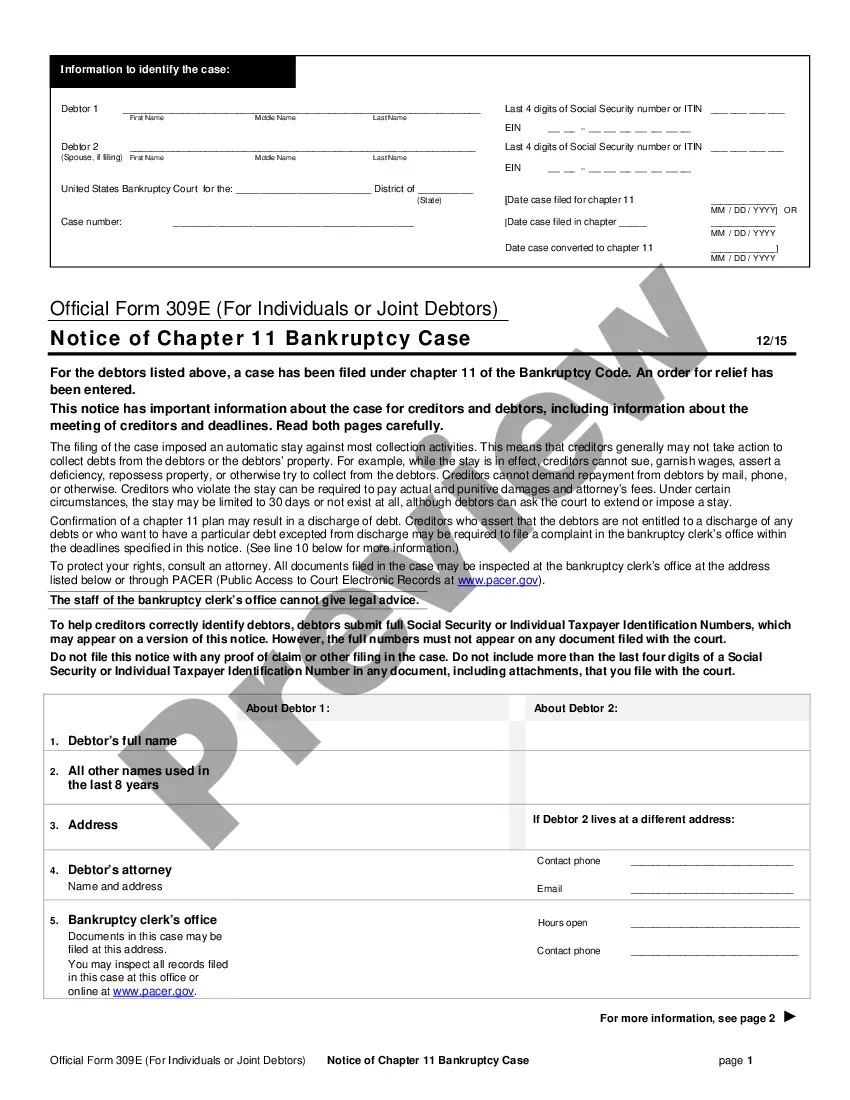

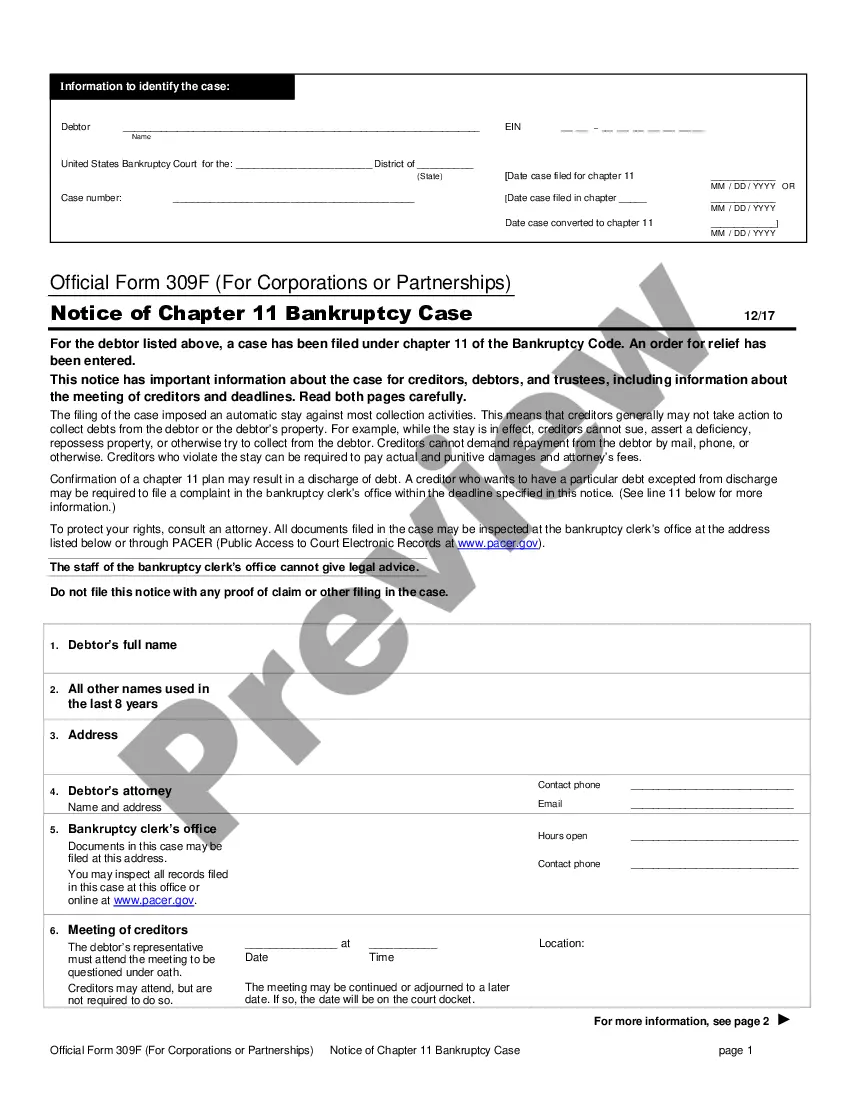

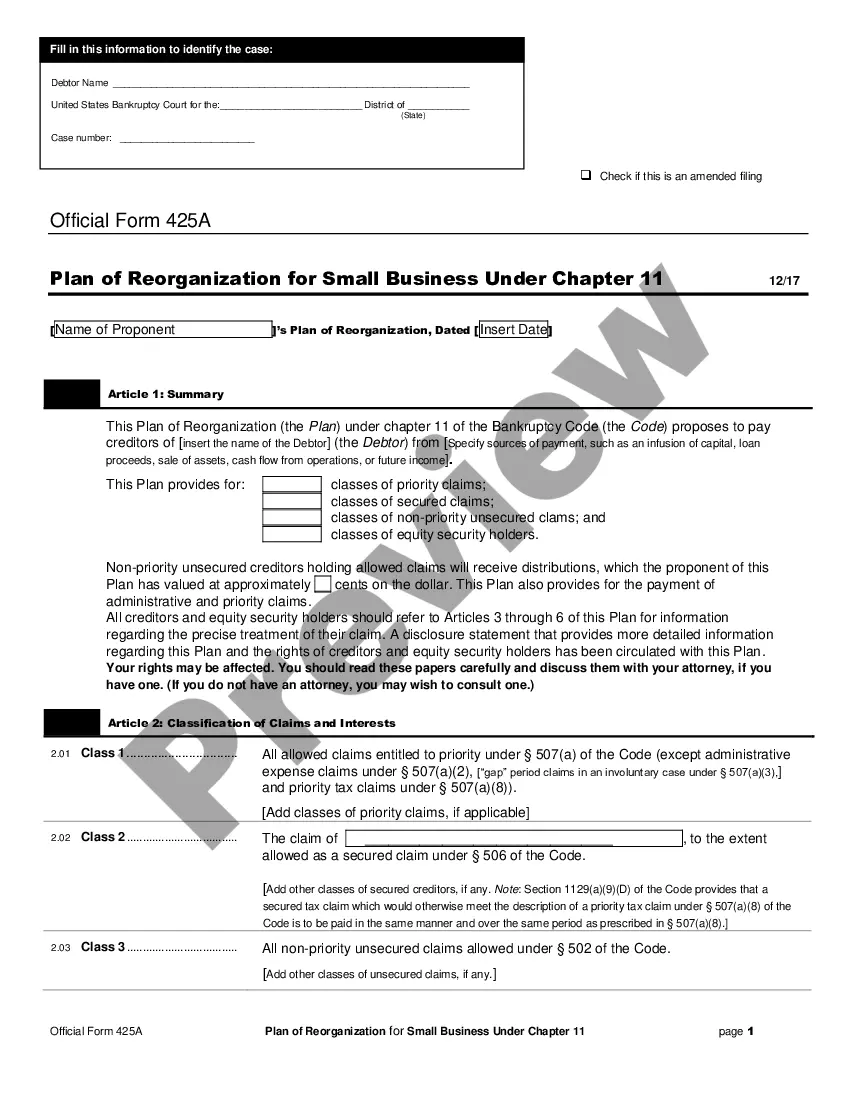

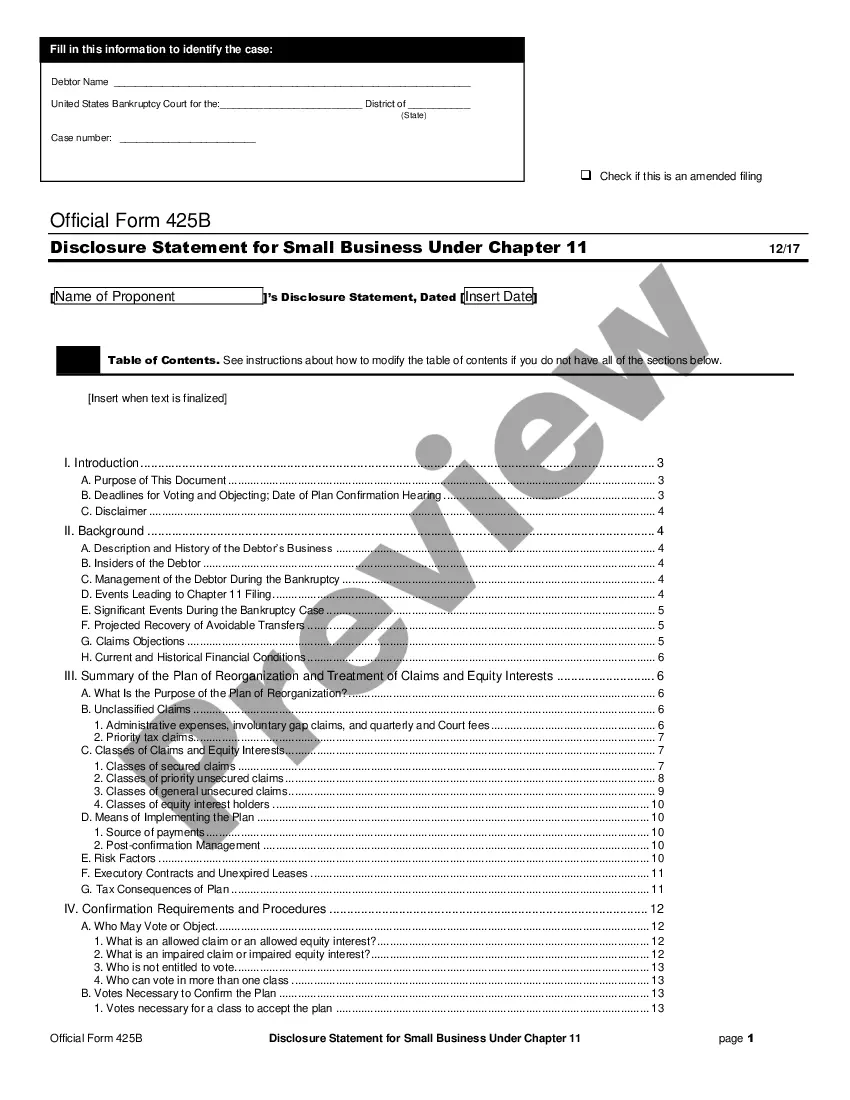

The Kentucky Disclosure Statement for Small Business Under Chapter 11 is a document required by the United States Bankruptcy Code for small businesses filing for bankruptcy under Chapter 11. This document must be provided to the court and creditors along with the proposed plan of reorganization. It is designed to provide creditors and the court with a full understanding of the debtor’s financial situation. The Kentucky Disclosure Statement must include information about the debtor’s business, assets, liabilities, projected income, expenses, and any other relevant financial information. It must also include a description of the debtor’s proposed plan of reorganization, including the proposed use of funds, the proposed repayment plan, the estimated length of time for repayment, and the expected impact on creditors and other parties. There are two types of Kentucky Disclosure Statements that a small business filing for Chapter 11 may need to provide: the Small Business Reorganization Act (SARA) Disclosure Statement and the Traditional Chapter 11 Disclosure Statement. The SARA Disclosure Statement is for debtors who qualify for the SARA and must include additional information about the debtor’s ability to pay creditors, the estimated timeline for repayment, and the expected impact on creditors and other parties. The Traditional Chapter 11 Disclosure Statement is for debtors who do not qualify for the SARA and must provide the same information as the SARA Disclosure Statement, but without the additional information about the SARA.

Kentucky Disclosure Statement for Small Business Under Chapter 11

Description

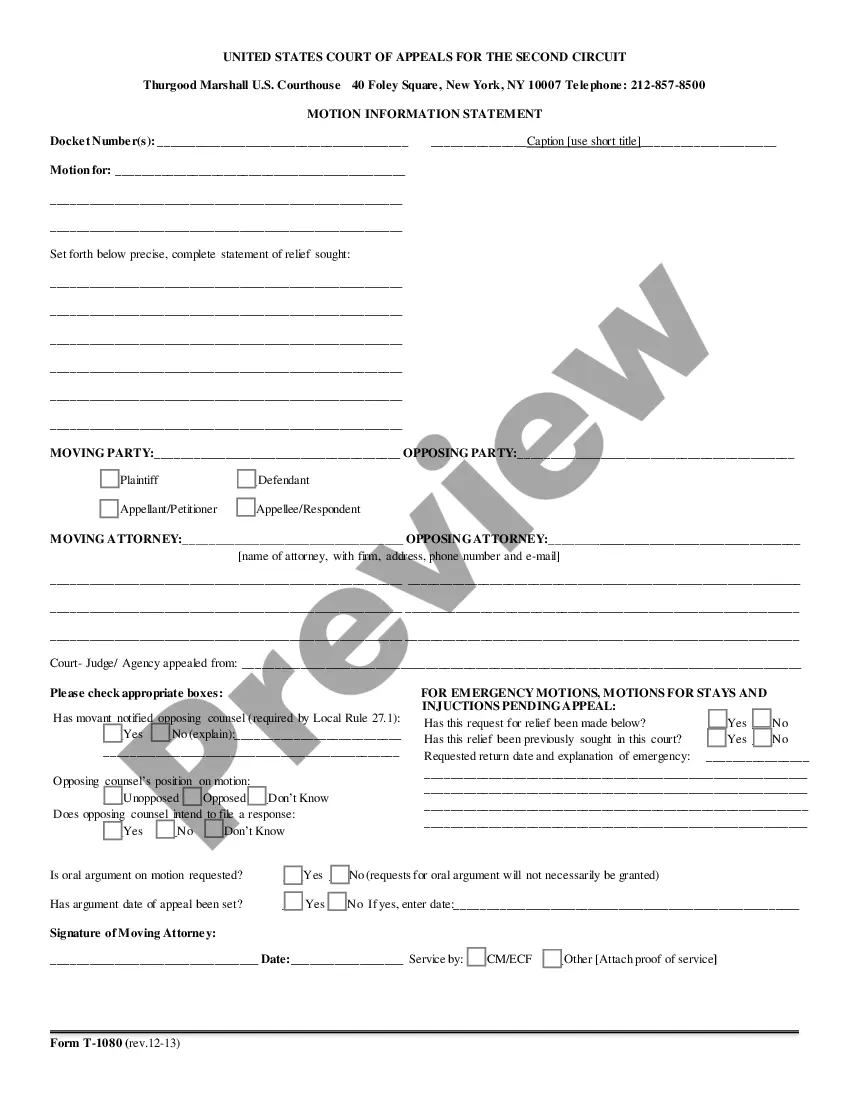

How to fill out Kentucky Disclosure Statement For Small Business Under Chapter 11?

Drafting legal documents can be quite overwhelming if you lack accessible fillable templates. With the US Legal Forms online collection of formal paperwork, you can be assured of the accuracy of the forms you discover, as all of them adhere to federal and state regulations and are reviewed by our professionals.

Thus, if you need to complete the Kentucky Disclosure Statement for Small Business Under Chapter 11, our service is the ideal location to download it.

Here’s a quick guide for you: Document compliance verification. You should carefully review the content of the document you wish to ensure that it meets your requirements and adheres to your state laws. Previewing your document and reviewing its general description will assist you in achieving this.

- Acquiring your Kentucky Disclosure Statement for Small Business Under Chapter 11 through our service is as straightforward as ABC.

- Existing users with an active subscription simply need to Log In and click the Download button after they find the appropriate template.

- Later, if needed, they can select the same blank from the My documents tab in their profile.

- However, even if you are a newcomer to our service, signing up with a valid subscription will only take a few moments.

Form popularity

FAQ

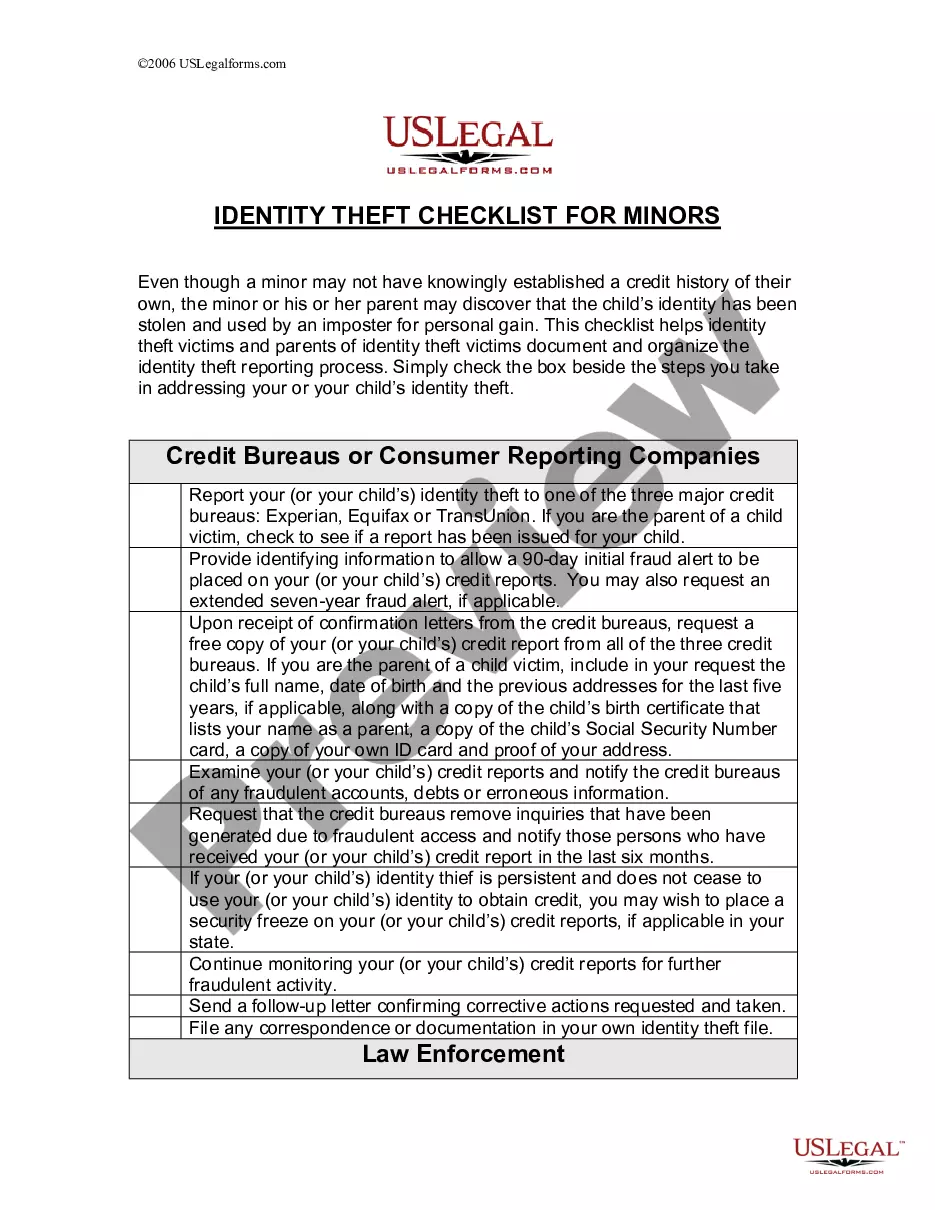

What Is a Proof of Claim? A proof of claim is an essential element in the bankruptcy process. It documents your right as a creditor to repayment from the debtor. A debtor's chapter 11 bankruptcy filing may significantly impact a creditor and can jeopardize its ability to handle its own financial responsibilities.

A Disclosure Statement is a written description of a contractor's cost accounting practices and procedures.

The purpose of a disclosure statement is to provide explanatory information regarding the significant features of the insurance policy to enable the insured to make an informed decision regarding purchasing the insurance policy.

The disclosure statement is a document that must contain information concerning the assets, liabilities, and business affairs of the debtor sufficient to enable a creditor to make an informed judgment about the debtor's plan of reorganization.

Disclosure statements provide you with the facts you need to make an informed decision. By reading through them and making sure to understand them, you'll better protect yourself from making a bad decision.