Kentucky Notice of Judgment Lien on Real Estate

Description

Definition and meaning

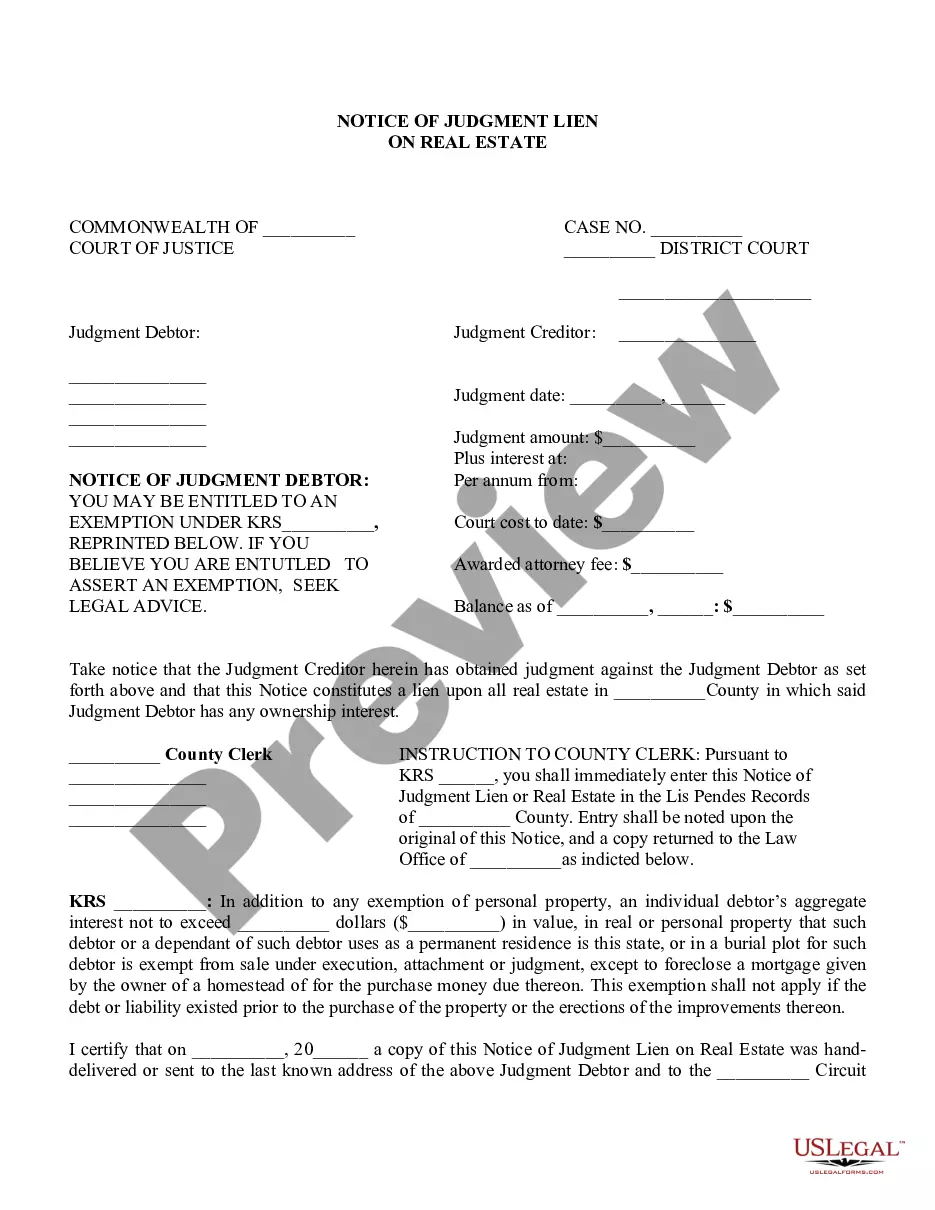

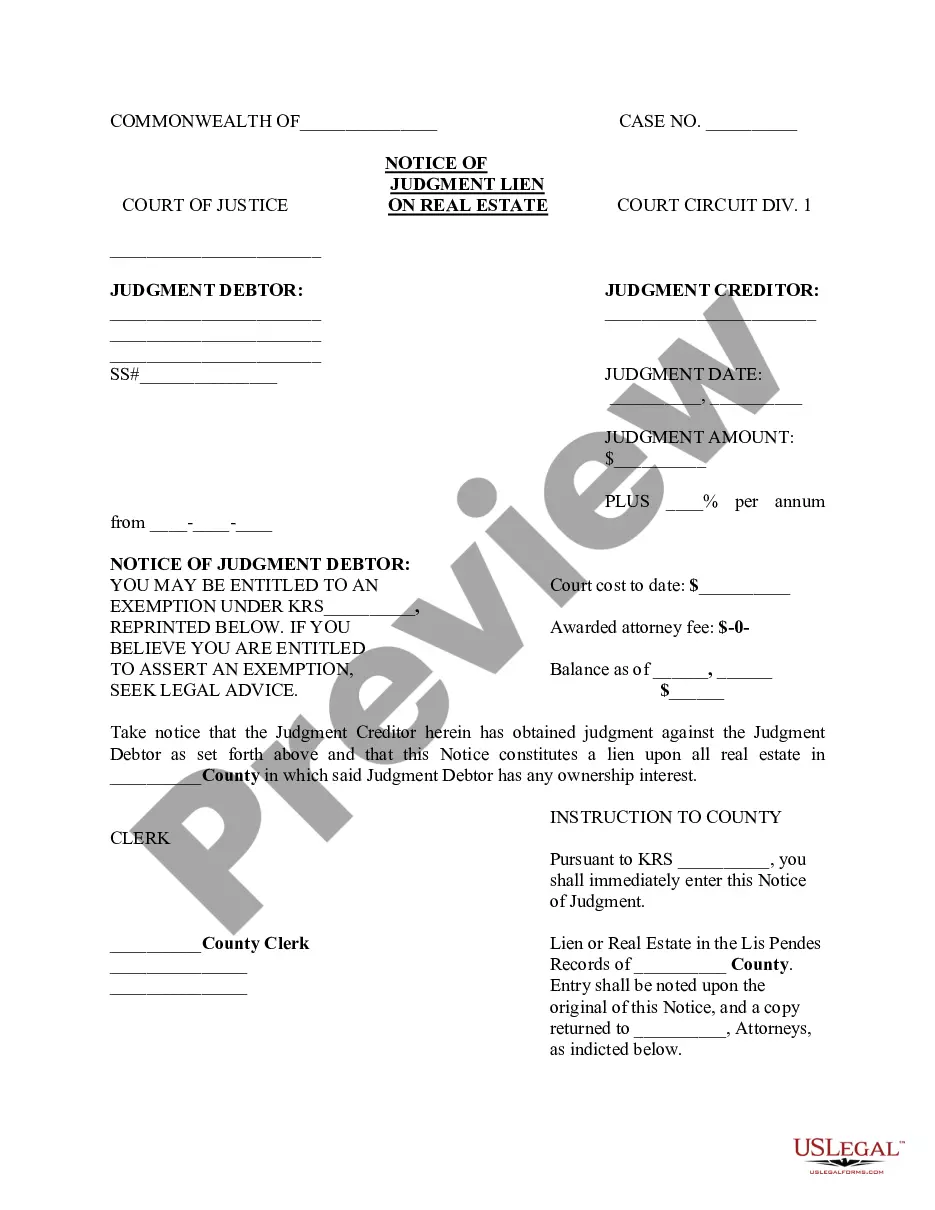

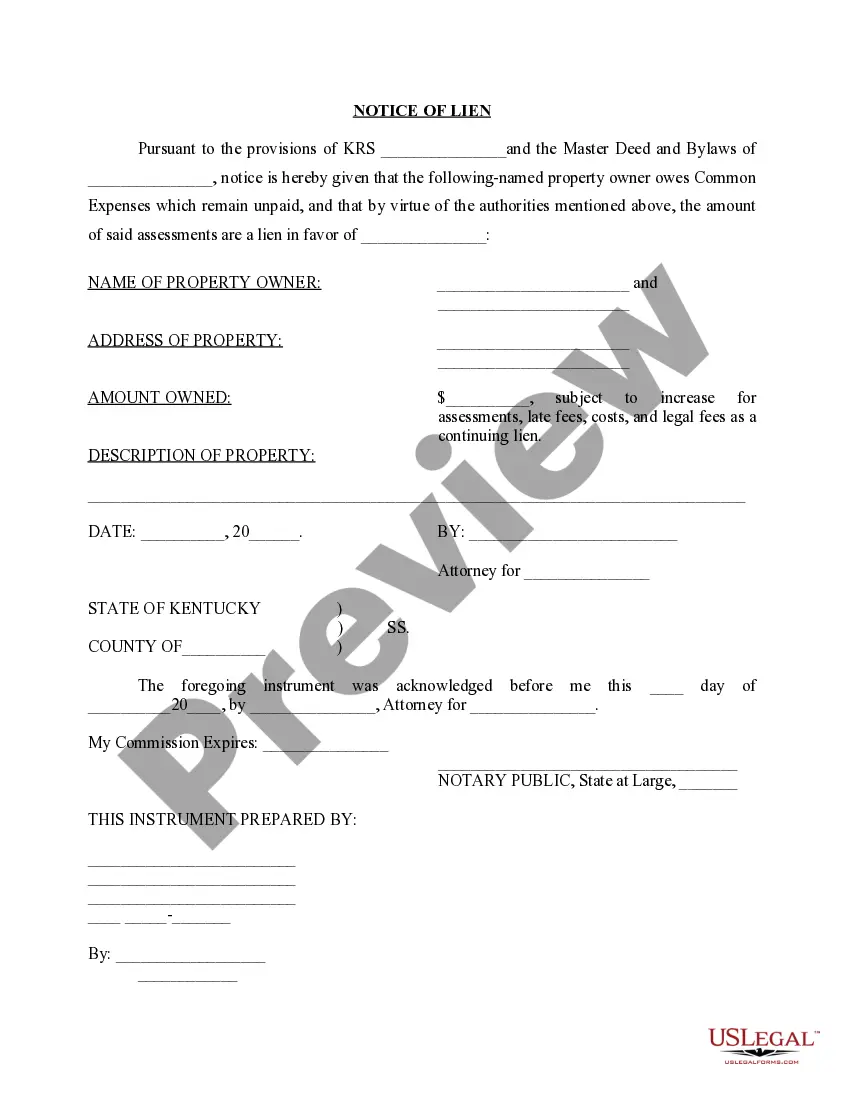

The Kentucky Notice of Judgment Lien on Real Estate is a legal document that serves as a public record of a judgment obtained by a creditor against a debtor. This notice establishes a lien on any real estate owned by the debtor within Kentucky, securing the creditor's interest in the property until the judgment is satisfied. It is essential for creditors to file this notice to protect their rights to collect the debt through the debtor's property.

How to complete a form

To properly complete the Kentucky Notice of Judgment Lien on Real Estate form, follow these steps:

- Enter the name of the court and case number at the top of the form.

- Provide the names and addresses of both the Judgment Debtor and Judgment Creditor.

- Specify the judgment date and the total judgment amount including any interest.

- List the court costs and any awarded attorney fees.

- Sign and date the form, indicating that you have prepared it.

Ensure all information is accurate to prevent delays or legal issues.

Who should use this form

This form should be used by creditors seeking to enforce a judgment against a debtor through real estate. It is especially relevant for individuals or businesses that have obtained a court judgment for unpaid debts or other financial obligations. Debtors also may need to understand this form if they are facing the risk of a lien being placed on their property.

Key components of the form

The Kentucky Notice of Judgment Lien on Real Estate includes several critical elements:

- Case Information: Court name, case number, and judgment date.

- Parties Involved: Names and addresses of the Judgment Debtor and Judgment Creditor.

- Financial Details: Total judgment amount, interest rate, court costs, and attorney fees.

- Exemption Information: Reference to applicable exemptions under Kentucky Revised Statutes (KRS).

- Filing Instructions: Instructions for the County Clerk regarding the entry of the lien in the public records.

Each component is vital to ensure the legality and enforceability of the lien.

State-specific requirements

The issuance of a Kentucky Notice of Judgment Lien on Real Estate must adhere to specific state laws. Under Kentucky law, creditors must file this notice with the County Clerk where the real estate is located. The form must be filed within a certain timeframe after the judgment has been awarded to maintain its effectiveness. Additionally, creditors should ensure compliance with KRS provisions regarding exemptions to protect any potential interests of the debtor.

Common mistakes to avoid when using this form

When completing the Kentucky Notice of Judgment Lien on Real Estate, avoid the following common errors:

- Failing to provide accurate case data or party information.

- Not including the correct judgment amount and applicable interest.

- Neglecting to file the notice with the appropriate county office.

- Overlooking applicable exemptions that the debtor may claim.

- Filing the form past the legal timeframe imposed by Kentucky statutes.

Taking care to avoid these mistakes can save time and prevent legal complications.

How to fill out Kentucky Notice Of Judgment Lien On Real Estate?

Utilize US Legal Forms to acquire a downloadable Kentucky Notice of Judgment Lien on Real Estate. Our court-acceptable forms are created and frequently refreshed by proficient attorneys. We offer the most extensive collection of Forms available online, providing affordable and precise examples for consumers, legal experts, and small to medium businesses (SMBs). The templates are categorized by state, and several can be viewed before downloading.

To access templates, users must possess a subscription and Log In to their account. Simply click Download next to any template you wish and locate it in My documents.

For individuals without a subscription, follow the guidelines below to effortlessly locate and download the Kentucky Notice of Judgment Lien on Real Estate.

US Legal Forms offers thousands of legal and tax documents and packages for both business and personal requirements, including the Kentucky Notice of Judgment Lien on Real Estate. Over three million users have successfully utilized our services. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- Ensure you have the correct template pertaining to the applicable state.

- Examine the form by reviewing the description and utilizing the Preview function.

- Select Buy Now if it is the document you desire.

- Create your account and complete payment via PayPal or credit card.

- Download the template to your device and feel free to use it repeatedly.

- Use the Search bar if you wish to find another document template.

Form popularity

FAQ

Yes, a Kentucky Notice of Judgment Lien on Real Estate can be placed on jointly owned property. If one owner owes a debt resulting in a judgment, the lien can attach to their share of the property. However, it is important to understand that the lien affects the property itself, not the individual owners. Always consult a legal expert to navigate the nuances of such situations.

In Kentucky, several types of personal property may be seized under a judgment, such as bank accounts, vehicles, and valuable assets. However, certain exemptions apply, meaning not all assets are subject to seizure. Understanding the Kentucky Notice of Judgment Lien on Real Estate can help you identify which assets may be at risk. For comprehensive information, visit US Legal Forms to find resources tailored to your situation.

A judgment lien in Kentucky is a legal claim against a person's property due to an unresolved debt or judgment. This lien allows the creditor to secure payment from the proceeds of the property upon its sale. Understanding the intricacies of the Kentucky Notice of Judgment Lien on Real Estate will help you navigate your rights and obligations. US Legal Forms offers resources to help you better understand judgment liens and their implications.