Kentucky Grant Agreement from 501(c)(3) to 501(c)(4)

Description

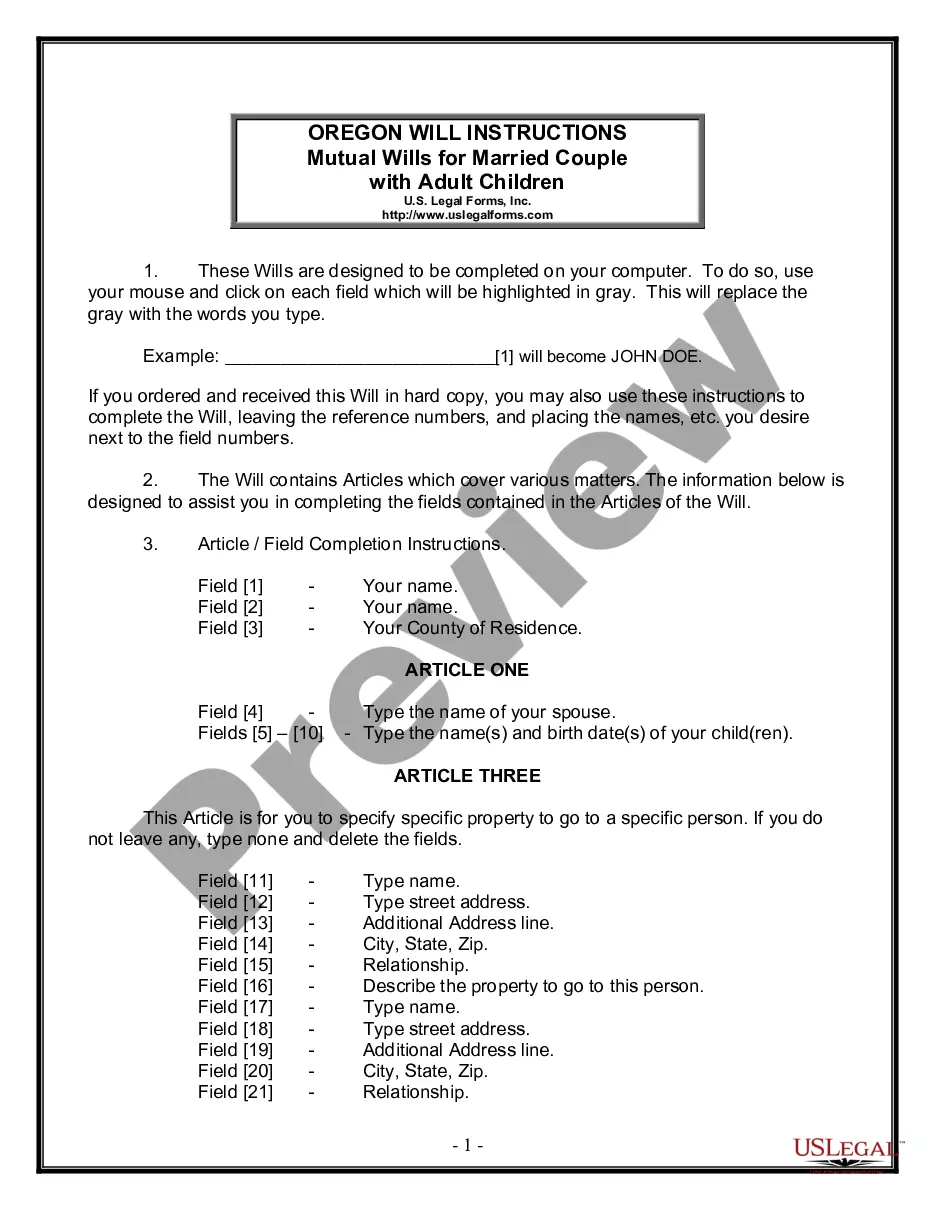

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

US Legal Forms - one of several greatest libraries of authorized forms in the States - gives a wide range of authorized record layouts you may down load or print. Using the website, you will get a huge number of forms for enterprise and person functions, sorted by groups, says, or keywords.You will find the most up-to-date versions of forms much like the Kentucky Grant Agreement from 501(c)(3) to 501(c)(4) in seconds.

If you already have a registration, log in and down load Kentucky Grant Agreement from 501(c)(3) to 501(c)(4) in the US Legal Forms library. The Obtain option can look on every develop you view. You have access to all formerly saved forms from the My Forms tab of your respective accounts.

If you would like use US Legal Forms for the first time, here are simple recommendations to help you began:

- Make sure you have selected the right develop for the town/area. Select the Preview option to analyze the form`s articles. Browse the develop information to ensure that you have chosen the appropriate develop.

- If the develop does not fit your requirements, use the Lookup field on top of the screen to obtain the one that does.

- When you are pleased with the shape, validate your choice by clicking the Purchase now option. Then, pick the rates strategy you prefer and offer your references to sign up on an accounts.

- Process the transaction. Utilize your credit card or PayPal accounts to perform the transaction.

- Pick the format and down load the shape on your product.

- Make alterations. Complete, edit and print and indication the saved Kentucky Grant Agreement from 501(c)(3) to 501(c)(4).

Each web template you added to your account does not have an expiration particular date and is also your own forever. So, if you wish to down load or print yet another backup, just check out the My Forms area and click on on the develop you want.

Obtain access to the Kentucky Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms, by far the most substantial library of authorized record layouts. Use a huge number of expert and express-certain layouts that meet your business or person requirements and requirements.

Form popularity

FAQ

Grants are awards of financial assistance, usually from a governmental agency or foundation, primarily for carrying out a public purpose of support or stimulation. A grant is distinguished from a contract, which is used to acquire property or services for the government's direct benefit or use. Grant and Contract - Division of Financial Services - Cornell University cornell.edu ? topics ? revenueclass ? grant... cornell.edu ? topics ? revenueclass ? grant...

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy. Grant Agreements: What to Include and What to Look Out For | Insights venable.com ? insights ? events ? 2023/01 venable.com ? insights ? events ? 2023/01

If the purpose is to acquire property or services for the direct benefit or use of the federal government, the agency is to use a procurement contract; if the purpose is to stimulate or support an activity that serves a public purpose, the agency is to use a grant or cooperative agreement. Henke v. U.S. Department of Commerce, 83 F.3d 1445 - Casetext casetext.com ? case ? henke-v-us-department-of-c... casetext.com ? case ? henke-v-us-department-of-c...

If you plan to write a grant proposal, you should familiarize yourself with the following parts: Introduction/Abstract/Executive Summary. ... Organizational Background. ... Problem Statement/Needs Assessment. ... Program Goals and Objectives. ... Methods and Activities. ... Evaluation Plan. ... Budget/Sustainability. Nonprofit Grant Writing: How to Secure Grants for Your Cause grantsplus.com ? nonprofit-grant-writing grantsplus.com ? nonprofit-grant-writing

The grant agreement defines what activities will be undertaken, the project duration, overall budget, rates and costs, the EU budget's contribution, all rights and obligations and more. Managing your project under a grant agreement European Commission ? funding-tenders ? man... European Commission ? funding-tenders ? man...

The government uses grants and cooperative agreements as a means of assisting researchers in developing research for the public good, whereas it uses contracts as a means of procuring a service for the benefit of the government. Grants are much more flexible than contracts. What is the difference between a Federal Grant and a Federal ... pitt.edu ? news ? what-difference-betwe... pitt.edu ? news ? what-difference-betwe...

In addition to 501c3 organizations, 501c3 nonprofits can also donate to 501c4 organizations. These contributions must be used for charitable purposes, and no amount can be used for political activities. 501c3 Donation Rules | Know All Requirements and Best Practices donorbox.org ? nonprofit-blog ? 501c3-donation... donorbox.org ? nonprofit-blog ? 501c3-donation...

Grants from a 501(c)(3) to a 501(c)(4) should not be made to cover fundraising costs or general support of the 501(c)(4) (this is to protect the 501(c)(3) from the grant being used for impermissible purposes). The Practical Implications of Affiliated 501(c)(3)s and 501(c)(4)s bolderadvocacy.org ? uploads ? 2012/05 ? The_P... bolderadvocacy.org ? uploads ? 2012/05 ? The_P...