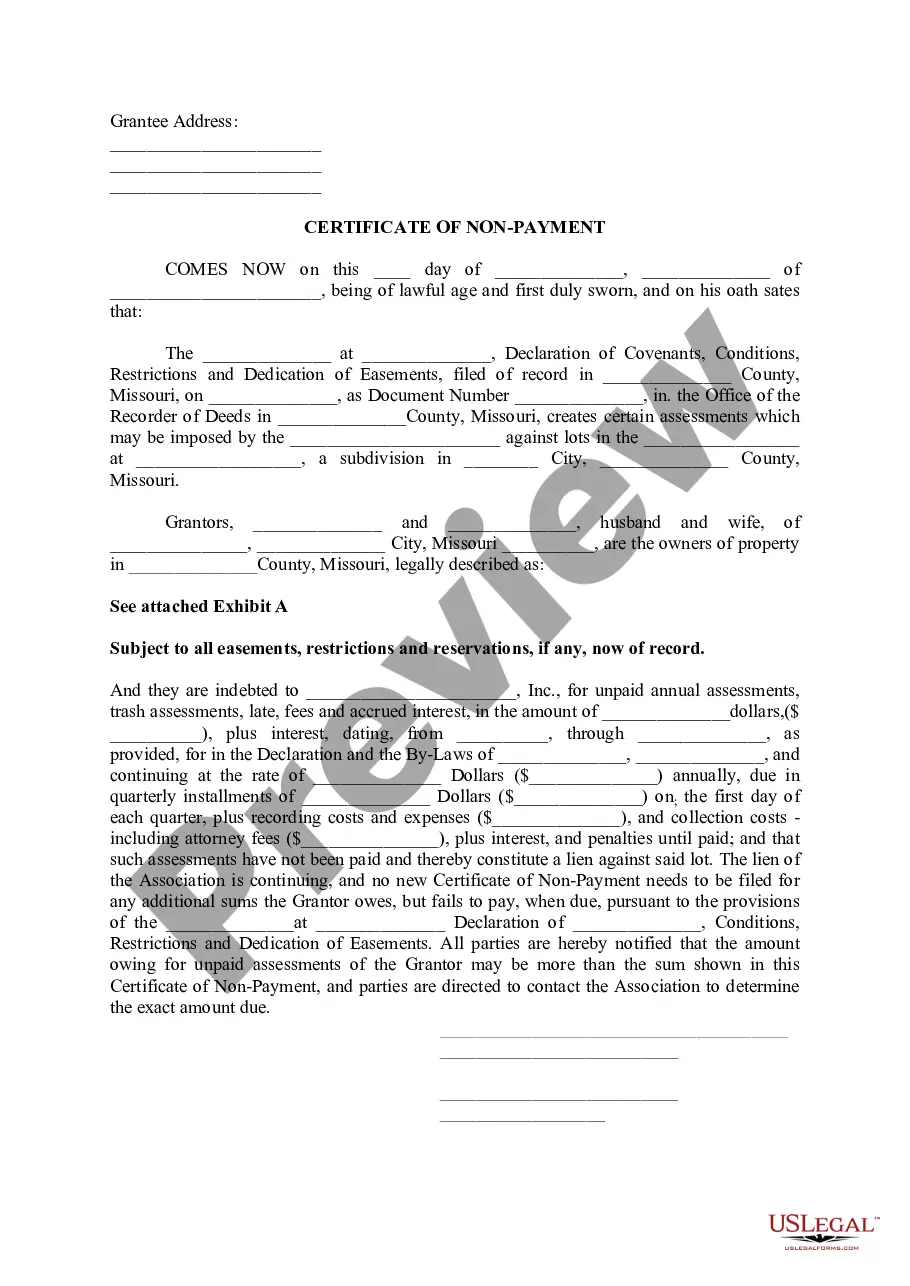

Missouri Certificate of Non-Payment

Description

How to fill out Missouri Certificate Of Non-Payment?

Obtain any version from 85,000 legitimate documents including Missouri Certificate of Non-Payment online through US Legal Forms. Each template is crafted and refreshed by state-recognized legal experts.

If you already possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the instructions below: Check the state-specific regulations for the Missouri Certificate of Non-Payment you need to utilize. Peruse the description and review the sample. When you are confident the template meets your needs, simply click Buy Now. Choose a subscription plan that aligns with your budget. Establish a personal account. Remit payment in one of two suitable methods: by card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the file to the My documents section. After your reusable form is downloaded, print it out or save it to your device.

- With US Legal Forms, you will always have rapid access to the suitable downloadable template.

- The platform provides you access to documents and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Missouri Certificate of Non-Payment swiftly and effortlessly.

Form popularity

FAQ

To obtain a no tax due letter in Missouri, start by contacting the Missouri Department of Revenue with your tax identification information. You must complete any outstanding tax obligations before requesting this letter. For a smoother experience, consider using the US Legal platform, which can guide you through the requirements and help streamline your request.

Receiving a letter from the Missouri Department of Revenue usually indicates that they need further information regarding your tax status. This could be related to outstanding taxes or a request for clarification on your tax filings. It's important to read the letter carefully and respond promptly to avoid any penalties. If you need assistance, the US Legal platform can provide helpful resources and support.

To acquire a certificate of no tax due in Missouri, you need to submit a request to the Missouri Department of Revenue. This request should include your identification details and any relevant tax information. You can also utilize the US Legal platform, which offers step-by-step instructions to help you navigate the application process efficiently.

In Missouri, obtaining a no tax due letter typically takes about 5 to 10 business days. However, processing times can vary depending on the workload of the Missouri Department of Revenue. To expedite the process, ensure that all required documents are submitted correctly. Using the US Legal platform can simplify this process by providing clear guidance on what is needed.

The Missouri form 943 is a tax form used for reporting and paying taxes withheld from employees' wages. This form is essential for employers to remain compliant with state tax laws. Understanding this form can help you avoid issues, including the need for a Missouri Certificate of Non-Payment.

Obtaining a no tax due certificate in Missouri involves filling out the appropriate forms and submitting them to the Missouri Department of Revenue. Ensure that you provide accurate information to expedite the process. This certificate can help you avoid complications related to a Missouri Certificate of Non-Payment.

To get a Missouri no tax due certificate, you should complete the necessary application form and submit it to the state's tax authority. This document serves as proof that you have no outstanding tax liabilities. It’s an essential safeguard against receiving a Missouri Certificate of Non-Payment.

You can obtain a certificate of no tax due by applying through the Missouri Department of Revenue. This certificate verifies that you do not owe any taxes, which can be beneficial for various transactions. Avoiding a Missouri Certificate of Non-Payment is easier with this certificate in hand.

Filling out the 53/1 form in Missouri requires you to provide detailed information about your business and its tax obligations. Make sure to follow the instructions carefully, as accurate completion is vital. This form plays a significant role in your tax filings and may relate to obtaining a Missouri Certificate of Non-Payment.

To obtain a tax exempt letter in Missouri, you must submit an application to the Missouri Department of Revenue. This letter certifies your tax-exempt status for specific purchases. Having this letter can prevent the need for a Missouri Certificate of Non-Payment during audits or inspections.