiana Mortgage to Secure Future Advances, send it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable samples.

- If this is a state-specific document, confirm its applicability in the state where you reside.

- Examine the description (if available) to determine if it’s the appropriate sample.

- Explore more content through the Preview option.

- If the sample meets all your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a card or PayPal account to register.

- Download the template in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

This is the sum your Lender has agreed you can borrow for your remortgage/purchase.

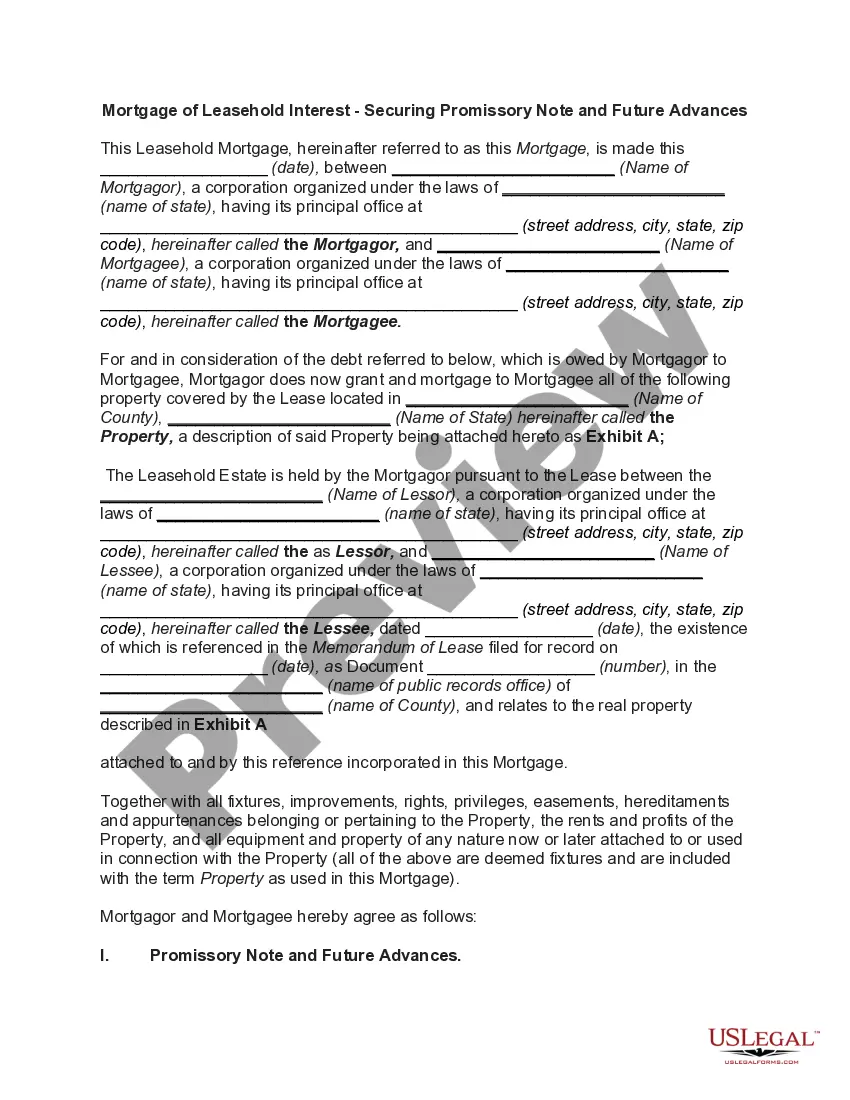

A future advance is a clause in a mortgage that provides for additional availability of funds under the loan contract.

What is a collateral loan? When you take out a collateral loan, you agree to give a lender the right to take the property that's securing the loan like a car, home or savings account if you fail to repay it as agreed.

Obvious forms of collateral include houses, cars, stocks, bonds and cash -- all things that are readily convertible into cash to repay the loan. Some of those assets are "hard," such as houses and automobiles; others are "paper," such as stocks and bonds.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Lenders use open-end mortgages to advance loan funds to borrowers while maintaining a first priority lien and without having to issue a new mortgage after each advance.

A further advance is taking on more borrowing from your current mortgage lender. This is typically at a different rate to your main mortgage.Your lender's further advance is competitive. You don't want to remortgage or switch lenders.

Multiple indebtedness mortgages (a MIM) serve the same purpose as collateral real estate mortgages. However, unlike a collateral mortgage, a MIM may secure multiple extensions of credit on a cross-collateralization basis. A MIM may also secure multiple loan advances under a secured revolving line of credit (La. Civ.

Once documents such as deeds, mortgage notes, or satisfaction of mortgage or judgment are recorded they become an official public record. Countrywide Process has the capability of completing document recordings quickly and efficiently throughout California.