Indiana Self-Employed Ceiling Installation Contract

Description

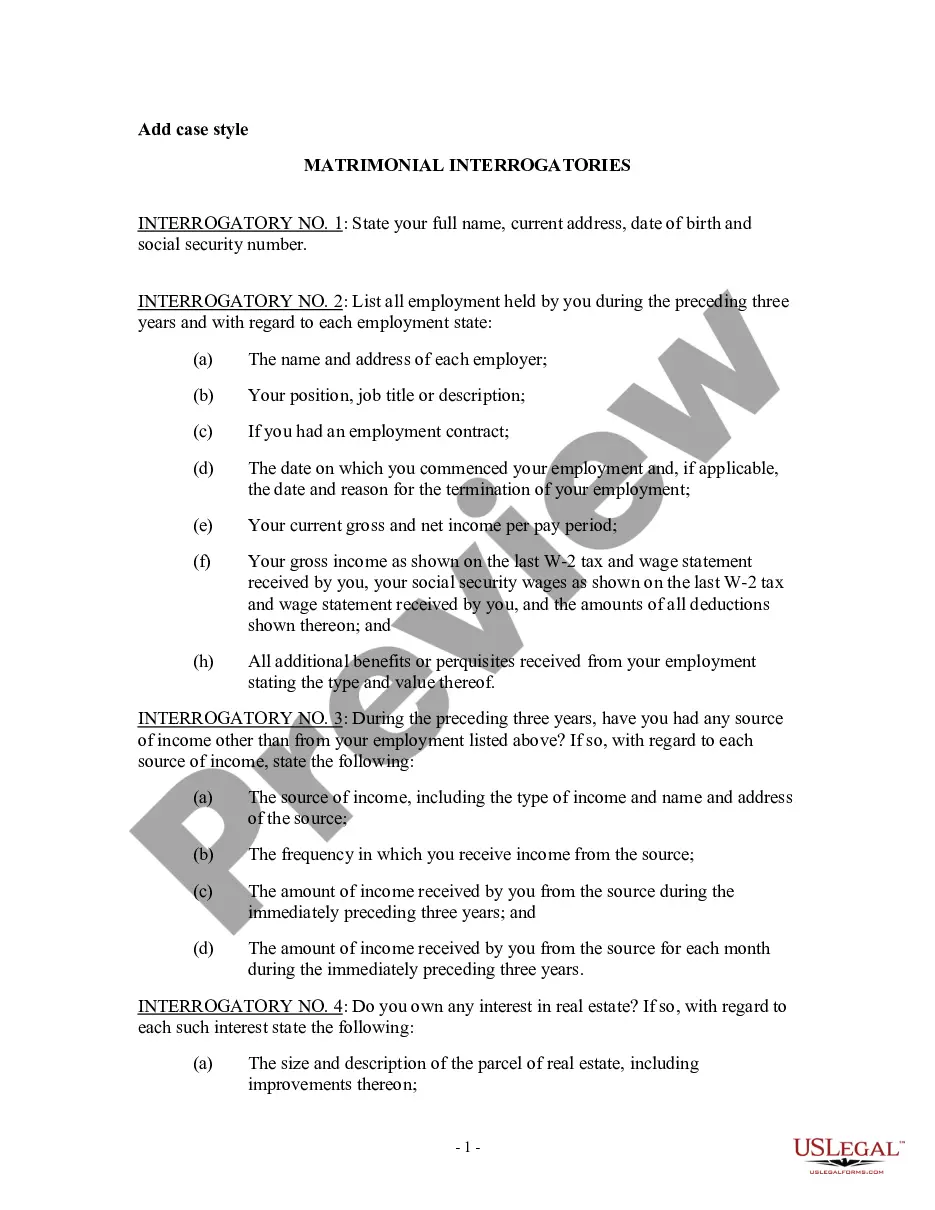

How to fill out Self-Employed Ceiling Installation Contract?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Indiana Self-Employed Ceiling Installation Contract in just a few minutes. If you have a membership, Log In to download the Indiana Self-Employed Ceiling Installation Contract from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your profile.

If you are using US Legal Forms for the first time, here are straightforward steps to get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the content of the form. Check the form summary to confirm you have selected the right document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit or debit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Edit. Complete, modify, and print and sign the downloaded Indiana Self-Employed Ceiling Installation Contract.

- Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Indiana Self-Employed Ceiling Installation Contract with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In Indiana, 1099 employees, or independent contractors, are usually not required to have workers' compensation insurance. However, if you hire others to assist with your ceiling installation projects, you may need to evaluate your insurance needs. An Indiana Self-Employed Ceiling Installation Contract can help clarify your business structure and responsibilities.

Independent contractors are not typically required to have workers' compensation insurance in Indiana unless they have employees. However, it is beneficial to have coverage for added protection. If you're planning to operate under an Indiana Self-Employed Ceiling Installation Contract, consider discussing insurance options with a professional.

A home improvement contract in Indiana is a legally binding agreement between a contractor and a homeowner. It outlines the scope of work, payment terms, and other essential details related to the project. Using a well-structured Indiana Self-Employed Ceiling Installation Contract ensures that both parties understand their rights and responsibilities.

Certain individuals are exempt from workers' compensation requirements in Indiana. This includes sole proprietors and independent contractors without employees. If you're self-employed and working under an Indiana Self-Employed Ceiling Installation Contract, you might fall into this category.

Independent contractors in Indiana generally do not need to carry workers' compensation insurance. However, if contractors have employees, they must obtain this coverage. It's wise to consider your specific situation and evaluate if having an Indiana Self-Employed Ceiling Installation Contract could enhance your professional standing.

In Indiana, you do not need a state-level license to work as a contractor for ceiling installations. However, some local jurisdictions may require permits or local licenses. It's important to check with your local government to ensure compliance. Using an Indiana Self-Employed Ceiling Installation Contract can help you outline your services clearly.

Yes, installation labor is generally considered taxable in many states, including Indiana. If you are operating under an Indiana Self-Employed Ceiling Installation Contract, you need to determine if the installation services you provide fall under taxable categories. Consulting with a tax professional or using resources from platforms like uslegalforms can help clarify your specific situation.

The new federal rule on independent contractors aims to clarify the classification of workers. It emphasizes the importance of the employer's control over the work being done. For those involved in an Indiana Self-Employed Ceiling Installation Contract, understanding this rule can help ensure compliance and avoid misclassification. Proper classification is essential for tax implications and benefits.