Kansas Computer Repairman Services Contract - Self-Employed

Description

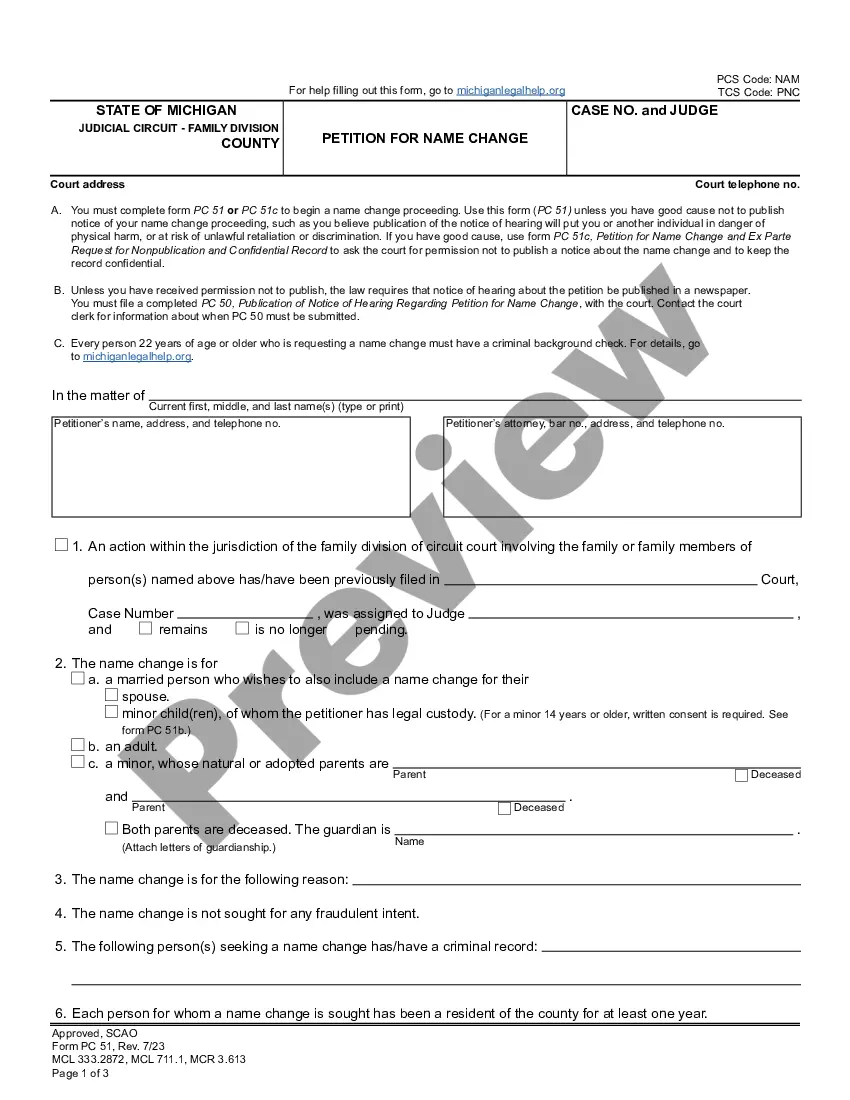

How to fill out Computer Repairman Services Contract - Self-Employed?

You might spend numerous hours online looking for the legal document template that matches the state and federal regulations you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the Kansas Computer Repairman Services Agreement - Freelance from the platform.

Examine the form summary to ensure you have selected the right document. If applicable, use the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- After that, you can complete, alter, print, or sign the Kansas Computer Repairman Services Agreement - Freelance.

- Every legal document template you acquire is yours permanently.

- To retrieve another copy of any obtained form, go to the My documents section and click on the respective button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

Form popularity

FAQ

Writing a contract agreement for services involves a few essential steps. Start by clearly defining the services you will provide, the payment terms, and the duration of the agreement. It's also crucial to outline any responsibilities and liabilities. For a Kansas Computer Repairman Services Contract - Self-Employed, consider using a template from uslegalforms, which simplifies the process of creating a professional agreement.

In Kansas, you typically do not need a specific license to operate as a handyman. However, if you plan to perform specialized tasks, such as electrical or plumbing work, you may need specific licenses or permits. Always check local regulations to ensure compliance. Using the Kansas Computer Repairman Services Contract - Self-Employed can help clarify the scope of your services.

As an independent contractor, filing taxes starts with keeping detailed records of your income and expenses related to your Kansas Computer Repairman Services Contract - Self-Employed. You will typically report your earnings using Schedule C when filing your federal tax return. Additionally, you may need to make estimated tax payments throughout the year. Using platforms like US Legal Forms can help streamline your tax preparation process, ensuring you comply with all necessary requirements.

Yes, Software as a Service (SaaS) may be subject to sales tax in Kansas. Generally, if you are providing a digital product as part of your services under a Kansas Computer Repairman Services Contract - Self-Employed, you should consider its tax implications. Consulting with a tax professional can give you clarity on how to handle these types of transactions.

Repair labor is usually not taxable in Kansas, particularly if it relates to service contracts like the Kansas Computer Repairman Services Contract - Self-Employed. However, you should also double-check if any materials provided during the service are taxable, as they might alter your tax obligations. It’s important to keep accurate records to ensure compliance with state tax laws.

In Kansas, professional services are generally not subject to sales tax. However, certain services may incur tax, depending on the nature of the work performed. For example, if you’re providing repair services under a Kansas Computer Repairman Services Contract - Self-Employed, those services typically fall outside the realm of taxable sales. Staying informed about the specific tax rules can help you manage your business finances effectively.

No, you do not need to have an LLC to work as a contractor. However, forming an LLC can provide you with personal liability protection, which may be beneficial for your business. For those offering Kansas Computer Repairman Services Contract - Self-Employed, an LLC can also enhance credibility in the eyes of clients. Ultimately, the decision should align with your financial and operational goals.

Yes, independent contractors need work authorization, just like any employee. This helps prevent legal issues and ensures you operate within the law. If you are a self-employed individual in computer repair, having a Kansas Computer Repairman Services Contract - Self-Employed is also vital to confirm your professional status. Always check your state’s regulations to be fully compliant.

Getting authorized involves several straightforward steps. Begin by registering your business with your state's appropriate agency, which can grant you the necessary permits. For those in the computer repair field, a properly structured Kansas Computer Repairman Services Contract - Self-Employed adds legitimacy. Staying compliant with federal and state laws ensures you can offer your services without hindrance.

To get authorized, start with obtaining all necessary licenses and permits specific to your state. This is essential for the Kansas Computer Repairman Services Contract - Self-Employed, where you may need specific certifications. Additionally, familiarize yourself with tax obligations under IRS rules for independent contractors. By taking these steps, you will be better prepared to serve your clients.