No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Kansas Acceptance of Claim and Report of Past Experience with Debtor

Description

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

If you want to complete, retrieve, or print authentic legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and convenient search feature to locate the documents you need.

Various templates for corporate and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Kansas Acceptance of Claim and Report of Past Experience with Debtor in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Kansas Acceptance of Claim and Report of Past Experience with Debtor.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the Kansas Acceptance of Claim and Report of Past Experience with Debtor.

- You can also access forms you previously retrieved in the My documents section of your account.

- If this is your first time using US Legal Forms, refer to the following instructions.

- Step 1. Make sure you have selected the form for the correct city/state.

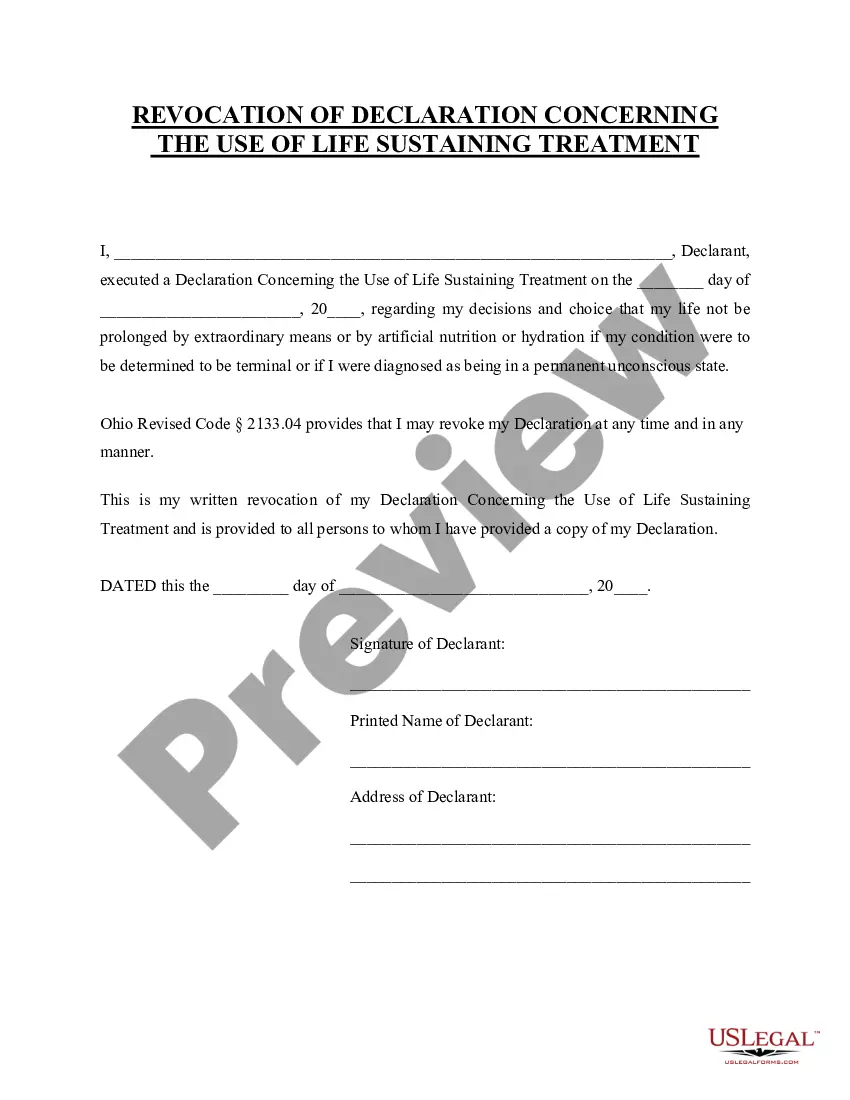

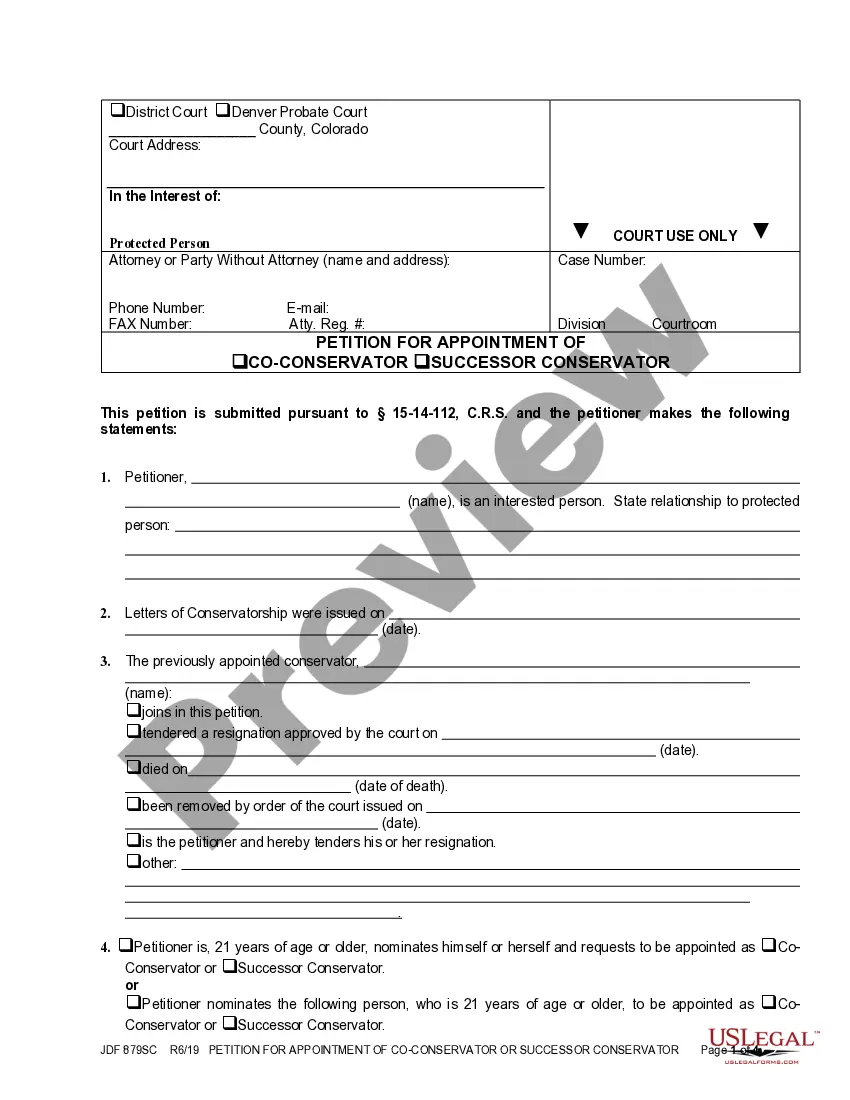

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other variations in the legal form format.

- Step 4. Once you have found the form you need, click the Acquire now button. Select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Debt collectors in Kansas can pursue you for up to five years, depending on the type of debt. Once this period runs out, creditors must cease collection efforts. Utilizing the Kansas Acceptance of Claim and Report of Past Experience with Debtor can inform you of your rights and options for dealing with old debts.

In Kansas, a debt becomes uncollectible after the statute of limitations expires, which is typically five years for most debts. Once this period elapses, creditors can no longer legally pursue recovery in court. The Kansas Acceptance of Claim and Report of Past Experience with Debtor can help individuals understand the implications of this time frame on their finances.

The Fair Debt Collection Practices Act (FDCPA) in Kansas protects consumers from unfair debt collection practices. It prohibits harassment, misleading tactics, and any form of abuse by debt collectors. Awareness of the Kansas Acceptance of Claim and Report of Past Experience with Debtor can empower consumers to report unfair practices and seek justice effectively.

The 7 7 rule refers to a common practice where debt collectors will typically wait seven months before taking legal action to collect a debt, after which they may escalate their efforts. This practice allows for a manageable approach in debt collection while adhering to legal guidelines. Understanding the Kansas Acceptance of Claim and Report of Past Experience with Debtor can provide clarity on the rights of both debtors and collectors during this process.

In Kansas, debt collectors can typically pursue a debt for up to five years. This period starts from the date of the last payment or acknowledgment of the debt. It is essential for consumers to know their rights regarding the Kansas Acceptance of Claim and Report of Past Experience with Debtor, which helps clarify the timeline for claims and potential collection efforts.

When a company files for Chapter 11, it undergoes a process intended to help it reorganize its debts. During this time, the company often seeks to negotiate with creditors and may implement a plan to repay some of its debts over time. The Kansas Acceptance of Claim and Report of Past Experience with Debtor allows affected parties to understand how their claims fit into this process and the potential recovery they may expect.

A debtor may want to file a motion to impose the automatic stay in situations where they face imminent collection actions, such as foreclosure on their home or aggressive creditor lawsuits. This motion helps provide a buffer that allows them to stabilize their finances before proceeding with bankruptcy. In relation to the Kansas Acceptance of Claim and Report of Past Experience with Debtor, implementing an automatic stay can significantly impact a debtor's ability to reorganize effectively and achieve favorable outcomes.

Yes, a debtor can file a proof of claim to assert their right to participate in a bankruptcy proceeding. This document outlines the details of their claim against the debtor, allowing them to seek repayment or relief. In the context of the Kansas Acceptance of Claim and Report of Past Experience with Debtor, submitting a proof of claim is a critical step for a debtor to potentially recover debts owed to them. It is advisable for debtors to follow legal guidelines closely while preparing this document.

A motion to impose the automatic stay is a request made by a debtor to create or extend an automatic stay in circumstances where it may have lapsed or not been applied. This type of motion is crucial for debtors seeking protection from creditors while they work on their bankruptcy case. It plays a significant role in the Kansas Acceptance of Claim and Report of Past Experience with Debtor, ensuring that debtors have the necessary time to prepare their plans without the pressure of creditor actions. Filing this motion requires careful consideration and often legal expertise.

The automatic stay stops various collection activities, including lawsuits, wage garnishments, and foreclosure actions against the debtor. This means that creditors cannot initiate or continue actions that could harm the debtor's ability to reorganize financially. Understanding what is covered by the automatic stay is vital for both debtors and creditors in relation to the Kansas Acceptance of Claim and Report of Past Experience with Debtor. This knowledge can influence legal strategies and outcomes during bankruptcy proceedings.