Kentucky Last Will and Testament for Single Person with No Children

What is this form?

This Last Will and Testament is a legal document designed specifically for a single person without children. It specifies how your assets will be distributed upon your death and designates a personal representative to manage your estate. Unlike other wills, this form caters to individuals who do not have dependents or a spouse, making its provisions tailored to simpler estate plans.

Form components explained

- Personal information fields, including your name and county of residence.

- Articles detailing specific property bequests and the designation of beneficiaries.

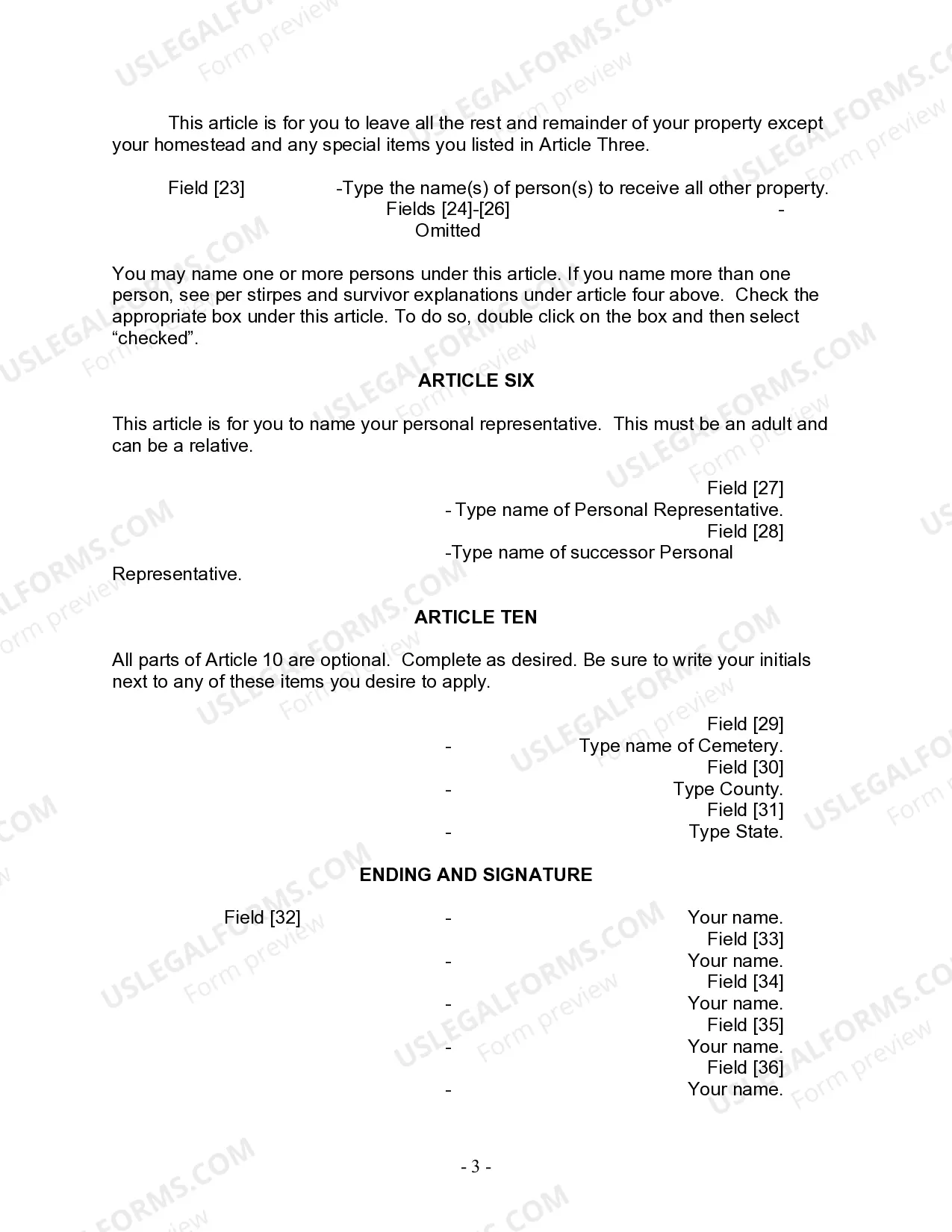

- Appointment of a personal representative to administer your estate.

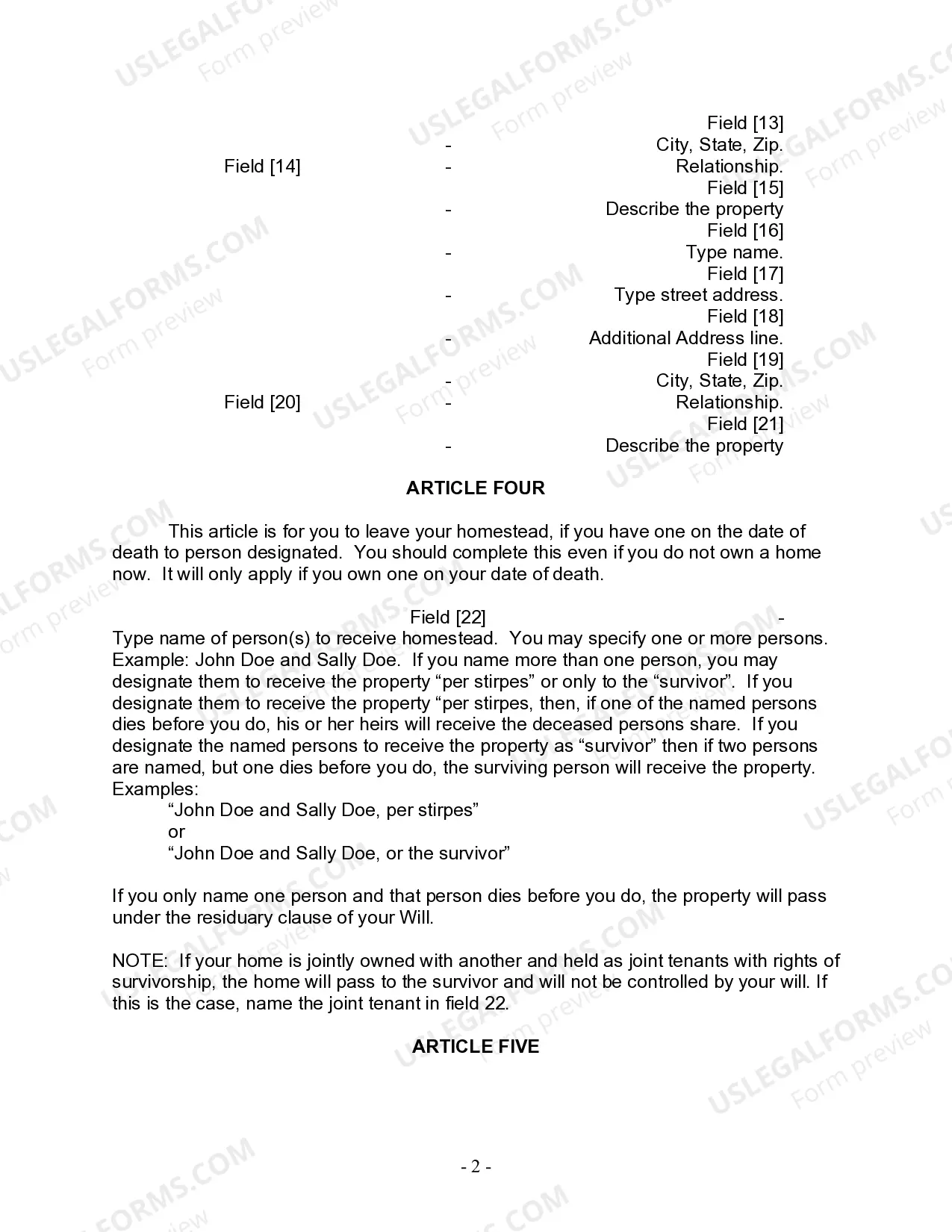

- Provisions for your homestead and residuary estate.

- Signature requirements for witnessing and notarization, if applicable.

Jurisdiction-specific notes

This form is structured to comply with the legal requirements of various U.S. states, including provisions for witness signatures and notarization where necessary. Always check local laws for any specific requirements that must be adhered to for valid execution.

When this form is needed

This form should be used if you are a single individual without children, looking to establish how your assets will be distributed after your death. It is essential for ensuring your intentions are legally documented, especially if you own property or possessions you wish to leave to specific individuals.

Who needs this form

This Last Will and Testament is suitable for:

- Single individuals with no dependent children.

- Those seeking to specify the distribution of their property.

- Individuals wanting to appoint an executor for their estate.

- Anyone who wishes to avoid intestate succession laws that apply when one dies without a will.

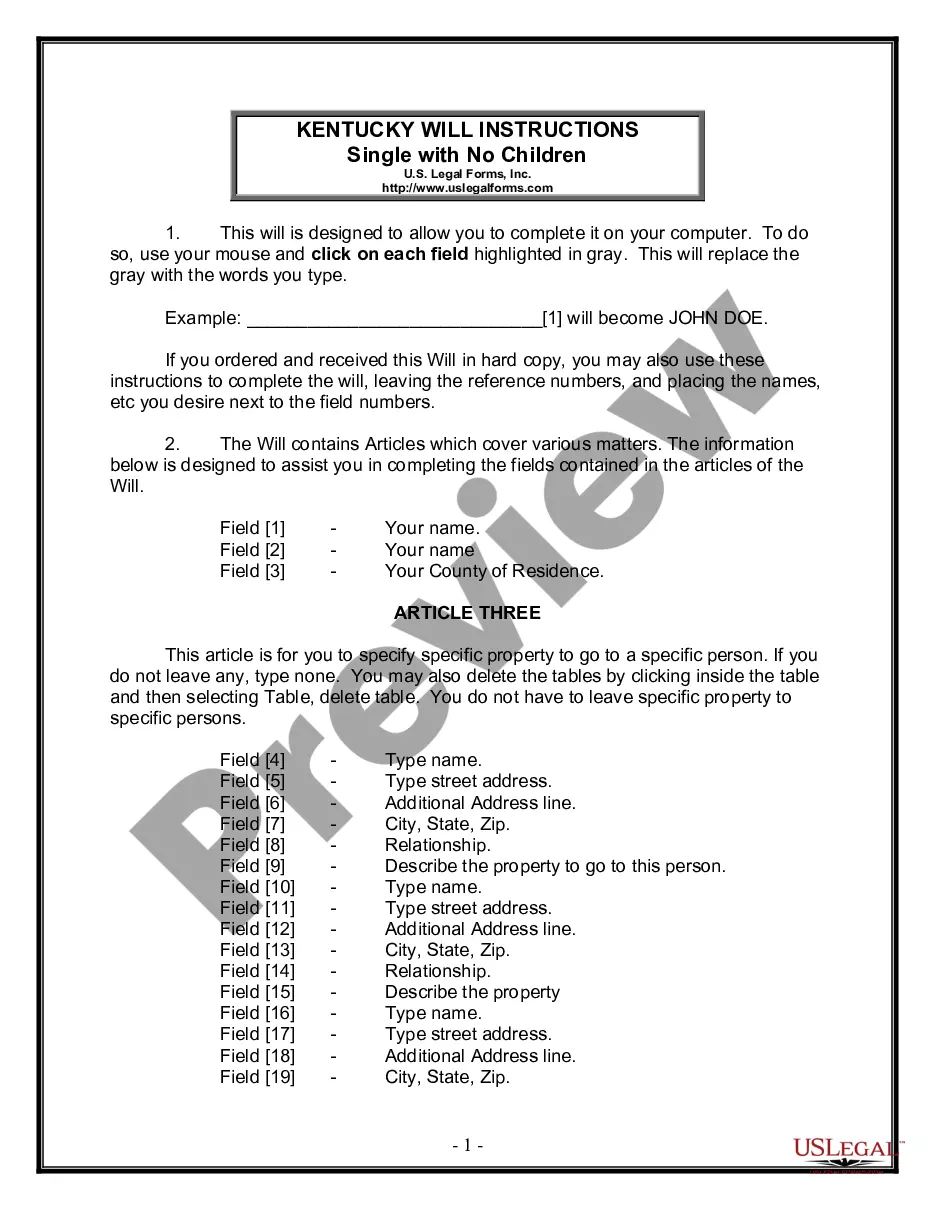

Steps to complete this form

- Open the document and fill in your name and county of residence in the designated fields.

- Identify specific property and beneficiaries in the appropriate articles of the will.

- Designate a personal representative to carry out the instructions in your will.

- Review the document for accuracy and ensure all fields are completed.

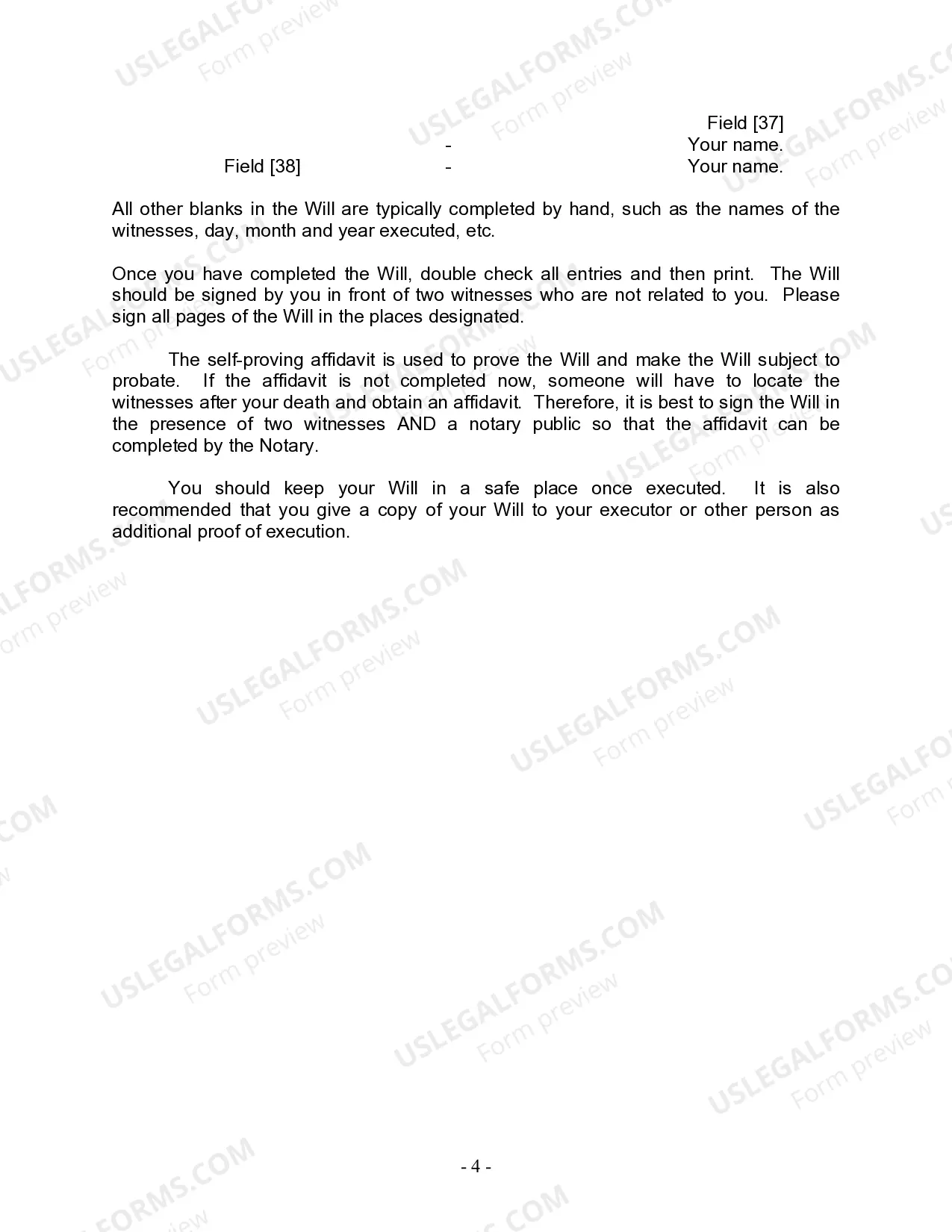

- Sign the will in front of two witnesses who are not beneficiaries, and, if necessary, obtain notarization.

Notarization guidance

Yes, this form must be notarized to be legally valid. Notarization adds a layer of verification, ensuring that you signed the document willingly and that it meets legal standards. US Legal Forms offers integrated online notarization services for your convenience, allowing for secure video calls without the need for travel.

Common mistakes to avoid

- Failing to have the will signed in the presence of the required number of witnesses.

- Not clearly specifying beneficiaries or property details.

- Overlooking the need for notarization if applicable in your state.

- Neglecting to update the will after significant life changes, such as moving or acquiring new assets.

Why complete this form online

- Easy to fill out electronically, ensuring no important sections are skipped.

- Edit and revise your will easily as your circumstances change.

- Cost-effective compared to hiring an attorney for document preparation.

- Accessible anytime, allowing you to create your will at your convenience.

Form popularity

FAQ

Property in a living trust. One of the ways to avoid probate is to set up a living trust. Retirement plan proceeds, including money from a pension, IRA, or 401(k) Stocks and bonds held in beneficiary. Proceeds from a payable-on-death bank account.

There is no difference between a testament and a will these days. A will traditionally included only instructions regarding real estate.It dealt with the disposition of land and structures on it that were owned by the testator.

A will can also be declared invalid if someone proves in court that it was procured by undue influence. This usually involves some evil-doer who occupies a position of trust -- for example, a caregiver or adult child -- manipulating a vulnerable person to leave all, or most, of his property to the manipulator instead

What Is a Last Will and Testament? A last will and testament, also known simply as a will, is a legal document that provides instructions for what should happen to a person's assets after his or her death.

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.

Include personal identifying information. Include a statement about your age and mental status. Designate an executor. Decide who will take care of your children. Choose your beneficiaries. List your funeral details. Sign and date your Last Will and Testament.

A last will and testament is a document that allows you to decide who will inherit your assets after you die. As the testator, you select who your heirs will be and what they each will receive. You also name an executor, who will be responsible for distributing your assets in accordance with your wishes.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.