Company Credit Card Denial for Unfavorable Report is when a financial institution denies a business or company a credit card due to an unfavorable credit report. This usually occurs when a company has an unfavorable credit score or a history of late payments or delinquencies. The credit report is used to determine the creditworthiness of a business or company and can include a review of payment history, debt, and other financial information. There are two types of Company Credit Card Denial for Unfavorable Report: Soft Denial and Hard Denial. A soft denial occurs when a financial institution denies a credit card but can still offer a lower credit limit or a higher interest rate. A hard denial is a more severe form of credit card denial and occurs when a financial institution denies a credit card completely.

Company Credit Card Denial for Unfavorable Report

Description

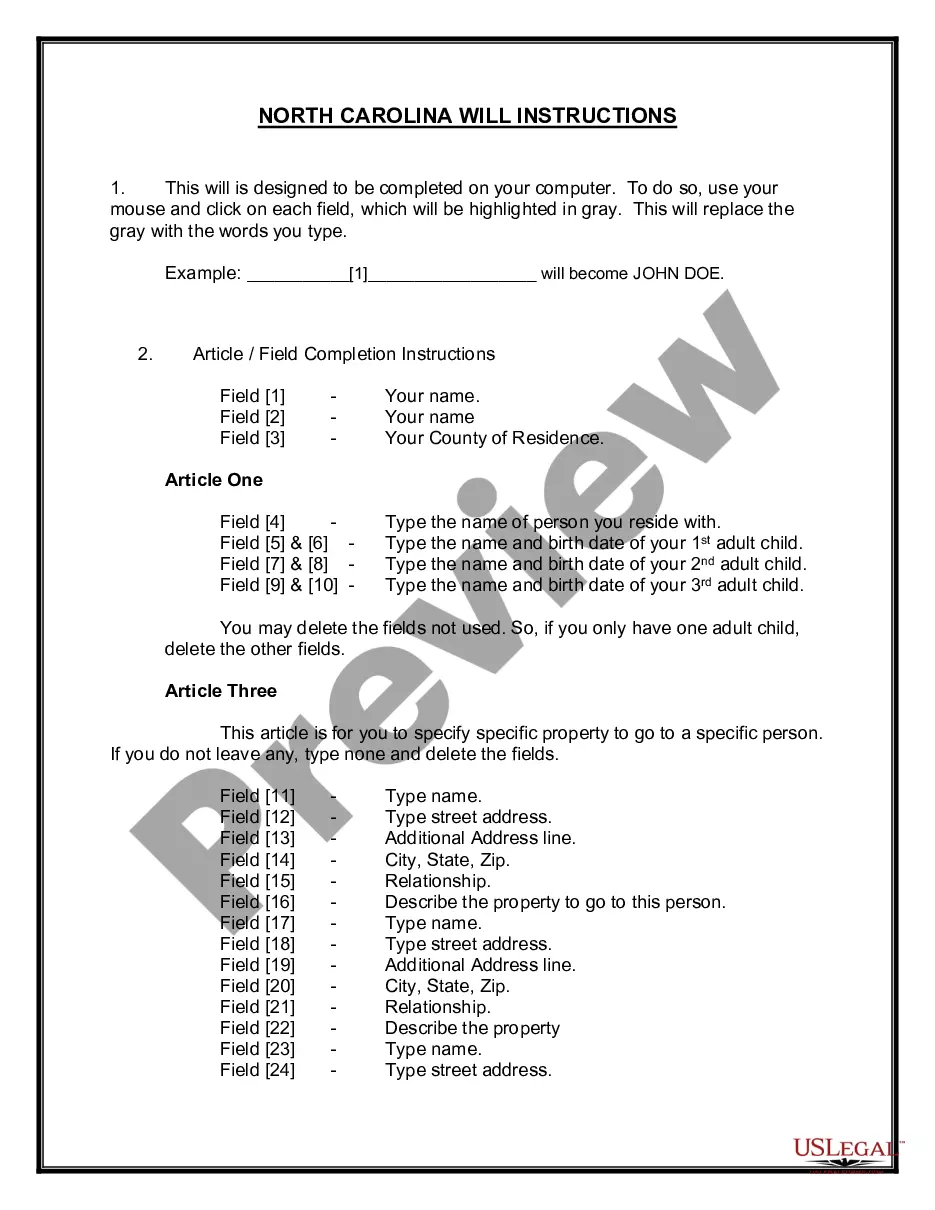

How to fill out Company Credit Card Denial For Unfavorable Report?

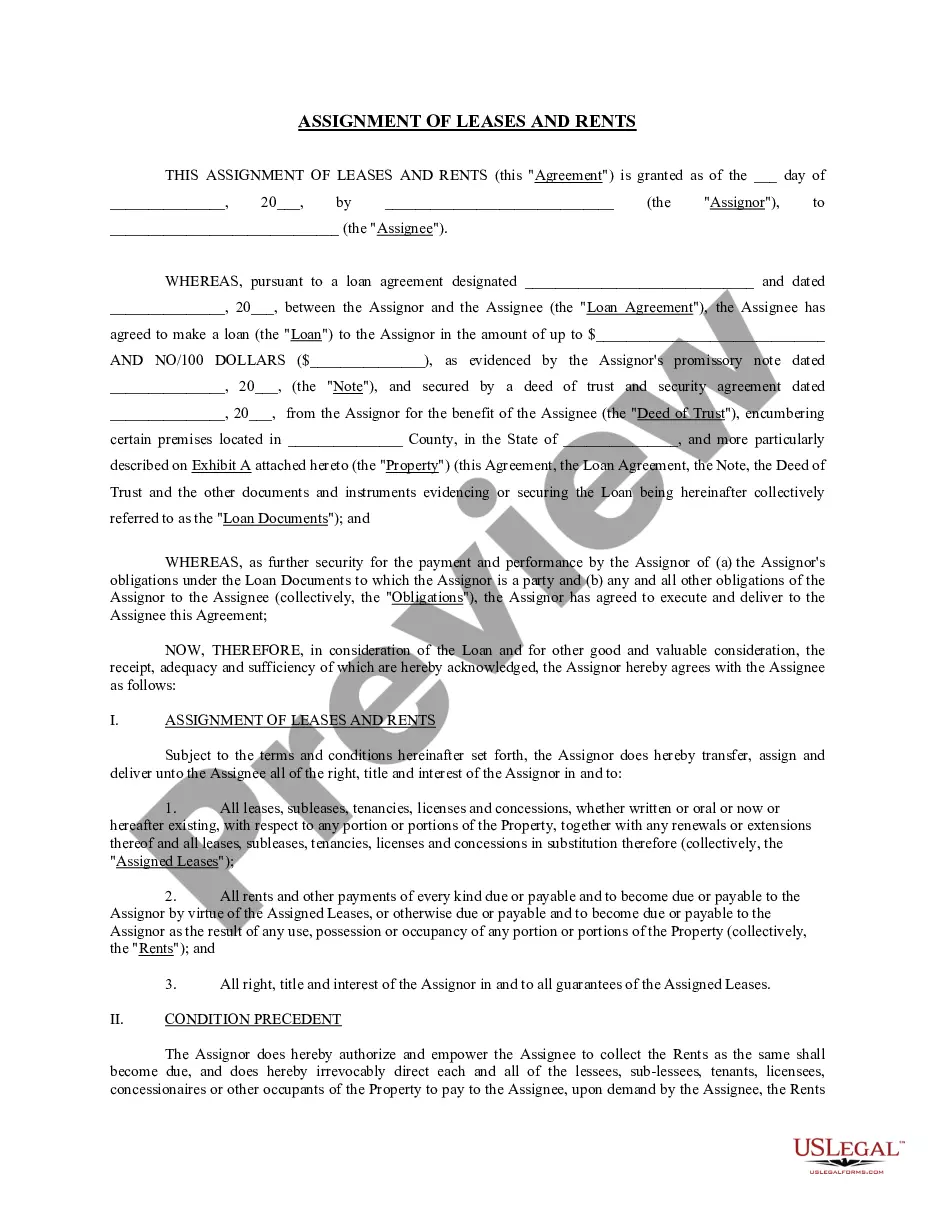

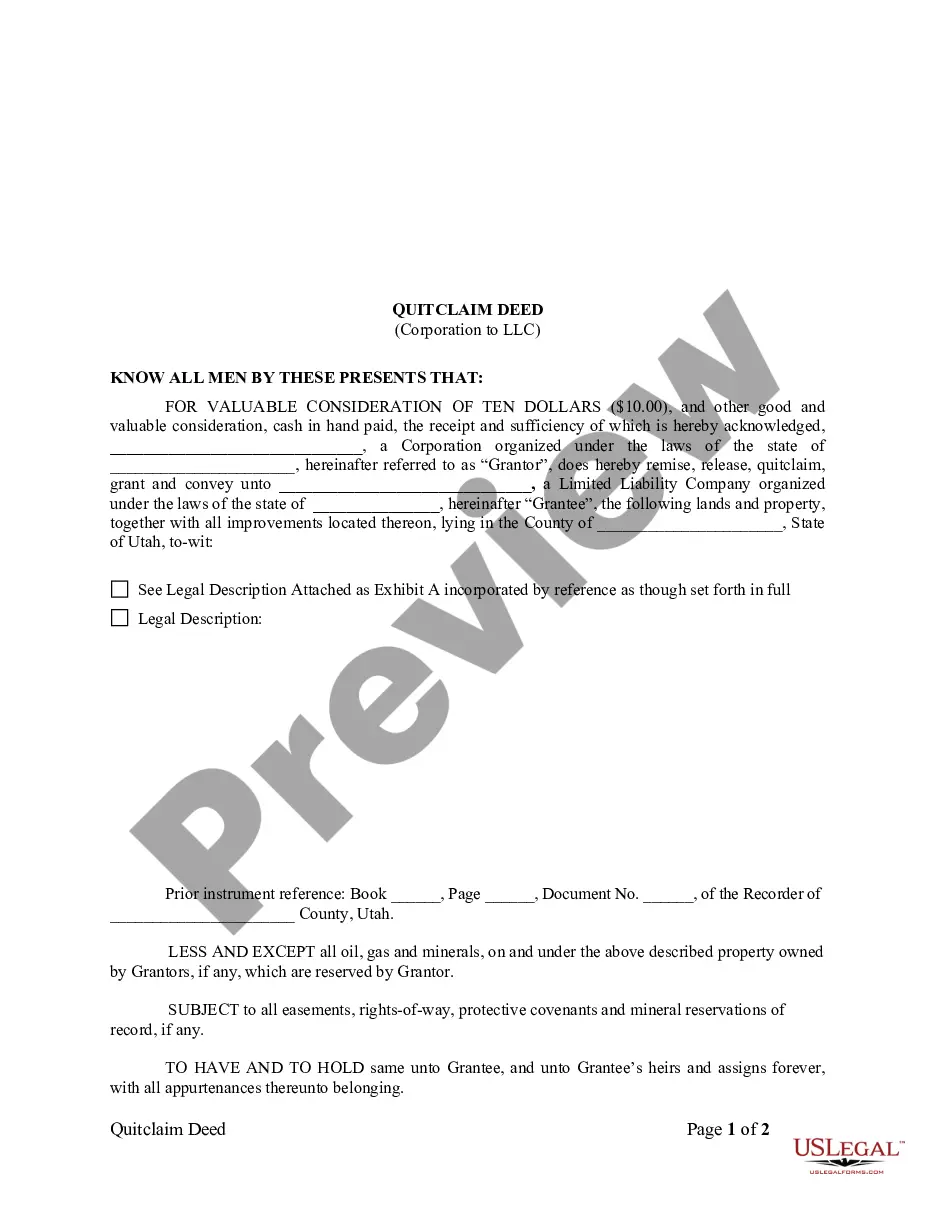

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are checked by our experts. So if you need to prepare Company Credit Card Denial for Unfavorable Report, our service is the perfect place to download it.

Obtaining your Company Credit Card Denial for Unfavorable Report from our catalog is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance check. You should carefully examine the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Company Credit Card Denial for Unfavorable Report and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

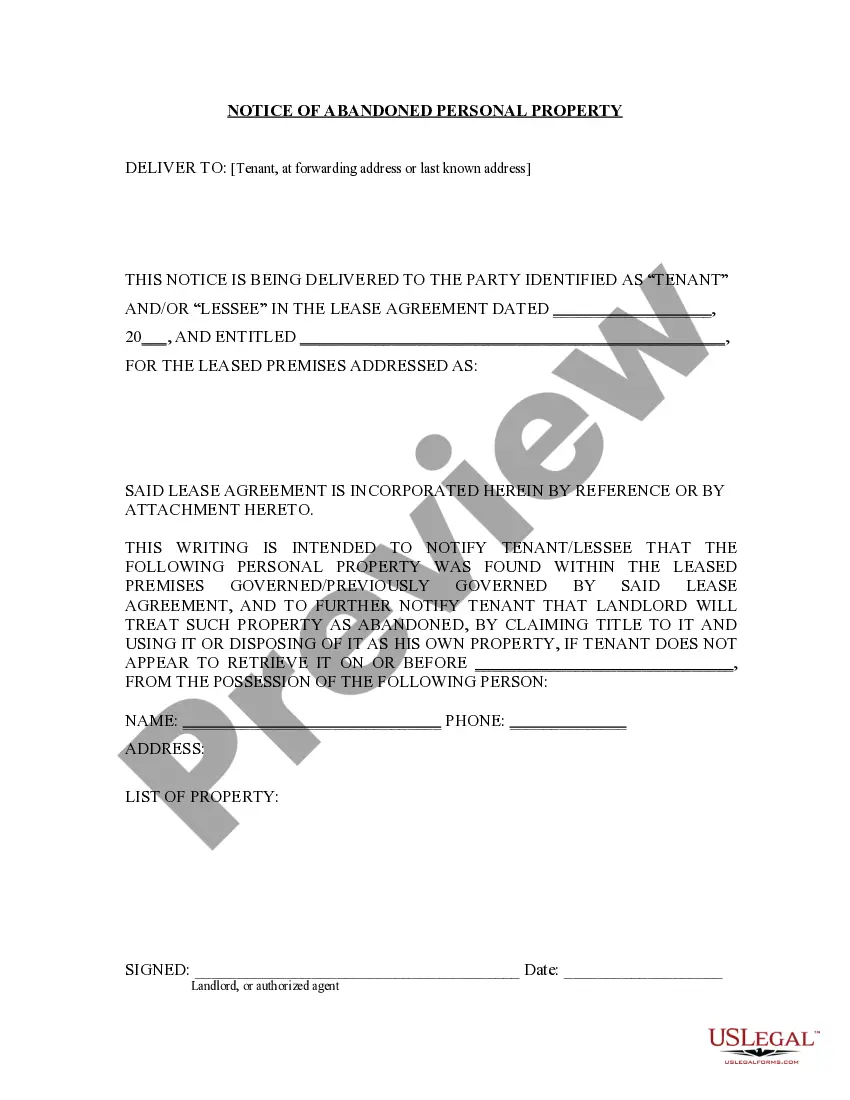

Credit cards are often denied because the applicant's credit score is too low. Each credit card has a recommended credit score range?and if your credit score is not high enough to fall within that range, the lender might deny your credit card application.

When you are denied credit, the lender is required by law to send you an adverse action letter explaining why. It must also provide instructions on how you can receive a free copy of the credit report it used to make its decision.

The Equal Credit Opportunity Act (ECOA) makes it illegal for creditors (also known as banks, mortgage companies, small loan and finance companies, credit unions, retail and department stores, credit card companies, other online companies offering credit, and people who arrange for credit) to discriminate against you.

The reasons they give for rejecting your application must be specific, such as, ?Your income is too low,? ?You have not been working long enough,? or ?You didn't receive enough points on our credit scoring system.?

If you apply for a credit card and get denied, you should receive a letter explaining the reasons for the denial. In some situations, you can ask the card issuer to reconsider its decision.

Prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, because an applicant receives income from a public assistance program, or because an applicant has in good faith exercised any right under the Consumer Credit Protection

Just because you have good credit doesn't mean you're guaranteed to be approved for all credit cards. It may seem counterintuitive and maybe even insulting to be rejected, but card issuers consider more than just those precious three numbers of a credit score.

If there's concern that the account you're applying for, combined with your existing financial commitments, will strain you, they may decline the application. Having a high Credit Score may not be enough to be accepted if the potential lender finds your affordability too low.