Kentucky Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal template options that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Kentucky Design Agreement - Self-Employed Independent Contractor in moments.

If you already have a subscription, Log In and download the Kentucky Design Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your location/region. Click the Preview button to review the form’s content. Check the form description to confirm you have chosen the right form. If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you want and provide your credentials to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Kentucky Design Agreement - Self-Employed Independent Contractor. Every template you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Kentucky Design Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

Yes, independent contractors file as self-employed individuals. When you operate under a Kentucky Design Agreement - Self-Employed Independent Contractor, you report your income and expenses using Schedule C on your tax return. This means you are responsible for paying self-employment taxes, which cover Social Security and Medicare. Utilizing resources like US Legal Forms can help you navigate the specifics of your tax obligations and ensure compliance with Kentucky regulations.

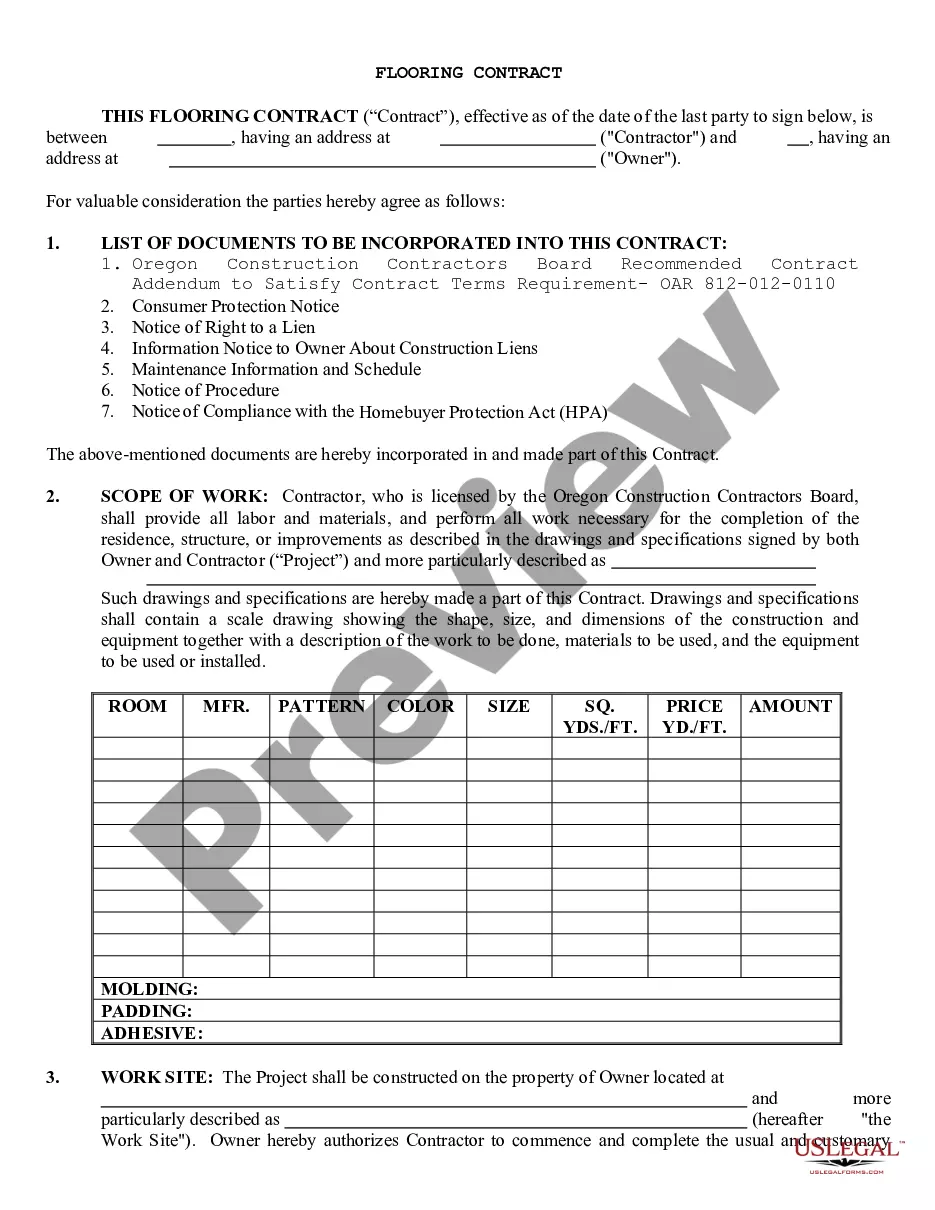

To fill out an independent contractor agreement, begin by entering personal details, like your name and address. Next, describe the services rendered, along with payment details and duration of the agreement. Make sure to review the terms before signing to ensure compliance. Platforms like uslegalforms offer convenient templates, tailored for Kentucky Design Agreement - Self-Employed Independent Contractor.

Writing a freelance design contract requires you to define the project scope, deliverables, and timelines. Include payment terms, such as rates and invoicing schedules, to avoid misunderstandings. It’s also essential to address ownership rights for the work produced. Using a Kentucky Design Agreement - Self-Employed Independent Contractor template can help craft a comprehensive contract securely.

To fill out a declaration of independent contractor status form, you should provide your name, business address, and the nature of your work. Clearly state that you operate as an independent contractor and not an employee. Include any relevant business licenses or registration numbers if applicable. For a reliable template, check uslegalforms’ Kentucky Design Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form involves entering your personal information, including your name, address, and Social Security number. You will also need to describe the services you provide and the expected payment. Make sure to sign and date the form to make it official. Consider using platforms like uslegalforms for user-friendly templates that ensure accuracy.

To write an independent contractor agreement, start by clearly identifying the parties involved, including their names and addresses. Next, outline the scope of work, payment terms, and deadlines. Lastly, include confidentiality clauses and terms for termination. Utilizing the Kentucky Design Agreement - Self-Employed Independent Contractor template can streamline this process.

To provide proof of employment as an independent contractor, keep all correspondence, invoices, and the signed independent contractor agreement. These documents serve as evidence of your work relationship with clients. Additionally, you can request a letter of reference from your clients that details your roles and responsibilities. This proof will be vital for future job opportunities where verification of your status as a self-employed independent contractor is required.

To create an independent contractor agreement, start by identifying the key components you'll need to include, such as project description, payment, and deadlines. You can either draft the agreement from scratch or use a reliable template from platforms like US Legal Forms. It's crucial to tailor the document to your unique situation. A Kentucky Design Agreement - Self-Employed Independent Contractor template can guide you through the necessary elements.

Typically, the client or hiring party drafts the independent contractor agreement. However, both parties should review and finalize the document to ensure it meets their specific needs. Some may opt to use templates or services like US Legal Forms to streamline the drafting process. Using a Kentucky Design Agreement - Self-Employed Independent Contractor template can save time while ensuring compliance with local laws.

The independent contractor agreement in Kentucky outlines the working relationship between a client and a self-employed independent contractor. This legal document defines the scope of work, payment terms, and responsibilities. It is essential for protecting both parties' interests and ensuring clear communication. A well-drafted Kentucky Design Agreement - Self-Employed Independent Contractor can help avoid misunderstandings down the line.