Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

Selecting the optimal genuine document format can be a challenge. Of course, there are numerous templates available online, but how do you obtain the genuine template you need? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor, which can be used for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor. Use your account to view the legal forms you have previously purchased. Go to the My documents section of your account to get another copy of the document you need.

Choose the document format and download the legal document format to your device. Complete, modify, print, and sign the obtained Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor. US Legal Forms boasts the largest collection of legal forms where you can find various document templates. Utilize the service to obtain professionally-crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your state/region.

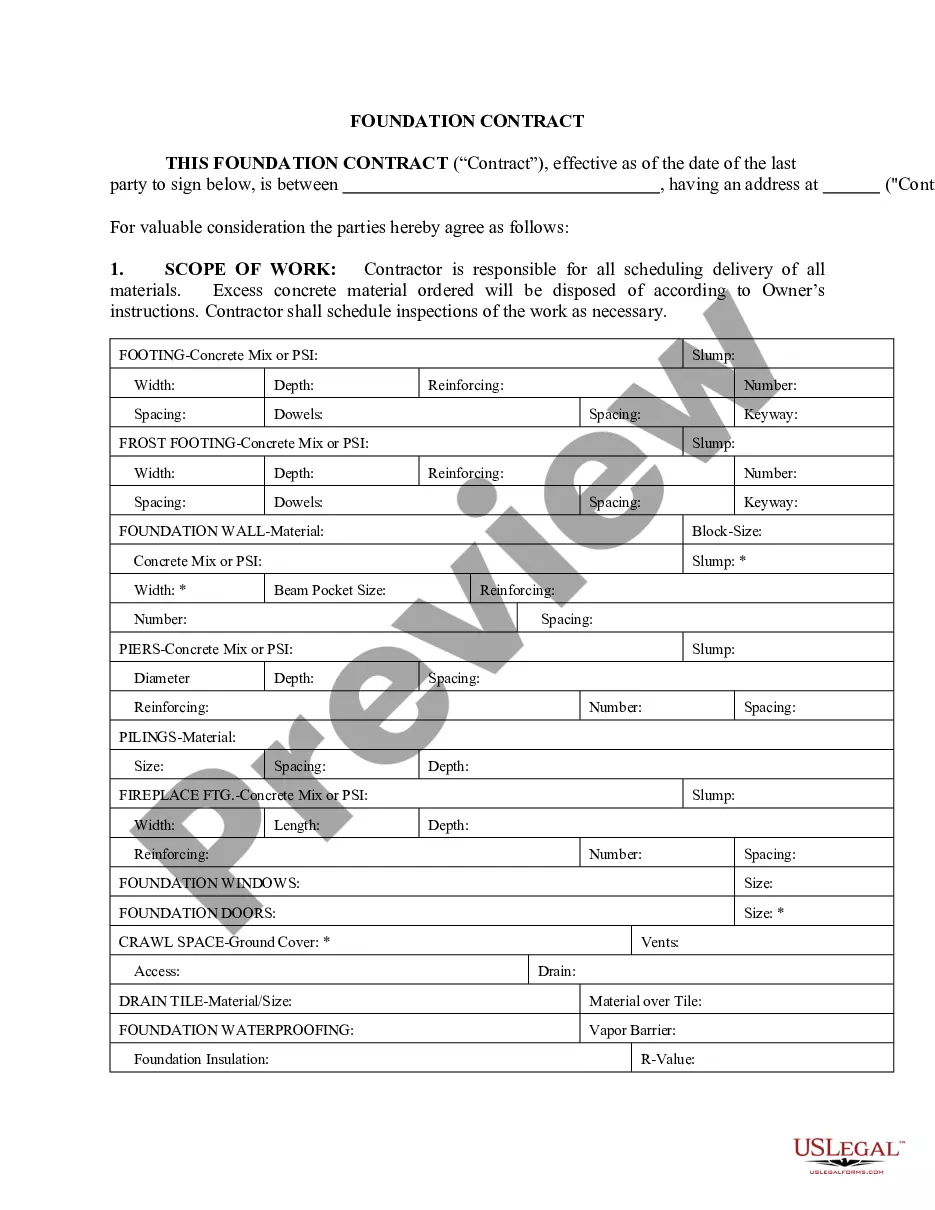

- You can review the form using the Preview button and read the form description to make sure it is the correct one for you.

- If the form does not meet your needs, use the Search area to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy now button to acquire the form.

- Select the pricing plan you require and enter the necessary information.

- Create your account and complete the order using your PayPal account or credit card.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. First, clearly define the scope of work, detailing the tasks you expect to be completed. Then, include terms regarding payment, deadlines, and confidentiality to ensure both parties understand their obligations. For a tailored solution, consider using the Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor template on the US Legal Forms platform, which simplifies the process and ensures compliance with local regulations.

Writing a Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor involves several key steps. Start by clearly defining the scope of work, including specific tasks and responsibilities. Additionally, outline payment terms, timelines, and confidentiality clauses to protect both parties. Finally, consider using a trusted platform like US Legal Forms to access customizable templates that can simplify the process.

An independent contractor typically files Form 1099-MISC to report income received from clients. This form ensures compliance with tax regulations and helps maintain accurate financial records. Utilizing resources such as uslegalforms can provide clarity on filing requirements for a Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement involves providing clear details about the project and payment terms. Ensure you include all relevant information, such as timelines and deliverables. Using templates from platforms like uslegalforms can simplify this process, particularly for a Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor.

Independent contractors must adhere to specific rules, including taxation responsibilities and bookkeeping practices. They are also required to meet deadlines and quality standards as outlined in their agreements. Following these guidelines ensures compliance, especially in a Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement includes essential elements like the project's scope, compensation, and duration. It may also detail confidentiality clauses and liability guidelines. Understanding these components is key to successfully navigating contracts like the Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor.

Breaking an independent contractor agreement can lead to legal consequences, like damages or loss of income. In some cases, the client may seek compensation for financial losses resulting from the breach. To safeguard yourself, familiarize yourself with the terms of your Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor and consult professionals if needed.

In Kentucky, an independent contractor agreement outlines the terms and conditions between a contractor and a client. This document specifies the scope of work, payment details, and deadlines. It is crucial for protecting both parties' interests, especially in the context of a Kentucky Electronics Assembly Agreement - Self-Employed Independent Contractor.