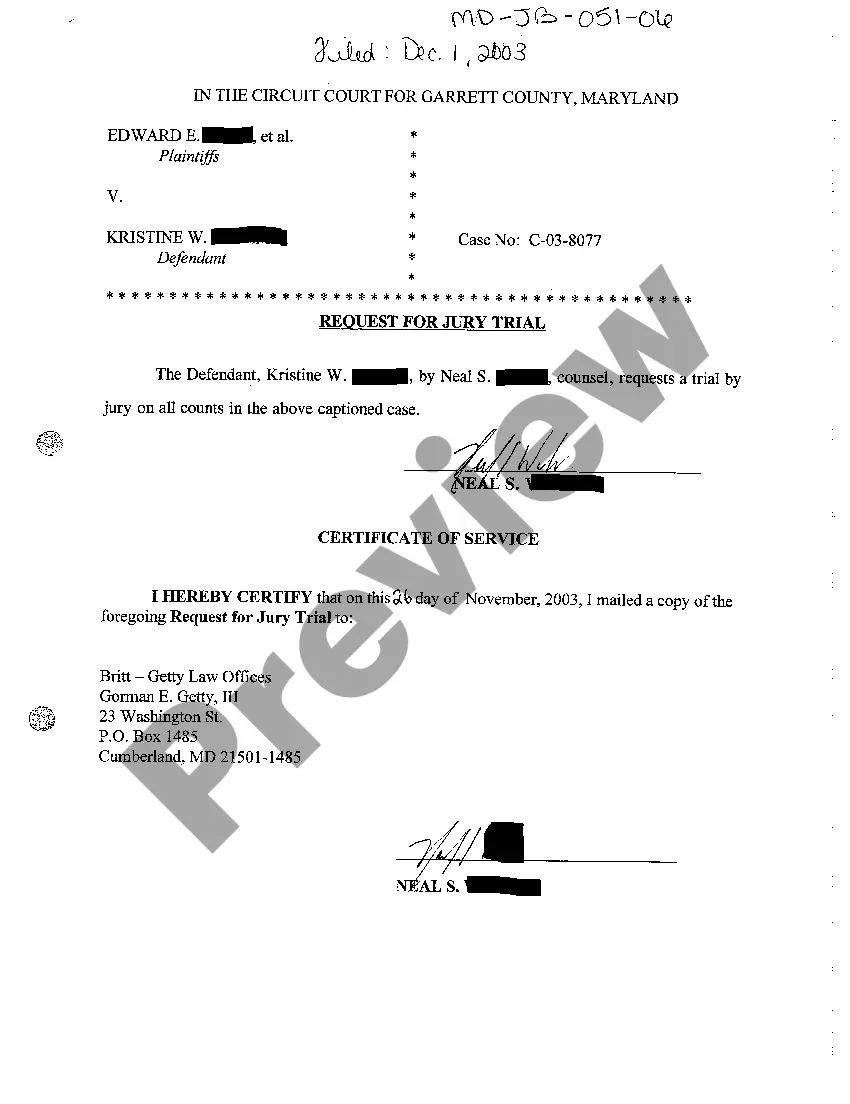

Kentucky Audio Systems Contractor Agreement - Self-Employed

Description

How to fill out Audio Systems Contractor Agreement - Self-Employed?

You may spend time online searching for the legal document template that meets the state and federal standards you require. US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or print the Kentucky Audio Systems Contractor Agreement - Self-Employed from our service. If you already have a US Legal Forms account, you may Log In and select the Download option. After that, you can complete, modify, print, or sign the Kentucky Audio Systems Contractor Agreement - Self-Employed. Each legal document template you purchase is yours to keep for years.

To obtain an additional copy of a purchased form, visit the My documents tab and click the appropriate option. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the region/city of your choice. Review the form outline to confirm you have chosen the right template. If available, utilize the Review option to examine the document template as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you wish to obtain another version of the form, use the Search field to find the template that suits your needs and specifications.

- Once you have located the template you desire, click Buy now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Select the format of the document and download it to your device.

- Make alterations to your document if necessary. You can complete, edit, sign, and print the Kentucky Audio Systems Contractor Agreement - Self-Employed.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

Form popularity

FAQ

Typically, either party can draft the independent contractor agreement, but it is often best to have a legal professional involved to ensure clarity and legality. By collaborating with legal experts, you can create a comprehensive Kentucky Audio Systems Contractor Agreement - Self-Employed that suits your needs. Many opt to use standardized templates available through platforms like US Legal Forms for efficiency and reliability.

Independent contractors must adhere to specific rules, such as managing their own taxes and maintaining a set schedule. They also should not be under direct control of a client, allowing for flexibility in how work is completed. Following the guidelines established in a Kentucky Audio Systems Contractor Agreement - Self-Employed can help avoid potential misunderstandings and ensure compliance with state regulations.

A basic independent contractor agreement includes fundamental aspects such as the scope of work, payment terms, and rights of both parties. It also commonly features confidentiality provisions and terms for termination. For those working in the audio systems industry, using a Kentucky Audio Systems Contractor Agreement - Self-Employed can provide a solid foundation for your agreements.

Breaking an independent contractor agreement can lead to legal consequences, including the possibility of financial loss due to claims for damages. The client may seek compensation for any losses incurred as a result of the breach. To avoid these situations, it is essential to fully understand the terms of your Kentucky Audio Systems Contractor Agreement - Self-Employed and adhere to them.

In Kentucky, an independent contractor agreement is a legal document outlining the relationship between a contractor and a client. This agreement specifies duties, compensation, and any obligations both parties must uphold. A well-drafted Kentucky Audio Systems Contractor Agreement - Self-Employed helps ensure clarity and legal protection for both sides.

To create an effective independent contractor agreement, begin by outlining the project scope, including specific tasks and timelines. Clearly define the payment terms, including rates and due dates. Additionally, include clauses for confidentiality, dispute resolution, and termination. Utilizing the Kentucky Audio Systems Contractor Agreement - Self-Employed template from US Legal Forms can simplify this process.

In Kentucky, the need for a contractor license depends on the type of work you are performing. While some projects may not require a license, many larger or specialized jobs, especially those involving audio systems, may need one. It's important to check local regulations to ensure compliance and to maintain professionalism. For more information on the Kentucky Audio Systems Contractor Agreement - Self-Employed and related licensing, consider exploring uslegalforms.

To write a Kentucky Audio Systems Contractor Agreement - Self-Employed, begin by outlining the scope of work required. Clearly define payment terms, deadlines, and any materials needed for the audio systems project. Don't forget to include liability clauses and terms for cancellation or dispute resolution. Using a platform like uslegalforms can simplify the process, ensuring you have a compliant and comprehensive agreement.

An independent contractor should fill out forms such as the Kentucky Audio Systems Contractor Agreement - Self-Employed and any relevant tax forms, like a W-9 for reporting income. It’s essential to track invoices and any additional paperwork tied to specific projects. These documents ensure clarity between you and your clients and protect your rights. You can find helpful resources and templates at uslegalforms to simplify this paperwork.

Filling out an independent contractor form requires you to provide essential details such as your name, address, and the specific services you will offer. Be sure to state the terms of payment clearly and outline the project deadlines. It's important to include your tax identification number for compliance. Uslegalforms provides easy-to-fill templates for the Kentucky Audio Systems Contractor Agreement - Self-Employed that can guide you in completing this process correctly.