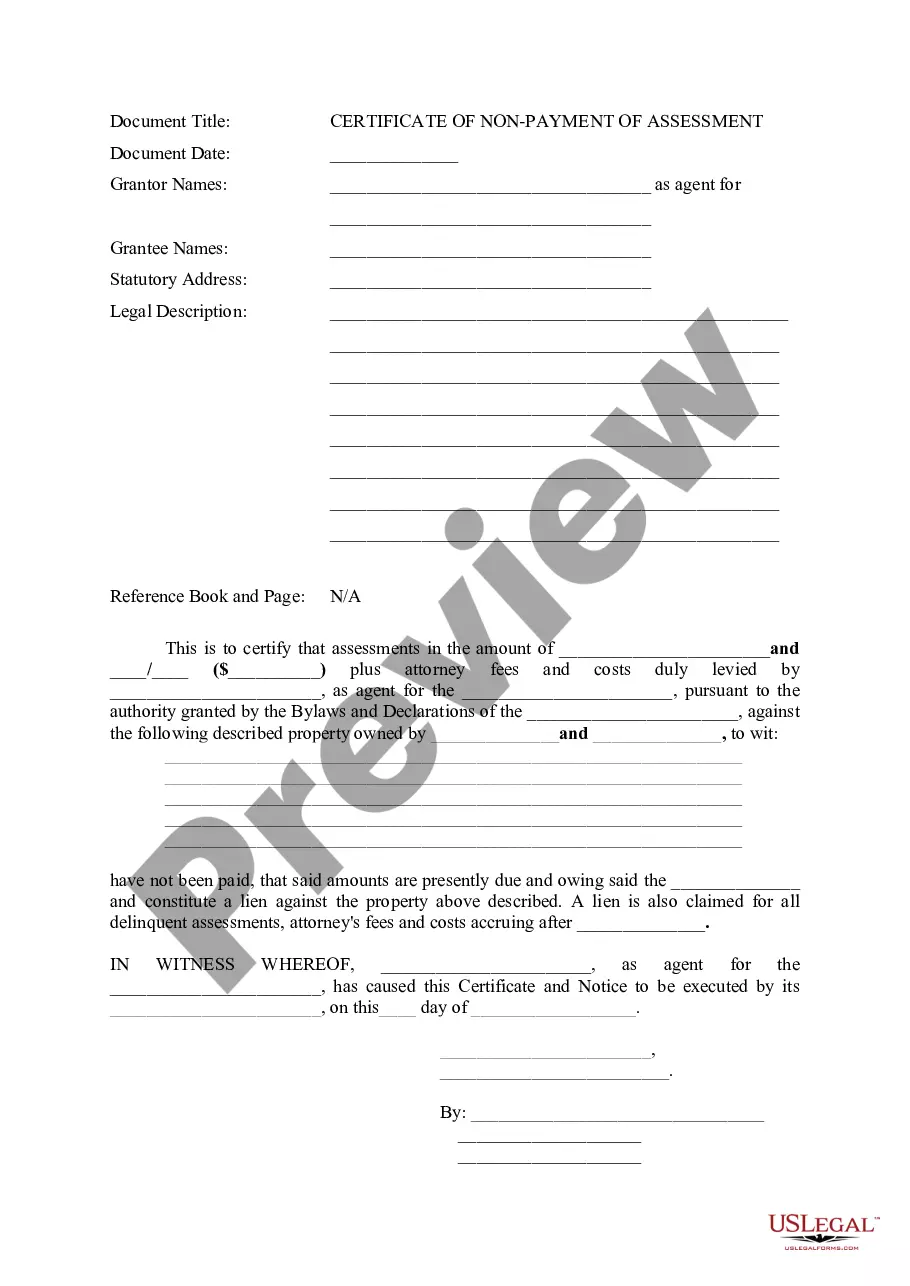

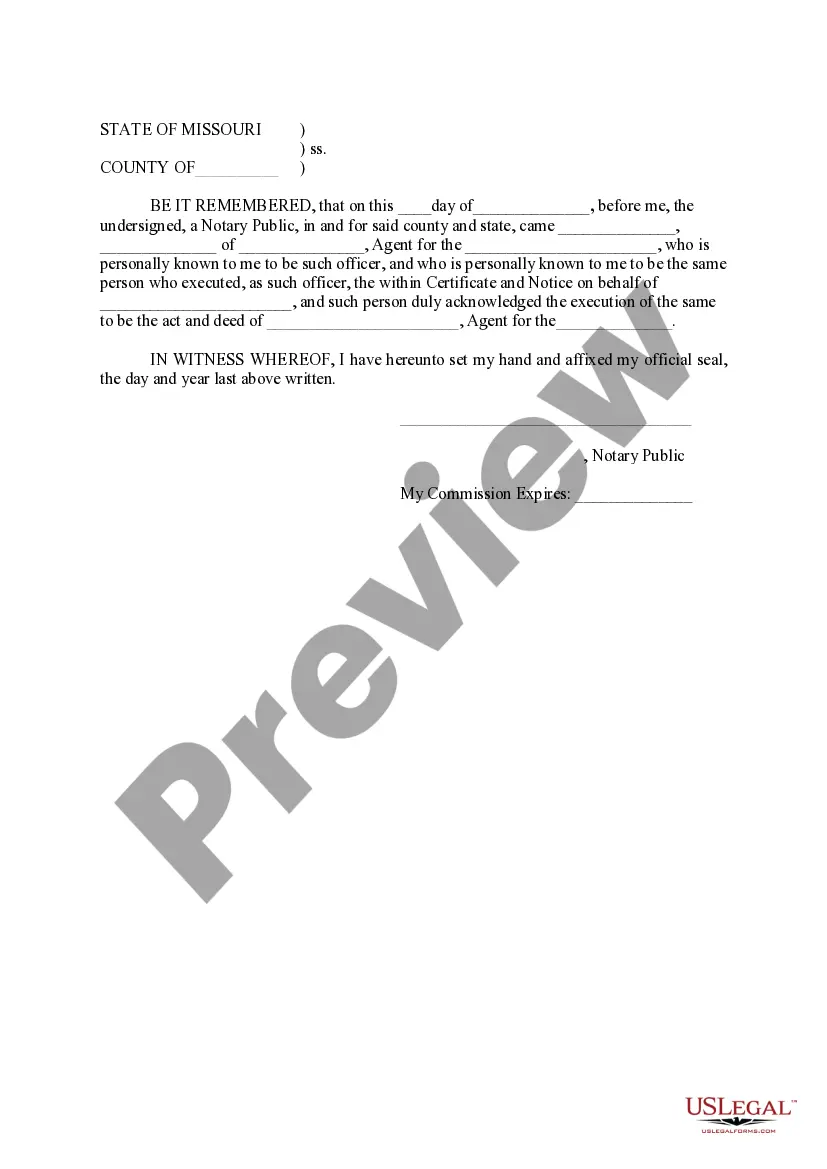

Missouri Certificate of Non-Payment of Assessment

Description

How to fill out Missouri Certificate Of Non-Payment Of Assessment?

Have any template from 85,000 legal documents such as Missouri Certificate of Non-Payment of Assessment on-line with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Missouri Certificate of Non-Payment of Assessment you want to use.

- Read description and preview the template.

- Once you are sure the sample is what you need, click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable sample. The platform will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Missouri Certificate of Non-Payment of Assessment fast and easy.

Form popularity

FAQ

In Missouri, seniors who are 65 years or older may qualify for property tax relief programs that can reduce or eliminate their tax burden. However, eligibility depends on various factors, including income and the value of the property. To navigate this process, you can use USLegalForms to find information and forms related to obtaining your Missouri Certificate of Non-Payment of Assessment for any applicable exemptions.

To request a 'no tax due' status in Missouri, you need to submit a formal request to your local tax authority, including your property details and any required documentation. This request may involve confirming that you have no outstanding taxes or assessments owed. For assistance, consider using USLegalForms, which provides tools and resources to help you obtain your Missouri Certificate of Non-Payment of Assessment without hassle.

To get a Missouri tax exempt letter, you must first determine your eligibility based on specific criteria set by the state. This often involves completing an application and providing supporting documentation that demonstrates your exempt status. You can streamline this process by utilizing USLegalForms, which offers the necessary forms and instructions to help you secure your Missouri Certificate of Non-Payment of Assessment efficiently.

To obtain a statement of non-assessment in Missouri, you typically need to provide your property details, including the parcel number and the address. Additionally, you may need to submit proof of ownership and any relevant documents that support your claim for a Missouri Certificate of Non-Payment of Assessment. Using platforms like USLegalForms can simplify this process by providing templates and guidance tailored to Missouri's requirements.

Yes, you can file the Missouri Property Tax Credit (PTC) online through the Missouri Department of Revenue's website. This online system allows you to submit your application conveniently from home, which can save you time and effort. If you are applying for a Missouri Certificate of Non-Payment of Assessment, ensure your PTC application is complete and accurate. For guidance and easy access to forms, check out US Legal Forms for reliable resources.

The best evidence to protest property taxes includes recent property appraisals, comparable sales data, and documentation of any errors on your property tax assessment. Gathering this information can significantly strengthen your case when contesting your property taxes. Moreover, presenting a solid argument supported by facts can lead to a favorable outcome, such as receiving a Missouri Certificate of Non-Payment of Assessment. US Legal Forms can assist you in preparing the required documents to support your protest.

To obtain a Missouri no tax due certificate, you need to contact your local tax authority or the Department of Revenue. They will require you to provide documentation that verifies you have no outstanding tax liabilities. The Missouri Certificate of Non-Payment of Assessment may be issued once they confirm your status. Utilizing US Legal Forms can simplify this process by providing the necessary forms and guidance.

The Missouri 149 form is a tax form used to certify that a property owner does not owe any assessments or taxes on their property. This form is essential for obtaining a Missouri Certificate of Non-Payment of Assessment, as it demonstrates that your property is in good standing. Completing this form accurately can help streamline the process of proving your tax status. For assistance, consider using platforms like US Legal Forms to ensure proper completion.