Kansas Summary Administration Package for Small Estates

Overview of this form

The Summary Administration Package for Small Estates is a legal document set designed for the streamlined management of smaller estates in Kansas. Under Kansas statute §59-1507, this form enables the personal representative to settle the decedent's debts and streamline the probate process, making it less complex than traditional estate administration. This package includes necessary forms that help facilitate a summary administration, allowing for quicker court approval and estate closure.

Main sections of this form

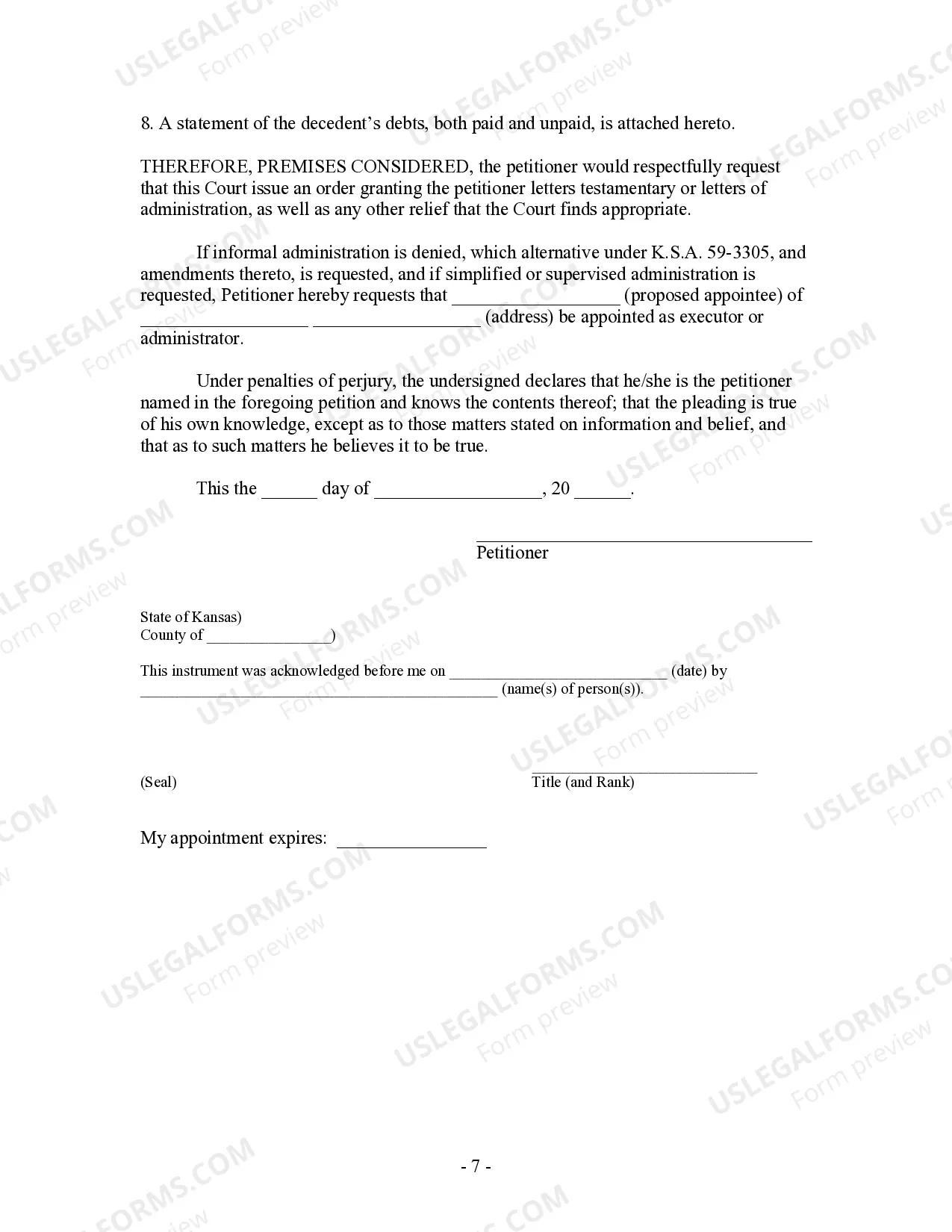

- Petition for Probate and/or Administration: Initiates the probate process and requests the court to appoint an administrator.

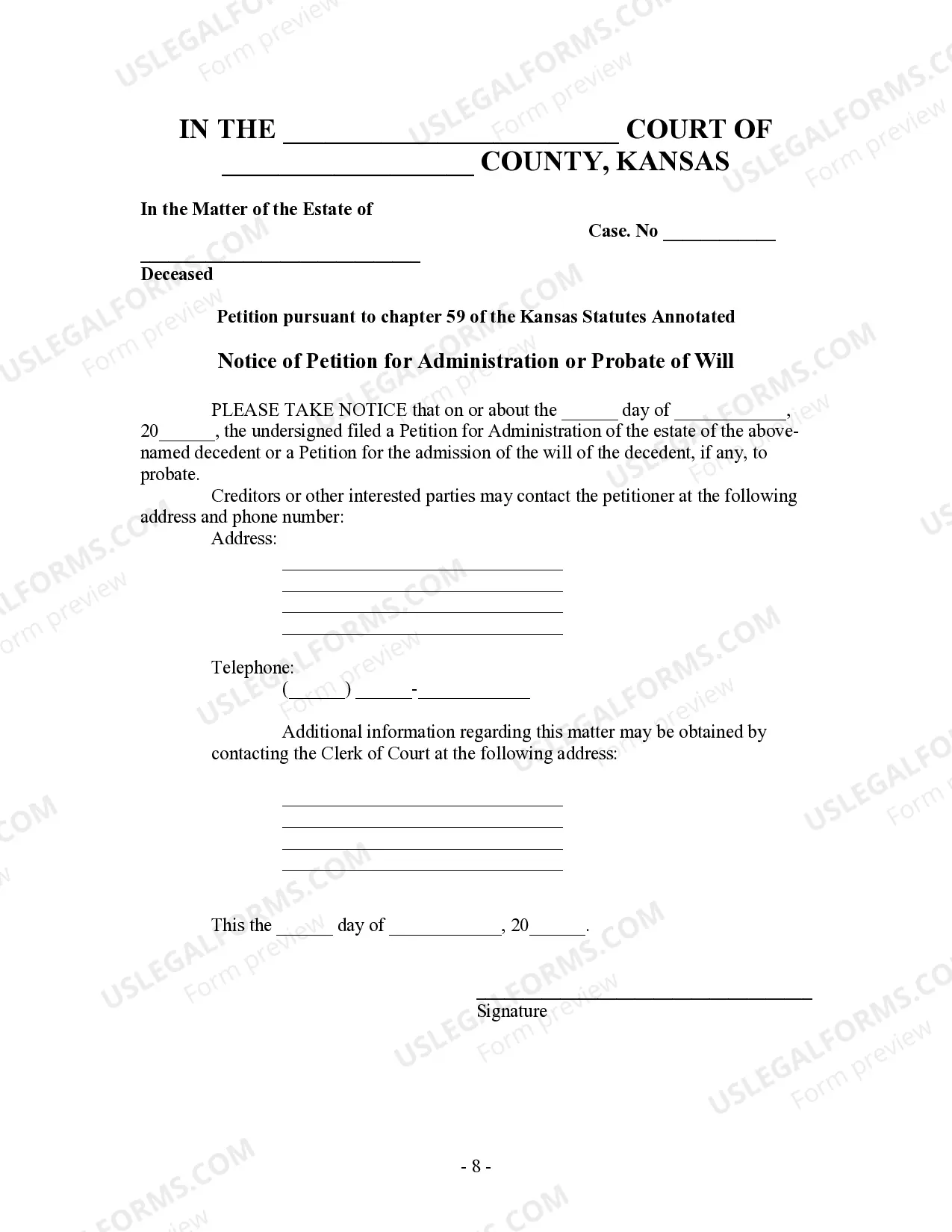

- Notice to Creditors: Informs creditors about the pending administration of the estate.

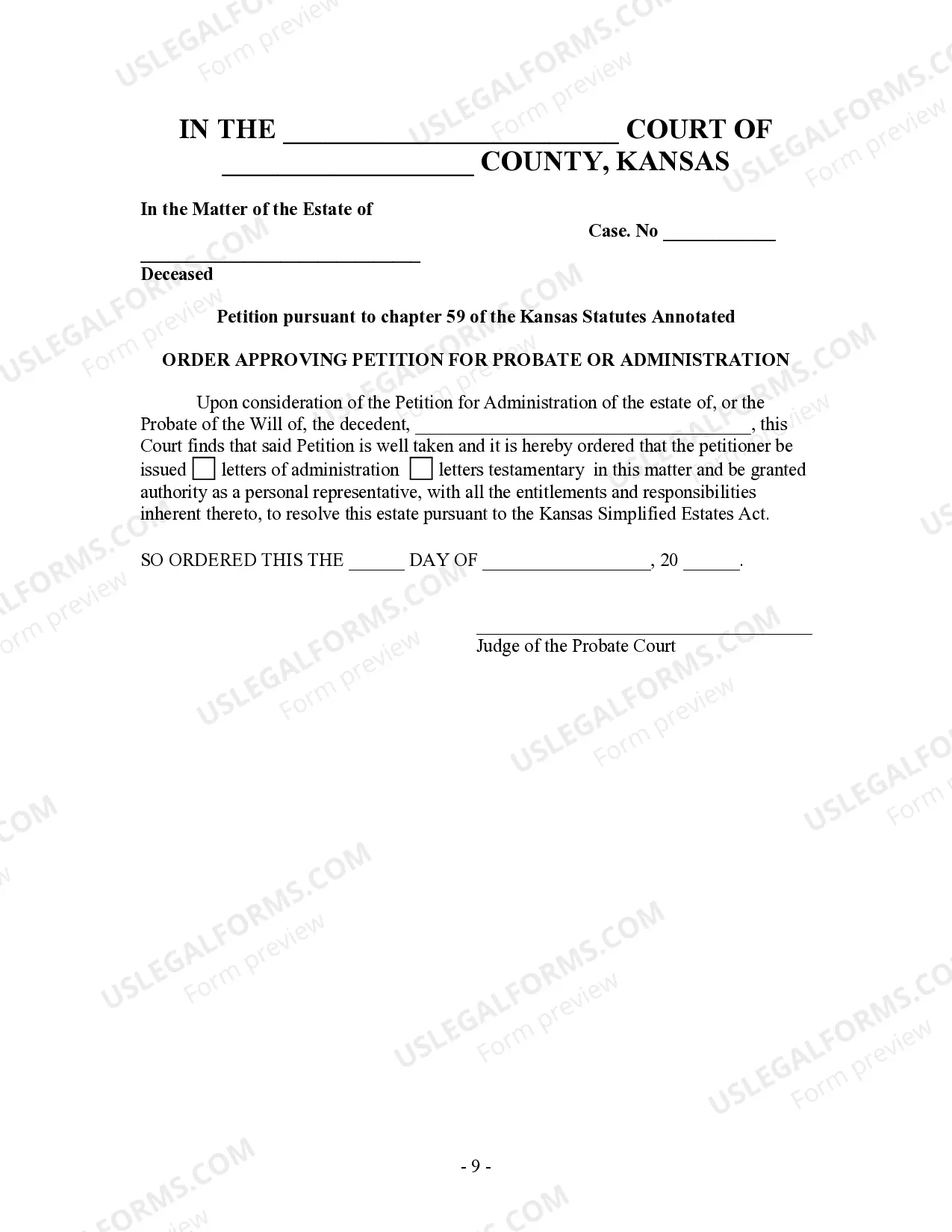

- Proposed Order Approving Petition: A formal request for the court to approve the petition filed.

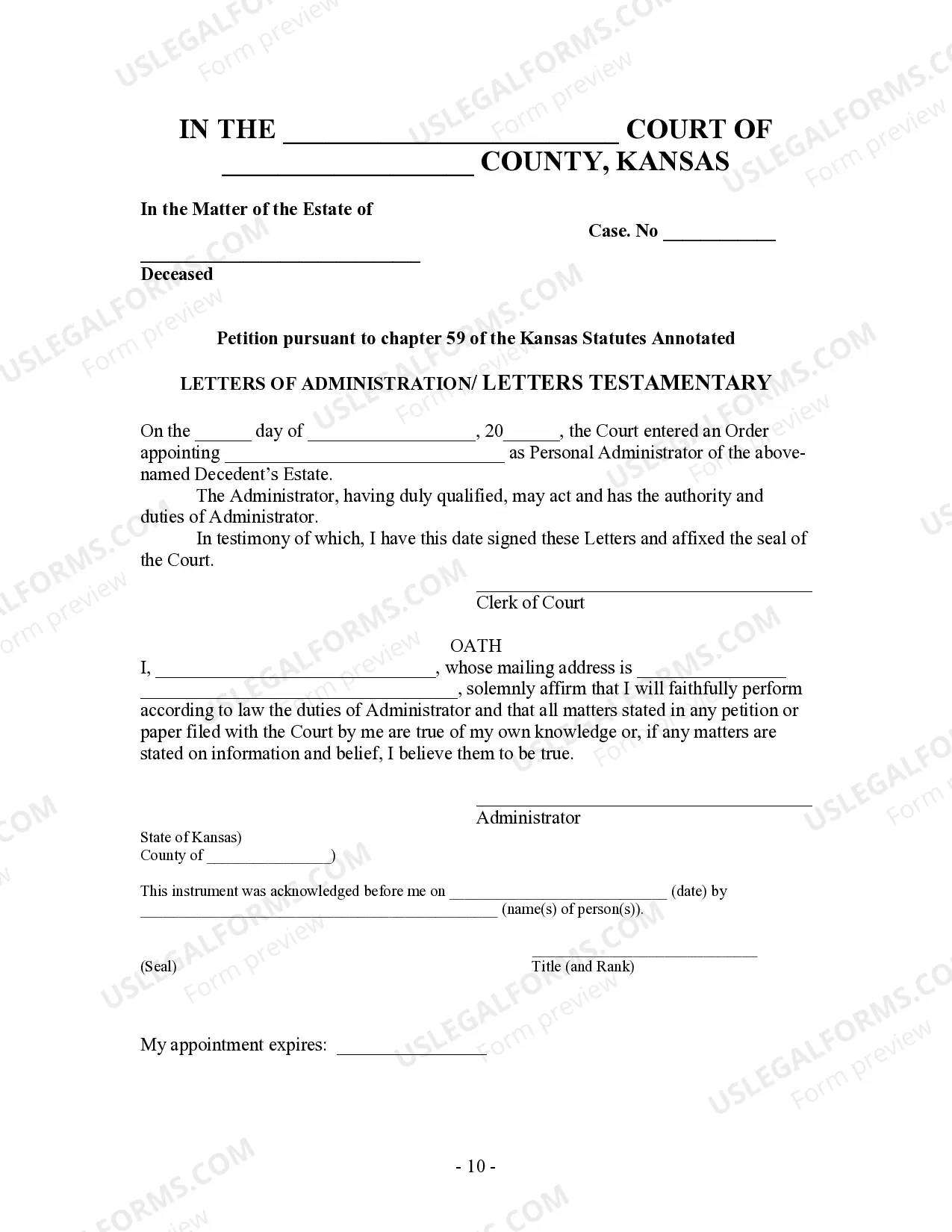

- Letters of Administration: Official documents granting the appointed representative the authority to act on behalf of the estate.

- Inventory and Valuation: A detailed list of the deceased's assets and their estimated values.

- Petition for Closing Order: Requests the court to officially close the estate after administration is complete.

When to use this form

This form should be used when the estate of a decedent is small enough to qualify for summary administration under Kansas law. It is typically applicable when the estate's value, excluding certain allowances, does not exceed specific limits set by the state. If you are the personal representative or heir seeking to settle a smaller estate, this form is the right choice to expedite the probate process.

Intended users of this form

This form is intended for:

- Personal representatives of decedents with small estates

- Heirs and beneficiaries looking to manage estate assets efficiently

- Individuals in Kansas who need to address decedent debts and distribute assets without extensive legal complexities

How to prepare this document

- Identify and gather all necessary information regarding the decedent and their estate.

- Fill out the Petition for Probate, ensuring all required fields, such as your relationship to the decedent and the decedent's information, are complete.

- Complete the Notice to Creditors, including relevant contact information.

- Prepare the Inventory and Valuation by listing all assets and their fair market values.

- File the completed forms with the appropriate Kansas court and notify interested parties as per statutory requirements.

- Once the court approves your petition, file a request for the closing order to finalize the estate administration.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to notify creditors on time, which can complicate the probate process.

- Omitting essential details in the Petition for Probate, leading to potential rejection by the court.

- Not providing accurate valuations for estate assets, which may cause accounting issues.

- Neglecting to keep copies of all documents filed with the court, which are essential for record-keeping.

Advantages of online completion

- Convenient access to necessary legal forms at any time, eliminating the need for in-person meetings.

- Editability allows you to easily fill in required information and make changes as needed.

- Reliable and secure forms drafted by licensed attorneys, ensuring compliance with state laws.

- Easy downloading and printing capabilities for a worry-free filing experience.

Looking for another form?

Form popularity

FAQ

Visit the appropriate court office. Check the court's limits for the estate's value. Obtain the correct affidavit form. Fill out the affidavit in full. Sign the affidavit. Obtain a death certificate.

2019 Statute (a) The executor or administrator appointed under the Kansas simplified estates act shall collect the decedent's assets, file an inventory and valuation, pay claims of creditors, and pay taxes owed by the decedent or the decedent's estate in the manner provided by law.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Dying Without a Will in Kansas If there isn't a will, the court then appoints someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the decedent's estate.

An estate is generally probated in the county where the deceased owned property. If property is located in another state, additional proceedings are sometimes necessary in that state. There is no natural right to inherit property.Kansas law provides for the probating of estates to protect all interested parties.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Kansas has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

In Kansas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.