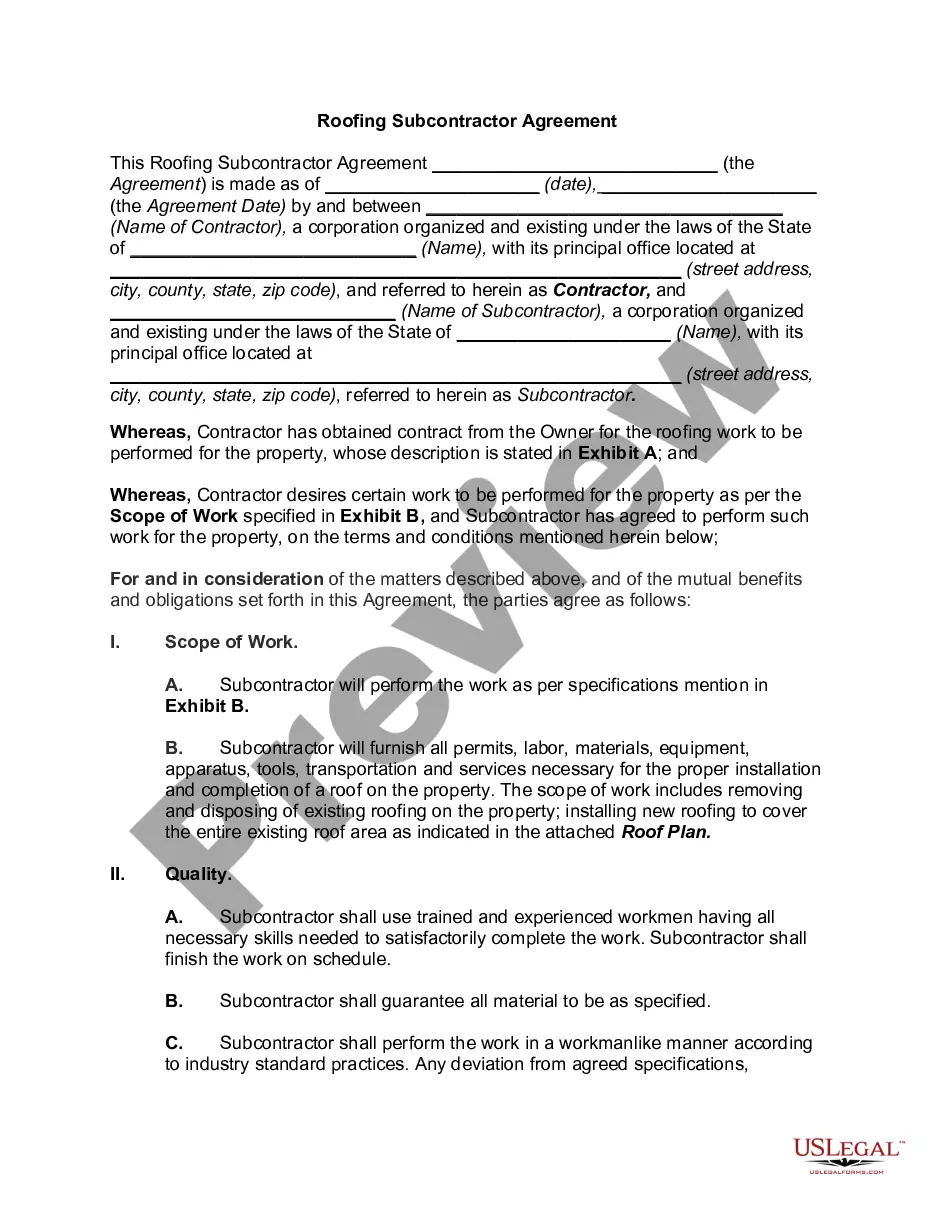

Indiana Self-Employed Roofing Services Agreement

Description

How to fill out Self-Employed Roofing Services Agreement?

You are capable of dedicating time online searching for the valid document template that satisfies the federal and state requirements you will need. US Legal Forms provides thousands of valid templates that have been evaluated by experts.

You can easily download or print the Indiana Self-Employed Roofing Services Agreement from the service. If you already possess a US Legal Forms account, you can Log In and click on the Obtain button. Subsequently, you can complete, modify, print, or sign the Indiana Self-Employed Roofing Services Agreement. Every valid document template you purchase is yours permanently.

To obtain another copy of the purchased form, navigate to the My documents tab and click on the appropriate button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the county/city of your choice. Review the form details to confirm you have chosen the right form. If available, use the Preview button to review the document template as well.

- If you wish to find another variation of the form, utilize the Search section to locate the template that fits your requirements.

- Once you have found the template you need, click on Purchase now to proceed.

- Select the pricing plan you desire, enter your details, and register for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the valid form.

- Choose the format of the document and download it to your device.

- Make modifications to your document if possible. You can complete, modify, sign, and print the Indiana Self-Employed Roofing Services Agreement.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of valid templates. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Creating a roofing contract involves outlining the key elements that define your project. Start with an Indiana Self-Employed Roofing Services Agreement that includes specific details like project scope, materials, timelines, and payment terms. It is crucial to be thorough to prevent misunderstandings later. US Legal Forms offers user-friendly templates that can simplify the process and ensure your contract is legally sound.

Yes, you can write your own legally binding contract for your roofing project, including an Indiana Self-Employed Roofing Services Agreement. However, it is essential to ensure that it meets all legal requirements in Indiana. Consider including clear terms about the scope of work, payment details, and timelines. Using a reliable platform like US Legal Forms can provide templates and guidance to help you create a comprehensive agreement.

Yes, roofers need both a license and insurance to protect themselves and their clients. Insurance safeguards against accidents and damages during the roofing project. When creating an Indiana Self-Employed Roofing Services Agreement, make sure to include a clause that requires proof of the contractor’s insurance and licensing.

To identify if your roofing contractor is not honest, compare bids from multiple contractors, ask for references, and check reviews. Look for any signs of pressure tactics or vague contracts. An Indiana Self-Employed Roofing Services Agreement can also clarify expectations, making it harder for dishonest practices to occur.

Indeed, roofers must be licensed in Indiana to provide their services legally. Licensing ensures that contractors meet specific standards of quality and safety. When drafting an Indiana Self-Employed Roofing Services Agreement, it is essential to verify that the contractor’s license is valid and up to date.

The 25% rule for roofing generally refers to the guideline that no more than 25% of a roof's surface should be replaced at one time without a complete renovation. This rule helps maintain structural integrity and ensures proper drainage. When creating an Indiana Self-Employed Roofing Services Agreement, consider including provisions related to this rule to protect both parties.

Yes, roofing contractors typically must obtain a license in Indiana. Each municipality may have different requirements, so it is wise to verify local laws. A well-drafted Indiana Self-Employed Roofing Services Agreement can help ensure compliance with these licensing regulations.

Writing a contract for a roofing job involves outlining the scope of work, materials to be used, timelines, and payment terms. Additionally, including clauses for warranties and dispute resolution can protect both parties. Utilizing an Indiana Self-Employed Roofing Services Agreement template can simplify this process and ensure all essential elements are covered.

Yes, roofers generally need a license to operate legally. In Indiana, licensing requirements may vary by city or county. It is crucial to check local regulations and ensure proper licensing, especially when drafting an Indiana Self-Employed Roofing Services Agreement.