Kansas Self-Employed Mechanic Services Contract

Description

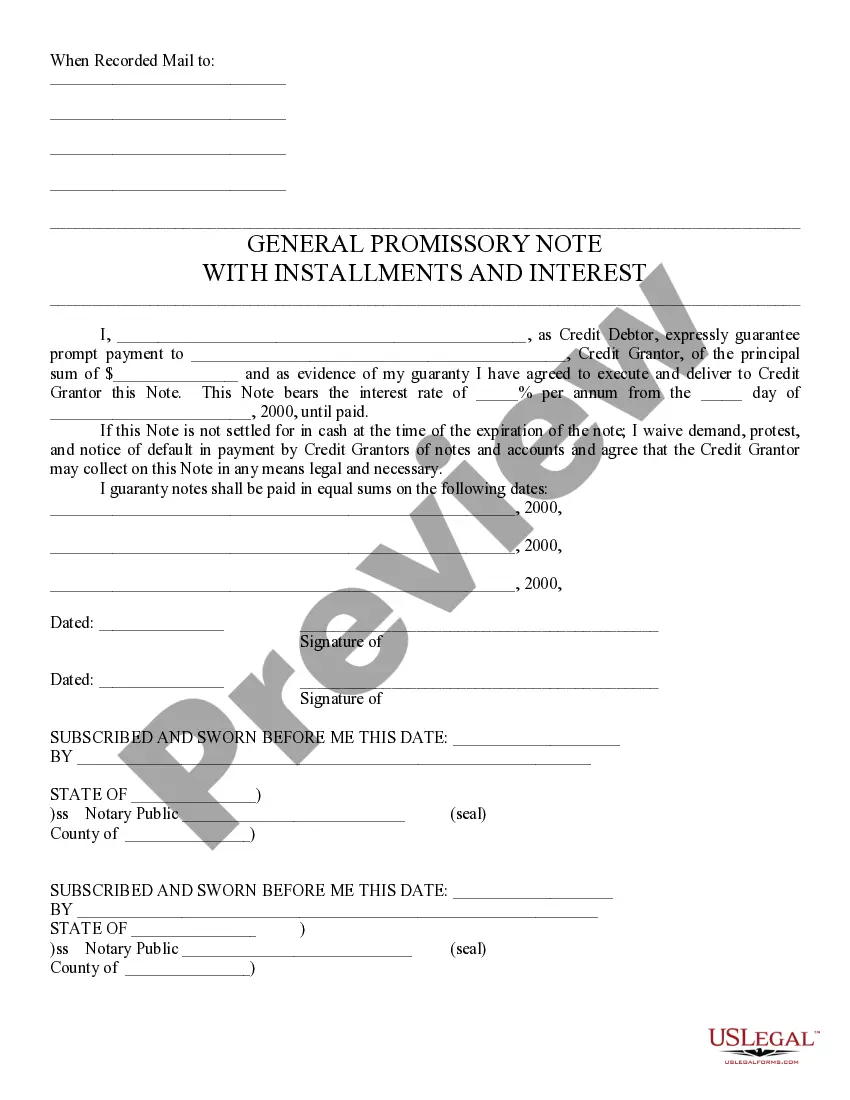

How to fill out Self-Employed Mechanic Services Contract?

It is feasible to spend hours online searching for the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast selection of legal forms that can be reviewed by professionals.

You can download or print the Kansas Self-Employed Mechanic Services Contract from my services.

If available, utilize the Preview button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Kansas Self-Employed Mechanic Services Contract.

- Every legal document template you obtain is yours permanently.

- To acquire an additional copy of any purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

A Kansas Self-Employed Mechanic Services Contract provides significant advantages for securing your payment and defining the scope of services. With this contract, you establish clear terms, reduce the risk of misunderstandings, and protect your rights if disputes arise. Additionally, having a formal agreement can enhance your professionalism and appeal to potential clients. By utilizing platforms like US Legal Forms, you can easily draft a comprehensive contract tailored to your needs.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Kansas sales tax is due on the total charge to the customer on the repair of tangible personal property. These are retail sales and as such, the sale of an appliance, repair parts and labor are all subject to sales tax and should be billed and collected from the repairman's customer on the total amount billed.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.