Louisiana Partial Dation En Paiement

What is this form?

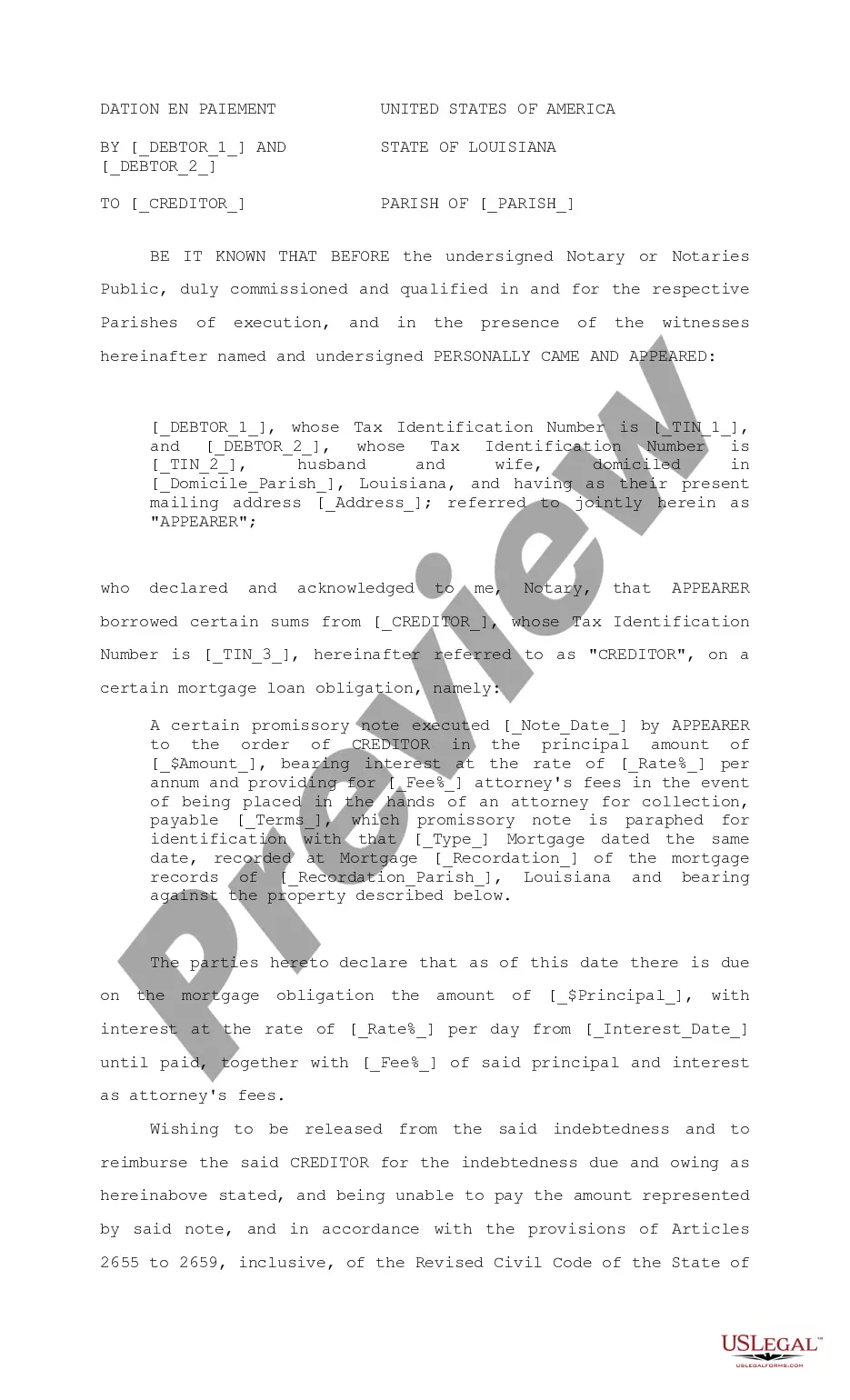

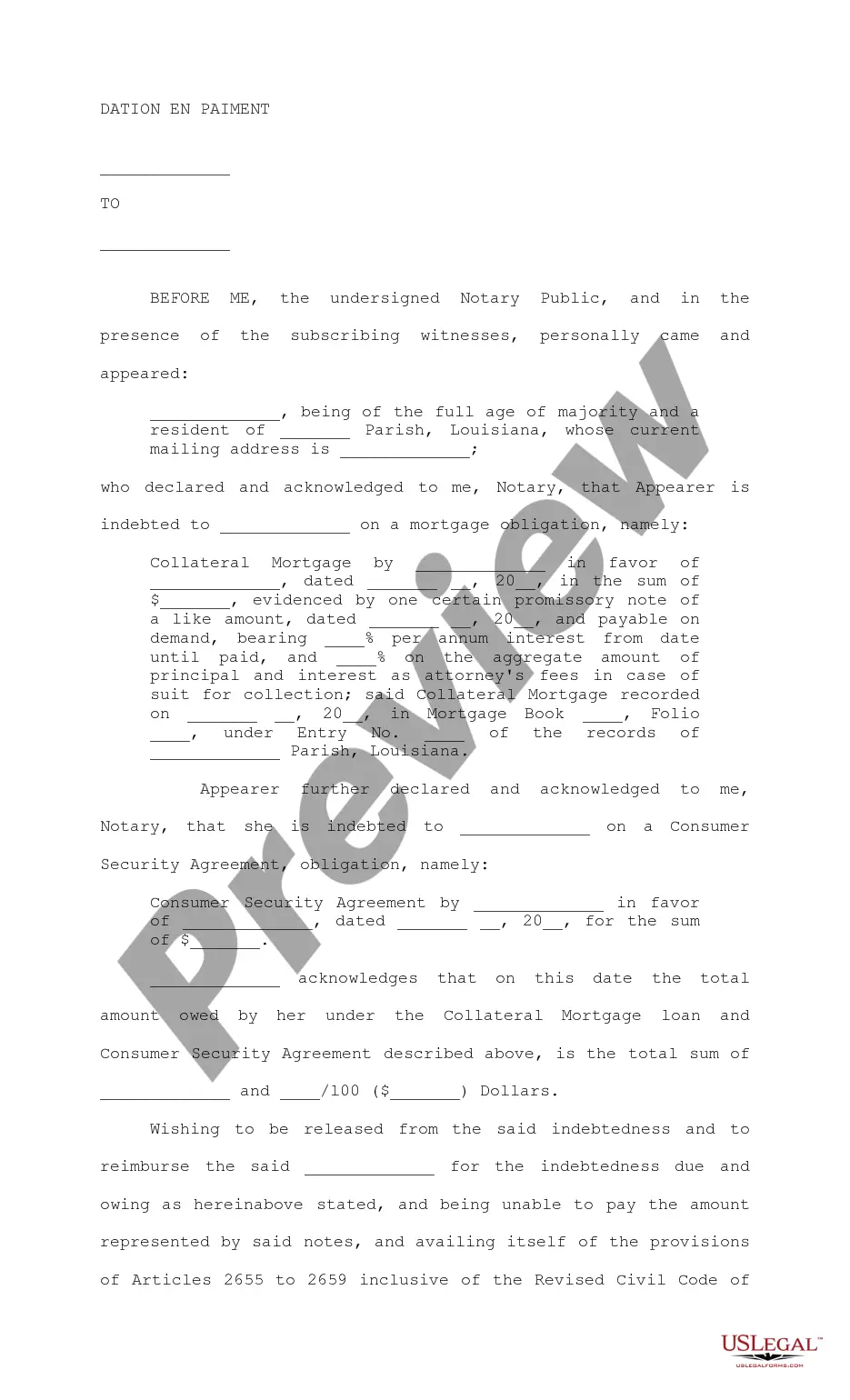

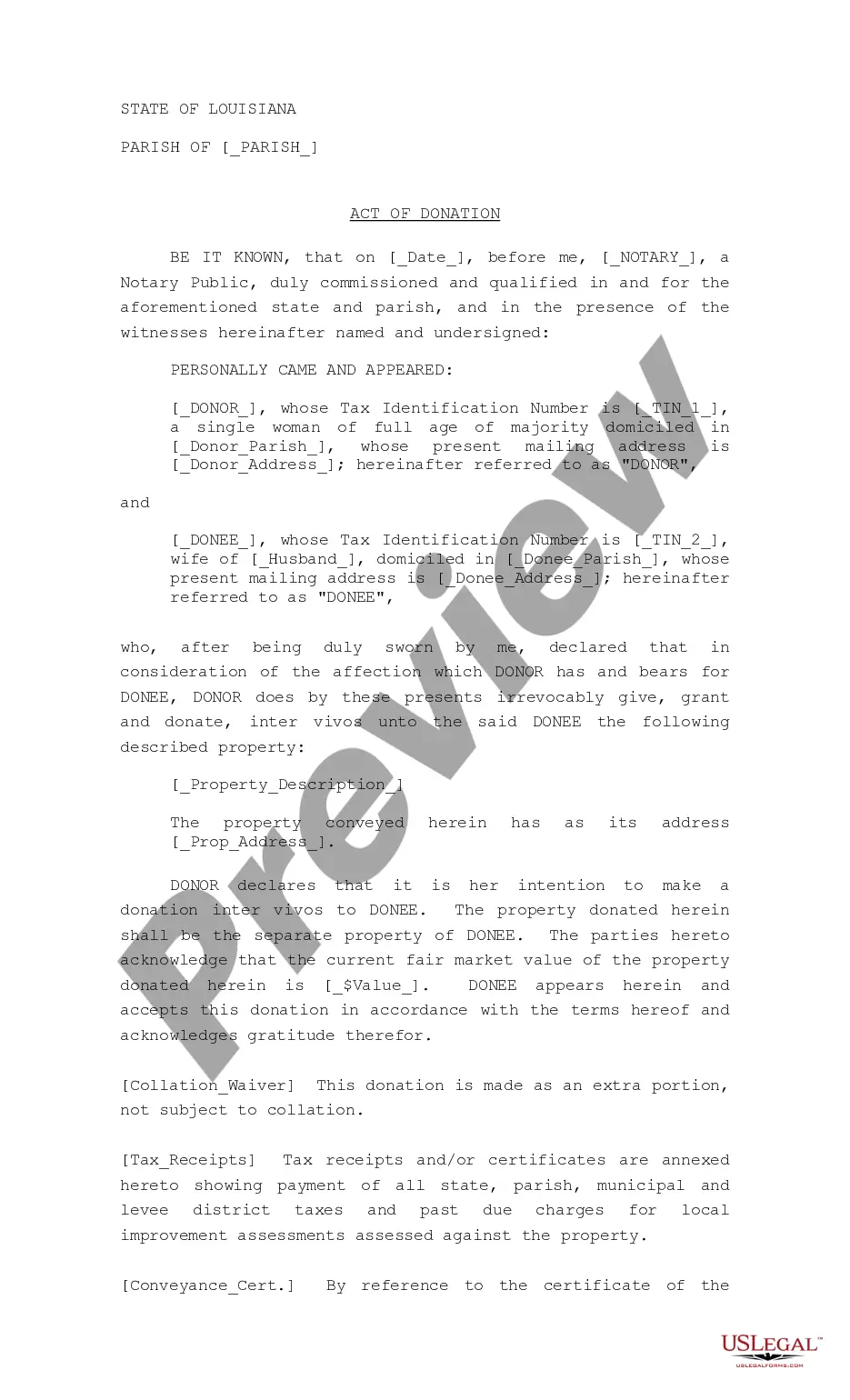

A Partial Dation en Paiement is a legal document used to transfer property in partial satisfaction of a debt. This form can be utilized for both commercial and consumer transactions, allowing a borrower to offer property to a creditor as part of settling an obligation. It is essential to understand how it differs from other forms, such as a full Dation en Paiement, which conveys property for complete debt forgiveness.

Key components of this form

- Identification of debtors and creditor, including Tax Identification Numbers.

- Details of the mortgage obligation, including amounts, interest rates, and payment terms.

- Property description and address being transferred.

- Agreements on property value and remaining debt obligations.

- Warranties by the debtor, confirming property condition and absence of claims.

- Signature and notarization requirements.

When to use this document

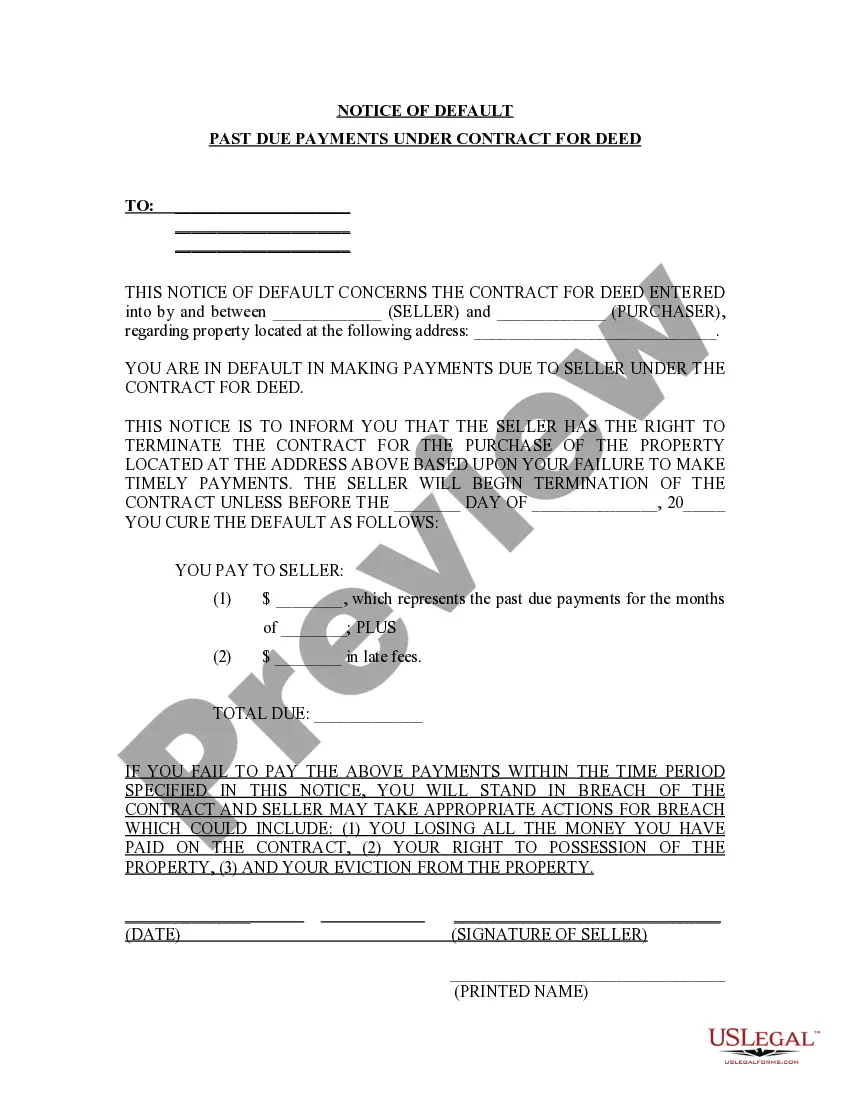

This form is necessary in situations where a debtor cannot pay the total amount owed and seeks to transfer property to the creditor as part of debt resolution. It is relevant for both commercial debts requiring accepted property value estimates and consumer debts that provide legal rights for appraisal and sale notice.

Intended users of this form

- Debtors who wish to settle part of their debts by transferring property.

- Credits looking to accept property in reduction of outstanding obligations.

- Parties engaged in commercial or consumer transactions within Louisiana jurisdiction.

Completing this form step by step

- Identify and list the names of all debtors and the creditor involved in the transaction.

- Provide the relevant details about the mortgage obligation, including the principal amount and terms.

- Describe the property being transferred, ensuring to include accurate descriptions and address information.

- State the agreed value of the property and any remaining debts after the partial transfer.

- Sign the document in the presence of a notary public and ensure all parties receive copies.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately describe the property being transferred.

- Not confirming the value of the property aligns with the agreement on the remaining debt.

- Neglecting to obtain necessary signatures from all parties involved.

- Overlooking notarization requirements, which may vary by situation.

Why complete this form online

- Convenient access to professionally drafted legal forms, available for immediate download.

- Editability allows users to tailor the form to their specific needs before finalizing.

- Reliability of getting a document that complies with Louisiana legal standards.

- Can be completed from anywhere, saving time by avoiding in-person appointments.

Key takeaways

- A Partial Dation en Paiement facilitates partial payment of debts through property transfer.

- It's crucial for both commercial and consumer transactions in Louisiana, adhering to specific state laws.

- Ensuring accurate details and notarization is essential for the document's validity.

Looking for another form?

Form popularity

FAQ

Une dation en paiement en art consiste à transférer un objet d'art en échange de l'annulation d'une dette. Cela peut être particulièrement intéressant pour les créateurs ou les collectionneurs d'art. En Louisiane, cette forme de dation peut offrir une solution unique pour ceux qui souhaitent valoriser leurs actifs. Consultez US Legal Forms pour découvrir des modèles spécifiques pour ce type de transaction.

Une dation en paiement est un transfert de propriété d'un actif en échange de l'annulation d'une dette. Cela permet de régler des obligations sans passer par des transactions monétaires. En Louisiane, cette pratique peut se révéler avantageuse pour les deux parties. US Legal Forms offre des modèles qui aident à structurer ces accords de manière légale et efficace.

La dation en paiement est un accord où un débiteur offre un actif en lieu et place d'un paiement monétaire. Cela peut inclure des biens immobiliers, des véhicules, ou d'autres actifs. Cette méthode est souvent utilisée pour simplifier le processus de remboursement. Pour une compréhension approfondie du concept en Louisiane, US Legal Forms propose des ressources utiles.

La dation en paiement fonctionne en permettant au débiteur de transférer la propriété d'un bien au créancier. Cela permet d'éteindre la dette sans recourir à l'argent. Ce processus doit être clairement documenté pour éviter toute confusion. Sur US Legal Forms, vous trouverez des outils pour formaliser ce type de transaction en Louisiane.

La dation en paiement désigne le processus où un débiteur transfère un bien au créancier pour régler une dette. Ce mécanisme permet souvent d'éviter des poursuites judiciaires. En Louisiane, la dation en paiement peut offrir une alternative efficace aux paiements monétaires. Explorez US Legal Forms pour découvrir des modèles de contrats qui facilitent cette démarche.

Un contrat de dation en paiement est un accord entre un débiteur et un créancier. Dans ce contrat, le débiteur offre un bien comme paiement d'une dette au lieu de l'argent. Cela peut être une solution avantageuse pour ceux qui souhaitent éviter des complications financières. Pour en savoir plus sur la dation en paiement en Louisiane, consultez les ressources disponibles sur US Legal Forms.