Louisiana Endorsement and Assignment of Mortgage Note

What this document covers

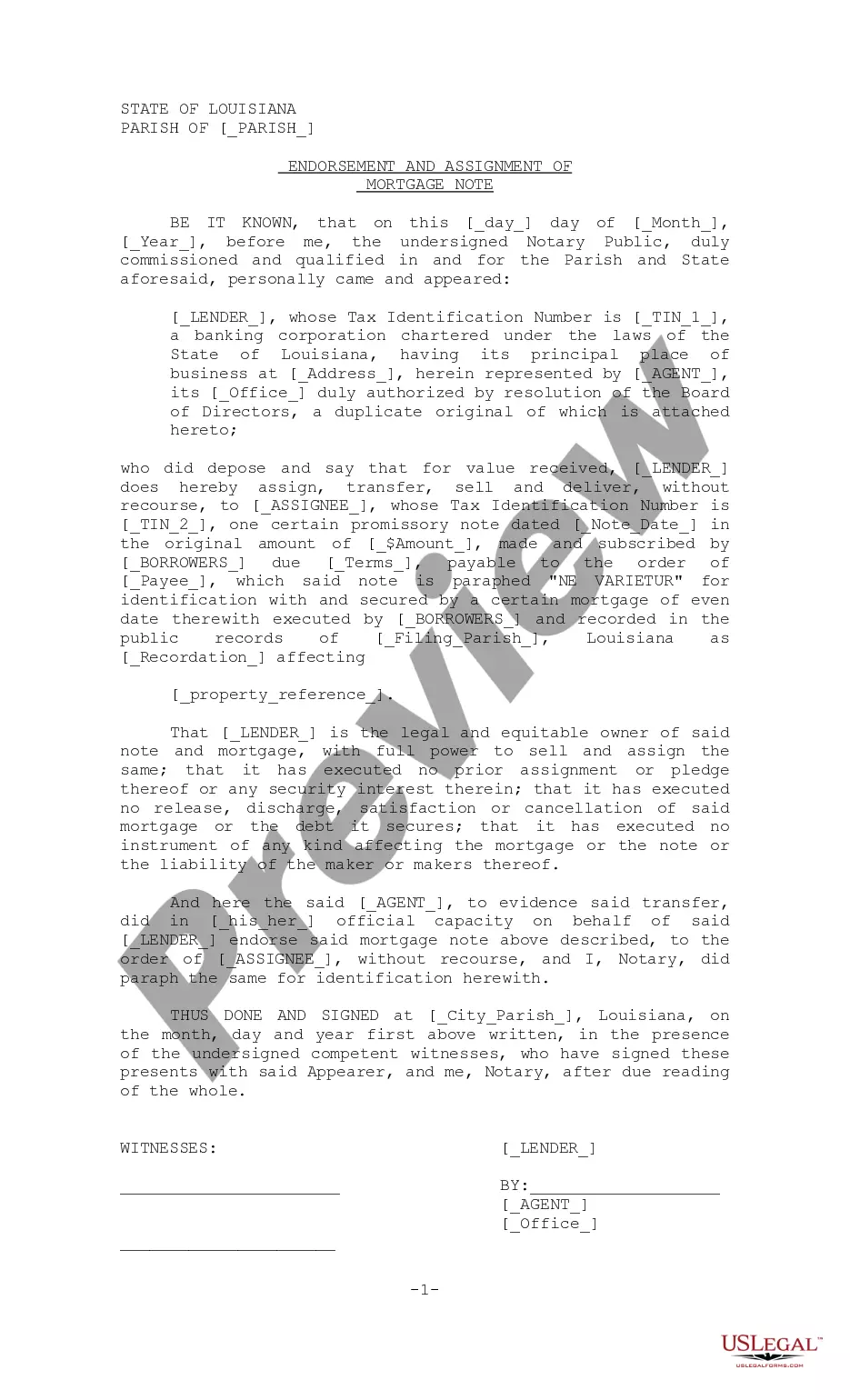

The Endorsement and Assignment of Mortgage Note is a legal document that facilitates the transfer of a mortgage note from one lender to another. This form serves as an endorsement without recourse, indicating that the original lender assigns the mortgage note to a new party, known as the assignee. Unlike a standard transfer, this endorsement ensures that the assignee steps into the shoes of the original lender, inheriting the rights associated with the mortgage note and the property it secures.

Key components of this form

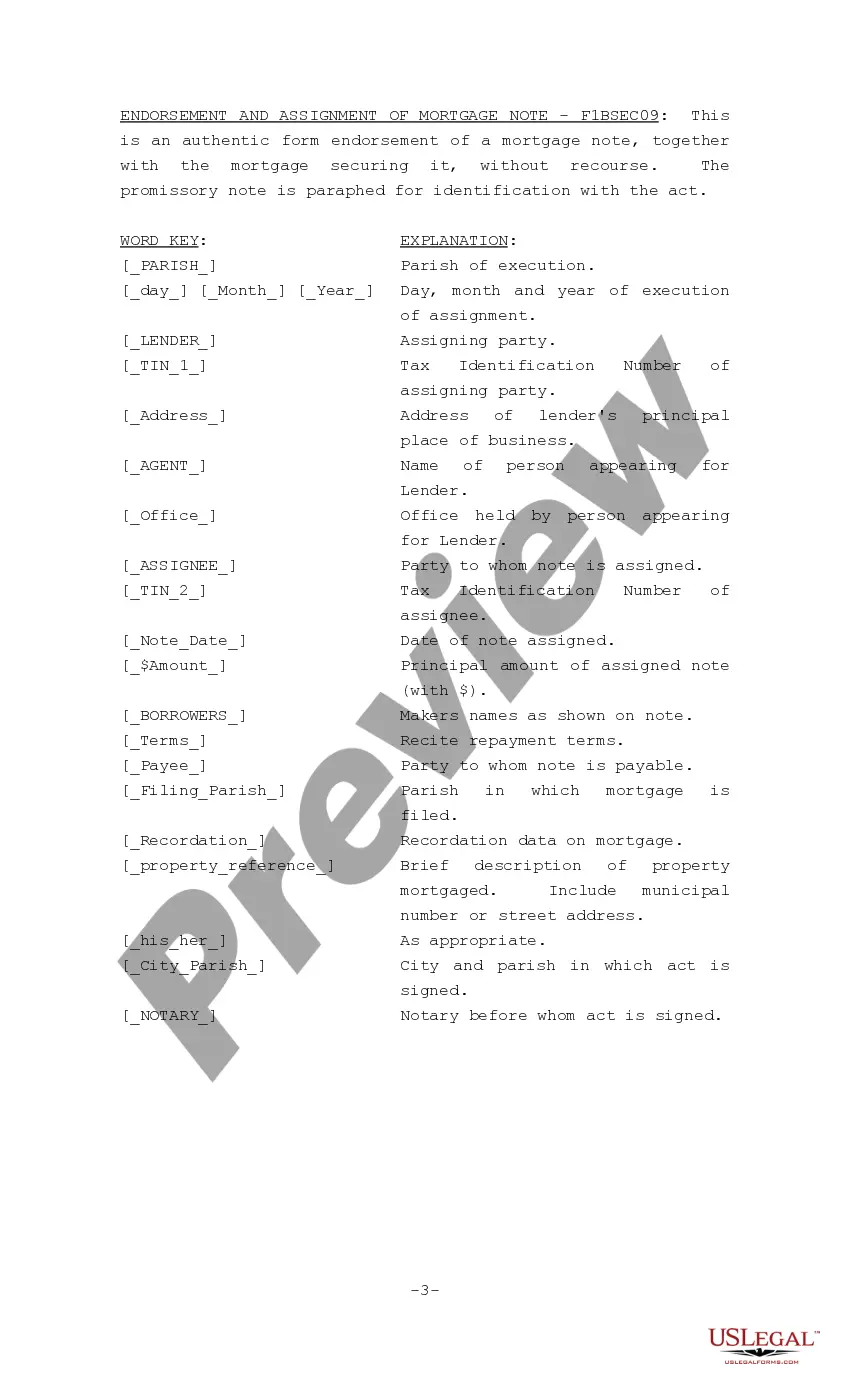

- Parties involved: identifies the lender, assignee, and any agents.

- Tax Identification Numbers: required for both the lender and the assignee.

- Property reference: includes details about the property secured by the mortgage.

- Promissory note details: specifies the note's date, amount, and repayment terms.

- Signature section: for the lender's agent and a notary public to validate the endorsement.

When this form is needed

This form should be used when a lender wishes to transfer their interest in a mortgage note to another lender. This scenario commonly occurs in real estate financing when financial institutions adjust their portfolios, or when secondary market transactions take place. It is also crucial for ensuring that the new lender can enforce the terms of the mortgage without recourse to the original lender.

Who should use this form

- Lenders wishing to assign their mortgage notes to other financial institutions.

- Banks or credit unions engaged in transferring mortgage obligations.

- Legal representatives handling the transfer of mortgage interests for clients.

Steps to complete this form

- Identify the parties: Insert the names and details of the lender and assignee.

- Specify the property: Enter a brief description of the mortgaged property, including its municipal address.

- Fill in the mortgage note details: Include the note's date, amount, and repayment terms.

- Sign and date the form: Ensure that the lender's agent signs the endorsement in the appropriate section.

- Notarization: Arrange for a notary public to witness the signing and validate the document.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Avoid these common issues

- Failing to complete all required fields, which can invalidate the document.

- Not notarizing the form when required, leading to legal issues.

- Forgetting to include specific property references, making it unclear which mortgage note is being assigned.

- Neglecting to keep a copy of the completed form for personal records.

Benefits of completing this form online

- Convenience: Easily download and complete the form from anywhere.

- Editability: Customize the document as needed for your specific situation.

- Reliability: Obtain a professionally drafted form that complies with legal standards.

Quick recap

- The Endorsement and Assignment of Mortgage Note is essential for transferring mortgage interests.

- Proper completion and notarization are critical for the form's legal enforceability.

- This document enables the assignee to act in place of the original lender with regard to the mortgage.

Form popularity

FAQ

Endorsements. When an investor purchases a loan, the previous owner will sign or endorse the note, formally indicating that the note is being transferred to a new owner. This process is called endorsement. Just as with a check, one party can transfer ownership of a note by signing it over to another party.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An allonge is a sheet of paper that is attached to a negotiable instrument, such as a bill of exchange. Its purpose is to provide space for additional endorsements when there is no longer sufficient space on the original instrument. The word allonge derives from the French word allonger, which means to lengthen."

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.

1If a loan is "assumable," you're in luck: That means you can transfer the mortgage to somebody else.2In most cases, the new borrower needs to qualify for the loan.3To complete a transfer of an assumable loan, request the change with your lender.How to Transfer a Mortgage to Another Borrower - The Balance\nwww.thebalance.com > can-you-transfer-a-mortgage-315698

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.