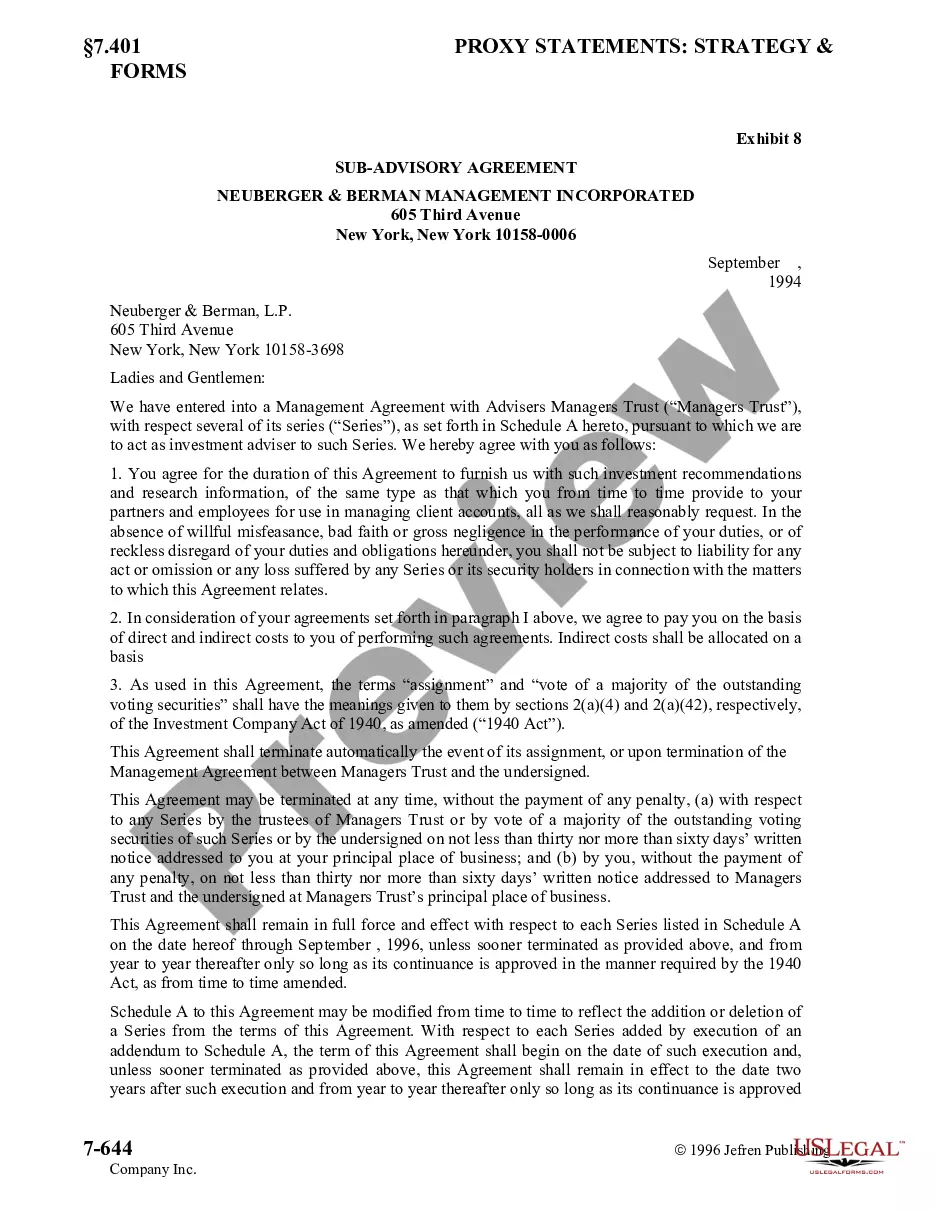

Kansas Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

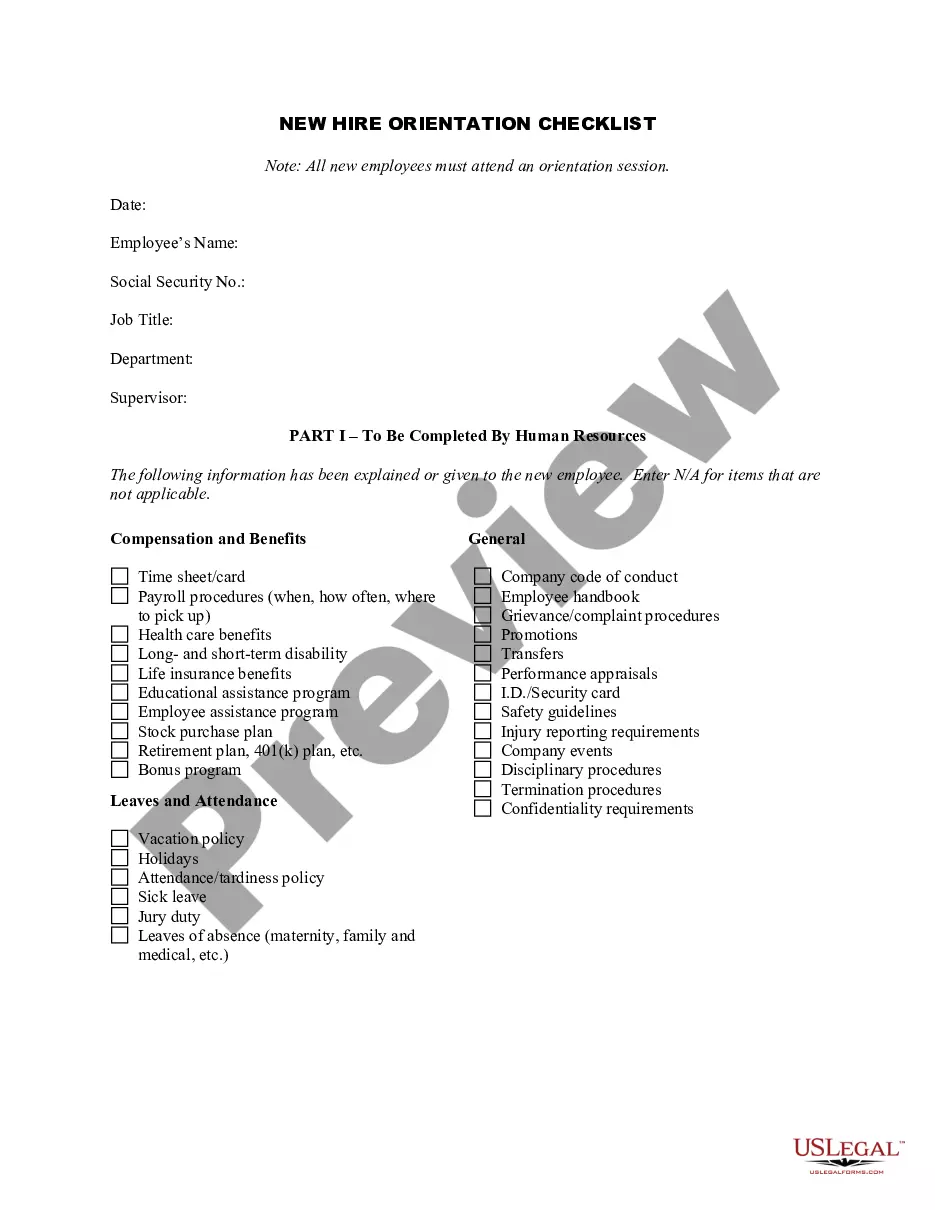

US Legal Forms - one of many biggest libraries of legitimate types in the States - provides a variety of legitimate papers web templates you can download or printing. Making use of the website, you can find 1000s of types for enterprise and personal functions, sorted by classes, suggests, or keywords and phrases.You will find the newest types of types such as the Kansas Sub-Advisory Agreement of Neuberger and Berman Management, Inc. in seconds.

If you have a membership, log in and download Kansas Sub-Advisory Agreement of Neuberger and Berman Management, Inc. through the US Legal Forms catalogue. The Down load button will show up on each type you view. You have access to all in the past acquired types within the My Forms tab of your account.

If you would like use US Legal Forms for the first time, here are basic guidelines to help you started out:

- Make sure you have chosen the correct type for your personal area/region. Click the Review button to examine the form`s articles. Read the type explanation to actually have selected the appropriate type.

- In the event the type doesn`t match your demands, make use of the Look for area on top of the monitor to discover the one who does.

- In case you are happy with the shape, confirm your option by simply clicking the Acquire now button. Then, select the prices prepare you favor and supply your references to sign up on an account.

- Method the transaction. Make use of credit card or PayPal account to complete the transaction.

- Pick the format and download the shape on your device.

- Make changes. Fill up, edit and printing and sign the acquired Kansas Sub-Advisory Agreement of Neuberger and Berman Management, Inc..

Each and every design you included in your account lacks an expiration day and is the one you have for a long time. So, if you would like download or printing an additional copy, just proceed to the My Forms portion and then click about the type you require.

Obtain access to the Kansas Sub-Advisory Agreement of Neuberger and Berman Management, Inc. with US Legal Forms, one of the most substantial catalogue of legitimate papers web templates. Use 1000s of specialist and condition-distinct web templates that meet your small business or personal demands and demands.

Form popularity

FAQ

At Neuberger Berman, our mission is clear ? to partner with clients to achieve their unique investment objectives. Since 1939, Neuberger Berman has been a leader in the asset management business servicing the investment needs of institutional and individual investors.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

From offices in 39 cities across 26 countries, Neuberger Berman manages a range of equity, fixed income, private equity and hedge fund strategies on behalf of institutions, advisors and individual investors worldwide.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

Neuberger Berman BD LLC is a registered broker-dealer and member FINRA/SIPC.

Investing For You and With You Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).