Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

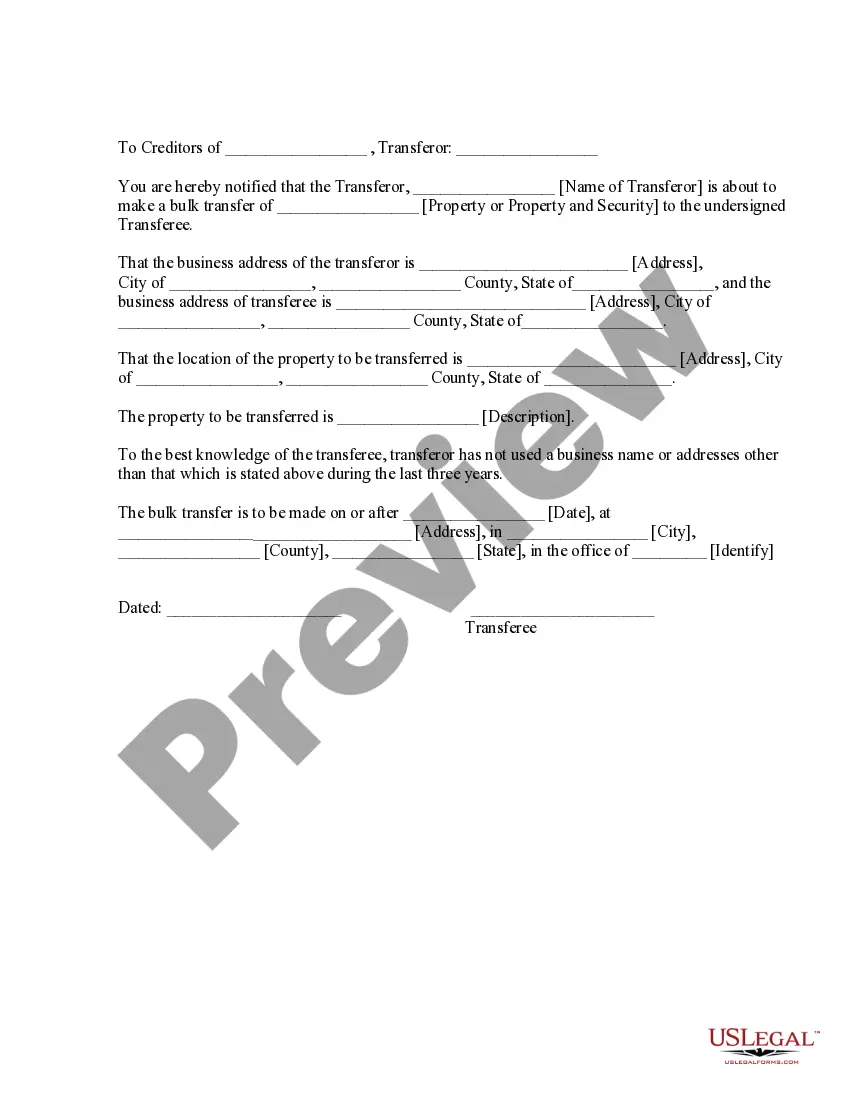

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

Finding the appropriate legal document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor, that can be used for both business and personal purposes.

You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by experts and comply with federal and state requirements.

- If you are currently registered, Log In to your account and click the Download button to obtain the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

- Use your account to browse through the legal forms you may have purchased previously.

- Go to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy instructions you can follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, a debt collector can still attempt to collect on an old debt, even if it exceeds common timeframes for legal action. However, if the debt is beyond the statute of limitations in Kansas, they cannot sue you for payment. It's important to understand your rights and the implications of the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor in these situations.

Debt collectors can attempt to contact you about debts that are over ten years old, but they cannot take legal action to collect them in Kansas. The statute of limitations limits the enforcement of debts to five years. Yet, it's beneficial to be aware of your rights and the specifics of the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

The 777 rule refers to the time limit for collecting certain debts. It provides guidance that after seven years, credit reporting agencies may remove debts from your report, while debts may remain collectible for up to seven years also. Always remember this rule when reviewing your financial situation, especially in the context of Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

While a debt may still exist after ten years, in Kansas, it generally cannot be enforced through legal action after five years. However, collectors may still contact you regarding the debt, but they cannot take you to court for recovery. It is essential to know your rights when dealing with such situations, especially related to the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

In Kansas, debts typically become uncollectible, or time-barred, after five years. This period starts from the last activity on the account, which includes payments or any written acknowledgment of the debt. Understanding this timeline can help you navigate your financial obligations while referring to the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

When writing a letter to a collection agency, clearly state your request for verification of the debt. Include your personal details and any account numbers, while requesting the agency to provide proof of the debt's validity. You can use resources from uslegalforms to guide you in drafting an effective letter, ensuring you assert your rights regarding the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

In Kansas, debt collectors can generally pursue collections for up to five years after the date of the last payment. However, after this period, the debt becomes uncollectible through the courts. This means it's crucial to understand the timeframes involved, especially with the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor, to protect your rights.

When you receive a summons for debt collection in Kansas, it is important to respond promptly. Begin by reviewing the summons to understand the details of the claim, including who is suing you and the amount owed. You should prepare your answer, clearly stating your defense or any objections to the claim. Additionally, consider using resources like US Legal Forms, where you can find guidance on the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor, helping you to navigate this process effectively.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that prohibits abusive collection practices. In Kansas, this law is crucial for ensuring that consumers are treated fairly by debt collectors and have rights concerning the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor. It protects individuals from harassment and outlines the proper procedures that collectors must follow. Familiarizing yourself with the FDCPA can enhance your ability to manage debt responsibly.

The 7 7 rule in collections states that a collector cannot communicate with a debtor more than seven times in one week. This regulation promotes a fair approach to debt collection, aligning with the Kansas Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Adhering to this rule helps maintain professionalism and reduces stress for the debtor, providing a clearer framework for communication. Utilizing this understanding can significantly impact your debt resolution strategy.