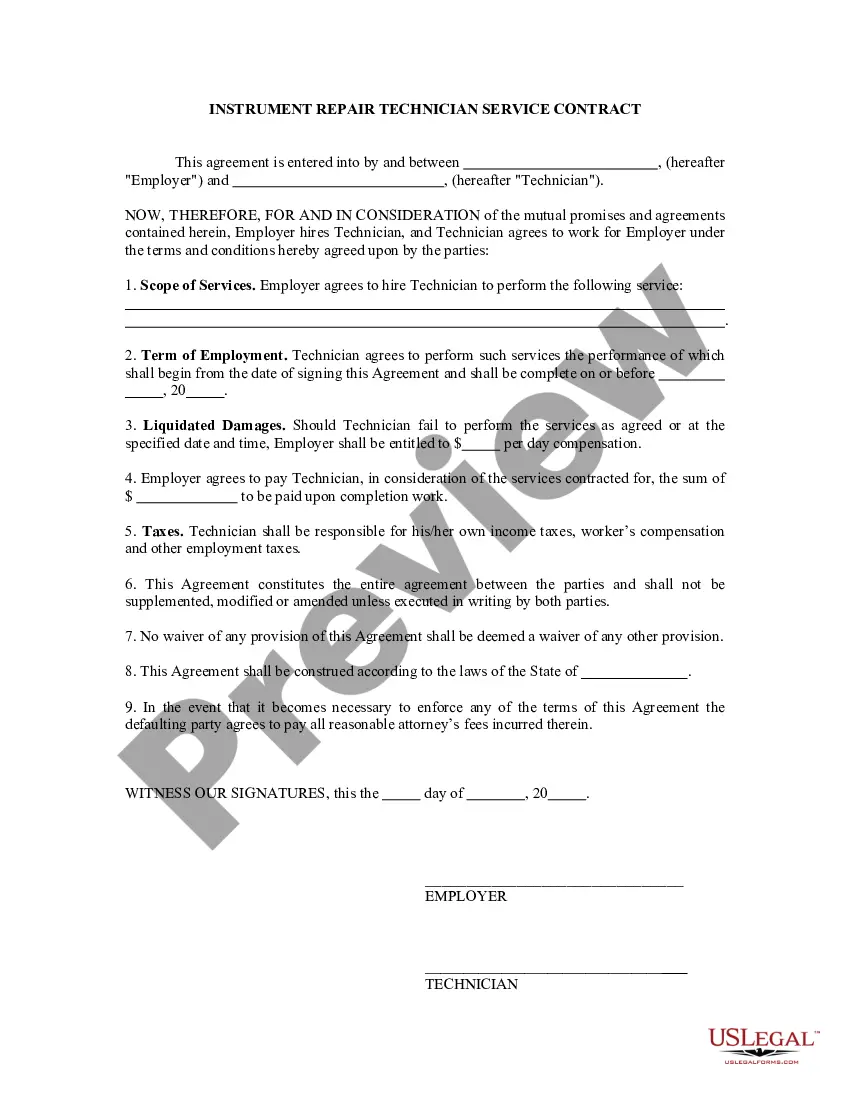

Kansas Self-Employed Technician Services Contract

Description

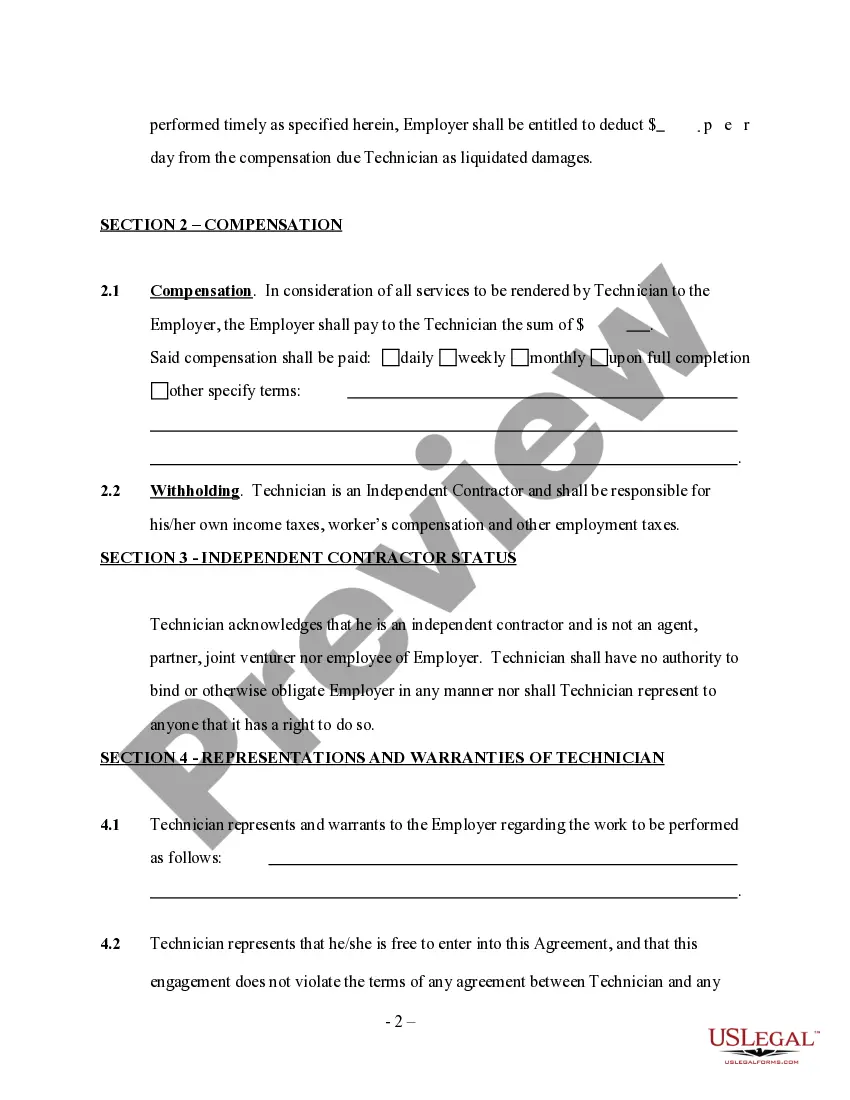

How to fill out Self-Employed Technician Services Contract?

Have you found yourself in a situation where you need documents for both business or specific reasons almost every day? There are numerous legitimate form templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms offers thousands of document templates, including the Kansas Self-Employed Technician Services Agreement, that are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, just Log In. Then, you can download the Kansas Self-Employed Technician Services Agreement template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Kansas Self-Employed Technician Services Agreement at any time if needed. Simply select the respective form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

- Use the Review button to assess the form.

- Read the description to confirm you have selected the appropriate form.

- If the form isn't what you're looking for, use the Search field to find the form that satisfies your needs and requirements.

- Once you find the correct form, click on Get now.

- Choose the payment plan you wish, complete the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

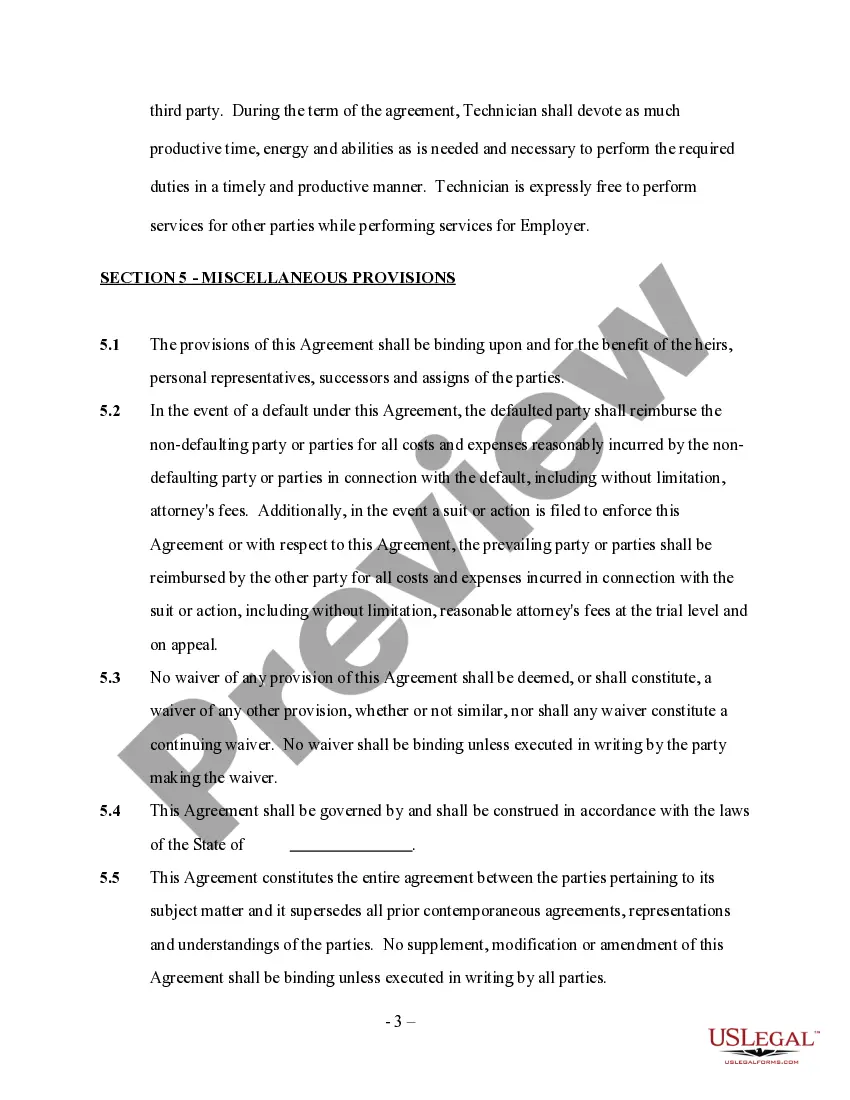

To be an independent contractor, you need to have specific skills or services to offer, obtain the necessary licenses, and manage your business independently. Additionally, you should maintain clear contracts, such as a Kansas Self-Employed Technician Services Contract, to outline services and payment terms. This approach helps ensure you meet legal requirements while protecting your interests.

The new federal rule on independent contractors focuses on clarifying the classification of workers as independent contractors versus employees. This regulation aims to protect workers' rights while ensuring that businesses can effectively manage their workforce. Understanding this rule is vital for anyone entering into a Kansas Self-Employed Technician Services Contract.

To be authorized as an independent contractor in the US, you should start by researching the specific requirements for your profession in your state. This often involves obtaining necessary licenses, registering your business, and understanding tax obligations. Creating a Kansas Self-Employed Technician Services Contract can also help formalize your status and responsibilities.

In Kansas, while an operating agreement is not legally required for LLCs, it is highly recommended. This document outlines the management structure, roles, and responsibilities of members. Having an operating agreement can provide clarity and protection, especially when entering into contracts like a Kansas Self-Employed Technician Services Contract.

Yes, independent contractors must have work authorization to legally perform services in the US. This may include possessing a Social Security number or an Employer Identification Number (EIN). By ensuring you have the proper documentation, you can confidently engage in Kansas Self-Employed Technician Services without legal complications.

To become authorized as an independent contractor in the US, you typically need to obtain the necessary licenses and permits for your specific profession. Additionally, you may need to register your business and fulfill any local requirements. A Kansas Self-Employed Technician Services Contract can further clarify your role and responsibilities, ensuring compliance with regulations.

A freelance service contract is a legally binding agreement between a self-employed technician and a client. This document outlines the scope of work, payment terms, and deadlines. It helps protect both parties by setting clear expectations and responsibilities, making it essential for anyone engaging in Kansas Self-Employed Technician Services.

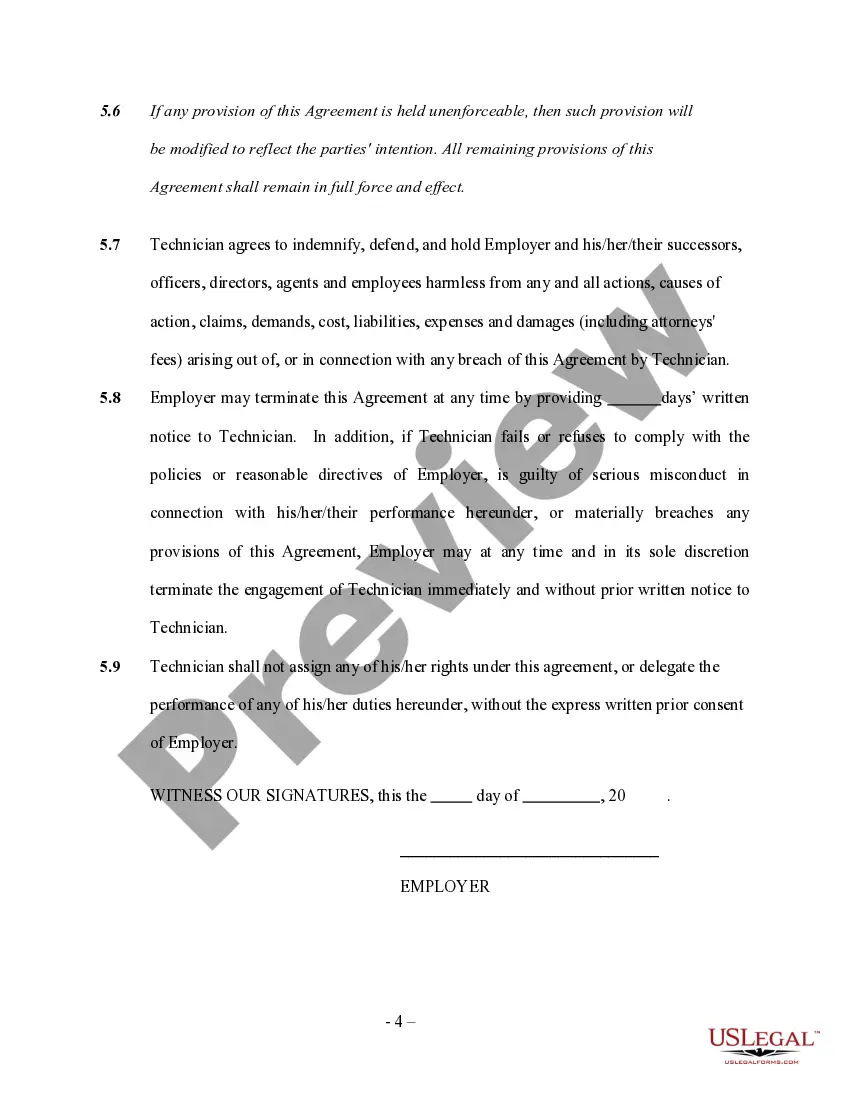

Service labor can be taxable in Kansas, but it depends on the type of service provided. Many services related to tangible goods or real property improvements are subject to tax, while others, such as professional services, may not be. It's important to analyze the specific nature of your services. To navigate these complexities, the Kansas Self-Employed Technician Services Contract can be a valuable tool, providing clarity on tax obligations.

In Kansas, several items and services may be exempt from sales tax. Generally, non-taxable services include certain labor services related to repairing or improving real property. Additionally, some services related to medical, educational, and agricultural sectors may also be exempt. To clarify these exemptions in your Kansas Self-Employed Technician Services Contract, consult with a tax professional or use US Legal Forms to find relevant information.

Whether to add tax to your invoice depends on the nature of your services. In Kansas, many services are subject to sales tax, but some may not be taxable. It is essential to understand the specific tax laws that apply to your work. For assistance in determining the correct approach, you might find the Kansas Self-Employed Technician Services Contract useful, as it often includes guidance on invoicing and tax considerations.