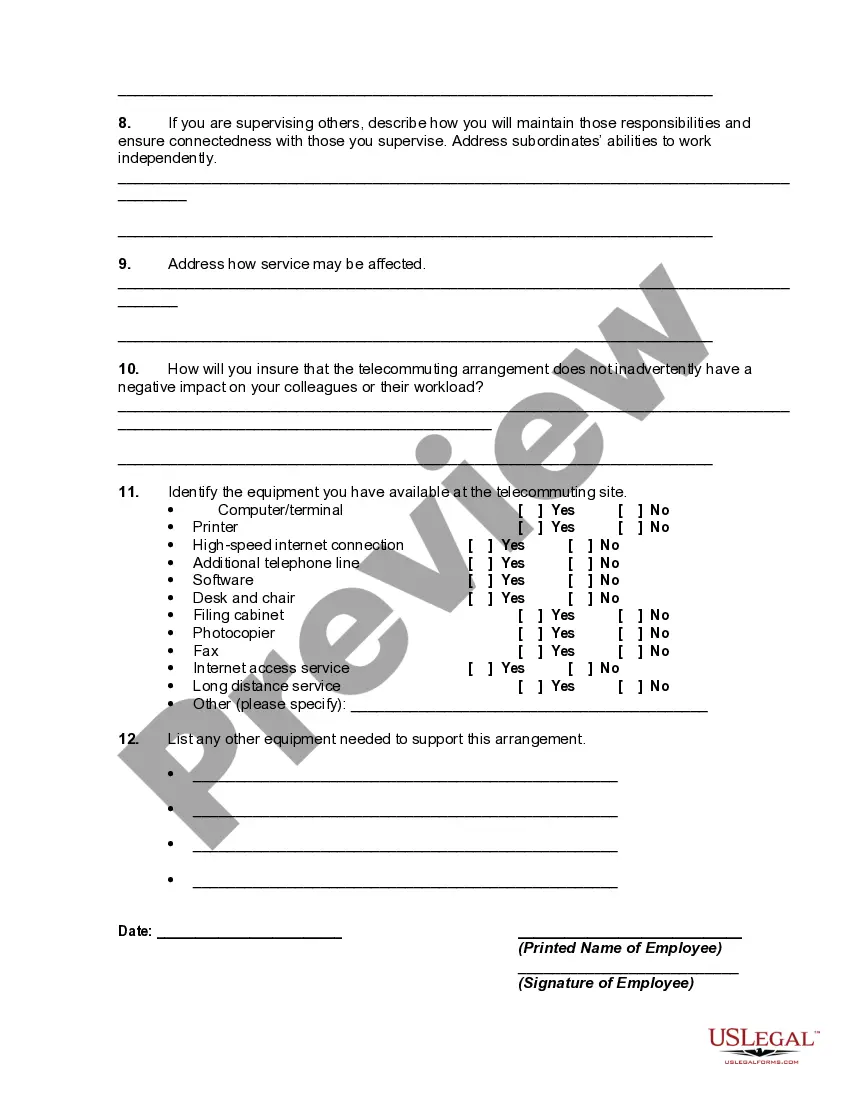

Kansas Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

You might dedicate hours online trying to locate the sanctioned document template that meets the federal and state regulations you need.

US Legal Forms offers numerous legal templates that are reviewed by experts.

You can easily obtain or print the Kansas Telecommuting Worksheet from my services.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Afterward, you can complete, modify, print, or sign the Kansas Telecommuting Worksheet.

- Every legal document template you acquire is yours indefinitely.

- To receive another copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for your region/city.

- Review the form description to confirm you have selected the right one.

Form popularity

FAQ

When asked if you are exempt from withholding, your response should depend on your tax situation. If you meet the criteria for exemption based on your income and previous tax return, you can answer affirmatively. Otherwise, you should indicate that you are not exempt. Utilize tools like the Kansas Telecommuting Worksheet to assess your status before responding.

Kansas will give you a credit for the tax you pay in Missouri, but only up to the amount of Kansas tax on the same income. So if you earned 50,000, and Missouri taxes you 2000 but Kansas only taxes you 1800, you will receive a credit of 1800 on your Kansas taxes to bring it down to zero.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Remote work is the practice of employees doing their jobs from a location other than a central office operated by the employer. Such locations could include an employee's home, a co-working or other shared space, a private office, or any other place outside of the traditional corporate office building or campus.

Should I file an income tax return if I live in Illinois but work in another state? Yes. As an Illinois resident you are subject to tax on all income no matter where it is earned.

If you live in Missouri but work in Kansas, you still need to fill out a Missouri tax return, but you may be able to get a credit for the income tax you pay to Kansas.

If the state you work in does not have a reciprocal agreement with your home state, you'll have to file a resident tax return and a nonresident tax return. On your resident tax return (for your home state), you list all sources of income, including that which you earned out-of-state.

Teleworking allows employees to carry out their duties and responsibilities from an offsite location other than the official workplace. It could involve working from home, another branch office, cafe, bookstore, or even a coworking space.

You will get a state tax credit in MO for any KS state income taxes that you paid on your nonresident KS state income tax return. You will want to work on your non-resident KS state income tax return first. You will then take a tax credit from your non-resident KS taxes on your resident MO state income tax return.

Telework: Working from home, a satellite office, or shared space rather than commuting to a nearby office. Remote Work: Working from home, a satellite office, or shared space regardless if an office exists in close proximity to you.