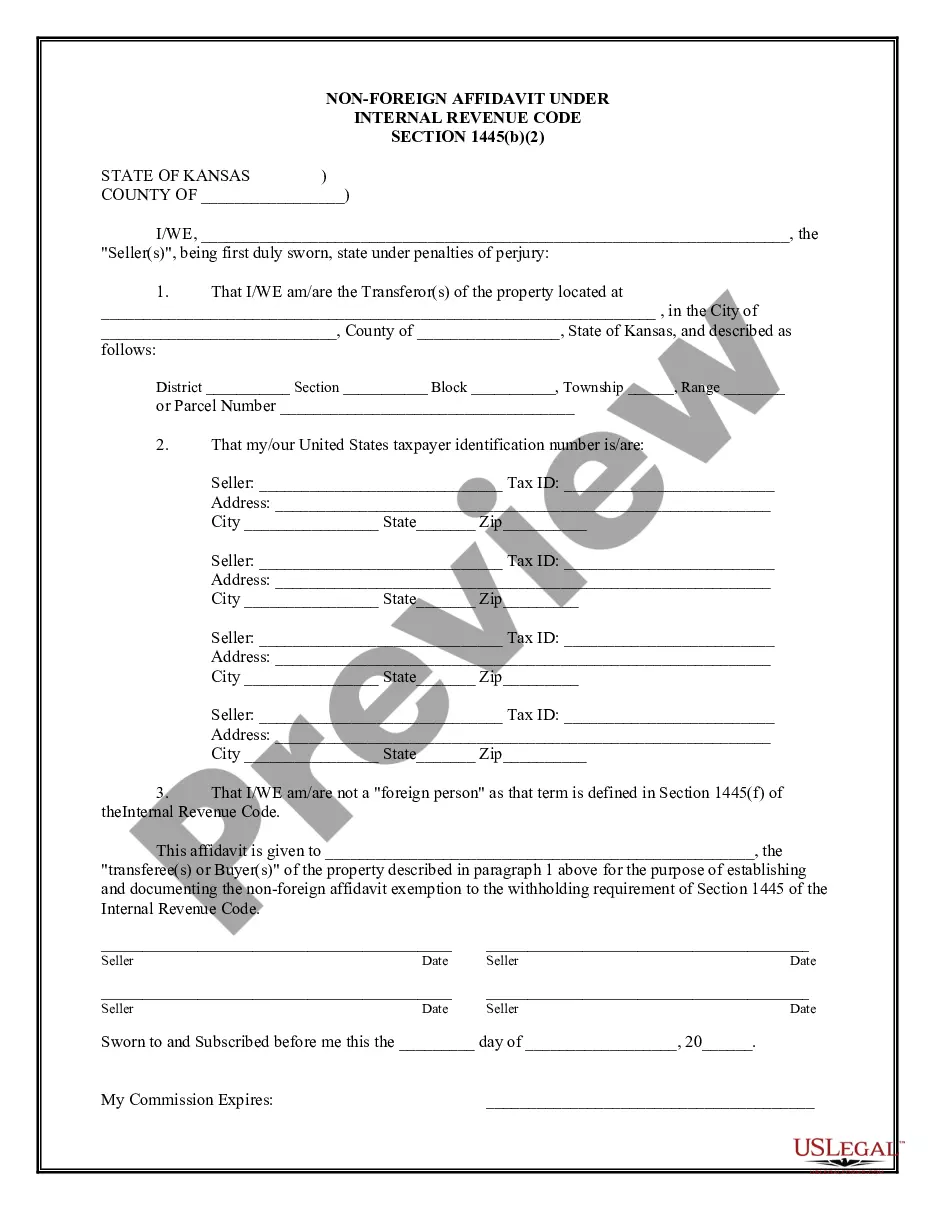

Kansas Non-Foreign Affidavit Under IRC 1445

What this document covers

The Non-Foreign Affidavit Under IRC 1445 is a legal document that sellers of real property use to declare that they are not foreign persons as defined by the Internal Revenue Code. This form is essential for sellers to avoid withholding taxes on the sale of real estate, which would otherwise apply if they were considered foreign. It helps facilitate the transfer of property by providing proof of the seller's tax status.

Form components explained

- Identification of the seller(s) and property being sold

- Declaration of non-foreign status based on IRC Section 26 USC 1445

- Tax identification numbers for the seller(s)

- Notary section for validation

- Signature lines for all sellers to affirm the affidavit

Situations where this form applies

This form is used when a seller is transferring real property and needs to prove to the buyer that they are not a foreign individual or entity. It is crucial in transactions involving real estate, particularly to avoid withholding taxes that apply to foreign sellers. Use this form whenever you are selling property and need to declare your non-foreign status.

Intended users of this form

This form is intended for:

- Individuals or entities selling real property in the United States

- Real estate agents or brokers facilitating transactions

- Buyers needing assurance about the seller's tax status

Instructions for completing this form

- Identify the seller(s) involved in the property transaction.

- Specify the property by providing its location and parcel information.

- Enter Tax Identification Numbers for each seller.

- Provide a declaration that confirms the non-foreign status of the seller(s).

- Have the form notarized to ensure its legal validity.

- All sellers should sign and date the form.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide all necessary seller information.

- Not entering Tax Identification Numbers accurately.

- Omitting the notarization step, which can invalidate the affidavit.

- Forgetting to sign and date the form before submitting.

Why complete this form online

- Convenience of instant access and download.

- Editability allows for easy completion of all fields.

- Reliable legal templates drafted by licensed attorneys.

- Reduces the risk of errors with clear instructions.

Looking for another form?

Form popularity

FAQ

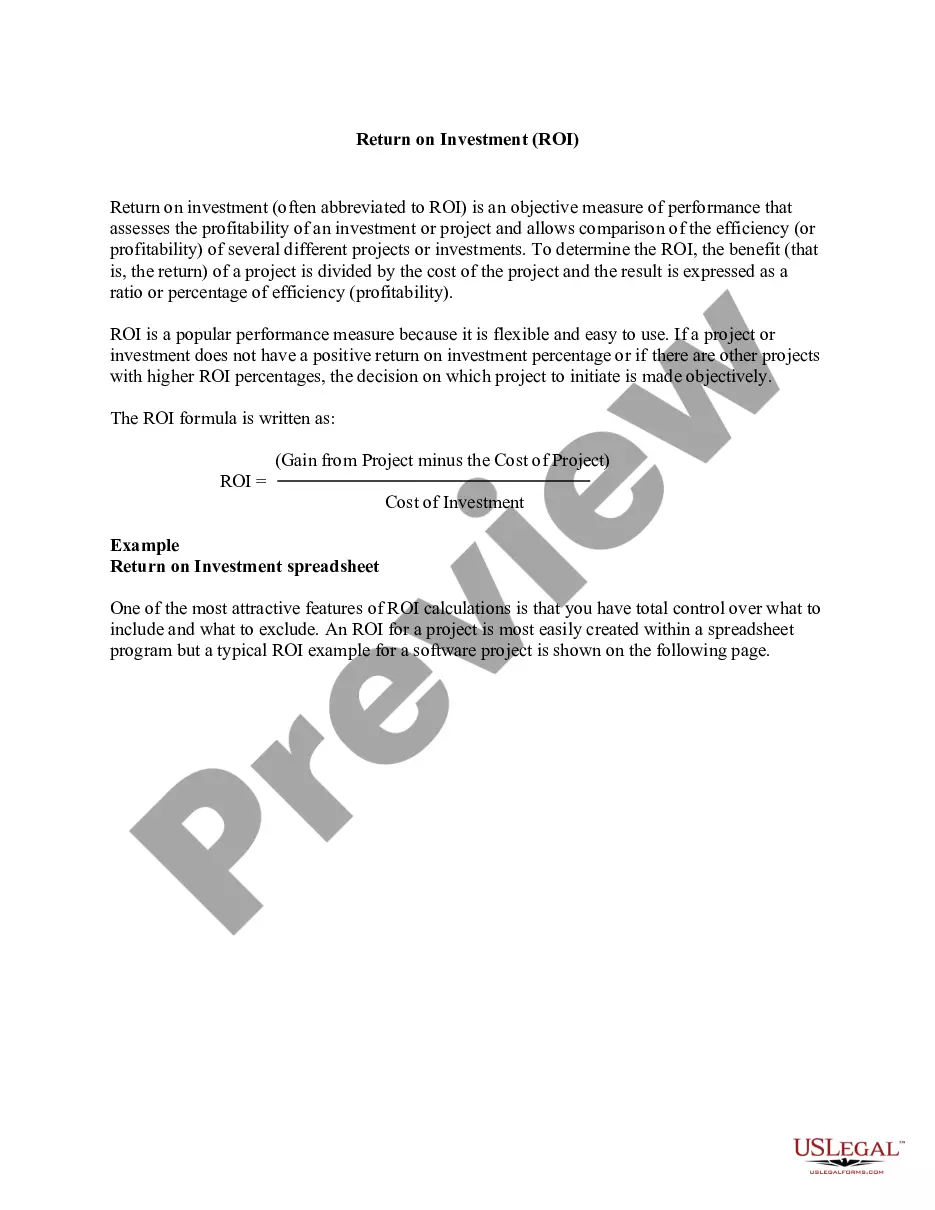

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).